JPY Strengthens as USD/JPY Retraces from Highs: Key Levels and Support/Resistance Zone

In the Asian trading session, we observed buy-backs of the Japanese Yen (JPY) against the US Dollar (USD) and Euro (EUR), while the Australian Dollar (AUD) and New Zealand Dollar (NZD) saw increased demand. USD/JPY faced some downward pressure as US yields remained subdued post-Fed and ahead of the US jobs report, with the pair trading in the range of 150.98 to 150.16. Japanese importers and option players were seen offering support around the 150.00 level, and there’s underlying technical support near the daily kijun at 149.52. Notable option expiries were seen at 150.00-20 and 150.40-50. US Treasury yields were soft in Tokyo, with 2-year and 10-year yields at 4.946% and 4.718%, respectively.

EUR/JPY traded between 159.07 and 159.48 but held above the 100/200-hourly moving averages at 158.98/93. GBP/JPY remained relatively stable in the range of 183.00-55 ahead of the Bank of England’s policy announcement. Both the AUD/JPY and NZD/JPY pairs saw increased demand, with AUD/JPY reaching levels not seen since September 29, trading between 96.39 and 96.75, while NZD/JPY also gained ground, trading in the range of 88.12 to 88.61, partly driven by interest in carry trades.

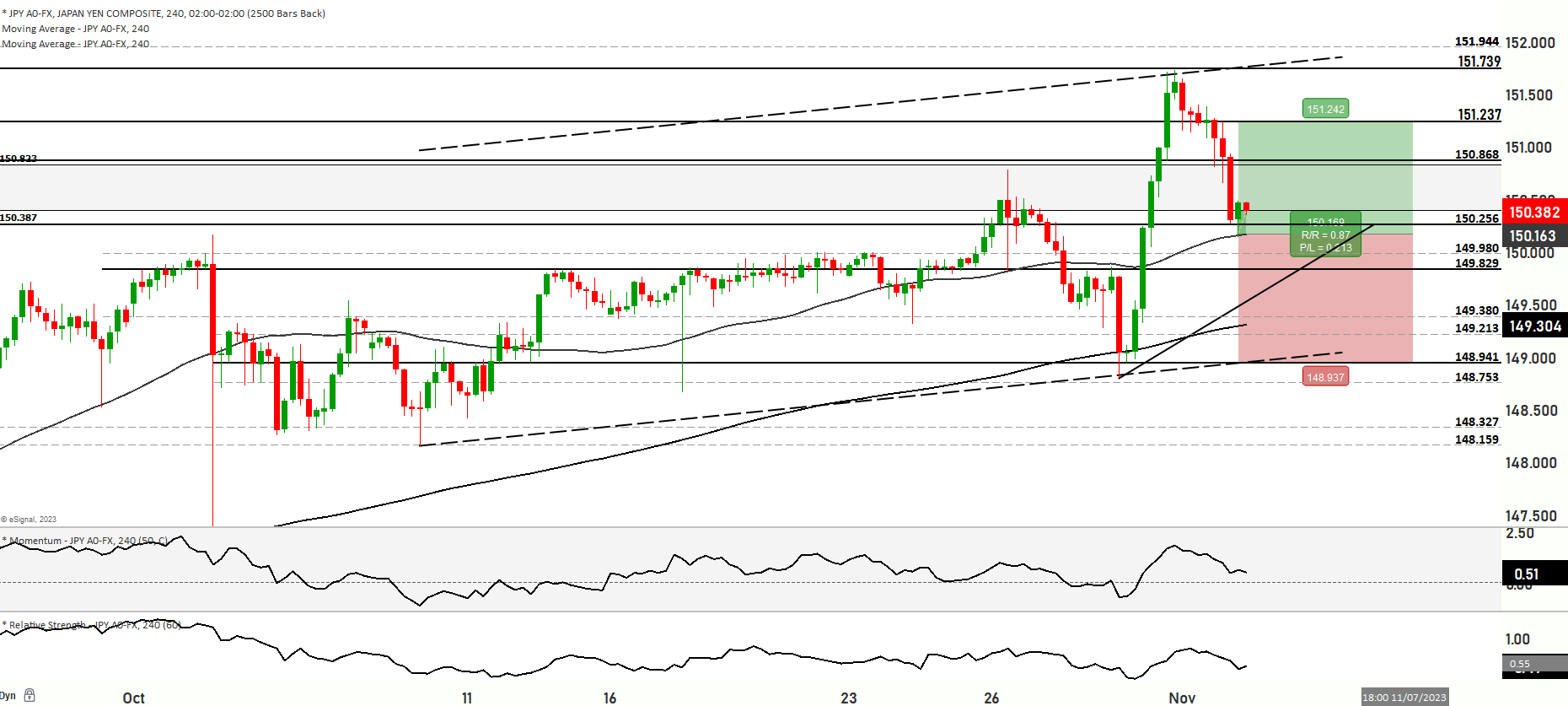

On the USD/JPY front, the pair retreated from its recent attempt to reach 2022’s peak, which was followed by multiple factors impacting its performance. Threats of intervention from the Japanese Ministry of Finance (MoF), soft US economic data, and news from the Treasury market and the Federal Reserve all weighed on the pair. US Treasury yields experienced a significant decline, with 2-year and 10-year yields falling 12-14 basis points after a refunding operation and the Fed’s announcements. While some attributed the decline to short-covering, it should be noted that US data and Fed news were not as bearish on rates. Nevertheless, USD/JPY retraced part of its recent rise, falling from the highs near 151.74 back to the 150.415 level.

In terms of technical analysis, USD/JPY remained above the 50-day and 200-day moving averages, indicating a bullish momentum. Potential scenarios included a continuation of the uptrend towards the 150.550 level or a decline to test support levels at 150.00 and 149.621. The market exhibited range momentum, but a pullback from previous highs suggested an oversold condition. The Relative Strength Index (RSI) was approaching the oversold region.

Overall, the Asian trading session saw various factors influencing currency pairs involving the JPY, with traders closely monitoring key levels and potential support and resistance areas in the market.

Key Levels to watch are 148.913,149.824,151,151.500,149.380

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 149.980 | 150.868 |

| Level 2 | 149.829 | 151.000 |

| Level 3 | 149.500 | 151.237 |