USD/JPY Faces Downside Risk as BOJ Tightening Prospects Grow

USD/JPY remains under pressure as fundamental and technical factors align in favor of yen strength. The possibility of the Bank of Japan tightening policy, rising JGB yields, and potential progress toward a resolution in Ukraine continue to weigh on the pair. Recent CFTC data highlights that asset managers have been increasing yen long positions, reflecting growing confidence in a stronger JPY. Meanwhile, the likelihood of a 25-basis-point rate hike at the BOJ’s June meeting is evenly split, with upcoming comments from board member Hajime Takata likely to provide further clarity on the central bank’s stance. On the flip side, risks remain for yen bulls, particularly if upcoming Japanese inflation data underwhelms or if renewed trade policies from the Trump administration boost USD demand.

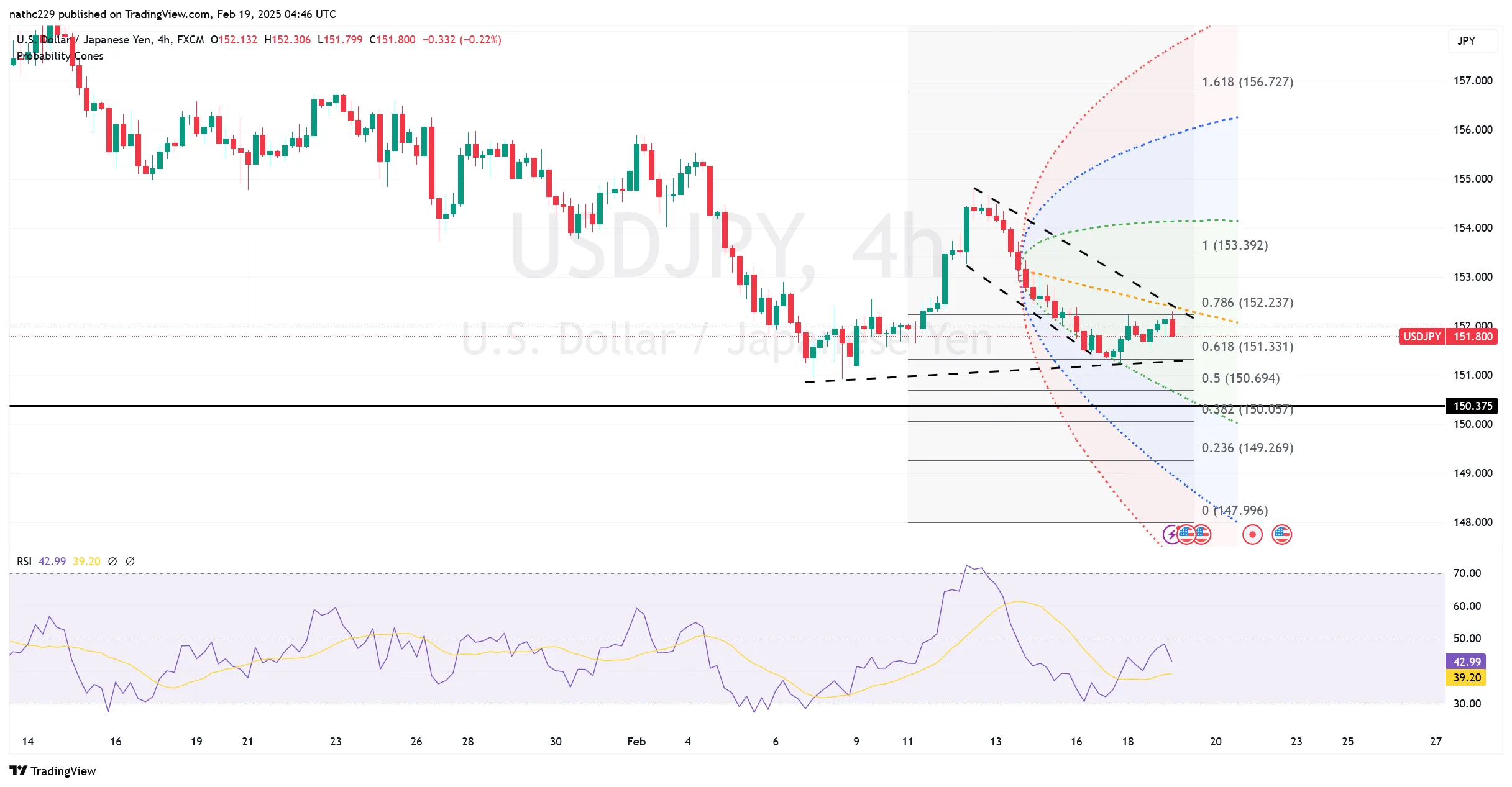

From a technical perspective, USD/JPY has been oscillating within its 150.93-152.22 daily range, with momentum currently lacking. The key support zone remains between 151.20 and 150.93 (February 7 YTD low), with a break below this region exposing downside risk toward 150.25 (December 3 high). Resistance is seen at 152.57 (9-day EMA), followed by 153.35 (100-DMA) and 153.77 (daily cloud bottom). Volatility has remained subdued, and options market data suggests a drop in yen implied volatilities, keeping the pair within a broader 150-155 range for now. However, a fundamental shift—such as a clear signal from the BOJ on rate hikes—could trigger a decisive break lower.

Looking ahead, traders will closely monitor Takata’s speech on Wednesday for potential policy signals, as well as upcoming Japanese inflation data. If inflation surprises to the upside, it would reinforce expectations of a BOJ rate hike, strengthening the yen and pushing USD/JPY lower. Conversely, weaker inflation could delay tightening, giving the pair room to test resistance levels. Overall, as long as USD/JPY remains below 152.68 (200-DMA), the downside bias remains intact, with a potential retest of the 150.93 YTD low in the coming sessions.