USD/JPY Moves Higher Supported by Rising Treasury Yields Ahead of Key Events

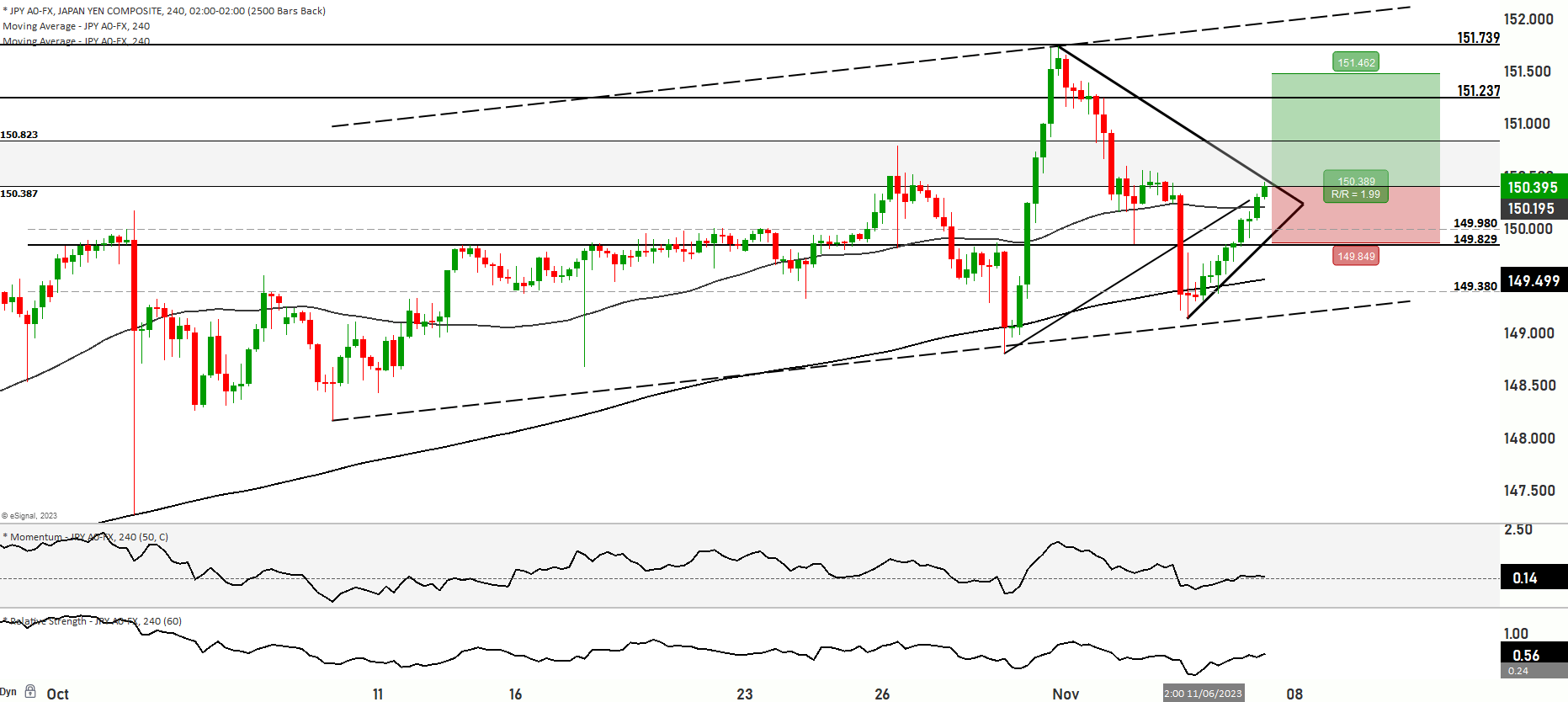

USD/JPY witnessed robust buying interest in the Asian trading session, ranging from 149.95 to 150.15. Importers and other buyers contributed to the upside movement. USD/JPY has witnessed an upswing, driven by the rebound in Treasury yields after Friday’s NFP-induced drop. Support for the pair comes from firmer US yields, with Treasury 2s at 4.930% and 10s at 4.644%. USD/JPY has now moved above the descending hourly Ichimoku cloud, which extends from 149.63 to 149.96, while the 200-hour moving average lies above at 150.18. The parameters for today include the daily tenkan-kijun levels at 149.52 and 150.27. Meanwhile, the Nikkei has retraced some of its previous day’s gains, declining by 1% to reach 32,394. Most JPY crosses have displayed buoyancy, hovering just below recent highs. AUD/JPY and NZD/JPY have been particularly strong, trading within ranges of 97.08 to 97.46 and 89.22 to 89.57, respectively.

Other pairs like EUR/JPY and GBP/JPY remained relatively quiet at 160.70 to 160.81 and 185.02 to 185.33, while MXN/JPY moved within the range of 8.5348 to 8.5506. Japan’s wage-consumption data is still on the weaker side, which aligns with expectations of the Bank of Japan (BOJ) holding its current policies. The pair may potentially retrace half of last week’s decline from 151.74 to 149.18, targeting 150.46. The presence of November’s 151.74 peak, close to the 2022 high of 151.94, raises the possibility of a double-top formation. The significant speculative short squeeze in Treasuries has concluded, particularly in light of this week’s Treasury refunding. The announcement of the refunding last week triggered a retreat in Treasury yields and USD/JPY. However, market participants now face the task of absorbing $112 billion worth of 3, 10, and 30-year debt. Furthermore, it’s likely that Federal Reserve speakers will push back against the extensive rate cuts that markets have priced in. The upcoming release of Japan’s wage data on Tuesday will be closely watched for any signs of a rebound, which could favor a less accommodative stance by the Bank of Japan. Nevertheless, wage agreements during the spring shunto period will be more pivotal in determining policy normalization, and any further rise in long-term JGB yields may lead to the repatriation of funds.

Key Levels to watch are 149.890,150.500,151.500,151.237

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 149.980 | 150.387 |

| Level 2 | 149.830 | 150.823 |

| Level 3 | 149.380 | 151.237 |