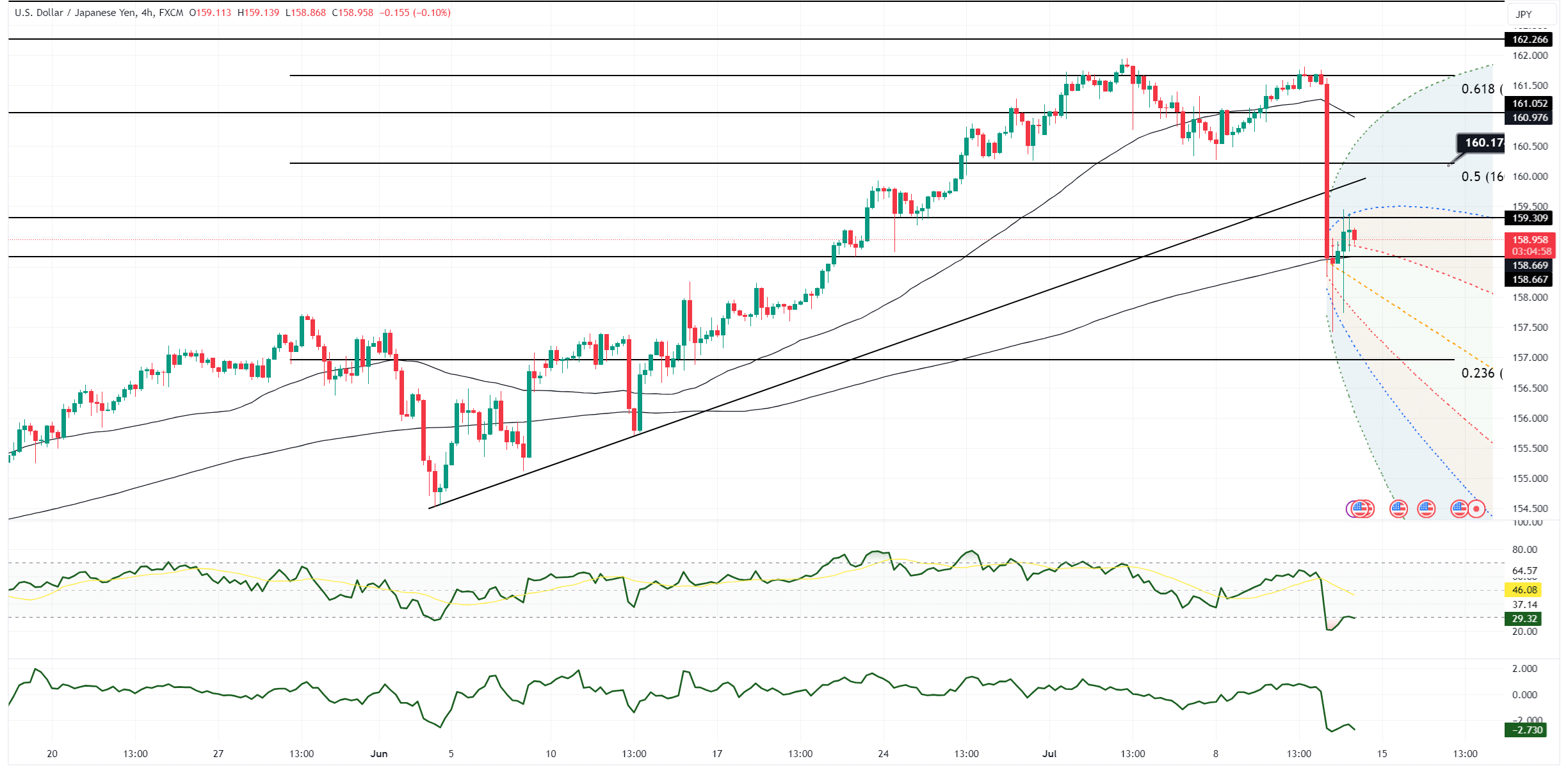

USD/JPY: MOF Intervention Sparks Market Uncertainty and Yen Volatility

Tokyo market players strongly believe Japan’s Ministry of Finance (MOF) stepped in with fresh FX intervention after Thursday’s US consumer price report. USD/JPY dropped big from 161.76 to 157.40 low. Intervention look very big, maybe $40 billion, which is five times normal full day trading. Maybe more intervention happen early Friday in Tokyo, USD/JPY fall quick from 159.45 to 157.75.

MOF currency boss Masato Kanda no confirm action, but say recent FX moves not match fundamentals. He point out US rates go down, but Japan bond yields go up to levels not seen since 2011. Kanda also say fast USD/JPY rise mostly from speculation, hurting Japanese families. USD/JPY climb lot since December, from 140.27 to 161.96 on July 3.

Market now wonder if MOF done or more action come if USD/JPY go up again. Japanese companies and investors (NISA-related) buying yen, push USD/JPY back to 159.00. This kind of buying might keep happening, so MOF might need do more if USD/JPY try go higher, especially near 162.00 where big option barriers exist.

Technically, USD/JPY find support around 55-day moving average at 157.57 Friday. Resistance at hourly kijun 159.58. Big option expiries between 158.80-160.60 might help keep price in range. US yields up little bit from overnight lows after weak CPI data.

Other yen pairs also fall from multi-year highs. EUR/JPY drop from 175.42 to 171.55, now back around 173 but talk of Bank of Japan rate checks and possible intervention keep lid on gains. Support at daily Ichimoku kijun 171.48, resistance at hourly kijun 173.48. GBP/JPY and AUD/JPY also see big drops, find support near daily kijun levels.

Nikkei stock market open lower, down 2.1% from yesterday record high. Overall, market stay cautious, watch for more possible intervention if yen start weakening again.

Key Levels to Watch: : 155,156,160,158