Introduction:

As of November 15, 2023, the top five performing stocks in the US Tech sector are:

1. NVIDIA Corp (NVDA): The stock value for NVIDIA is increased to 212.05% and 197.7% for 2023. One of the top manufacturers of tech devices is NVIDIA, which designs and sells graphics and video processing chips for desktop and gaming personal computers, workstations, and other highly advanced computing systems and supercomputer.

2. Broadcom Inc (AVGO): Broadcom’s stock has also done well, with a one-year yield of 80.95% . Broadcom is a major supplier of semiconductor and infrastructure software solutions and designs and develops such solutions.

3. Advanced Micro Devices Inc. (AMD): Their stock has a one-year return of 79.10% and a 2023 performance of 52.1% for Advanced Micro Devices. It is a multinational semiconductor company developing processors and business and consumer computer markets.

4. Adobe Inc (ADBE): The one-year stock return of Adobe stands at 70.57% and its performance in 2023 is 58.1% . Adobe is a multinational computer software company, and for this reason it is well known for its Adobe Flash web software ecosystem, Photoshop image editing software, Adobe Illustrator vector graphics editor, Acrobat Reader, and the Portable Document Format (PDF).

5. Synopsys, Inc. (SNPS): Synopsys’ stock has a one year return of 62.05% and a 2023 performance of 47% . Synopsys is headquartered in California and is a leading American electronic design automation (EDA) supplier focusing on silicon design and verification, silicon intellectual property (IP), and software security and quality.

NVDIA Stock Performance

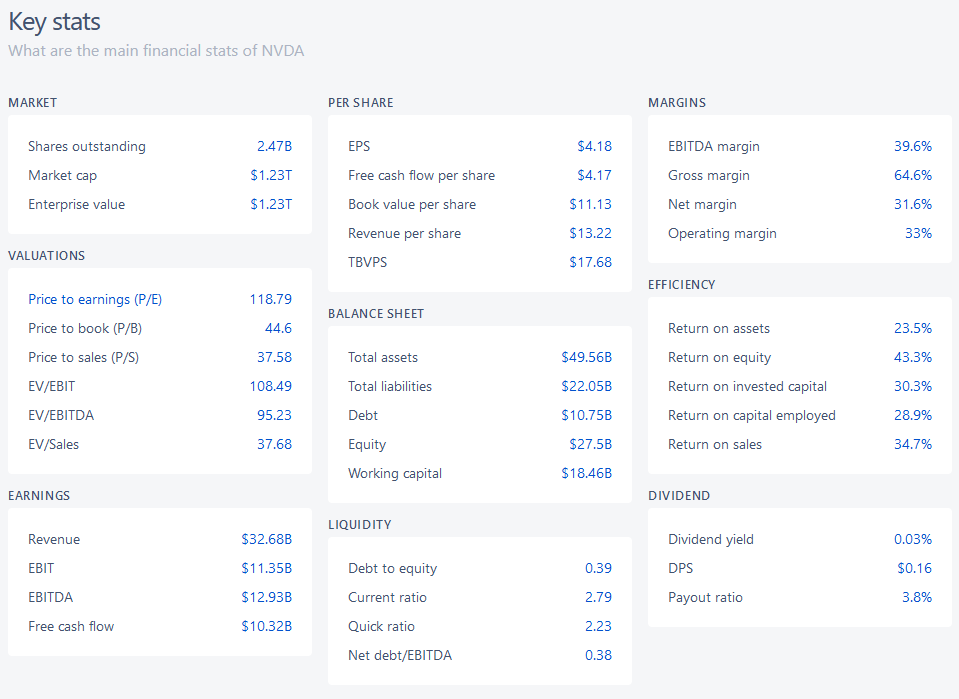

As of November 15, 2023, NVIDIA Corporation (NVDA) is one of the major firms in the technology sector, especially in the production of GPUs for games as well as professional markets and SoCs intended for use in mobile computing and automotive. The company’s market capitalization is estimated as $1.16 trillion and the earnings per share (EPS) as $1.93. NVIDIA’s financial performance has been strong with it making $13.51 billion in revenue for the second quarter that ended on July 30, 2023, which shows a 101% increase from last year and a 88% increase from This quarter, net earnings attributable to share dilution was $2.48, up 854% from a year ago, and up 202% from the previous quarter.

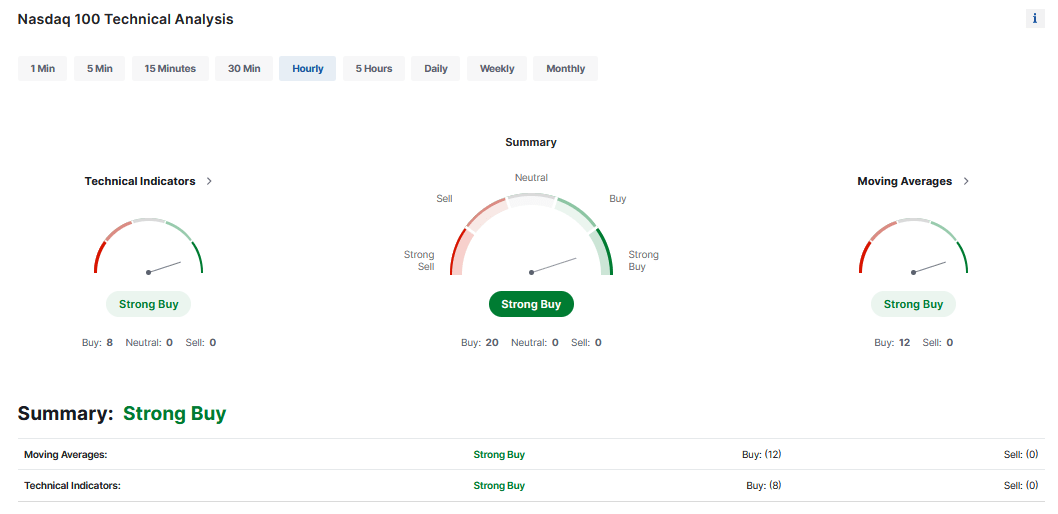

NVDA ended the day’s stock performance at $468.06, representing a 2.20% increase from the previous closing price. On the other hand, the RSI 14 is 79, which is usually a signal of an upcoming reversal in prices or slowdown in the recent stock gains. The organization has also been involved in the process of rewarding shareholders. For the fiscal year 2024, during the second quarter, the company repurchased 7.5 million shares worth $3.28 billion and paid cash dividends of $48.7 million (NVIDIA, 2014).

On the side of upcoming events, NVIDIA will take part in the Supercomputing 2023 event in Denver, CO from November 12-17, and the MS Ignite event in Seattle, WA from November 15-16, 2023.

There is a consensus in the market from the experts and analysts. According to them, 35 analysts suggest “Buy”, three analysts suggest hold and one analysts suggest “Sell”. This recommendation is predominantly influenced by the firm’s positioning as a leading player in its sector, strong growth expectations, and the predominantly bullish market sentiment surrounding it.

Meta Stock Performance

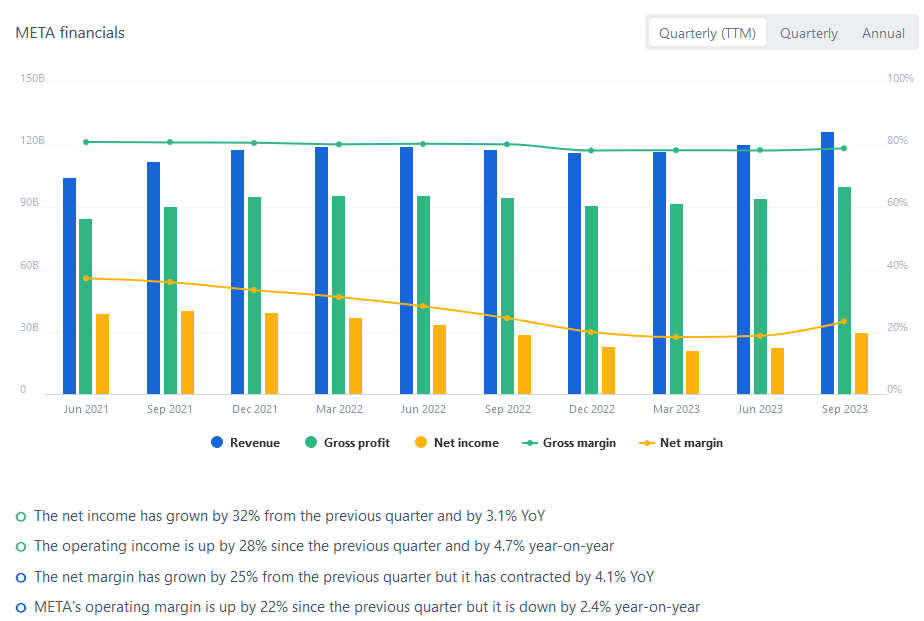

Since the low of November 2022, Meta Platforms Inc. (formerly Facebook) has been witnessing a surge in its share price and now stands at around 3.5 X of that value. This is a massive bounce after a record $251 billion drop in February which is the largest one-day stock wipeout. However, Meta appears to be stronger as 62 out of 70 analysts tracked by Bloomberg rate it equal to buy, which is the highest confidence level since its IPO in 2012.

Wall Street now forecasts Meta’s profitability for next year to be about $18 per share compared to around $10 a year ago. In their third quarter 2023 report, Revenue grew by 23% year-over-year while Net Income increased by 164%. The firm had a market capitalization of $813.62 billion as at November 7, 2023 .

This growth has been influenced by enhanced interaction with their products namely Instagram, WhatsApp, messenger, and Facebook[4]. Meta’s use of AI to recommend Reels leads to traffic on Facebook and Instagram[4]. Nevertheless, macroeconomic conditions continue to pose a challenge to Meta’s advertising revenues as well as targeting and measurement issues arising from the changes in iOS.

The social media giant still remains the most affordable of the seven major technology and internet stocks despite the rise of Meta’s valuation this year, which currently stands at about 18 times earnings projected over the subsequent 12 months. It also has a discount compared to both Nasdaq 100 and S&P 500 indexes.

Looking forward, Meta is expected to benefit from artificial intelligence and growth in digital ad spending in the years to come. The company’s focus on cost-cutting, toned-down metaverse rhetoric, and resurgent revenue growth have helped allay most skepticism. However, some analysts remain skeptical, citing rising competition and potential challenges from mobile operating system changes like Apple Inc.’s iOS.

Apple Stock Performance

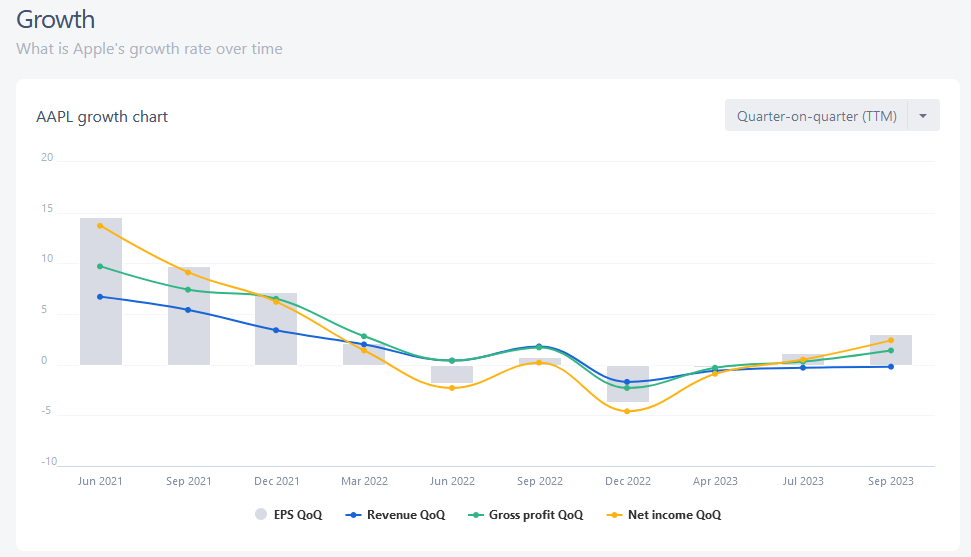

Apple Inc. remains one of the major corporations in the tech industry that emphasizes innovation, privacy, and sustainability. Financial performance wise, Apple announced its fiscal 2023 fourth quarter results on November 2, 2023. In the third quarter, the company’s revenue was $89.5 billion, down 1% year over year. The quarterly earnings per diluted share were $1.46, up 13% year over year. In addition, the company announced cash dividend of $0.24 per share, to be made on the 16th of November 2023, to shareholders registered by the close of business of the 13th of November 2023.

Apple’s CEO Tim Cook announced a September quarter record for revenue in iPhone and an all-time in Services. Additionally, he emphasized the company’s strongest product line-up ever ahead of the holiday season, comprising of the iPhone 15 line-up and the first carbon-neutral Apple watches. This is a major milestone in Apple’s quest to have all its products carbon-neutral by 2030.

Software has been one of the core issues that have made Apple work hard on the product development front. In October 2023 there were beta versions of iOS 17.2, iPadOS 17.2, macOS 14.2, tvOS 17.2, and watchOS 10.2 from the company. Apple also introduced cloud-centred security features such as iMessage Contact Key Verification, Security Keys for Apple ID, and Advanced Data Protection for iCloud.

In June 2023, Apple announced major updates to Safari Private Browsing, Communication Safety, and Lockdown Mode on a privacy front. The company also added new features that prioritize privacy and security issues like Check in, NameDrop and Live Voicemail.

Apple’s commitment to environmental sustainability is evident in its updated Regulated Substances Specification, which took effect on May 15, 2023. This document outlines Apple’s global requirements and restrictions on the use of certain chemical substances or materials in its products, accessories, manufacturing processes, and packaging.

Apple continues to demonstrate strong financial performance, commitment to privacy and security, and dedication to environmental sustainability. The company’s ongoing product and software innovations, coupled with its robust lineup of products, position it well for future growth.

Conclusion

US tech sector, as of November 2023, displays an evolving environment having numerous top performers. NVIDIA Corp, Broadcom Inc, Advanced Micro Devices Inc., Adobe Inc, and Synopsys, Inc. to mention a few are the companies which have shown great stock returns over a period of a year. The stock of Meta Platforms Inc. (formerly Facebook) has bounced back from a massive fall earlier in the year, and analysts are confident of the company’s future prospects. On the other hand, issues such as economic conditions and changes in mobile operating systems remain a cause for concern.

However, Apple Inc. still stands as a pillar in the tech industry, with a sound financial strength, a passion for privacy and sustainability, and a determination to continuously innovate. Apple’s endeavor to attain carbon neutrality by 2030 and the fact that it focuses on privacy and security in its software offerings gives it the ability to continue experiencing growth and relevance. Each of the tech giants has its own strengths and weaknesses, highlighting the rapidly changing dynamics of the tech industry. Investors and observers will continue to keep eyes on them as they try to survive in the ever-changing world of technology and innovation.

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.