USD/JPY in consolidation amidst BOJ interest rate decisions.

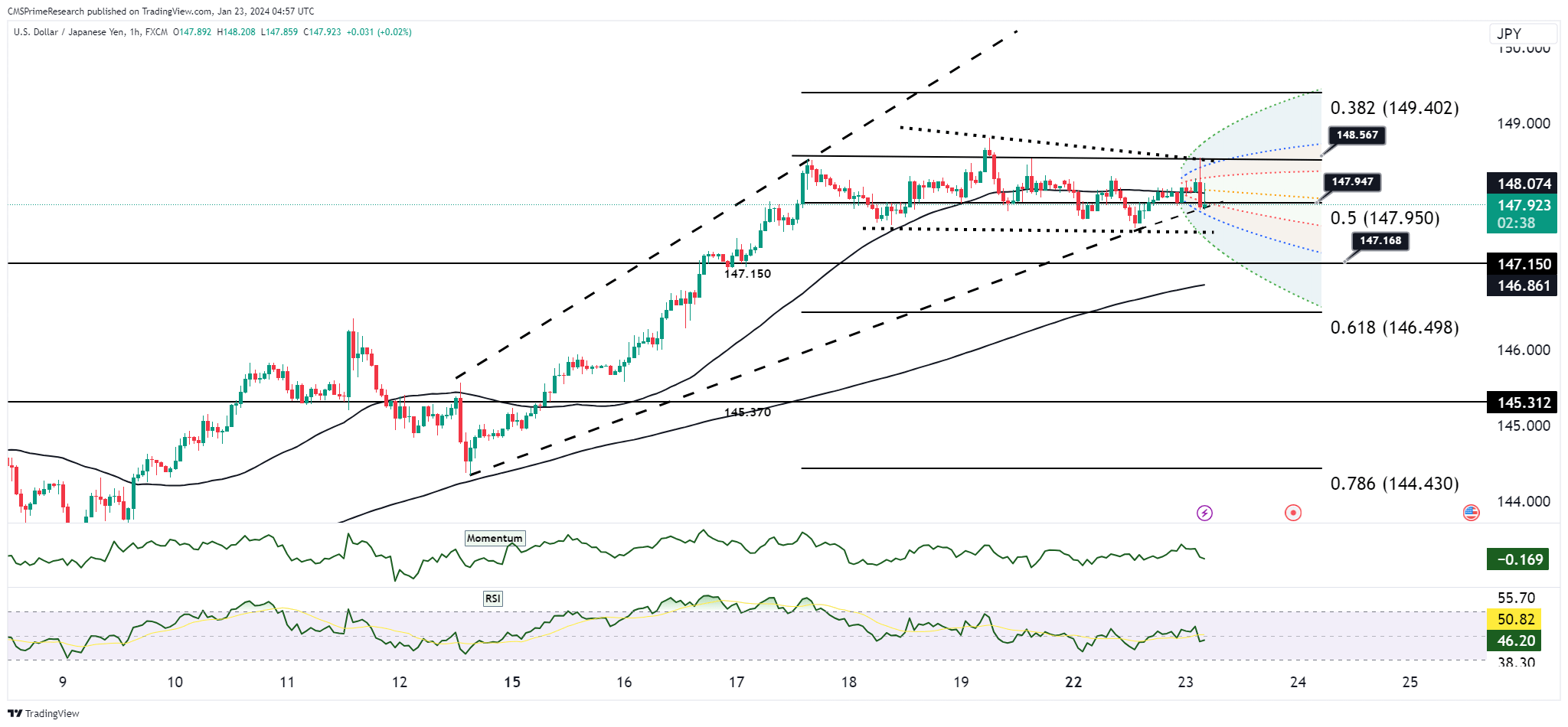

The USD/JPY pair is currently exhibiting a phase of consolidation as observed in the hourly timeframe, navigating through a constricted Ichimoku cloud. The flattening of the 50-Day Moving Average (DMA) at 148.5 and an ascending 100-DMA at 147.95 suggests a potential support zone, providing a base for the currency pair.

From the momentum indicators, the Relative Strength Index (RSI) is hovering above the midpoint, indicating neither overbought nor oversold conditions. This neutral standing is reflective of the market’s indecision ahead of significant economic releases or events.

The price action is contained within a range, with Fibonacci retracement levels marked from a recent swing high to low, providing potential resistance and support levels. As we approach the upper Fibonacci levels, it would be prudent to observe the price reaction, as these often act as psychological barriers to further price movement.

Additionally, the pivot points suggest the immediate resistance and support levels, which can be instrumental for intraday traders to gauge potential entry and exit points.

The Bank of Japan (BOJ) has retained its ultra-easy monetary policy, keeping yields on Japanese Government Bonds (JGBs) capped, which has a dovish implication for the yen. With the 10-year JGB yield target around 0%, the BOJ’s stance remains accommodative, contrasting with other central banks that are in a tightening phase. This divergence in monetary policy may underpin the yen’s weakness against the dollar.

Moreover, market sentiment is affected by the anticipation of the BOJ Governor Ueda’s press conference. Investors will parse his commentary for any hints on future policy direction, which could induce volatility in the currency pair.

The currency pair popped to 148.50 following the BOJ’s announcement, indicating a brief sentiment of bullishness. However, resistance ahead of the 149.00 mark remains intact, with historical concerns of intervention looming if the pair makes a strong push towards 150.00.

On the cross-rate front, JPY is seen stable against other currencies, with the pairings holding near recent highs, suggesting a broad market consensus on yen valuation across different currency spectrums.

Overall Market Sentiment:

The current sentiment analysis, is indicative of a cautious market stance on the USD/JPY pair.

- Positive Sentiment: 40%

- Negative Sentiment: 40%

- Neutral Sentiment: 20%

Key Levels to Watch: : 147.732,146.909,146.436,149.380

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 148.437 | 149.007 |

| Level 2 | 147.732 | 149.074 |

| Level 3 | 146.909 | 149.380 |