Yen Strengthens as Carry Trade Unwinds Ahead of Crucial BoJ Meeting

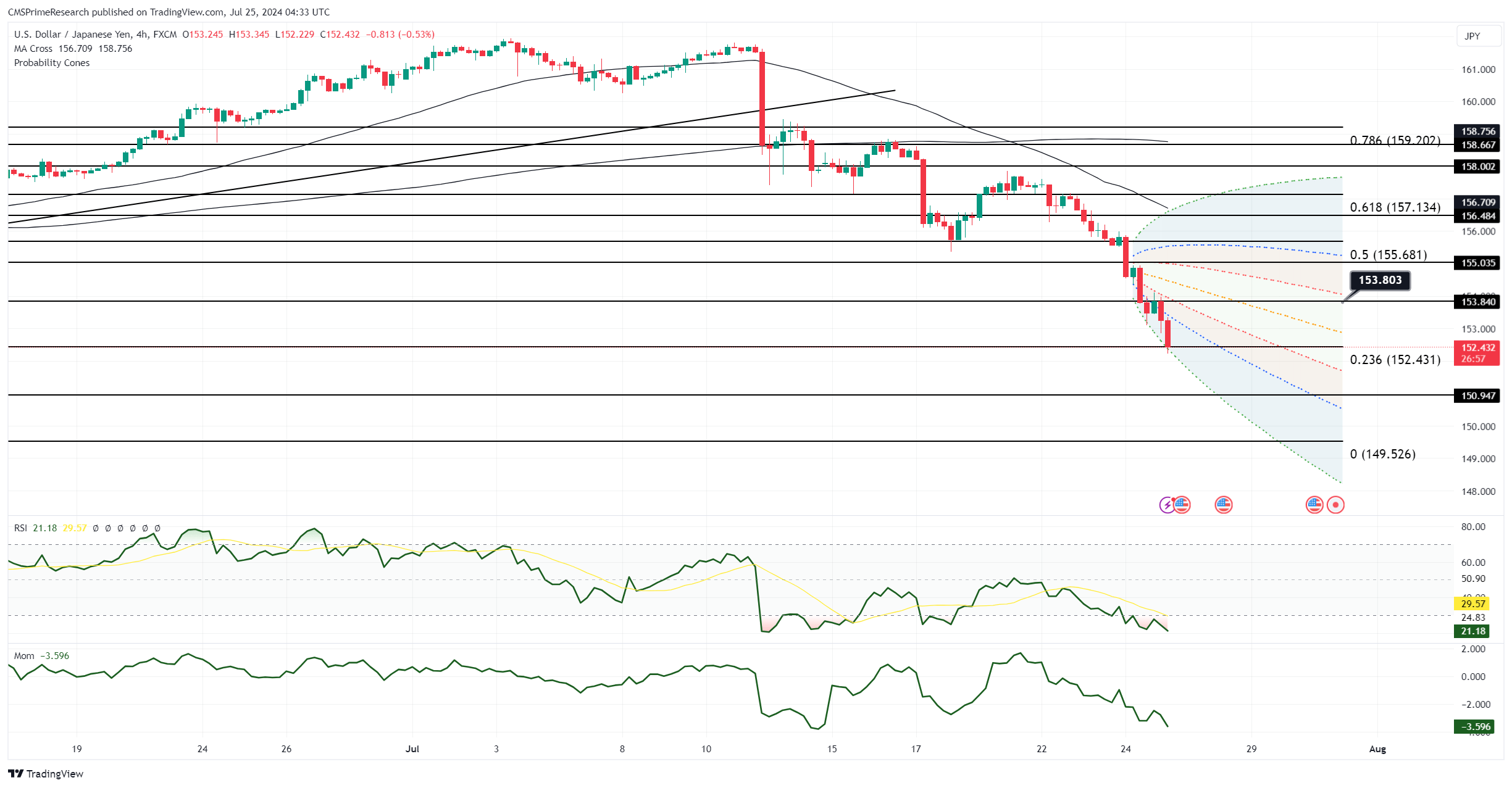

The ongoing unwinding of carry trades is favoring low-yielding currencies, particularly the yen and the Swiss franc. On Wednesday, USD/JPY broke below the key support level at the 100-day moving average (155.37), accelerating its decline to a low of 153.10, the lowest level since early May. The market’s growing focus on the Bank of Japan’s (BoJ) upcoming meeting next week has intensified the yen short squeeze, with increasing speculation of a potential rate hike. This makes the Tokyo inflation figures due on July 26 even more crucial.

Market sentiment now suggests a 62% chance of a BoJ rate hike at the July 31 meeting, up from 40% on Monday. However, a Reuters poll indicates that over three-quarters of economists expect the central bank to hold rates steady this month. This discrepancy implies that the market will be caught off guard regardless of the BoJ’s decision, whether they hike or maintain rates. With a week to go until the BoJ meeting and considering the recent yen appreciation, the risk of significant market reactions remains high.

The yen has continued its rally as USD/JPY narrows the gap with U.S. yields. The increasing likelihood of a BoJ rate hike has exacerbated the carry trade unwinding. The upcoming Tokyo CPI data on July 26 is expected to have a significant market impact given the current economic context. As the BoJ meeting approaches, the potential for market volatility remains elevated.

After breaking below the 100-day moving average, USD/JPY finds little support until the 151.53-86 range. Near-term resistance is identified at 155.00 and the 100-day moving average at 155.37. The current situation highlights USD/JPY’s heightened sensitivity to both domestic and international economic signals, with traders keenly watching forthcoming data releases and central bank statements.

Key Levels to Watch: : 155,156,160,158