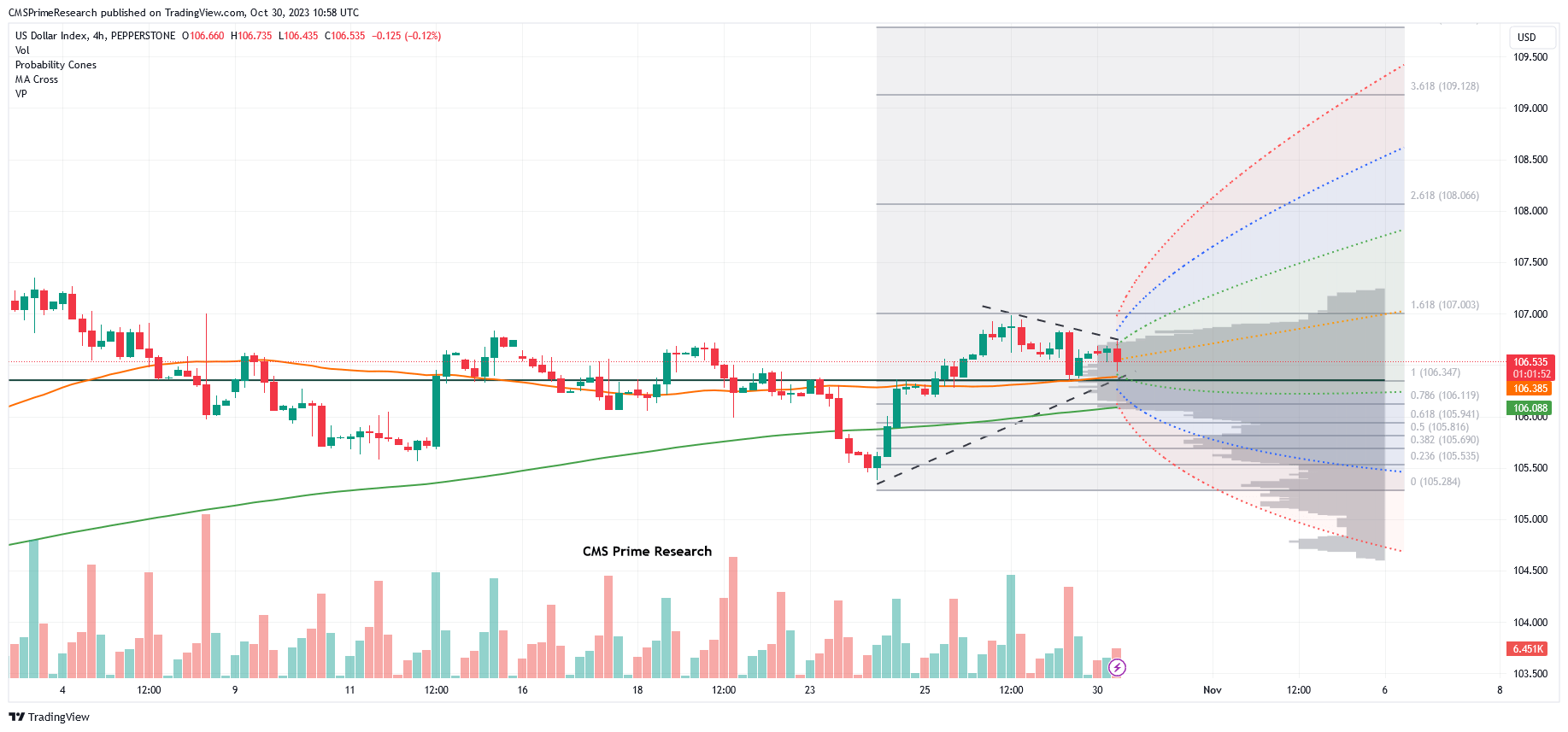

Dollar Index:

As of October 30, 2023, several key events and factors are impacting the price of the US dollar (USD):

Traditional Economic Theory and GDP Growth

The US economy experienced a strong expansion in the third quarter of 2023, growing at an annualized rate of 4.9%. This was significantly higher compared to the second quarter’s pace of 2.1% and exceeded economists expectations of a 4.3% rate. The growth was primarily driven by robust consumer spending, which increased at an annualized rate of 4% from July to September, marking its strongest performance since the fourth quarter of 2021.

Despite challenges such as high interest rates and inflation, the US economy demonstrated resilience, with sectors like the housing market also contributing to its growth. However, there are potential obstacles ahead, including rising bond yields and the resumption of student loan repayments.

Strength of USD and Treasury Yields

The US dollar has been experiencing a rally due to a surge in real yields. The real yield on U.S. 10 year Treasuries reached its highest level in nearly 15 years at 2.47%, making the US currency more attractive for bullish investors seeking profitability. The dollar has risen by 7% from its lows in 2023 against a basket of currencies and is currently at a ten month high point. The Federal Reserve’s commitment to maintaining higher interest rates for an extended period, along with robust economic growth in the United States, has propelled nominal yields to their highest levels since 2007.

This, together with a slowdown in inflation, has caused real yields to surge, leading to the dollar’s recovery.

Weakness of the Japanese Yen and Possible Intervention

The Japanese yen has weakened to a new low of 150.48 per dollar, approaching the lowest level in 32 years at 151.94 per dollar reached in October last year. This has raised concerns about potential intervention by Japanese authorities. The decline in the yen is attributed to the increasing interest rate differential between Japan and the United States, resulting in a drop of over 20% since the U.S. Federal Reserve started aggressively raising rates to combat inflation in March 2022

Performance of Asian Stocks and Interest Rates

Asian stocks mostly experienced declines ahead of a decision on interest rates by the Federal Reserve. Tokyo’s Nikkei 225 index fell by 1% due to speculations that the Bank of Japan might adjust its monetary policy as a response to signs indicating persistent inflation.

In the meantime, the Shanghai Composite index experienced a slight increase of 0.1% as more than 30 companies listed in China revealed their plans to carry out share buybacks and purchases in response to measures aimed at stabilizing declining stock prices.

Gold Price and FOMC Meeting

It is worth noting that decisions made by the Federal Reserve regarding interest rates can have a significant impact on the value of gold. When interest rates rise, it often strengthens the dollar, which can put downward pressure on gold prices. Conversely, if the Federal Reserve chooses to maintain low interest rates, this could potentially support higher gold prices. Investors closely monitor FOMC (Federal Open Market Committee) meetings for insights into future monetary policy directions.

The US economy experienced a strong expansion in the third quarter of 2023, growing at an annualized rate of 4.9%. Despite challenges such as high interest rates and inflation, the US economy demonstrated resilience. The US dollar has been experiencing a rally due to a surge in real yields, with the real yield on U.S. 10 year Treasuries reaching its highest level in nearly 15 years at 2.47%. The Federal Reserve’s commitment to maintaining higher interest rates for an extended period has propelled nominal yields to their highest levels since 2007, leading to the dollar’s recovery.

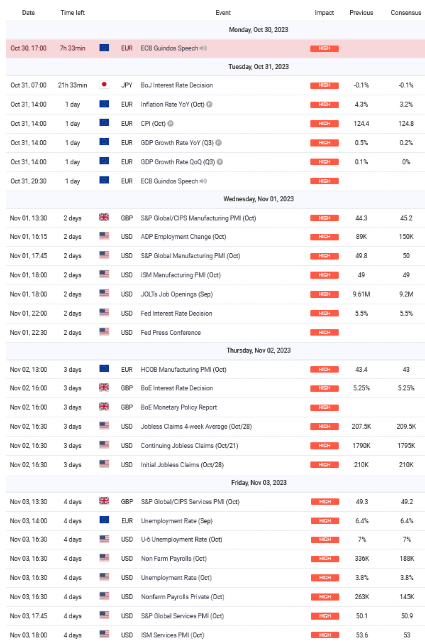

Upcoming Events for the week:

1. EUROZONE ECB Guindos Speech (Oct 30, 2023):

Market Impact Criteria:

– Monetary Policy Clues: Speeches by ECB officials can provide insights into the Eurozone’s monetary policy outlook.

– Impact on Currency Markets: ECB’s comments can influence market expectations, potentially impacting the EUR.

2. JAPAN BoJ Interest Rate Decision (Oct 31, 2023):

Market Impact Criteria:

– Monetary Policy: The BoJ’s interest rate decision reflects Japan’s monetary policy stance.

– Impact on Currency Markets: Any changes or guidance related to interest rates can influence the JPY and currency pairs involving JPY.

3. EUROZONE Inflation Rate YoY (Oct) and CPI (Oct) (Oct 31, 2023):

Market Impact Criteria:

– Inflation Data: These reports reflect the Eurozone’s inflation levels.

– Impact on Currency Markets: Higher inflation figures can influence the EUR and potentially affect currency pairs involving EUR.

4. EUROZONE GDP Growth Rate YoY (Q3) (Oct 31, 2023):

Market Impact Criteria:

– Economic Growth: The GDP growth rate provides insights into the Eurozone’s economic performance.

– Impact on Currency Markets: Positive economic growth data may support the EUR.

5. US S&P Global Manufacturing PMI (Oct) and JOLTs Job Openings (Sep) (Nov 1, 2023):

Market Impact Criteria:

– Business Activity and Labor Market: PMI gauges business activity, while JOLTs data reflects job openings in the US.

– Impact on Currency Markets: Stronger data can impact market sentiment and potentially strengthen the USD.

6. US Fed Interest Rate Decision (Nov 1, 2023):

Market Impact Criteria:

– Monetary Policy: The Fed’s interest rate decision reflects the US monetary policy stance.

– Impact on Currency Markets: Changes or guidance related to interest rates can significantly impact the USD.

7. UK BoE Interest Rate Decision and BoE Monetary Policy Report (Nov 2, 2023):

Market Impact Criteria:

– Monetary Policy: These reports reflect the BoE’s monetary policy stance and outlook.

– Impact on Currency Markets: Changes or guidance related to interest rates can influence the GBP.

8. US Initial Jobless Claims (Oct/28) and Non-Farm Payrolls (Oct) (Nov 3, 2023):

Market Impact Criteria:

– Labor Market Health: These reports provide insights into the health of the US labor market.

– Impact on Currency Markets: Stronger job data can influence market sentiment and potentially impact the USD.

9. EUROZONE Unemployment Rate (Sep) and US S&P Global Services PMI (Oct) (Nov 3, 2023):

Market Impact Criteria:

– Labor Market and Business Activity: These reports reflect the labor market in the Eurozone and business activity in the US services sector.

– Impact on Currency Markets: Strong data can affect the EUR and USD, respectively.

Traders and investors should closely monitor these events and assess their potential impacts on the EUR, JPY, GBP, and USD, as they can lead to significant movements in currency pairs. Factors like monetary policy, economic growth, inflation, and labor market health are crucial in shaping market sentiment and exchange rates.

The Japanese yen has weakened to a new low of 150.48 per dollar, raising concerns about potential intervention by Japanese authorities. The decline in the yen is attributed to the increasing interest rate differential between Japan and the United States. Asian stocks mostly experienced declines ahead of a decision on interest rates by the Federal Reserve, with Tokyo’s Nikkei 225 index falling by 1%.

EUR USD Outlook:

Starting with the speech by ECB’s Guindos on 10/30, the tone and content will be crucial for the EUR/USD pair. Investors will be listening closely for any hints about the future direction of monetary policy or assessments of the Eurozone’s economic health. If Guindos adopts a dovish tone or expresses concerns about the economy, it could put downward pressure on the Euro.

On 10/31, a slew of data from the Eurozone will be released, starting with the BoJ Interest Rate Decision. Although it primarily affects the Yen, it can also influence broader market sentiments and risk appetite, indirectly impacting EUR/USD.

The Eurozone inflation rate and GDP growth data will be pivotal. If inflation comes in higher than the 3.20% consensus, it might raise expectations of tighter monetary policy from the ECB, potentially boosting the Euro. However, if GDP growth is weaker than the expected 0.20%, concerns about economic stagnancy could weigh on the currency. The CPI data will also play a role; a higher-than-expected reading could signal rising inflationary pressures, while a lower figure might ease those concerns.

On the US front, the Fed Interest Rate Decision on 11/1 is a major event for EUR/USD. The market has priced in a rate hold at 5.50%, so any deviation from this could lead to significant volatility. If the Fed raises rates unexpectedly, the USD could strengthen, pushing EUR/USD down. If they hold rates or adopt a dovish tone, the Euro could find some support.

The BoE Interest Rate Decision on 11/2 will also be on traders’ radar. Although it directly impacts the GBP, its implications for broader market sentiment mean it could also influence EUR/USD.

The US Non-Farm Payrolls and Unemployment Rate on 11/3 will be crucial. A strong job market in the US strengthens the case for a stronger USD, potentially leading to a decline in EUR/USD. However, if the job data disappoints, the Euro could find some room to gain.

Across these events, it’s crucial to note that unexpected outcomes or significant deviations from consensus can lead to sharp and sudden movements in EUR/USD. Traders and investors will need to keep a close eye on these releases, interpreting them in the context of the broader economic landscape and central bank narratives.

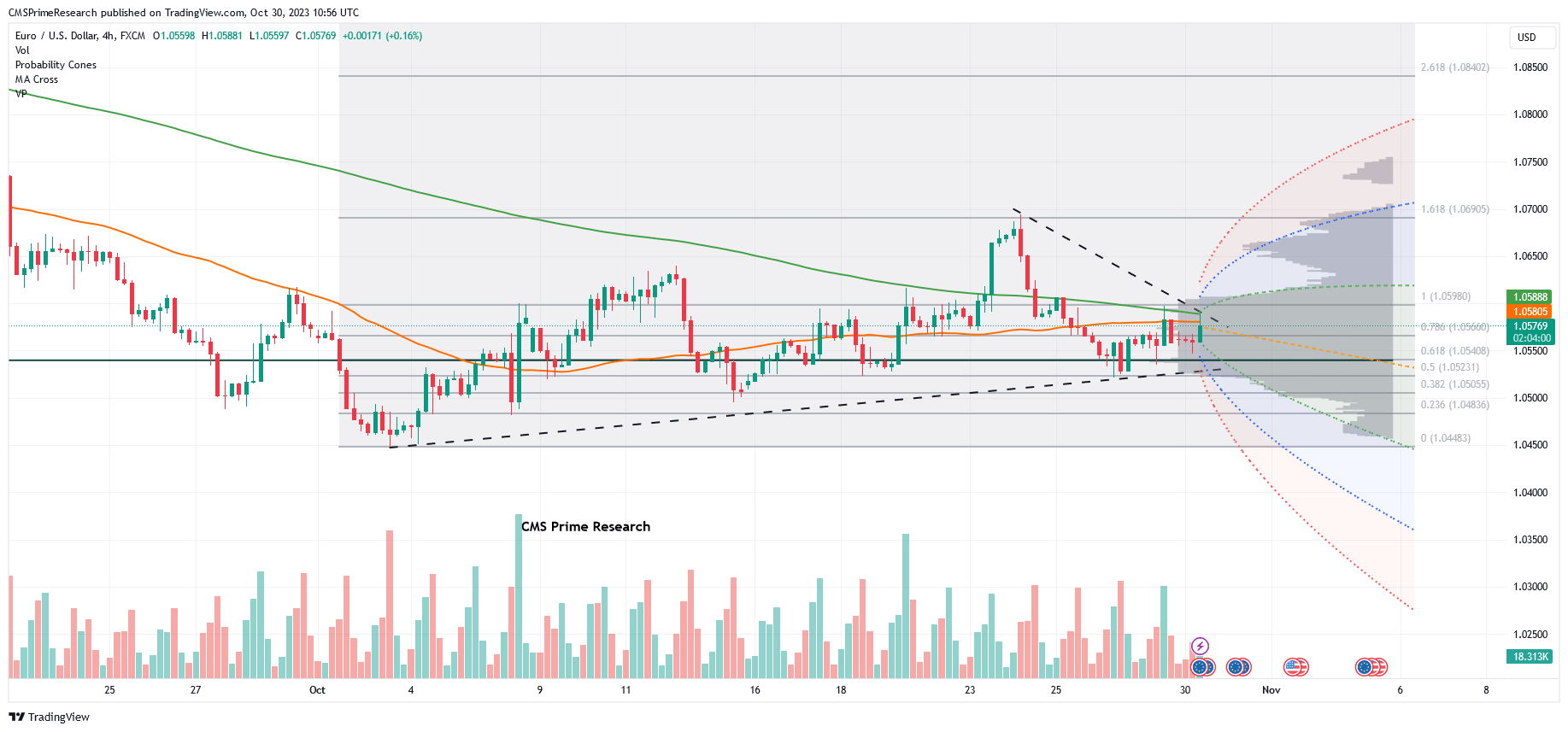

EUR/USD Technical Snapshot:

Scenario 1: Bullish Movement

- Potential upward movement to test levels from 1.05740 to 1.05951 and further up to 1.06099.

- If momentum persists, additional tests at 1.06218 and 1.06505.

- Possible bullish continuation towards 1.06700, with further upside potentials at 1.06889 and 1.07239.

Scenario 2: Bearish Movement

- Possibility of a decline to test levels 1.05391 and 1.05102.

- If bearishness continues, further tests expected at 1.05038, followed by a significant support at 1.04821.

- Additional support levels to watch are between 1.04800 and 1.04728, with 1.04728 as a crucial bearish support level.

- Previous week’s levels around 1.04530 might be revisited if bearish market sentiment persists.

Market Momentum & RSI

- Short-term momentum: bearish, with a decreasing momentum observed on the weekly timeframe.

- RSI is in the oversold zone, indicating potential short-term bearishness.

- Possible trading range could be anticipated based on current market conditions and technical indicators.

GBP USD Outlook:

The GBP/USD currency pair, also known as “cable,” is set to experience volatility with several high-impact events lined up. Starting with the BoE Interest Rate Decision on 11/2, the market expects rates to hold steady at 5.25%. Any deviation from this consensus could trigger significant movement in GBP/USD. An unexpected rate hike might bolster the GBP, as it would signal confidence in the UK economy, leading to an appreciation of GBP/USD. On the other hand, a rate cut or dovish commentary in the BoE Monetary Policy Report could undermine the GBP, causing a depreciation against the USD.

Simultaneously, the US has its own high-impact events that could influence GBP/USD. The Fed Interest Rate Decision on 11/1 is critical. With a consensus to maintain rates at 5.50%, any surprise move or shift in future rate expectations could cause sharp movements in GBP/USD. A rate hike or hawkish tone from the Fed would likely strengthen the USD, resulting in a lower GBP/USD, while a hold or dovish tone could lead to a weaker USD and a higher GBP/USD.

The US Non-Farm Payrolls and Unemployment Rate are also crucial. Strong job growth and a low unemployment rate in the US would support a stronger USD, potentially leading to a drop in GBP/USD. However, if the employment data is weaker than expected, it could weaken the USD, causing an appreciation in GBP/USD.

In terms of evaluation criteria, it’s important to consider not just the data itself but also the broader economic context and market expectations. Deviations from the consensus can lead to sharp movements, but the direction and magnitude also depend on how the data fits into the ongoing economic narrative and central bank policies.

Overall, the coming days are packed with potential triggers for volatility in GBP/USD, and traders should brace for significant price movements, keeping a close eye on both the UK and US events for cues on the pair’s direction.

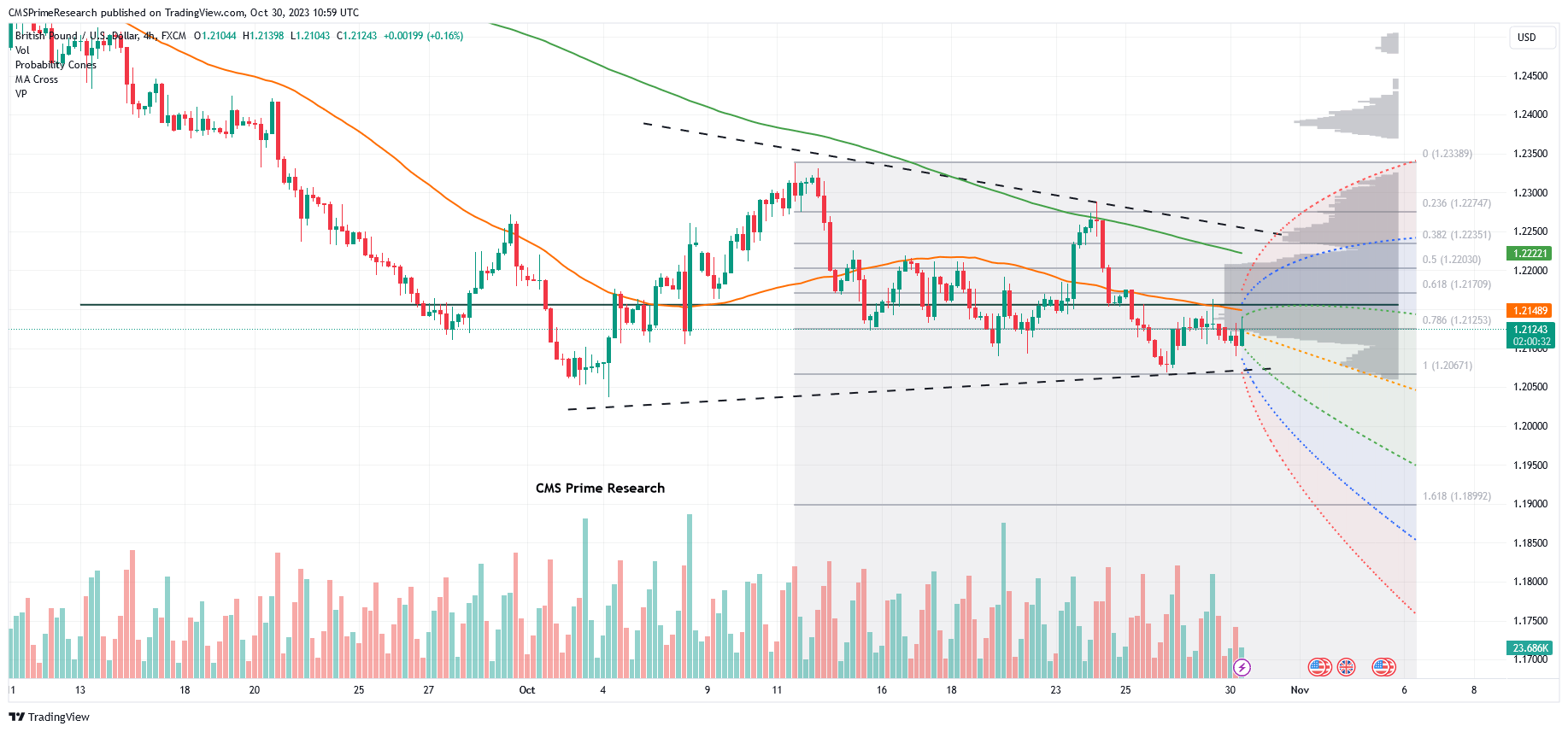

GBP/USD Technical Snapshot:

Scenario 1: Bullish Movement

– Possible upward retest at 1.2203, aiming for resistance at 1.2240, 1.2262, with a critical point at 1.2280.

Scenario 2: Bearish Movement

– Downward trend could test support at 1.2085.

– A breach of this level may lead to further decline towards 1.2063.

– Continuation of bearish momentum might drop prices into the range of 1.2037 to 1.1997.

– Major support levels span from 1.1977 to 1.1920.

Market Conditions and Indicators

– Currently, the pair is below both the 50-day and 200-day moving averages, signaling a bearish trend.

– The market is close to the 50-day MA, hinting at a possible shift in direction.

– RSI is trending towards the oversold region, indicating potential downward pressure.

– Despite the downtrend momentum, traders should remain cautious of a potential bullish reversal.

USD/JPY Outlook:

USD/JPY, a major currency pair, is poised for potential volatility with several high-impact events on the horizon. Firstly, the Bank of Japan’s Interest Rate Decision on 10/31 is a crucial event for the JPY. With the rate expected to remain at -0.10%, any unexpected change could lead to significant fluctuations in USD/JPY. A surprise rate hike could bolster the JPY, resulting in a decrease in USD/JPY, while a rate cut could weaken the JPY, causing an increase in USD/JPY.

Simultaneously, economic indicators from the US will also play a vital role in determining the USD/JPY movement. The Fed Interest Rate Decision on 11/1 is particularly significant. Given that the market anticipates the rates to stay at 5.50%, any deviation could trigger sharp movements in USD/JPY. An increase in rates or a hawkish stance could strengthen the USD, pushing USD/JPY higher, while a rate cut or dovish outlook might weaken the USD, causing USD/JPY to drop.

The US Non-Farm Payrolls and Unemployment Rate data due on 11/3 are also crucial. Strong employment figures and a low unemployment rate in the US would likely lead to a stronger USD, potentially pushing USD/JPY higher. Conversely, disappointing job data could weaken the USD, leading to a decrease in USD/JPY.

It is essential to consider not only the actual data but also the market expectations and the broader economic context. Deviations from the consensus can result in significant price movements, but the direction and magnitude of the move also depend on how the data aligns with the overall economic narrative and central bank policies.

To summarize, USD/JPY is set to experience significant volatility, influenced by major economic events from both Japan and the US. Traders and investors should pay close attention to these events and be prepared for potential price swings in the currency pair, with particular attention to central bank decisions and employment data from the US.

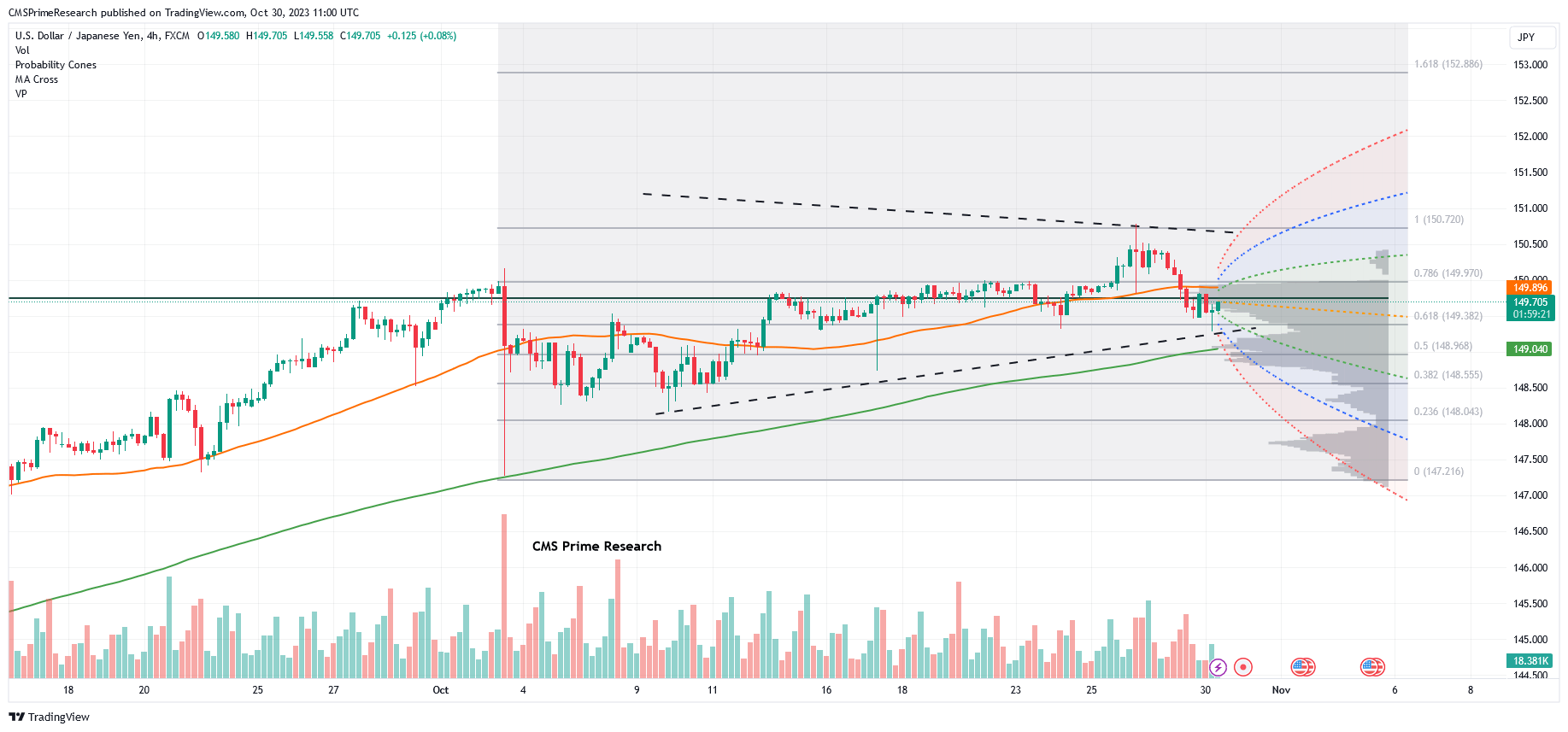

USD/JPY Technical Snapshot

Scenario 1: Bearish Movement

– Potential decline towards 149.450, with additional tests at 149.600 (61.8% Fibonacci level).

– Further decrease might target ranges between 149.302 to 149.180.

– Critical support found at 148.913, and major support level established at 148.404.

Scenario 2: Bullish Movement

– Possibility of an upswing to retest 149.980.

– Success here could propel prices towards 150.120 and then 150.256.

– Surpassing these levels might result in a test of the 150.410 benchmark.

Market Conditions and Indicators

– The pair is navigating between the 50 and 200-day moving averages, indicating a bullish range momentum.

– RSI is currently in the overbought territory, hinting at potential range-bound movements.

– Overall, the market maintains a bullish long-term momentum, though short-term bearishness is expected.

XAU/USD Outlook:

Firstly, ECB Guindos Speech , followed by the inflation data and GDP growth rate from the Eurozone on 10/31, will have a consequential impact. Typically, higher inflation rates and stronger GDP growth can lead to a stronger EUR, potentially weakening the USD and thereby increasing the XAU/USD. If the actual data for inflation and GDP growth rate come out significantly higher than the consensus, it could lead to an upward movement in gold prices. On the contrary, if the data is weaker than expected, it could strengthen the USD and lead to a potential decrease in XAU/USD.

Subsequently, the Fed Interest Rate Decision is a major event for USD, and thereby for XAU/USD. Given the market’s expectation for rates to remain steady at 5.50%, any deviation from this could lead to sharp movements. An increase in interest rates or a hawkish tone from the Fed could strengthen the USD, leading to a decrease in XAU/USD. On the other hand, a rate cut or dovish commentary could weaken the USD and increase XAU/USD.

Later in the week, the Non-Farm Payrolls and Unemployment Rate from the US on 11/3 will also be closely watched. Strong job growth and a low unemployment rate could bolster the USD, potentially leading to a decrease in XAU/USD. However, if the employment data disappoints, it could weaken the USD, resulting in an increase in XAU/USD.

Throughout this period, it is crucial to monitor the market’s expectations and the broader economic context, as these will influence how the actual data impacts the market. For instance, if the market is already pricing in a certain outcome, the actual event would need to deviate significantly from expectations to cause substantial movements in XAU/USD.

In summary, the upcoming events pose significant potential for volatility in XAU/USD, with a focus on economic indicators from the Eurozone and the US, as well as central bank communications. Traders and investors should remain vigilant and consider both the actual data and the broader market sentiment when navigating the markets during this time.

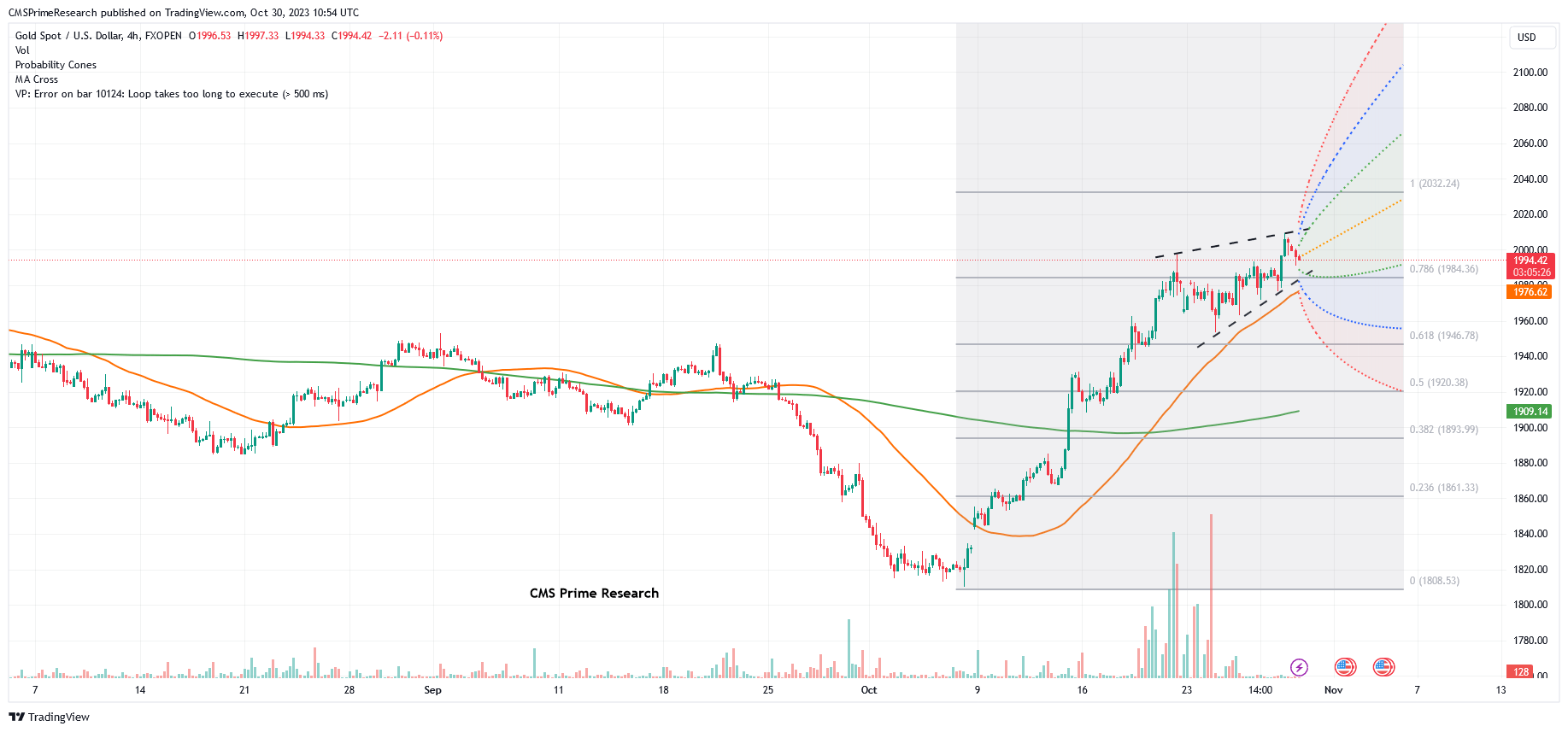

Gold Price Technical Snapshot:

Scenario 1: Bullish Continuation

– Initial upward movement towards 2010.

– Further progression might aim for 2015.

– Persistent bullish momentum could lead to tests of 2024.50, with significant levels at 2032 and 2037.50 to watch.

Scenario 2: Bearish Reversal

– Potential decline to 1995.

– Continued bearish pressure might target 1988, a crucial support level.

– Further downside could find support in the range of 1973.50 to 1953.

Market Conditions and Indicators

– Price is trending above both the 200-day and 50-day moving averages, suggesting a neutral market sentiment within a bullish uptrend.

– The long-term trend remains bullish

Volatility Considerations:

Central Bank Decisions and Monetary Policy:

- Upcoming Interest Rate Decisions: Decisions from the Federal Reserve (U.S.), Bank of Japan (Japan), and Bank of England (U.K.) are imminent. Any unexpected changes in interest rates or unexpected shifts in monetary policy can lead to sharp movements in currency pairs and gold prices. For instance, a higher than expected interest rate hike by the Fed could strengthen the USD, impacting various currency pairs and potentially leading to a decrease in gold prices (XAU/USD).

- Guidance on Future Monetary Policy: Traders and investors will be closely monitoring the accompanying statements and reports for clues about future monetary policy directions, which can significantly impact market sentiments.

Economic Indicators and Data Releases:

- Inflation and GDP Growth Data: The release of inflation rate and GDP growth rate data for the Eurozone can influence the EUR, and consequently affect currency pairs such as EUR/USD. Higher inflation or stronger GDP growth than expected could lead to anticipations of tighter monetary policy, potentially boosting the EUR.

- Labor Market Reports: The U.S. Non-Farm Payrolls and Unemployment Rate, as well as other labor market indicators, are crucial for assessing the health of the economy. Strong job data can strengthen the USD, impacting various currency pairs and potentially leading to a decrease in gold prices.

Geopolitical Events and Market Sentiments:

- Global Geopolitical Events: Events and developments on the global stage, including potential interventions in currency markets (e.g., Japanese authorities potentially intervening due to the weak yen), can lead to shifts in market sentiments and cause volatility.

- Market Expectations and Reactions: How the market has priced in certain outcomes prior to the event, and how traders and investors react to the actual data or decisions, can lead to significant price movements.

Currency-Specific Factors and Differential Movements:

- Interest Rate Differentials: The widening interest rate differential between Japan and the United States has been a key factor in the weakening of the Japanese yen. Movements in interest rate differentials between different economies can lead to shifts in currency strengths and weaknesses, influencing currency pairs.

- Performance of Asian Stocks and Regional Factors: The performance of Asian stocks, particularly in response to monetary policy decisions and economic indicators, can also play a role in influencing currency markets and potentially leading to volatility.

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.