Japanese Yen Buy-Backs Fuel Declines in USD/JPY and JPY Crosses Amid Recession Fears

Japanese yen buy-backs continued in Asia, causing significant declines in the USD/JPY pair and various yen crosses. Stocks suffered due to heightened US recession risks, while bonds benefited from expectations of rapid rate cuts, contributing to increased market volatility.

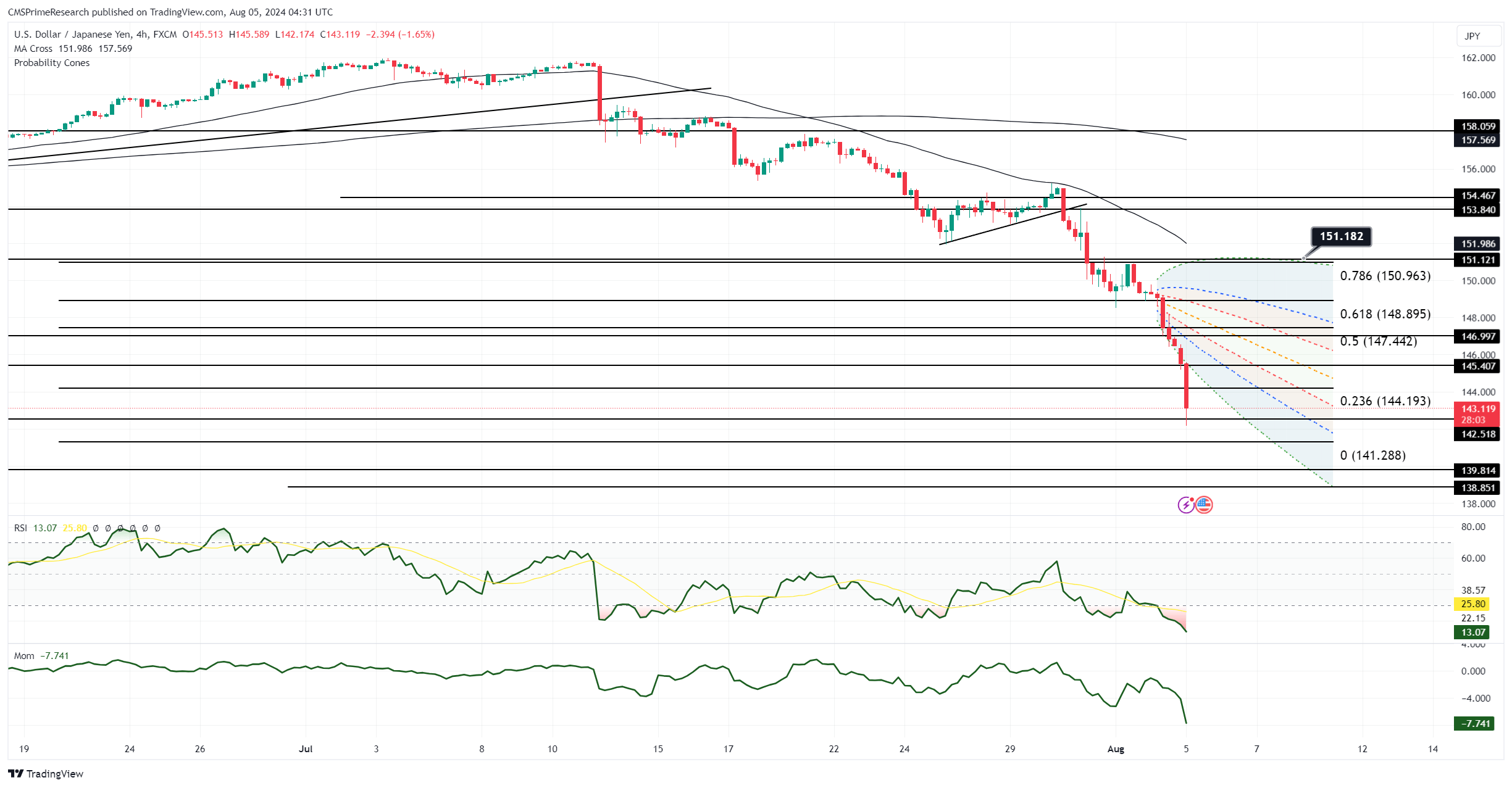

On the EBS platform, USD/JPY experienced a notable drop from 146.55 to 144.14, with further declines anticipated as the market remains heavily short on yen. Key support levels include the 144.58 monthly Ichimoku kijun and the 55-week moving average (WMA) just below at 144.55. The pair is now trading within the 140.48-145.83 weekly Ichimoku cloud, with a double bottom at 144.33/35 from January 10/12. Option expiries are not a major factor today, with most positioned above 146.00.

Similarly, EUR/JPY declined from 159.81 to 157.58 amid continued yen buy-backs, with further downside expected. Support levels are currently at 158.00, followed by 157.84 from January 10, and the 153.22 spike low from December 7, 2023. GBP/JPY dropped from 187.69 to 184.19, holding just above the 185.00 level, with the February 1 low at 184.98. AUD/JPY fell from 95.54 to 93.46, the lowest since December 7, 2023, at 93.74. Significant option expiries today include 93.20 with AUD 600 million and 95.00 with AUD 356 million.

The Nikkei index also took a significant hit, dropping 6.3% to 33,659, with all Asian bourses in the red. Japanese Government Bond (JGB) yields fell alongside US yields, with 2-year JGBs at 0.327% and 10-year JGBs at 0.840%. The Bank of Japan’s June 13-14 minutes suggested a hawkish tilt, and Chief Cabinet Secretary Hayashi reiterated close monitoring of market moves. Meanwhile, Japan’s July services PMI remained strong at 53.7, with the composite PMI at 52.5.

USD/JPY Tests Towards 140, Further Declines Possible

The USD/JPY pair has seen a significant decline from its high of 161.96 on July 3, driven by Japanese FX intervention and major shifts in US Federal Reserve expectations. With the market still heavily short on yen, further declines in USD/JPY are anticipated, with some players eyeing possible tests of the 140.00 level or lower.

The first bout of Japanese intervention at the end of April and early May aimed to stem further yen weakness after USD/JPY breached a high dating back to 1990. The second round on July 11-12 followed a weak US CPI report. These interventions, combined with subsequent weak US data, saw USD/JPY drop as low as 144.76 on Monday. With significant yen-short positions still present as of July 30, the path of least resistance for USD/JPY appears to be downwards. Some market players suggest it may test this year’s low of 140.80 from January, possibly the 140.27 low from December 2023, or even lower.

Following Friday’s weak US jobs report, expectations are building for a potential 50-basis point cut in the Fed funds rate in September, and maybe a full point cut by early next year. In contrast, the Bank of Japan seems committed to more rate hikes this year, data permitting. These diverging central bank expectations have significantly narrowed the Japan-US interest rate differentials, from 517 basis points in October 2023 to 344 basis points on Monday. Further narrowing of this differential could provide more support for yen strength going forward.