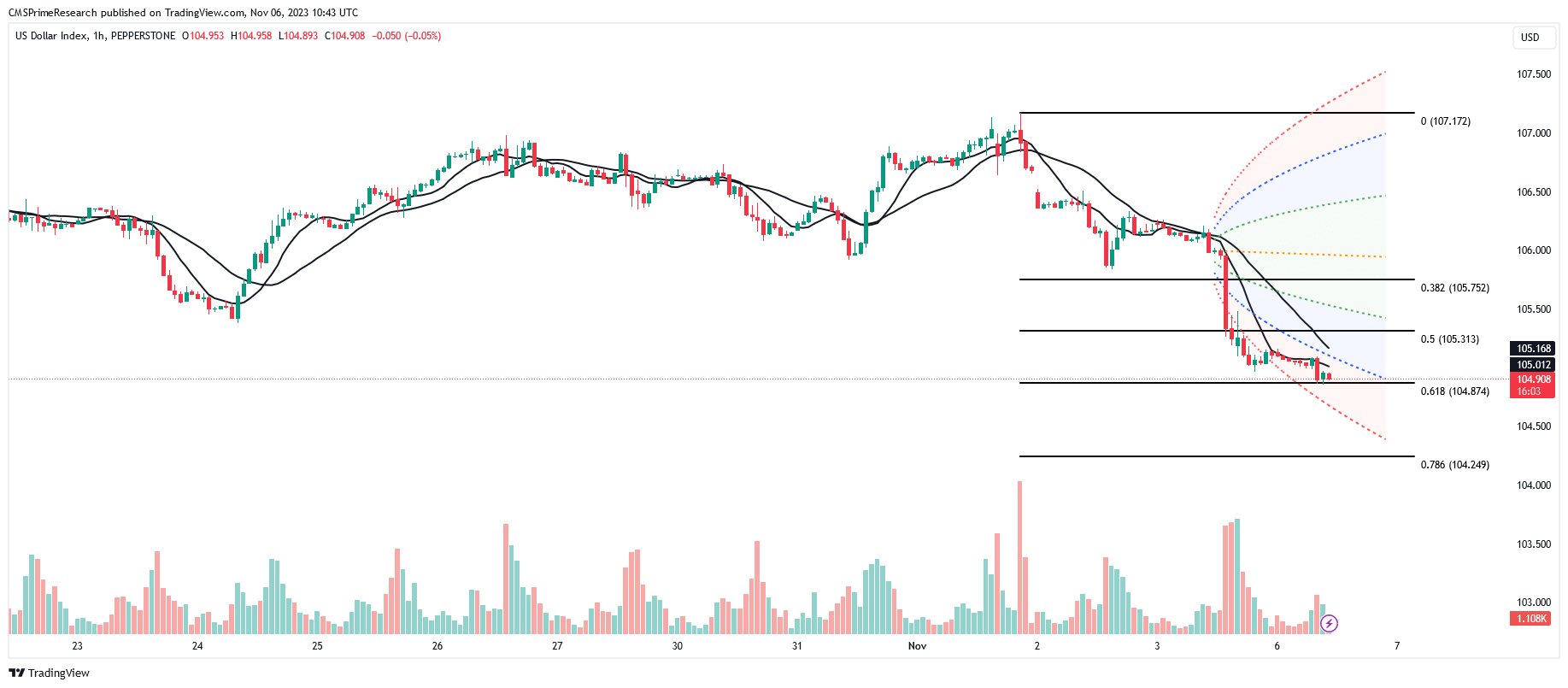

Dollar Index:

As of Novemeber 06, 2023, several key events and factors are impacting the price of the US dollar (USD):

Federal Reserve Policy and Dollar Index

- The Federal Reserve has softened its aggressive stance on interest rate hikes.

- This shift in rhetoric led to a more than 1% decline in the dollar index last week, reaching a six-week low.

- The market now heavily anticipates that the Fed has concluded its rate hikes, with a high chance of policy easing starting as early as June.

Analyst Perspectives

- Analysts from J.P.Morgan Securities believe that the fundamental strengths of the USD are still present, although diluted.

- They suggest that a significant decline in the dollar would require substantial improvements in the economies of the euro zone, China, and other regions.

Global Currency Movements

- The Japanese yen has slightly weakened, trading at 149.58 per dollar.

- The South African rand remains stable against the weakening dollar.

- The New Zealand dollar (NZDUSD) has rallied, confirming a bullish trend.

- In Pakistan, the US dollar saw a modest appreciation against the Pakistani rupee.

- In Sri Lanka, the rupee opened weaker against the US dollar.

Stock and Commodities Market

- Asian stock markets are expected to rise following a rally in US stocks and bonds.

The Federal Reserve has softened its aggressive stance on interest rate hikes. This shift in rhetoric led to a more than 1% decline in the dollar index last week, reaching a six-week low. The market now heavily anticipates that the Fed has concluded its rate hikes, with a high chance of policy easing starting as early as June

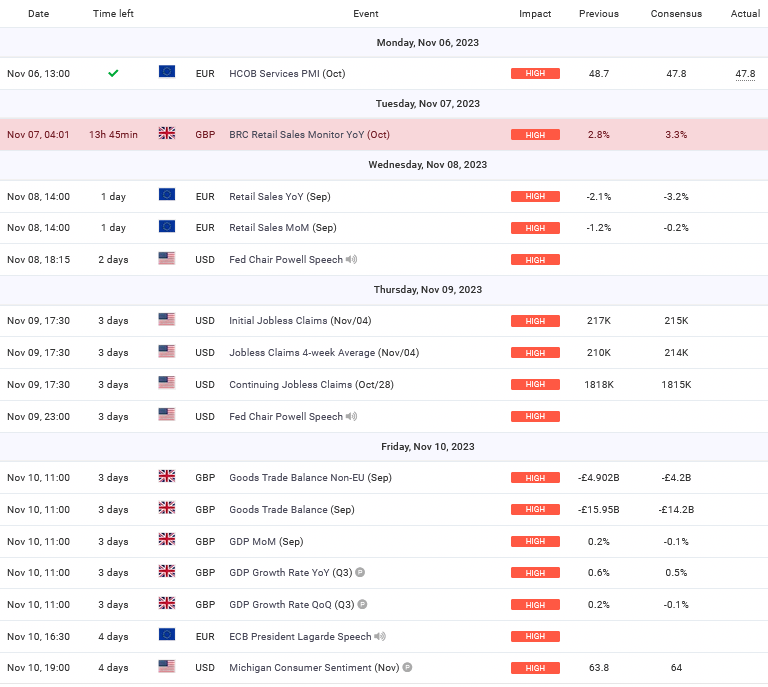

Upcoming Events for the week:

In the upcoming week, a set of significant economic events in the Eurozone (EUR), the United States (USD), and the United Kingdom (GBP) are poised to have a notable impact on the currency markets. These events range from critical economic data releases to speeches by central bank officials, all closely watched by traders and investors for insights into the potential direction of these currencies.

Starting with November 8th, the Eurozone’s Retail Sales MoM (Month-on-Month) data for September is expected. The consensus anticipates a modest improvement from the previous -1.20% to -0.20%. Should the actual figure deviate significantly from this expectation, it could influence the EUR’s value. A better-than-expected retail sales report may boost the EUR, reflecting improved consumer spending, while a worse outcome might weaken it.

On the same day, Federal Reserve Chair Jerome Powell is scheduled to deliver a speech. While the content of his speech may not be predetermined, any hints at the Fed’s monetary policy stance could impact the USD.

Powell’s remarks will be closely scrutinized for insights into potential interest rate changes, which could lead to USD volatility. Moving to November 9th, the United States will release the Initial Jobless Claims for the week ending November 4th. With a consensus of 215,000 and a previous figure of 217,000, any deviation from this number could influence the USD’s value. A lower number of jobless claims may boost confidence in the labor market and strengthen the USD, while a higher figure could have the opposite effect.

Analysts from J.P.Morgan Securities believe that the fundamental strengths of the USD are still present, although diluted. They suggest that a significant decline in the dollar would require substantial improvements in the economies of the euro zone, China, and other regions

EUR USD Outlook:

Initially, on Nov 08, the Eurozone’s Retail Sales MoM for September will be under scrutiny. A smaller decline than the previous -1.20%, particularly if it beats the -0.20% consensus, could indicate resilience in the Eurozone’s consumer sector, potentially bolstering the Euro. On the same day, the speech by Fed Chair Powell in the US holds significance. Market participants will parse Powell’s words for insights into the Fed’s future monetary policy. A hawkish stance could strengthen the USD, while a dovish tone might lead to a weaker USD, benefiting the EUR/USD pair.

The US Initial Jobless Claims data on Nov 09 will be a marker of the job market’s health. Claims lower than the forecasted 215K could signal a robust job market, potentially strengthening the USD against the Euro. Conversely, higher than expected claims might indicate economic softness, potentially weakening the USD. On Nov 10, the Michigan Consumer Sentiment for November will be released. An improvement over the expected 64 could imply rising consumer confidence in the US, typically a positive sign for the USD, and could place downward pressure on the EUR/USD pair.

Lastly, ECB President Lagarde’s speech on Nov 10 will be pivotal for the Euro. Her remarks on monetary policy and the economic outlook in the Eurozone will be closely analyzed. A hawkish tone could strengthen the Euro, while any dovish signals might weaken it against the USD.

In conclusion, these events collectively hold the potential to cause notable fluctuations in the EUR/USD pair. Traders will be closely monitoring these releases, with particular attention to deviations from consensus and the broader narrative they present about economic health and monetary policy in the Eurozone and the US. The interplay between these factors will be key in determining the direction of the EUR/USD pair in the short term.

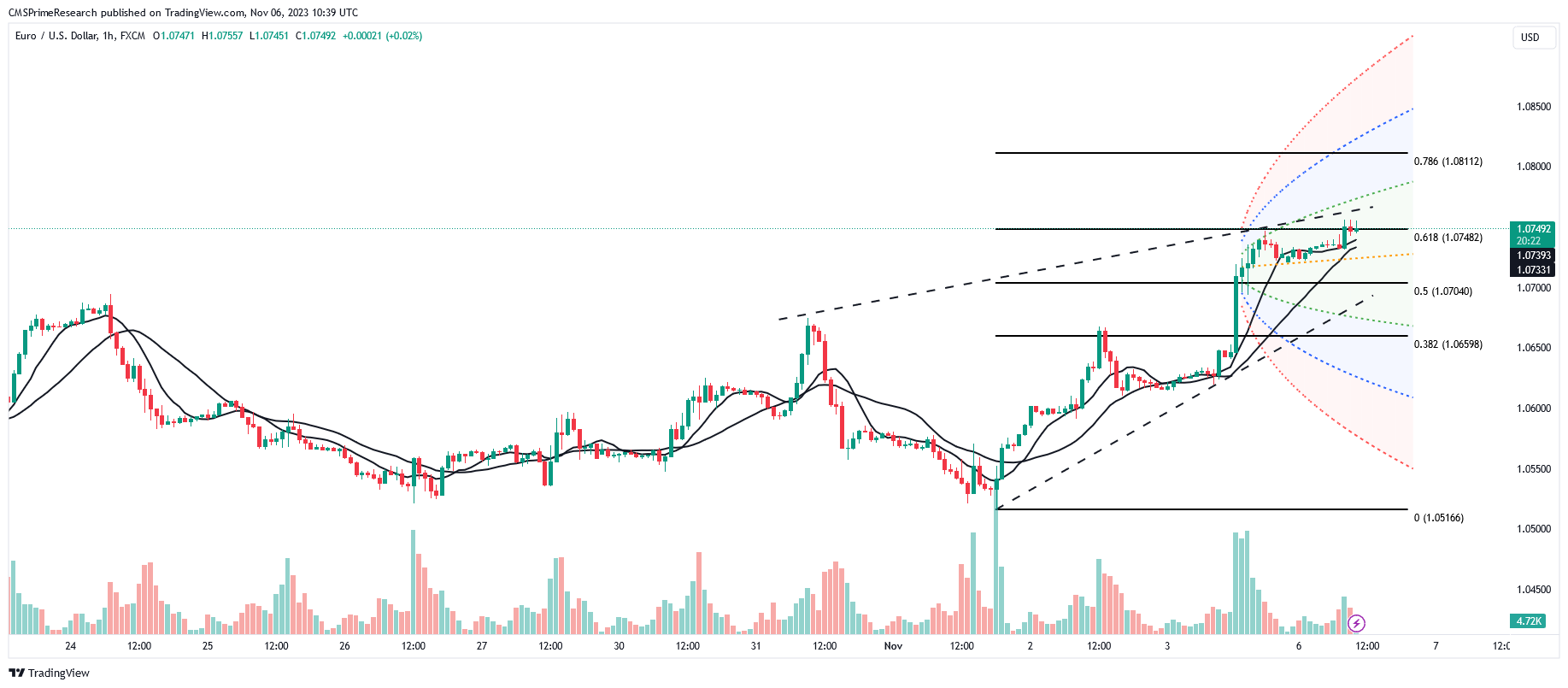

EUR/USD Technical Snapshot:

Scenario 1: Bullish Movement

- Potential upward movement to test levels from 1.07480 to 1.07708 and further up to 1.08048.

- If momentum persists, additional tests at 1.08097 and 1.08393.

- Possible bullish continuation towards 1.08393, with further upside potentials at 1.08850.

Scenario 2: Bearish Movement

- Possibility of a decline to test levels 1.07298 and 1.06823.

- If bearishness continues, further tests expected at 1.06613, followed by a significant support at 1.06338.

Market Momentum & RSI

- Short-term momentum: bullish, with an increasing momentum observed on the weekly timeframe.

- RSI is in the increasing zone, indicating potential short-term bullishness.

- Possible trading range could be anticipated based on current market conditions and technical indicators.

GBP USD Outlook:

The UK economic data due on Nov 10, comprising the Goods Trade Balance, both Non-EU and total, and the GDP MoM for September, will be closely watched. If the trade deficit narrows more than expected (-£4.2B for Non-EU and -£14.2B total), it could indicate a strengthening UK economy, potentially boosting the GBP. Conversely, a wider deficit might pressure the GBP downwards. The GDP MoM is another critical figure; a positive reading, contrary to the expected -0.10% contraction, could significantly bolster the GBP, while a contraction could have the opposite effect.

On the US side, Fed Chair Powell’s speech on Nov 08 and the Michigan Consumer Sentiment on Nov 10 are key events. The market will be parsing Powell’s speech for any hints on future monetary policy and economic outlook. A hawkish tone could strengthen the USD, leading to a decrease in GBP/USD, whereas a dovish tone might weaken the USD and lift GBP/USD. The Michigan Consumer Sentiment, forecasted to be slightly higher than the previous value, provides insights into consumer confidence. A higher sentiment could signal a robust consumer sector, potentially strengthening the USD against the GBP.

The critical aspect here is to gauge how actual numbers compare against the consensus. Significant deviations can lead to immediate market reactions. For instance, better than expected UK economic data could lead to GBP strengthening, while worse data could weaken it. In the US, stronger data typically bolsters the USD, and weaker data can lead to a softer USD.

In summary, the GBP/USD pair’s movement in the upcoming days will be influenced by a combination of UK economic indicators and key US events. Traders will be watching these events closely, not just for the data itself but also for the broader economic implications and the potential shifts in monetary policy they might suggest. The interplay between these factors will be crucial in determining the short-term direction of the GBP/USD pair.

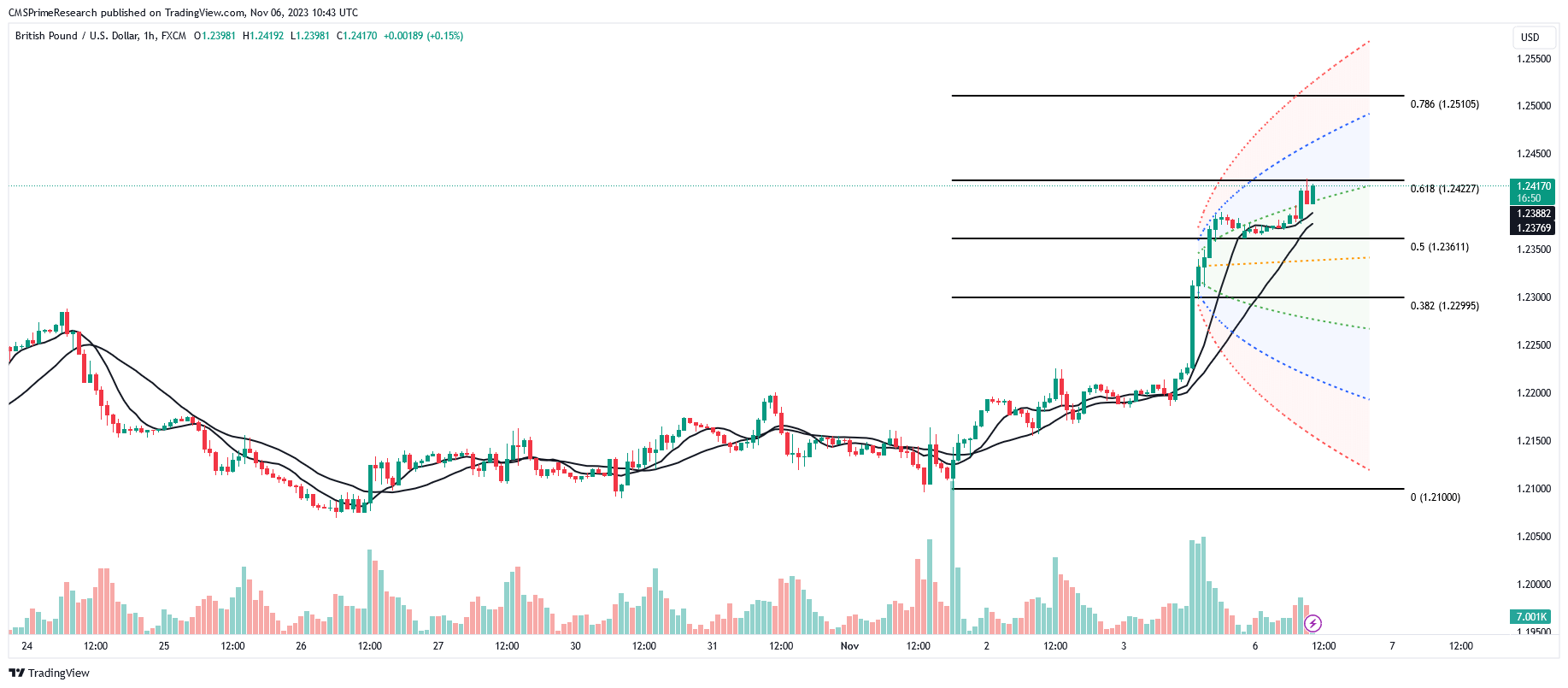

GBP/USD Technical Snapshot:

Scenario 1: Bullish Movement

– Possible upward retest at 1.2455, aiming for resistance at 1.2491, 1.2550, with a critical point at 1.2600.

Scenario 2: Bearish Movement

– Downward trend could test support at 1.2345.

– A breach of this level may lead to further decline towards 1.2305.

– Continuation of bearish momentum might drop prices into the range of 1.2262.

– Major support levels span from 1.2175

Market Conditions and Indicators

– Currently, the pair is above both the 50-day and 200-day moving averages, signaling a bullish trend.

– The market is strongly above to the 50-day MA, hinting at a possible shift in direction.

– RSI is trending towards the increasing region, indicating potential upward pressure.

– Despite the uptrend in momentum, traders should remain cautious of a potential bearish short term reversal.

USD/JPY Outlook:

For the USD/JPY currency pair, the upcoming economic events are likely to create significant market movements, especially considering the major events in both the US and other influential economies.

Starting on Nov 08, the speech by Fed Chair Powell is highly anticipated. Markets will be attuned to any comments on the US economic outlook and monetary policy. A hawkish stance, indicating potential for continued rate hikes or a strong economy, could strengthen the USD against the JPY. Conversely, dovish tones might weaken the USD, leading to an appreciation in the JPY.

Following this, on Nov 09, the US Initial Jobless Claims will provide insights into the labor market. Lower than expected claims (below 215K) could suggest a robust job market, potentially bolstering the USD. Higher claims, however, might indicate economic softness, potentially weakening the USD against JPY.

Eurozone’s Retail Sales data and ECB President Lagarde’s speech on Nov 10 are important for global economic sentiment. While these are more directly relevant to EUR, strong retail sales or a hawkish ECB stance could boost overall market confidence, potentially impacting risk currencies like the USD against safe havens like the JPY.

The key is to assess how actual figures compare against the consensus. For instance, better-than-expected US data could lead to USD strengthening, while worse-than-expected data could weaken it. Moreover, the market’s reaction may be influenced by the context of these data releases, such as ongoing economic conditions and central bank policies.

In summary, the USD/JPY pair will likely experience volatility in response to these events, with market reactions influenced by the data’s implications for economic health and monetary policy in the US, the UK, and the Eurozone. Traders will be watching these indicators closely, considering both the actual data and the broader economic narrative they contribute to.

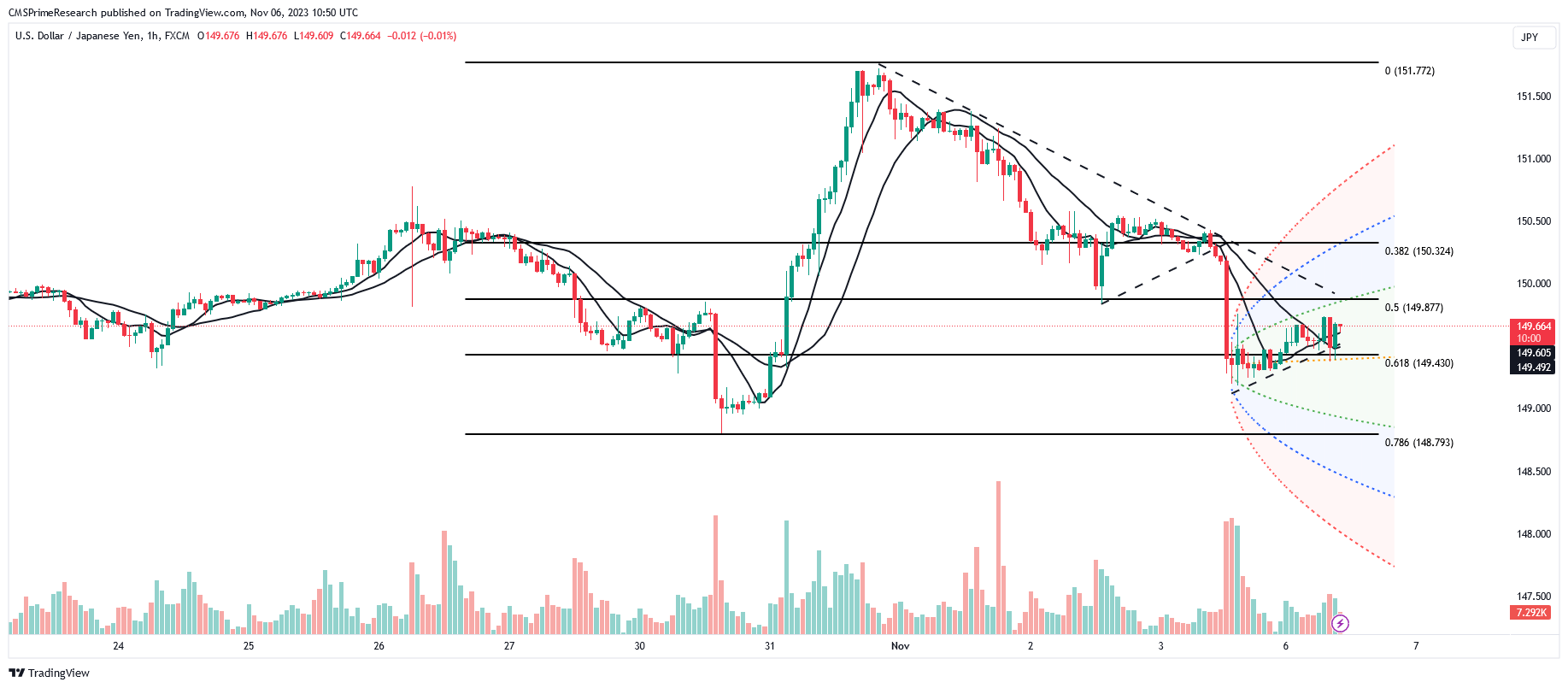

USD/JPY Technical Snapshot

Scenario 1: Bearish Movement

– Potential decline towards 149.450, with additional tests at 149.600 (61.8% Fibonacci level).

– Further decrease might target ranges between 149.302 to 149.180.

– Critical support found at 148.913, and major support level established at 148.404.

Scenario 2: Bullish Movement

– Possibility of an upswing to retest 149.980.

– Success here could propel prices towards 150.120 and then 150.256.

– Surpassing these levels might result in a test of the 150.410 benchmark.

Market Conditions and Indicators

– The pair is navigating between the 50 and 200-day moving averages, indicating a bearish range momentum.

– RSI is currently in the decreasing territory, hinting at potential range-bound movements.

– Overall, the market maintains a bearish short-term momentum

XAU/USD Outlook:

On Nov 08, the Eurozone’s Retail Sales MoM for September will be in focus. A smaller decline than the previous -1.20% or a figure better than the -0.20% consensus could indicate a stronger-than-expected consumer sector in the Eurozone, potentially leading to a stronger EUR. This might indirectly weaken the USD, thus lifting XAU/USD. Conversely, a weaker retail sales report could strengthen the USD, pressuring gold prices. Additionally, ECB President Lagarde’s speech on Nov 10 might provide insights into the ECB’s monetary policy outlook. Hawkish tones could strengthen the EUR, potentially boosting XAU/USD, whereas dovish remarks could have the opposite effect.

In the US, Fed Chair Powell’s speech on Nov 08 is highly anticipated. Markets will scrutinize his comments for clues on future interest rate hikes and the Fed’s economic outlook. Hawkish remarks could strengthen the USD, leading to lower gold prices, while dovish comments might weaken the USD, boosting XAU/USD. On Nov 09, the Initial Jobless Claims data will offer a glimpse into the US labor market’s health. Lower-than-expected claims could signify a strong job market, supporting the USD and potentially pushing down gold prices. Conversely, higher-than-expected claims could weaken the USD, increasing gold’s appeal.

The UK’s economic data on Nov 10, particularly the Goods Trade Balance and GDP MoM, will be closely watched. While these are more directly relevant to the GBP, significant deviations from expectations can affect global market sentiment. A substantially weaker-than-expected UK GDP could increase market uncertainty, potentially boosting gold as a safe-haven asset.

Finally, the Michigan Consumer Sentiment in the US on Nov 10 can influence market perceptions of consumer confidence and spending prospects. An improvement in sentiment could signal economic optimism, strengthening the USD and pressuring gold prices. Conversely, a weaker sentiment could lead to a softer USD and a rise in gold prices.

In summary, the impact of these events on XAU/USD will depend on how they influence perceptions of economic health and monetary policy in major economies. Significant deviations from consensus in these data releases can lead to market volatility, with implications for the USD and, consequently, for gold prices. Traders and investors will need to interpret these events within the broader context of global economic trends and risk sentiment.

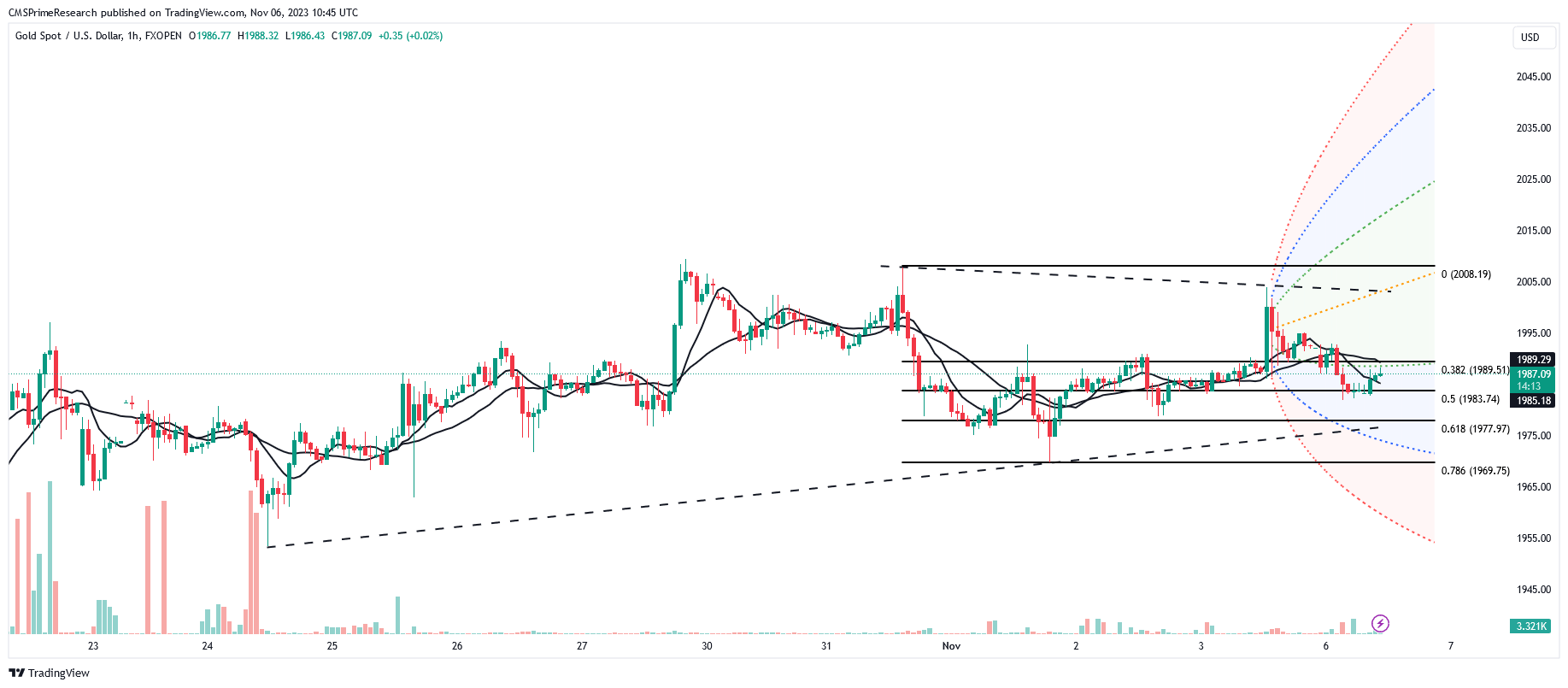

Gold Price Technical Snapshot:

Scenario 1: Bullish Continuation

– Initial upward movement towards 2000.

– Further progression might aim for 2010.

– Persistent bullish momentum could lead to tests of 2015, with significant level at 2020 to watch.

Scenario 2: Bearish Reversal

– Potential decline to 1971.

– Continued bearish pressure might target 1963.50, a crucial support level.

– Further downside could find support in the range of 1955.20 to 1946.50

Market Conditions and Indicators

– Price is trending near both the 200-day and 50-day moving averages, suggesting a neutral market sentiment within a bullish uptrend.

– The long-term trend remains bullish

Volatility Considerations:

1. Federal Reserve Policy and Dollar Index:

– Impact on Currency Markets: The Federal Reserve’s stance on interest rates and its potential shift towards policy easing can significantly affect the value of the US dollar. Any surprises or changes in Fed Chair Jerome Powell’s speech on November 8th could lead to sudden fluctuations in currency markets, particularly in the EUR/USD and USD/JPY pairs.

– Volatility in Forex: Traders will closely monitor Powell’s remarks for clues about future interest rate changes. A hawkish tone might lead to USD strength, while a dovish tone could weaken it, causing volatility in currency pairs.

2. Analyst Perspectives:

– Market Sentiment: The views of analysts from J.P. Morgan Securities suggest that the fundamental strengths of the USD are still present. However, they also highlight the need for substantial improvements in other economies for a significant decline in the dollar. Market sentiment may shift based on these perspectives, affecting trading decisions and potentially increasing volatility in currency markets.

3. Global Currency Movements:

– Impact on Safe Havens: The Japanese yen’s weakening and the potential for intervention by Japanese authorities raise concerns in the forex market. If there is any intervention, it could lead to sudden and sharp movements in USD/JPY. Conversely, stability in currencies like the South African rand and strength in the New Zealand dollar may reflect shifts in investor sentiment and impact the relative strength of these currencies against the USD.

4. Upcoming Economic Events:

– Data Releases and Speeches: Economic events, such as the Eurozone’s Retail Sales MoM, Fed Chair Powell’s speech, and the US Initial Jobless Claims, can lead to short-term volatility in currency markets. Deviations from consensus forecasts in these data releases or unexpected comments in Powell’s speech could trigger rapid price movements in the EUR/USD and USD/JPY pairs, as well as other currency pairs.

These considerations highlight the potential for news and events to create volatility in the currency markets, impacting trading strategies and risk management for traders and investors. Traders should stay informed and be prepared for market reactions to these events, which can lead to both opportunities and risks.

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.