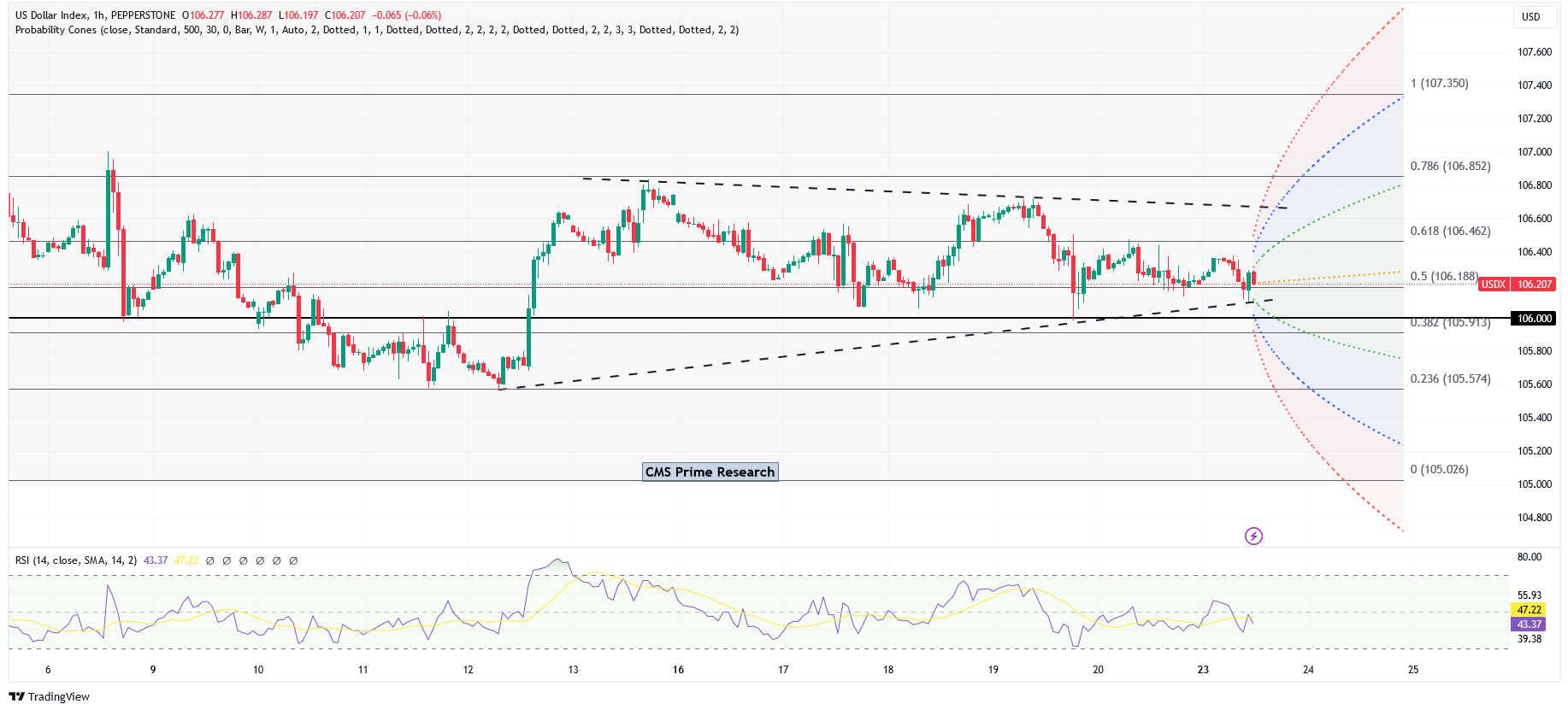

Dollar Index:

As of October 23, 2023, several key events and factors are impacting the price of the US dollar (USD):

- Elevated US Treasury Yields: The yield on the benchmark 10-year U.S. Treasury note rose above 5.0%, hitting a milestone last seen in July 2007. This increase has been driven by investors pricing in stronger U.S. growth and fiscal slippage. The 10-year yield touched 5.004% on Monday, up around 8 basis points (bps) on the day. It was briefly bid at a 16-year high of 5.001% on Thursday. It has risen 160 basis points since mid-May.

- Federal Reserve’s Hawkish Stance: The Federal Reserve Chair Jerome Powell indicated last week that the U.S. economy’s strength and hot labor market might warrant tighter financial conditions. This statement has led to a rise in yields and has contributed to the strengthening of the USD.

- Middle East Conflict: The ongoing conflict in the Middle East has led to market volatility. This has led to a dip in oil prices, which could potentially impact the USD.

- Japanese Yen’s Weakness: The Japanese yen weakened briefly to the 150-per-dollar level due to elevated U.S. Treasury yields. This has led to a strengthening of the USD against the yen.

- European Central Bank Meeting and U.S. GDP Data: Investors are also closely watching the upcoming European Central Bank meeting and U.S. GDP data due later in the week. These events could potentially impact the USD.

- U.S. Budget Deficit: The U.S. government posted a $1.695 trillion budget deficit in the year to September 2023, a 23% jump from the prior year and the largest since a COVID-fueled $2.78 trillion gap in 2021. This fiscal situation could potentially impact the USD.

In conclusion, the USD price is being influenced by a combination of global geopolitical events, economic indicators, and monetary policy decisions. Investors and market participants are closely monitoring these factors to gauge their potential impact on the USD.

In conclusion, the USD price is being influenced by a combination of global geopolitical events, economic indicators, and monetary policy decisions. Investors and market participants are closely monitoring these factors to gauge their potential impact on the USD

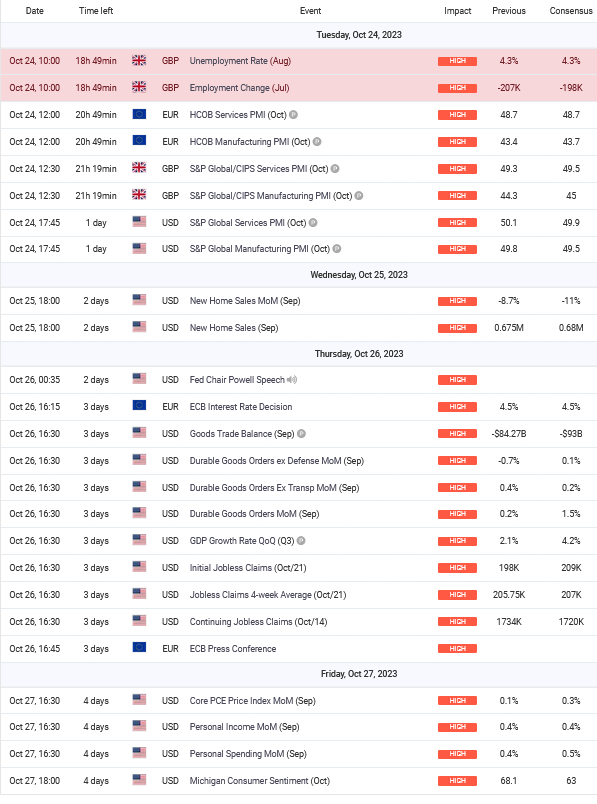

Upcoming Events for the week:

1. UK Unemployment Rate (Aug) and Employment Change (Jul) (Oct 24, 2023):

- Market Impact Criteria:

- Labor Market Health: These reports provide insights into the UK labor market’s health and employment trends.

- Impact on Currency Markets: Positive employment data may support the GBP, potentially leading to GBP/USD appreciation if the data is favorable.

2. US S&P Global Services PMI (Oct) and S&P Global Manufacturing PMI (Oct) (Oct 24, 2023):

- Market Impact Criteria:

- Business Activity: PMI reports gauge business activity in the services and manufacturing sectors of the US economy.

- Impact on Currency Markets: Stronger PMI figures may strengthen the USD, potentially impacting GBP/USD.

3. US New Home Sales MoM (Sep) and New Home Sales (Sep) (Oct 25, 2023):

- Market Impact Criteria:

- Housing Market: These reports reflect the performance of the US housing market, which is a critical economic indicator.

- Impact on Currency Markets: A significant change in housing data can influence consumer sentiment and impact the USD.

4. US Fed Chair Powell Speech (Oct 26, 2023):

- Market Impact Criteria:

- Monetary Policy Outlook: Speeches by the Fed Chair can offer insights into the future direction of US monetary policy.

- Impact on Currency Markets: Powell’s comments can affect market expectations, potentially impacting the USD.

5. EUROZONE ECB Interest Rate Decision (Oct 26, 2023):

- Market Impact Criteria:

- Monetary Policy: The ECB’s interest rate decision reflects the Eurozone’s monetary policy stance.

- Impact on Currency Markets: Changes or guidance related to interest rates can impact the EUR, which may, in turn, affect GBP/USD.

6. US Goods Trade Balance (Sep) and GDP Growth Rate QoQ (Q3) (Oct 26, 2023):

- Market Impact Criteria:

- Trade Balance and Economic Growth: These reports provide insights into the US trade balance and economic growth.

- Impact on Currency Markets: Significant changes in these figures can influence the USD and GBP/USD.

7. US Initial Jobless Claims (Oct/21) (Oct 26, 2023):

- Market Impact Criteria:

- Labor Market Health: Jobless claims data reflects the health of the US labor market.

- Impact on Currency Markets: Stronger jobless claims data may support the USD, potentially impacting GBP/USD.

8. US Core PCE Price Index MoM (Sep), Personal Income MoM (Sep), and Personal Spending MoM (Sep) (Oct 27, 2023):

- Market Impact Criteria:

- Inflation and Consumer Spending: These reports reflect US inflation levels and consumer spending patterns.

- Impact on Currency Markets: Higher inflation or robust consumer spending may influence the USD and GBP/USD.

9. US Michigan Consumer Sentiment (Oct) (Oct 27, 2023):

- Market Impact Criteria:

- Consumer Sentiment: The Michigan Consumer Sentiment Index reflects consumer confidence and sentiment.

- Impact on Currency Markets: Positive sentiment may support the USD and potentially impact GBP/USD.

Traders and investors should closely monitor these events and assess their potential impacts on the GBP, USD, and EUR, as they can lead to significant movements in currency pairs. Factors like employment, business activity, monetary policy, and consumer sentiment are crucial in shaping market sentiment and exchange rates.

Traders and investors should closely monitor these events and assess their potential impacts on the GBP, USD, and EUR, as they can lead to significant movements in currency pairs. Factors like employment, business activity, monetary policy, and consumer sentiment are crucial in shaping market sentiment and exchange rates.

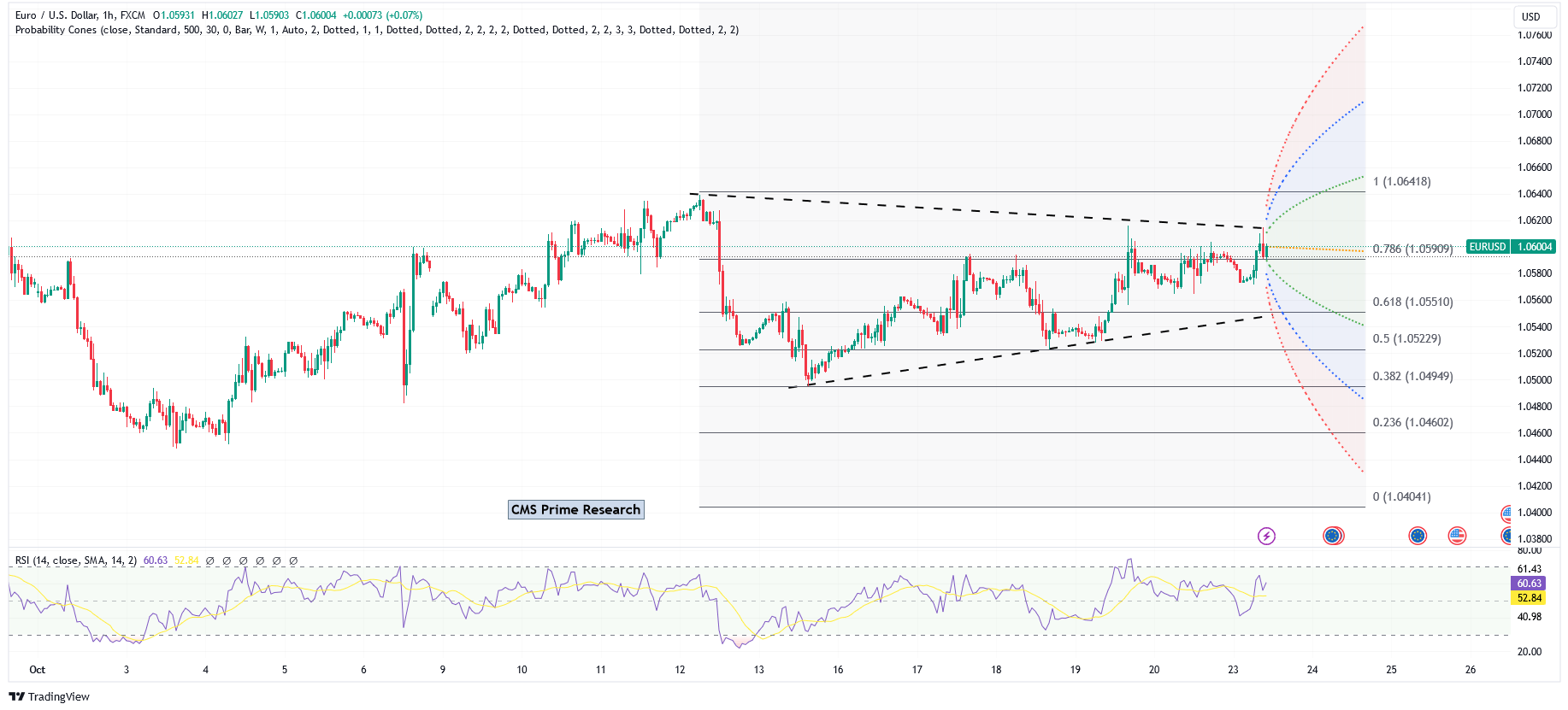

EUR USD Outlook:

Firstly, turning our gaze to the US, the S&P Global Services and Manufacturing PMI for October, scheduled for release on 10/24, hover around the pivotal 50 mark, which separates expansion from contraction. Any dip below this benchmark, especially if the manufacturing PMI underperforms the forecasted 49.5, might point towards a weakening US economy, potentially buoying the EUR against the USD.

On 10/26, attention will sharply pivot to the central banks, with the ECB’s interest rate decision on the radar. While the consensus suggests a steady stance at 4.50%, any surprise move or accompanying commentary could send ripples through the EUR/USD market. Almost in tandem, the Fed Chair Powell’s speech, absent of a specific agenda, remains a wildcard. Given the influence of central bank communications on market sentiments, traders will hang on to every word, parsing for clues on future policy directions.

Still, within the US economic landscape, the GDP growth rate for Q3 and the initial jobless claims for the week ending Oct/21 emerge as potential market movers. With the Q3 growth rate projected to bounce back robustly to 4.20% from the previous 2.10%, a confirmation of this rebound could fortify the USD. Conversely, any shortfall might dampen its shine. Likewise, jobless claims below the expected 209K would paint a rosy picture of the US job market, potentially applying downward pressure on the EUR/USD pair.

Wrapping up the week, personal income and spending metrics, coupled with the Michigan Consumer Sentiment for October, provide insights into consumer behavior and sentiment. While personal income for September is expected to remain steady at 0.40%, an uptick in personal spending to 0.50% could hint at increased consumer confidence. However, the real litmus test lies in the consumer sentiment index. A reading surpassing the forecasted 63 could solidify the USD’s stance, while a dip could provide the EUR with a comparative advantage.

In essence, the coming days for the EUR/USD pair promise a rollercoaster of potential shifts, with traders juxtaposing real-time data against forecasts, all set against the backdrop of broader economic narratives unfolding on both sides of the Atlantic.

Technical Snapshot:

Scenario 1: Bullish Movement

- Potential upward movement to test the range 1.05951 to 1.06099.

- Further testing at 1.06218 if momentum persists.

- Possible upward movement towards 1.06505 and 1.06700.

- Additional bullish tests at 1.06889 and 1.07239.

Scenario 2: Bearish Movement

- Possibility to decline and test 1.05391 and then 1.05102.

- If bearishness persists, further tests at 1.05038.

- 1.04821 identified as a significant support level.

- Deeper bearish moves might target 1.04800 to 1.04728.

- 1.04728 identified as a major bearish support level.

- A revisit to the previous week’s levels at 1.04880 is also possible.

Market Momentum & RSI

- Short-term momentum: bearish.

- RSI indicates an oversold zone, suggesting bearishness.

- Decrease in momentum observed on the weekly timeframe.

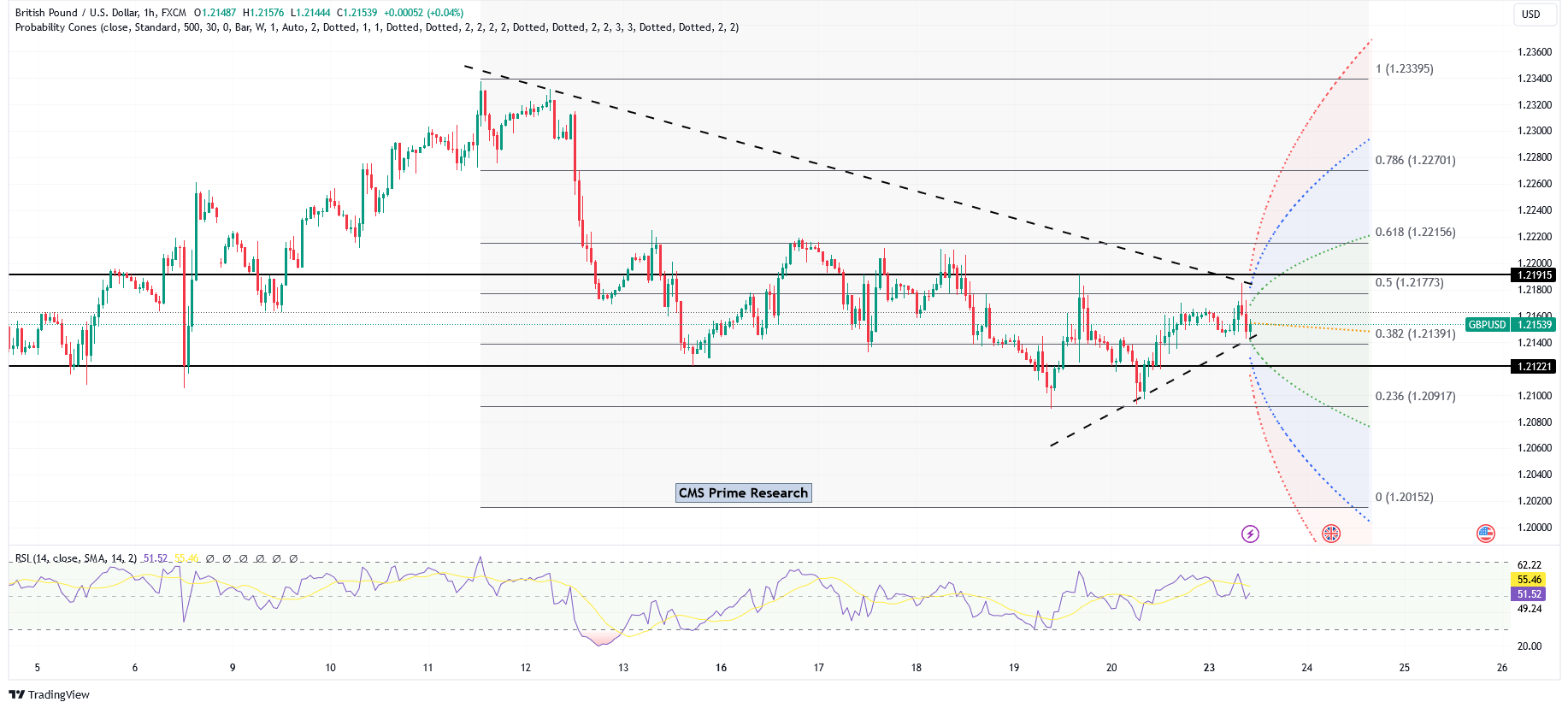

GBP USD Outlook:

Firstly, the UK’s labor market indicators are due for release on 10/24, focusing on the unemployment rate for August and employment change for July. The consensus hints at the unemployment rate staying put at 4.30%, maintaining status quo. However, the employment change shows signs of moderate improvement, with an expected decline of -198K, a bit less dire than the prior -207K. Should these numbers deviate significantly from expectations, especially in a positive direction, the GBP could gain traction, reflecting increased economic optimism.

The spotlight on 10/26 will be undoubtedly shared between the Eurozone and the US. While the ECB’s interest rate decision is crucial for EUR, its ramifications can indirectly affect the GBP/USD pair due to the interconnectedness of the global markets. However, more directly influential will be the US economic indicators. Foremost among these is the GDP growth rate for Q3, where a bullish leap to 4.20% from the preceding 2.10% is anticipated. If this rebound is realized or even exceeded, the USD might ascend, applying downward pressure on the GBP/USD pair. This sentiment could be further reinforced or countered by the initial jobless claims data, with the market hoping for a figure below the 209K mark.

Closing the week, the 10/27 release of the US consumer-focused metrics, including the Core PCE Price Index, personal income and spending for September, and especially the Michigan Consumer Sentiment for October, will be pivotal. A higher-than-projected consumer sentiment, potentially above the 63 mark, could be a testament to heightened consumer optimism, invariably bolstering the USD’s position.

In summary, the forthcoming events present a potential seesaw for the GBP/USD pair, shaped by labor market health, manufacturing vigour, housing momentum, economic growth narratives, and consumer sentiment. As always, the true impact will be determined by the interplay of data with market expectations, interspersed with global geopolitical nuances and macroeconomic tales from either side of the Atlantic.

GBP/USD Technical Snapshot:

Scenario 1: Bullish Movement

- Potential upward movement to test 1.2203.

- Further testing at 1.2240 if momentum persists.

- Possible upward movement towards 1.2262, 1.2280, and 1.2303.

- The topmost bullish target is located at 1.2348.

Scenario 2: Bearish Movement

- Potential downward movement to test 1.2117.

- If bearishness persists, further tests at 1.2107.

- 1.2085 identified as a significant support level.

- Deeper bearish moves might target 1.2037 and 1.2005.

- 1.1920 identified as a major bearish support level.

Market Momentum & RSI

- Short-term momentum: bearish.

- RSI heading towards oversold territory: suggests potential for bearishness.

- Although the trend is bearish, there might be a potential pullback to bullish sentiment.

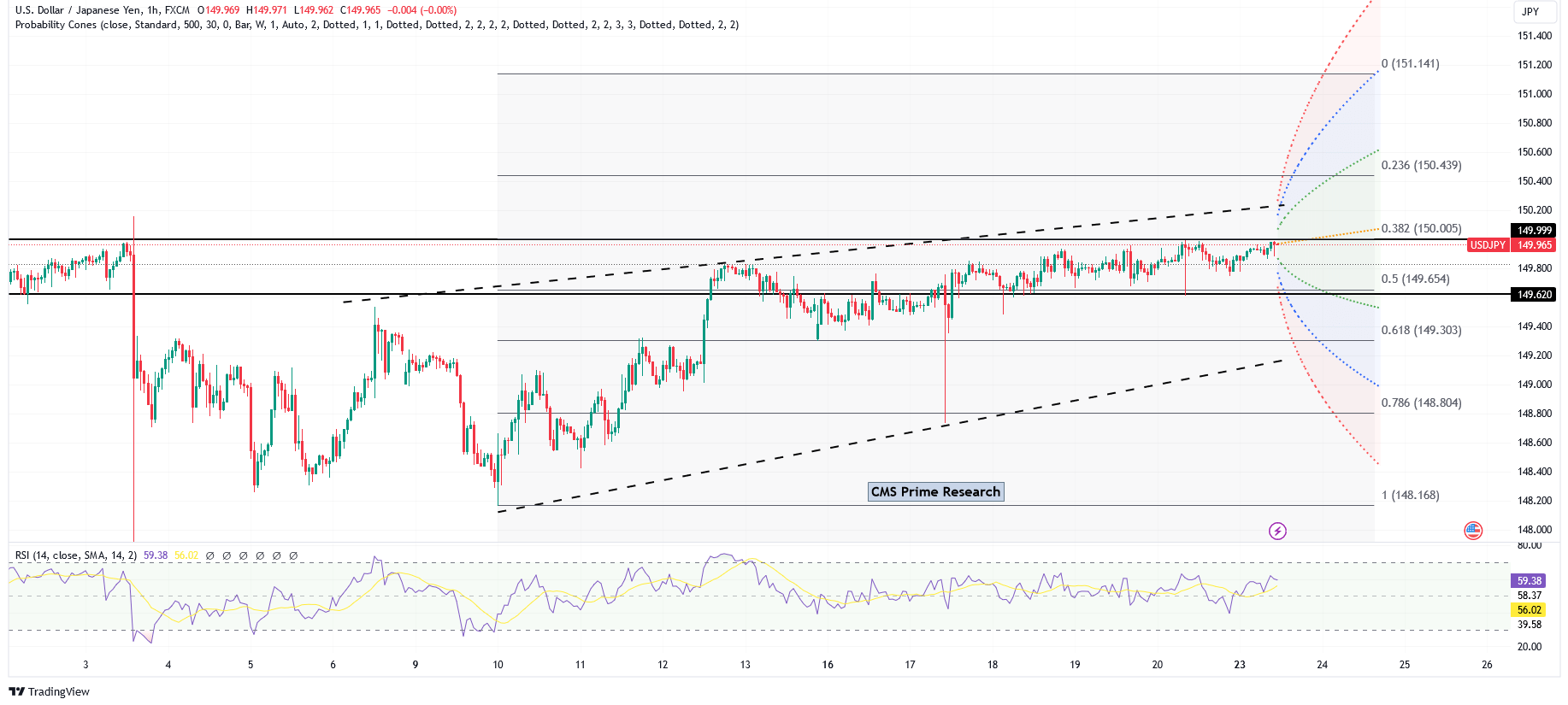

USD/JPY Outlook:

A significant highlight is Fed Chair Powell’s speech. The content, tone, and outlook presented can be instrumental in setting expectations for future monetary policy, interest rates, and the economic trajectory. On the same day, the ECB’s interest rate decision, although directly impacting the EUR, will have ramifications on global financial markets and can indirectly influence the USD/JPY dynamics.

Furthermore, the US GDP Growth Rate for Q3, A strong reading may solidify confidence in the US economy, possibly boosting the USD. However, this boost could be tempered by the initial jobless claims data, where a lower figure is anticipated, further reinforcing the economic health narrative.

In summation, the USD/JPY pair’s trajectory over the coming days will be sculpted by a medley of labor, housing, economic outlook, and consumer sentiment data. The interplay of domestic economic narratives with global market sentiments, shaped by these data points, will determine the pair’s direction. As always, the actual impact will be a manifestation of data in tandem with broader geopolitical events and macroeconomic stories from both the US and Japan.

USD/JPY Technical Snapshot

Scenario 1: Bearish Movement

- Potential downward movement to test 149.732.

- Further testing at the 61.8% Fibonacci level at 149.600.

- Possible downward movement towards 149.510 and 149.380.

- 149.213 identified as the most critical support level.

- 149.050 recognized as a major support level.

Scenario 2: Bullish Movement

- Potential upward movement to test 149.980.

- If bullish momentum persists, further tests at 150.120 and 150.256.

- Possible bullish continuation towards 150.410.

Market Momentum & RSI

- Short-term momentum: potential bearishness due to overbought RSI.

- RSI is in the overbought zone: suggests a potential retracement.

- Long-term momentum remains bullish.

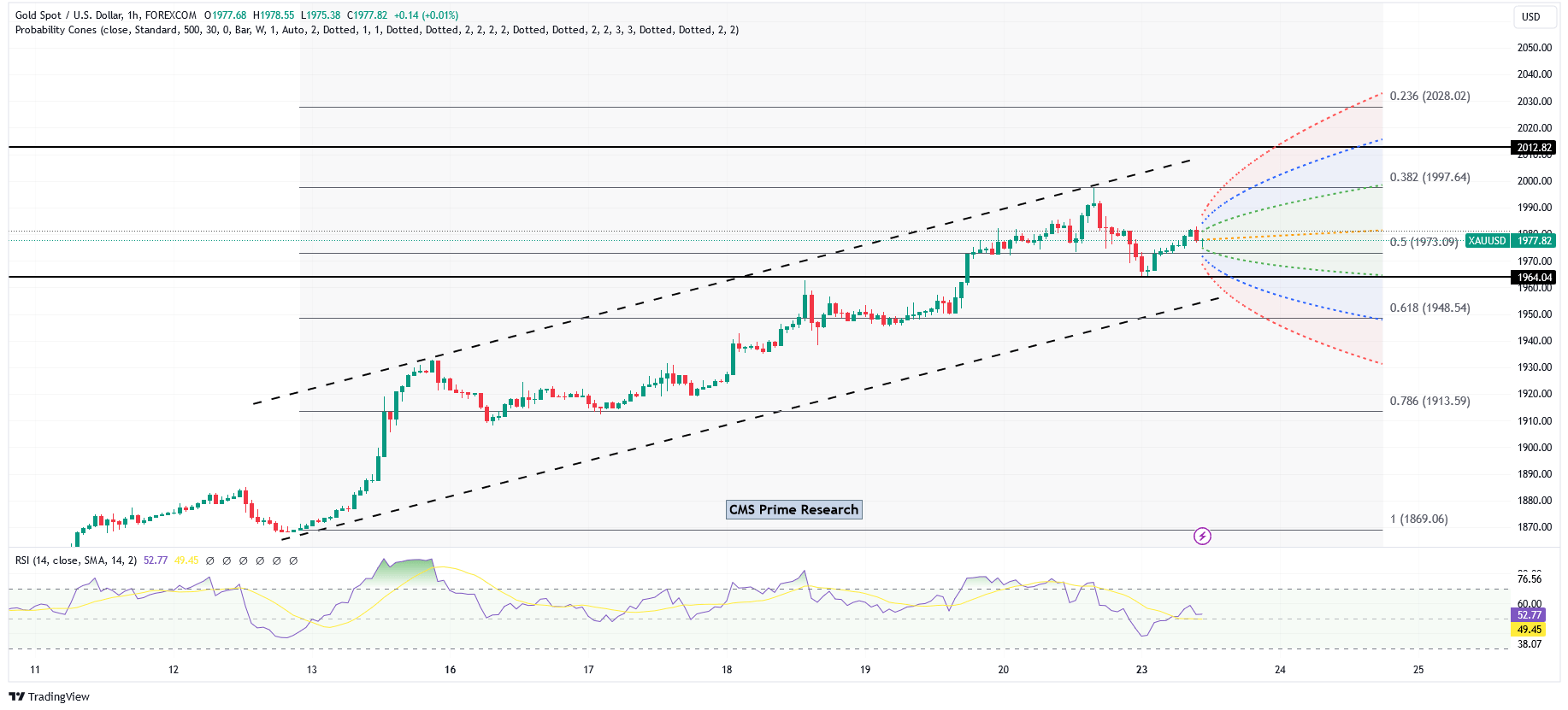

XAU/USD Outlook:

Moving across the Atlantic, the S&P Global Services and Manufacturing PMI from the US are anticipated to be around the critical threshold of 50. Any figure above this mark typically indicates expansion, while below suggests contraction. A rebound or sustained growth in these sectors can signify economic vitality, potentially strengthening the USD and exerting downward pressure on XAU/USD. On the flip side, a contraction could increase gold’s appeal as a refuge against economic downturns.

However, the real heavyweights in the lineup are on 10/26. The speech by Fed Chair Powell can have profound implications. The nuances of Powell’s tone, insights into the Federal Reserve’s future trajectory, and potential policy hints can move markets. For gold, any indications of dovishness (like hints at lower interest rates) might enhance its allure, while hawkish tones could strengthen the USD, pressuring gold downwards.

The same day also sees the ECB’s interest rate decision. Although it primarily affects the euro, its repercussions on global financial markets cannot be understated. If the ECB alters rates or provides a surprising economic outlook, it could lead to shifts in global risk appetite, influencing gold demand.

The US GDP Growth Rate for Q3 is another critical pointer. An expected leap to 4.20% from the previous 2.10% underscores a robust economic rebound. A confirmed robust GDP growth might elevate the USD, making gold less attractive in the short term.

Rounding off the week, 10/27 presents data that shines a light on the consumer’s role in the US economy. From the Core PCE Price Index to personal income and spending, these data points offer insights into inflationary pressures and consumer behavior. Particularly, the Michigan Consumer Sentiment, which is poised for a significant jump, could be indicative of heightened consumer optimism. A surge in this sentiment might buoy the USD, potentially causing a dip in XAU/USD.

In essence, the upcoming events present a mix of labor, economic outlook, monetary policy, and consumer sentiment indicators that could shape the course of the XAU/USD pair. While each event carries its weight, their collective narrative, intertwined with other global developments, will determine gold’s pricing in USD in the near term.

Gold Price Technical Snapshot:

Scenario 1: Bullish Movement

- Potential upward movement to test 1977.

- Further testing at 1981 if momentum persists.

- Possible upward movement towards 1991.

- Key bullish levels to monitor are 1998 and 2008.

Scenario 2: Bearish Movement

- Potential downward movement to test 1963.

- If bearishness persists, further tests at 1946.

- 1946 identified as a major support level.

- Further bearish targets include 1937 and 1931.

Market Momentum & RSI

- Short-term momentum: bearish.

- RSI indicates an undecided zone: suggests a potential range-bound movement or lack of clear directional bias.

- Despite the current bearish sentiment, the price might move within a range for the week.

Volatility Considerations:

Monetary Policy Decisions and Central Bank Speeches: The statements and decisions from both the Federal Reserve (Fed) and the European Central Bank (ECB) play a crucial role in shaping market sentiment. Any unexpected changes in interest rates or hints at future monetary policy direction, especially if they lean towards a hawkish stance, can lead to significant volatility in currency pairs like EUR/USD and USD/JPY.

Economic Data Releases: Key economic data releases, such as GDP growth rate, employment figures, and PMI reports, can have a substantial impact on currency markets. Stronger-than-expected economic data in the U.S., such as a robust GDP growth rate or positive PMI figures, may strengthen the USD, while weaker data could weaken it. Similarly, in the UK, employment data can influence GBP/USD.

Geopolitical Events and Market Sentiment: Geopolitical events, such as the Middle East conflict , can introduce uncertainty and volatility into the market. Traders often seek safe-haven assets like gold (XAU/USD) during times of geopolitical turmoil. Therefore, the evolving situation in the Middle East would impact gold prices.

Consumer Sentiment and Spending: Consumer sentiment and spending data offer insights into the health of the domestic economy. Positive consumer sentiment may support the USD, while a drop in consumer confidence could weaken it. Additionally, changes in consumer spending patterns can have implications for inflation and overall economic health, influencing currency pairs like XAU/USD, as well as GBP/USD.

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.