USD/JPY Reacts to Fed Expectations and U.S. Inflation, Eyes on Support at 150.00

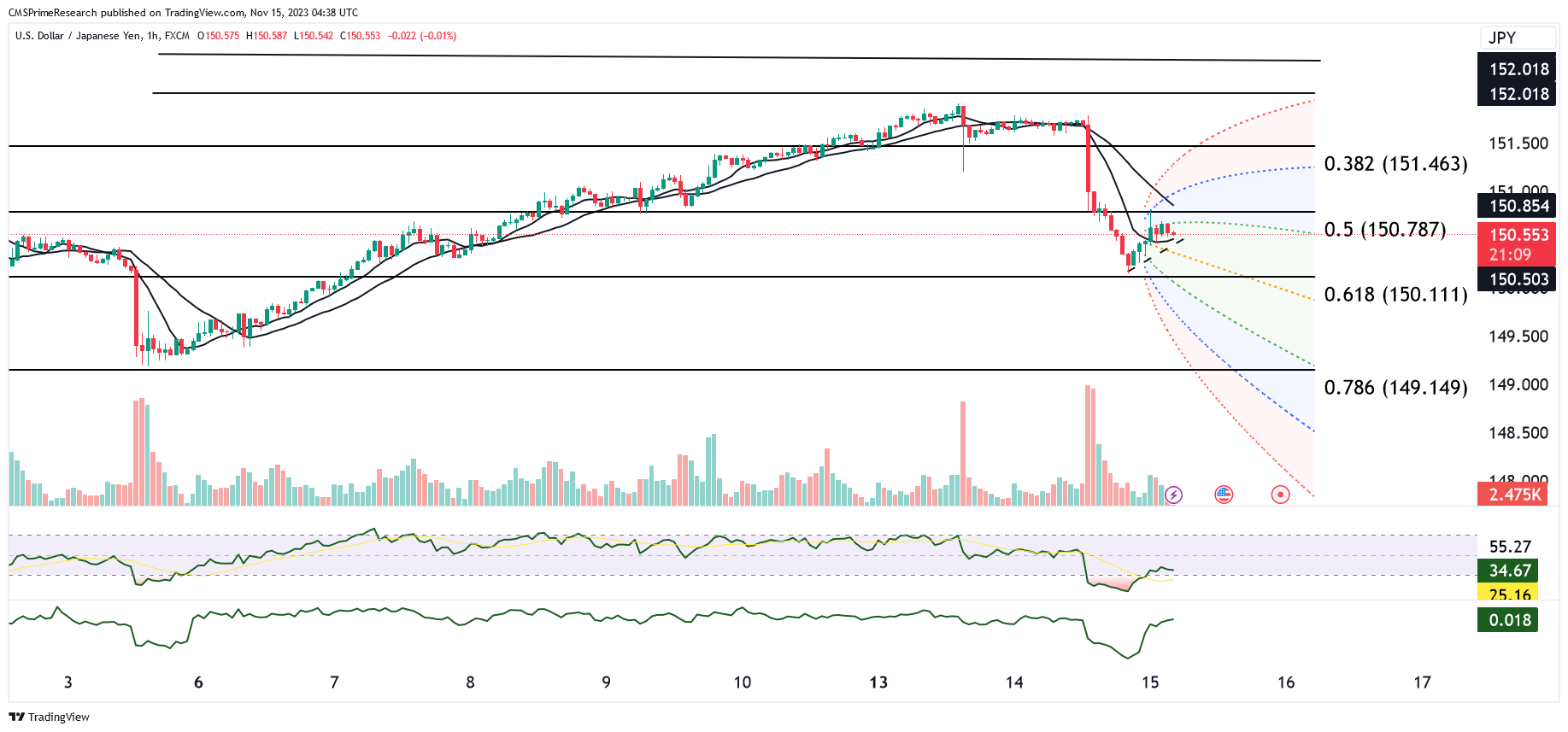

The USD/JPY currency pair experienced a significant decline following the release of below-forecast U.S. inflation data, fueling expectations of an earlier-than-anticipated policy shift by the Federal Reserve, potentially involving rate cuts as soon as May. While the outlook remains uncertain, the pair may find support around the 150.00 level. After reaching a high of 151.90, USD/JPY retreated to 150.15 before stabilizing. The shifting sentiment surrounding Fed policy has been a prominent driver of recent price movements, making it challenging to predict the future direction of U.S. yields and the USD/JPY pair. The 150.00 level is critical as it coincides with significant option expiries this week, further reinforced by Japanese importers’ interest. Japanese retail and institutional players have been actively involved in short and medium-term carry trades due to the wide interest rate differentials between Japan and the U.S. Given the Bank of Japan’s accommodative stance and the persistent interest rate gap, the conditions for a reversal in the USD/JPY uptrend are not yet favorable.

In the Asian session, USD/JPY stabilized, trading within the range of 150.30 to 150.80. While the pair remains influenced by U.S. Treasury yields, which have been relatively weak, it faces challenges from the ongoing uncertainty surrounding Fed policy. The presence of significant option expiries, coupled with bids from Japanese importers, offers support for the pair around 150.00. Despite the fluctuations in USD/JPY, other JPY crosses have shown strength, driven by yield-seeking behavior and strong carry trade demand. Notably, EUR/JPY, AUD/JPY, NZD/JPY, and GBP/JPY have all displayed notable resilience. As the currency pair grapples with evolving Fed expectations and U.S. economic data, market participants are keenly awaiting the U.S. retail sales report for further insights into its future trajectory. A downside surprise in the data could potentially lead USD/JPY toward its 50-day moving average at 149, impacting the pair’s recent strong performance.

Key Levels to Watch: 149.824,148.913,150.868,151.500

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 149.980 | 150.868 |

| Level 2 | 149.830 | 151.350 |

| Level 3 | 149.380 | 151.735 |