Introduction:

The Top 4 Trading Strategies are:

Stock Market Trading:

- The “Holiday Effect” strategy is particularly significant around specific holidays like Independence Day, Thanksgiving, and Christmas. This involves analyzing how the S&P 500 performs before and around these holidays to make informed trading decisions.

Investment in Specific Sectors:

- During the holiday season, sectors like retail, e-commerce, logistics, and technology often see a boost due to increased consumer confidence and spending. Companies in these sectors may experience a significant uptick in sales, often translating into higher stock prices. Notable companies that are customer favorites during this period include MercadoLibre, Amazon, Alibaba Group, Next Plc, and Walmart.

Forex Trading Strategies:

- Planning ahead, setting realistic goals, using stop loss orders, diversifying the portfolio, leveraging technology, and practicing self-care are key strategies for a stress-free holiday season in forex trading. These strategies help in managing risks and capitalizing on opportunities in a potentially volatile and unpredictable market.

Retail Sector Trends:

- A “soft landing” in the economy is expected to drive a favorable holiday shopping season, with a majority of consumers planning to spend the same or more compared to the previous year. This could have a positive impact on retail stocks.

- Younger consumers, particularly Gen Z and Millennials, are expected to be key drivers of sales growth, owing to their higher wage gains.

- The trend of starting holiday shopping earlier, with a significant portion completed by the end of November, highlights the importance of early deals and promotions.

- Online platforms are increasingly dominating the retail space, with personalization being a key factor for engaging younger consumers.

These strategies and insights provide a comprehensive view of the potential opportunities in various market segments during the holiday season. Traders and investors can use this information to make informed decisions based on current trends and historical data.

Analyzing Seasonality Through the Lens of Patterns

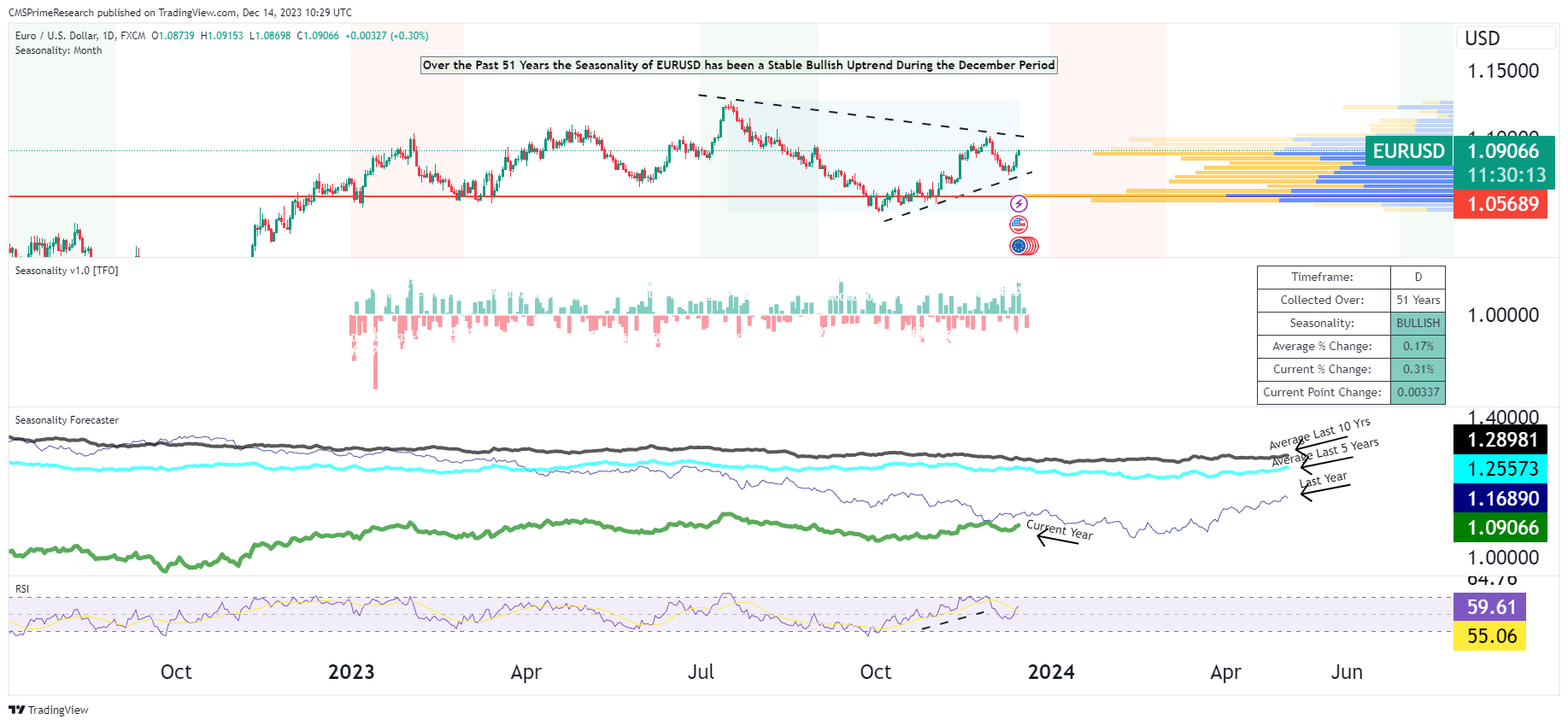

The EUR/USD currency pair exhibits a historical pattern of bullish behavior in December, a trend sustained over a 51-year analysis. The chart reflects this through a projected uptrend line and a volume profile indicating key trading levels, suggesting areas of potential support and resistance. The Seasonality tool further supports this pattern, alongside a Seasonality Forecaster comparing current year trends against historical data. The RSI stands neutral, implying no immediate overbought or oversold conditions. Current trends outperform historical averages, with the current percentage change at 0.31% versus an average of 0.17%. Key price levels from the past, including 1.28981, 1.25573, and 1.16890, are highlighted, potentially representing future pivot points.

The green line depicting the current year’s price trend is notably divergent from the historical average lines, which could suggest an atypical market movement for this period.

The averages from the last 5 and 10 years, illustrated by the cyan and black lines respectively, serve as historical benchmarks. They highlight that, while there are fluctuations, there appears to be a general trend that could be interpreted by traders as indicative of future price behavior. For instance, if the current year’s line is below the historical averages, it might suggest a potential for a reversion to the mean.

The volume profile to the right indicates where the most trading activity has occurred, with price levels such as 1.28981, 1.25573, and 1.16890 potentially serving as areas where the market has previously shown strong reactions. These levels could act as support or resistance in the future, with the price often gravitating towards these zones of high volume.

Looking at these elements collectively, one could infer that if the current year’s trend continues to deviate from historical averages, it may suggest a changing market dynamic that could disrupt the typical seasonal pattern. Conversely, if the price begins to align with the historical trend lines, it may reaffirm the seasonal tendencies and offer opportunities for trend-following strategies.

The robust dataset, derived from daily price movements across five decades, underpins the analysis, but it is essential to consider live economic indicators and market sentiments to inform trading decisions dynamically. Despite the bullish seasonal inclination, the unpredictable nature of the forex market necessitates risk management practices, such as stop-loss orders, especially considering the volatility and external factors that can influence currency valuations.

Key Holiday Season Retail & E-commerce Stock Trading Indicators

Earnings Reports and Forecasts: Investors should pay attention to the earnings reports and forecasts of major retailers. For instance, reports from companies like Walmart and Target can give insights into the overall health of the retail sector and consumer spending trends.

Consumer Spending Trends: Understanding shifts in consumer behavior, such as increased caution due to inflation and interest rates, and how these factors influence spending, is crucial. Monitoring how consumers finance their purchases, like the use of credit cards or savings, can provide insights into the sustainability of spending patterns.

Pricing Strategies and Market Share: Retailers’ approaches to pricing and discounting to maintain market share are important indicators. Observing trends in consumer preferences, such as trading down to essentials in the face of inflation concerns, can offer valuable insights into potential stock performance.

By closely monitoring these indicators, traders and investors can gain a comprehensive understanding of the retail and e-commerce sectors’ performance during the holiday season, thereby informing their stock trading decisions.

Timing Trades for Holiday Retail and Tech Sector Gains

In the retail sector:

Early Shopping Trend: The holiday shopping season is starting earlier each year, with 60% of holiday shopping expected to be complete by the end of November. This shift is driven by online platforms and earlier retail promotions, indicating that engaging in retail sector trades earlier in the holiday season could be beneficial.

Peak Shopping Period: Despite the lengthening of the holiday season, the critical period for retailers remains tight, with more than half of customers aiming to complete their shopping by Black Friday and Cyber Monday. This suggests a concentrated window of opportunity around these dates.

Market Projections: U.S. retail sales (excluding automotive) are projected to increase by 3.7% during the holiday season, running from November 1 to December 24. E-commerce is expected to rise by 6.7%, while in-store sales may see a 2.9% increase year over year. Stocks like Amazon, GameStop, and others in the e-commerce and electronics sectors are positioned as prospective winners.

In the technology sector:

December Opportunities: For tech stocks, December presents a unique buying opportunity. Companies that have remained undervalued despite navigating past turbulence well are considered good picks. This includes companies like Fabrinet, PayPal, and eBay, which are expected to benefit from ongoing trends in AI, BNPL payment processing, and dual-pronged holiday sales opportunities.

Consumer Behavior Trends: The holiday season is typically not the peak time for tech stocks, except for well-known e-commerce companies like Amazon. However, this creates a potential opportunity for investors to buy quality tech stocks that might be overlooked in favor of consumer discretionary stocks during this time.

Based on these insights, for the retail sector, an effective strategy might involve entering trades early in the holiday season, potentially in early November, and focusing on companies benefiting from e-commerce and electronics sales growth. For technology stocks, considering investments in undervalued but strong-performing companies in December could be advantageous, especially in areas like AI and digital payment platforms.

Scenario-Based Risk Management: Key Considerations

Effective risk management during the holiday season requires an understanding of both general trading principles and specific seasonal trends.

Scenario 1: Sudden Market Downturn

- Risk Management Strategy: Implement strict stop-loss orders to limit losses and use hedging strategies to offset positions.

- Currency Pair Impact: Diversify across multiple currency pairs, avoiding overexposure to correlated pairs like EUR/USD and GBP/USD.

Scenario 2: Low Liquidity Leading to Price Gaps

- Risk Management Strategy: Reduce position sizes (1% rule) to mitigate the impact of sharp price movements.

- Currency Pair Impact: Be cautious with pairs involving currencies from countries observing the holiday, as these may experience lower liquidity.

Scenario 3: Unexpected Macro News Release

- Risk Management Strategy: Maintain a solid trading plan and be prepared to adjust strategies quickly.

- Currency Pair Impact: Monitor economic calendars closely for any scheduled announcements that could affect currency pairs.

Scenario 4: Increased Volatility Post-Holidays

- Risk Management Strategy: Utilize a favorable risk/reward ratio to ensure potential profits justify the risks.

- Currency Pair Impact: Focus on pairs less likely to be influenced by holiday seasonality, such as pairs involving currencies from countries not observing the holiday.

Scenario 5: Emotional Trading Due to Holiday Sentiment

- Risk Management Strategy: Master trading psychology to avoid emotional decisions and impulsive trades.

- Currency Pair Impact: Adhere strictly to the trading plan and avoid making decisions based on short-term market sentiments.

By preparing for scenarios like sudden market downturns, low liquidity, unexpected macro news, increased post-holiday volatility, and the tendency for emotional trading, traders can navigate the unique challenges of holiday season trading. This involves strategies such as using stop-loss orders, hedging, adjusting position sizes, diversifying currency pairs, monitoring economic calendars, maintaining a solid trading plan, and controlling emotional responses. These tailored strategies help manage the risks associated with holiday seasonality, particularly in the forex market, and capitalize on potential opportunities.

Conclusion

In conclusion, the holiday season introduces unique dynamics and opportunities in trading and investing, notably in retail, technology, and forex. Early entry strategies, close monitoring of key indicators, and effective risk management are essential for success during this festive period. In the retail and e-commerce sectors, understanding consumer behavior shifts, embracing online platforms, and staying informed about earnings reports and pricing strategies are vital. For technology stocks, December offers potential buying opportunities, particularly in undervalued companies specializing in AI and digital payments.

To navigate the season, traders should be prepared for scenarios like market downturns, low liquidity, unexpected news releases, post-holiday volatility, and emotional trading. Utilizing risk management techniques, including stop-loss orders and disciplined trading plans, can help traders seize potential opportunities while safeguarding against risks. Ultimately, the holiday season demands adaptability, strategy, and vigilance. By leveraging these insights and strategies, traders and investors can enhance their decision-making and aim for profitable outcomes amid the festivities.

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.