USD/JPY Technical Analysis: Bullish Momentum Faces Resistance Amid Overbought Signals

The USD/JPY currency pair is currently trading around the 145.495 level.

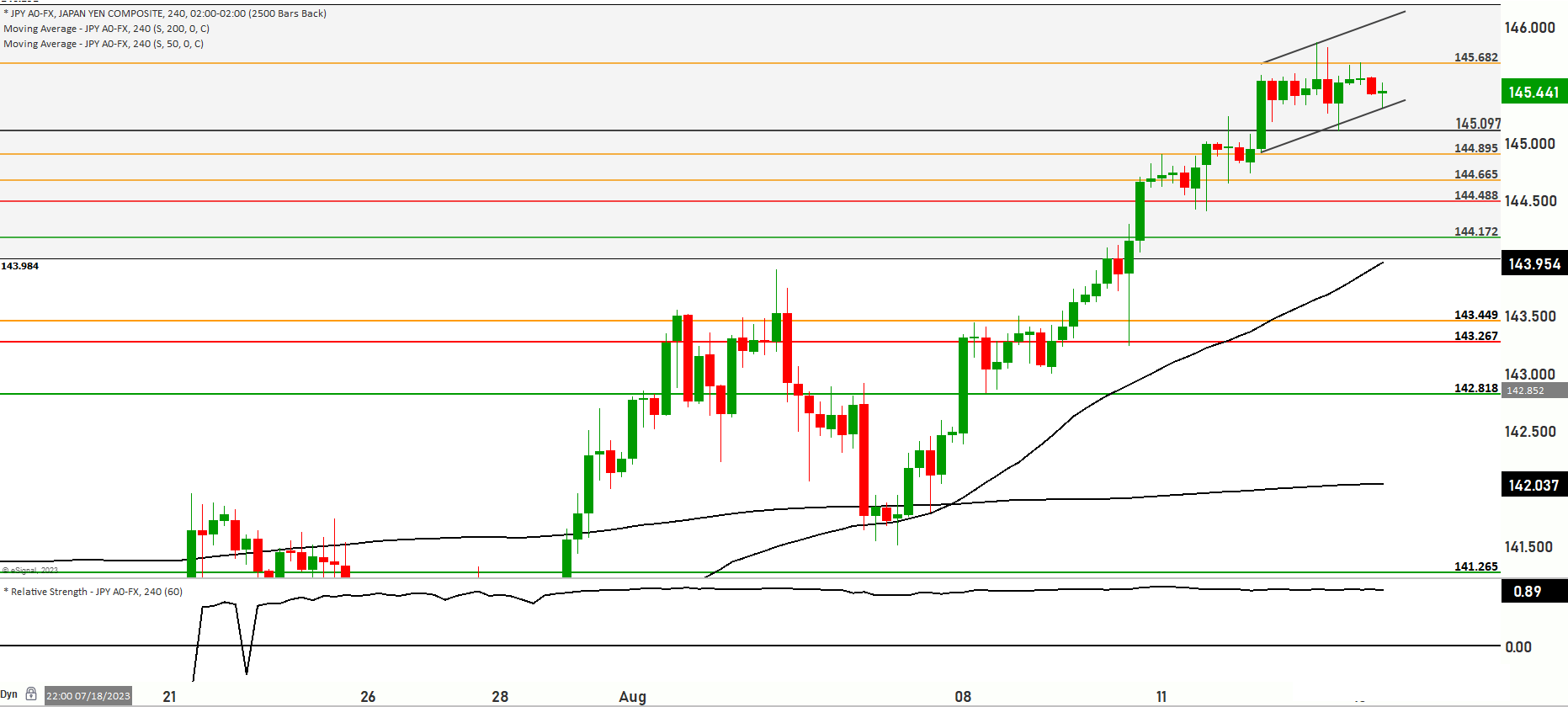

A significant observation is that the current price is positioned above both the 200-Day Moving Average (DMA) and the 50-Day Moving Average. This alignment of prices above these moving averages suggests a favorable bullish momentum. The momentum indicates a potential for further price appreciation.

Scenario 1: The price has the possibility to continue its upward movement and potentially revisit the 145.682 level. If this bullish trend persists, there’s potential for the price to climb even higher, aiming to test the range between 145.850 and 146.050. This specific range corresponds to a resistance level where the price could face challenges in advancing further. It’s noteworthy that the highest resistance level to watch is at 146.050.

Scenario 2: On the other hand, there’s a chance that the price might decrease and test the 144.895 level. Should this test prove successful, it could pave the way for the price to continue its downward trajectory towards the 144.692 level. In case of further decline, subsequent support levels become relevant, with a focus on 144.488 and 144.338. Of particular significance are the key levels at 144.172.

Despite the current positive momentum in the market, there’s a notable observation to be made. A pullback from recent highs indicates that the market might be experiencing an overbought condition. This means that prices have risen significantly, potentially too much too quickly. Supporting this notion, the Relative Strength Index (RSI), a technical indicator used to measure momentum, is nearing a level typically associated with overbought conditions. This might imply that a period of consolidation or a corrective move could be in the cards.

Key levels to watch are 144.895,144.346,145.682, 145.920

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 145.150 | 145.682 |

| Level 2 | 144.895 | 145.906 |

| Level 3 | 144.692 | 146.050 |