USD/JPY bearish after key Market sentiments and Fed News

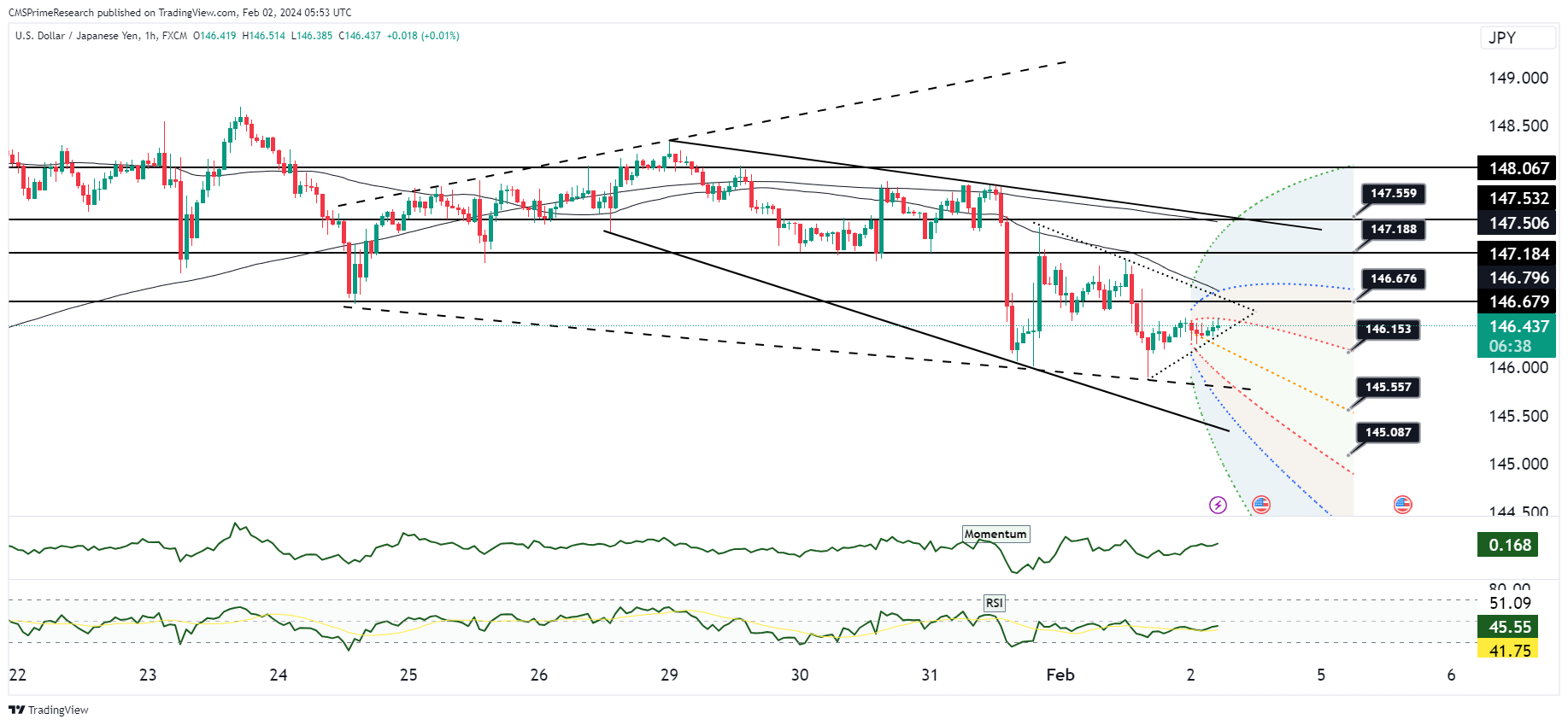

The USD/JPY pair has experienced significant bearish pressure, evident from its dive to 145.95. The recent price action has seen USD/JPY test and momentarily breach key support levels, with the currency pair still hovering above the 38.2% Fibonacci retracement of the rise at 145.50. This level is crucial; a definitive close below could accelerate the bearish momentum, potentially targeting the 50% Fibonacci level at 144.500.

From a technical standpoint, the pair has pierced through the cloud top and the weekly Kijun line, which are indicative of a bearish trend, although it has not yet closed below these indicators, leaving some ambiguity in the short term. The Tenkan line and the 50-Day Moving Average (DMA) have turned downwards, and Bollinger Bands are expanding from previous tight conditions, suggesting increased market volatility.

The technical indicators are currently showing a strong sell signal, although the moving averages present a neutral to slightly bullish divergence with the MA20 and MA30 indicating a buy. This mixed signal suggests that while the immediate trend is bearish, there could be potential for short-term retracements if supported by fundamental developments.

The USD/JPY pair is at a critical juncture, with U.S. Treasury-Japanese Government Bond (JGB) yield spreads falling to this year’s lows. Recent U.S. labor data, predominantly softer than forecast, has not provided the necessary impetus to halt the yen’s advance. This decline comes in the face of a sizeable rise in December JOLTS job openings earlier in the week and Federal Reserve Chair Powell’s remarks, which steered markets away from March rate cut expectations.

Futures markets are still pricing in a significant easing by year-end, which could continue to weigh on the USD/JPY pair. However, a robust U.S. jobs report on Friday could offer temporary support for the dollar. The yen’s strength has also been aided by risk-off flows and a bold call by Societe Generale for a potential BOJ rate hike in March.

Overall Market Sentiment:

The market sentiment for USD/JPY, considering both technical and fundamental factors, can be broken down as follows:

- Positive Sentiment: 20% – This modest bullish sentiment is supported by the short-term moving average signals, indicating potential for retracement.

- Negative Sentiment: 60% – Reflecting the strong technical sell signals, recent bearish price action, and the market’s anticipation of a dovish Fed stance.

- Neutral Sentiment: 20% – Accounting for the market’s caution ahead of the U.S. jobs data and potential for mixed signals from the upcoming fundamental events.

The sentiment is predominantly bearish, with the market preparing for the possibility of further USD/JPY declines.

Key Levels to Watch: : 147.436,146.615,145.538

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 146.137 | 146.909 |

| Level 2 | 145.792 | 147.090 |

| Level 3 | 145.538 | 147.436 |