USD/JPY is consolidating within the 144.11-145.20 range as markets await the results of the Liberal Democratic Party’s (LDP) leadership election. The pair has found support from firming U.S. Treasury yields, which rose following hawkish comments from Federal Reserve speakers and solid U.S. economic data, including a drop in jobless claims. Overnight volatility remains elevated at around 23%, reflecting market expectations of significant spot swings post-election and with Friday’s U.S. Personal Consumption Expenditures (PCE) data. While yen sentiment turned bearish with the prospect of a Takaichi victory, speculation that other LDP candidates may prevail has tempered this view, leaving USD/JPY to trade within a tight range ahead of the key events.

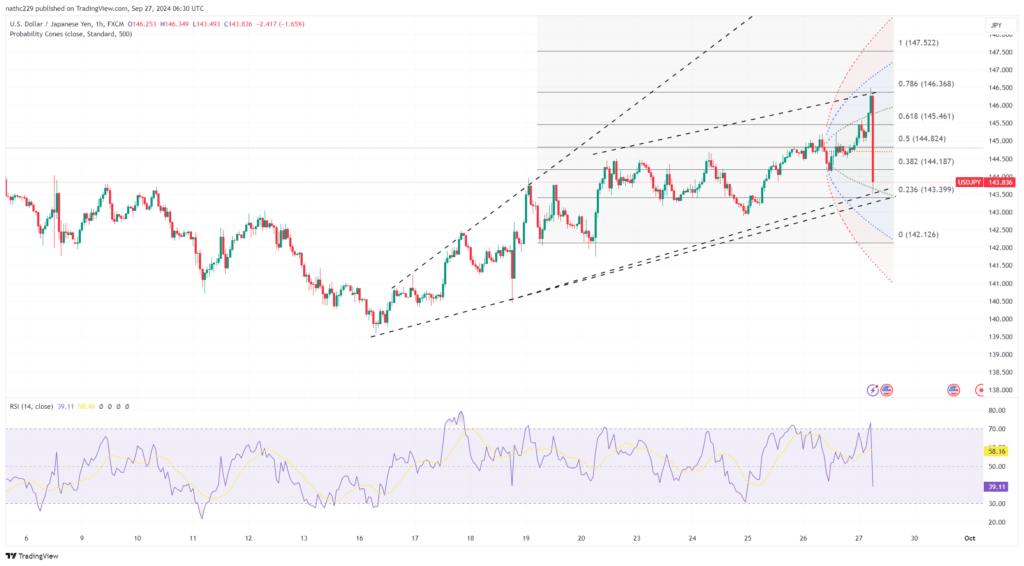

Technically, USD/JPY is testing critical levels on both ends. A break above the Aug. 21 doji at 145.25 would signal further gains for dollar bulls, with potential to push the pair toward the 2023 highs. However, if the pair falls below the 144.20-22 support zone, which aligns with the Aug. 5 close and the post-U.S. payrolls high, bears may gain control. Further downside could see USD/JPY testing the 21-day exponential moving average (EMA) at 143.80 and the Ichimoku base line at 143.39, with price congestion around the 143.11 low from Sept. 24 serving as additional support. Broadly softer USD sentiment and falling oil prices have limited the yen’s decline, while improving risk appetite, fueled by China’s stimulus measures and the Swiss National Bank’s (SNB) rate cut, has helped yen crosses like AUD/JPY and GBP/JPY reach new monthly highs.

Looking ahead, the outcome of the LDP leadership election will be pivotal for USD/JPY traders, especially given the market’s positioning toward a weaker yen. Should either Ishiba or Koizumi emerge victorious, there could be room for yen gains, particularly if Tokyo’s CPI, also due this week, surprises to the upside. A higher-than-expected inflation reading would likely impact the tone of the Bank of Japan (BOJ), increasing the possibility of yen strength. Conversely, a victory for Takaichi, a known stimulus proponent, could reinforce yen weakness. Traders will also closely watch the U.S. PCE report on Friday, which could drive further market moves if U.S. inflation trends lower, supporting a dovish Fed outlook and potentially weakening the dollar against the yen.