Yen Surge as BOJ Policy Shift Looms; USD/JPY Technical Levels in Focus

The recent surge in the yen has significant ramifications for other currencies due to its prevalent use in funding carry trades. Investors have heavily sold the yen to profit from interest rate differentials, relying on its historically low interest rate, driven to record lows this year by the Bank of Japan’s persistent bond purchases. This dynamic is poised to shift on July 31 when the Bank of Japan is expected to announce adjustments in its bond-buying strategy. While bond purchases are anticipated to continue, potentially further devaluing the yen, there is a strong likelihood that the heavily shorted yen could react sharply in the near term. An adjustment in this overcrowded trade could significantly boost the yen, exerting pressure on currencies favored by carry trade investors.

Many carry trades are centered on the US dollar, but they also include the British pound, euro, Canadian dollar, and New Zealand dollar, along with less liquid currencies such as Mexico’s peso, Hungary’s forint, and Poland’s zloty. A shakeout of these trades could lead to the unwinding of speculative positions, particularly those betting on the pound and New Zealand dollar appreciating. Furthermore, the Swiss franc could face increased pressure if traders switch their funding source for carry trades to another major currency with a suitably low interest rate.

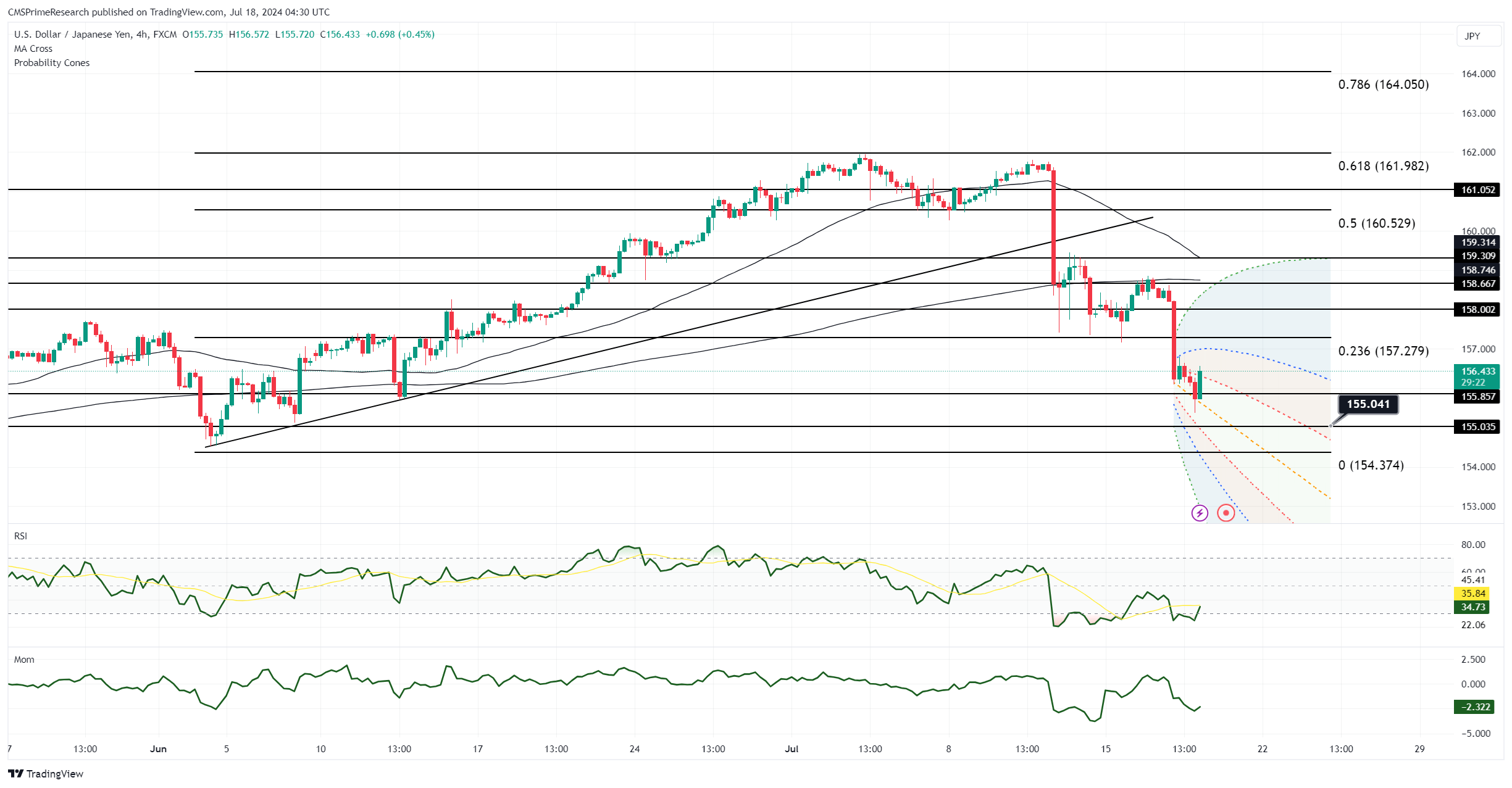

On the technical side, the yen’s rally has impacted the risk tone and softened bond yields, adding momentum to the bid. The USD/JPY has fallen below its 55-day moving average, opening the possibility of it reaching the 155-155.10 range, aligned with the 100-day moving average. The notable movement in the yen has sparked speculation about potential further intervention. However, trading volumes on the EBS platform suggest otherwise, and upcoming Bank of Japan data may provide more clarity. Concurrently, Federal Reserve officials have hinted at a possible rate cut in September, adding another layer to the evolving market dynamics.

Key Levels to Watch: : 155,156,160,158