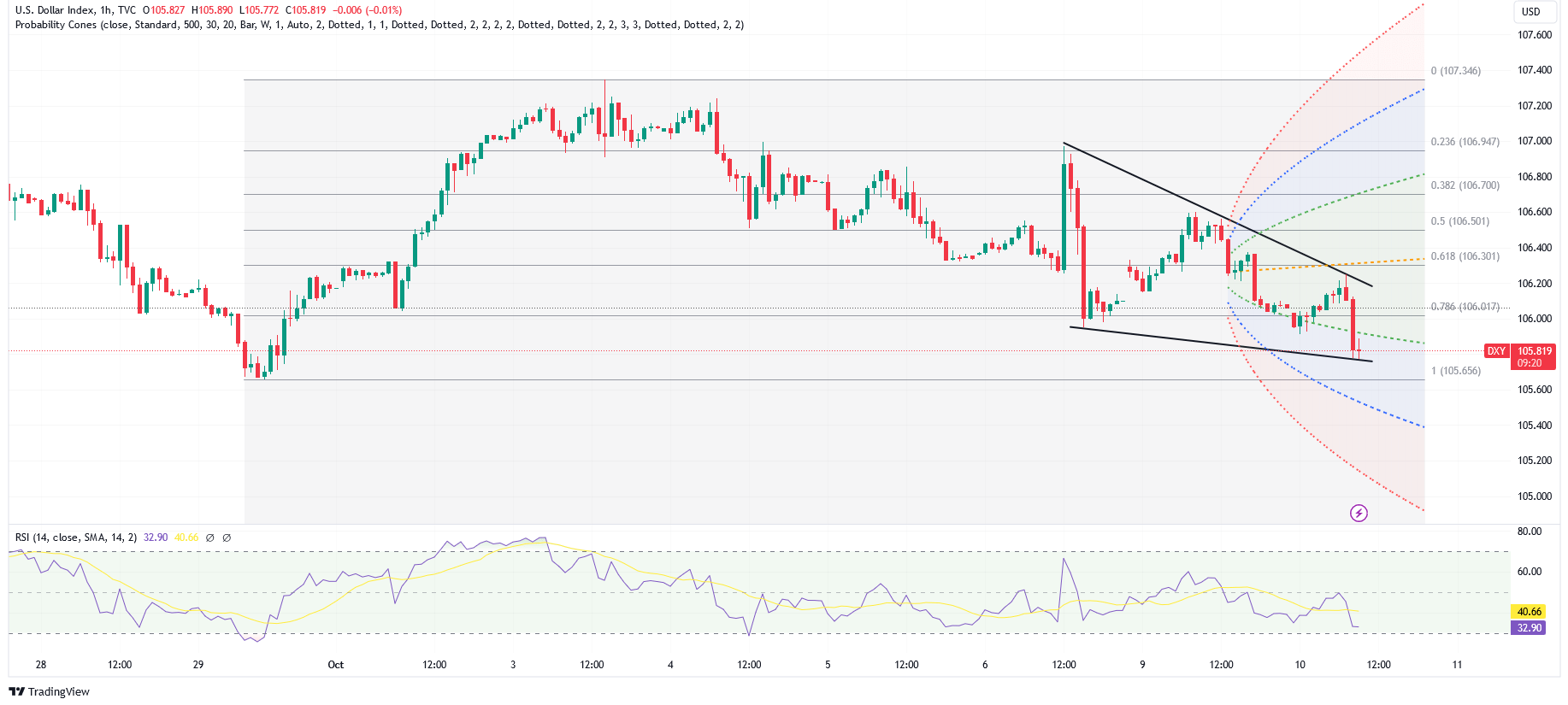

Dollar Index:

As of October 10, 2023, several key events and factors are impacting the price of the US dollar (USD):

1. Federal Reserve’s Dovish Tone: The USD has remained steady against major peers following a pause in its rally due to a slight dovish shift in Federal Reserve officials’ tone. The Federal Reserve officials indicated that rising yields on long-term U.S. Treasury bonds could steer the Fed away from further increases in its short-term policy rate. This has led to a decrease in futures-implied pricing for the chance of another Fed hike this year from above 40% last week to about 26% on Tuesday.

2. US Treasury Yields: The USD retreated tracking the pullback in Treasury yields. Longer-dated U.S. Treasury yields moved further away from 16-year highs, which tends to impact the USD as it is sensitive to U.S. yields.

3. US Labor Market: The market is focusing on the U.S. Labor Department’s jobs report for September. Although analysts said more evidence was needed to assess how fast the U.S. labor market is cooling, money markets have priced in an 80% chance the Fed will keep its benchmark overnight interest rate steady.

4. Middle East Conflict: The ongoing conflict between Israel and the Palestinian Islamist group Hamas has led to a flight to safety within financial markets. This has traditionally benefited safe-haven currencies like the USD.

5. Global Economic Growth: The global economic growth remained in the doldrums in September, according to the latest PMI data. This could potentially impact the USD as it is often influenced by global economic conditions.

6. Inflation: Inflation readings will also be due from mainland China for an update of both factory gate and consumer price developments. This could potentially impact the USD as it is often influenced by global inflation conditions.

In conclusion, the USD price is being influenced by a combination of factors including the Federal Reserve’s policy, US Treasury yields, the US labor market, global conflicts, global economic growth, and inflation. These factors are subject to change and should be monitored closely for their potential impact on the USD.

The USD price is being influenced by a combination of factors including the Federal Reserve’s policy, US Treasury yields, the US labor market, global conflicts, global economic growth, and inflation. These factors are subject to change and should be monitored closely for their potential impact on the USD.

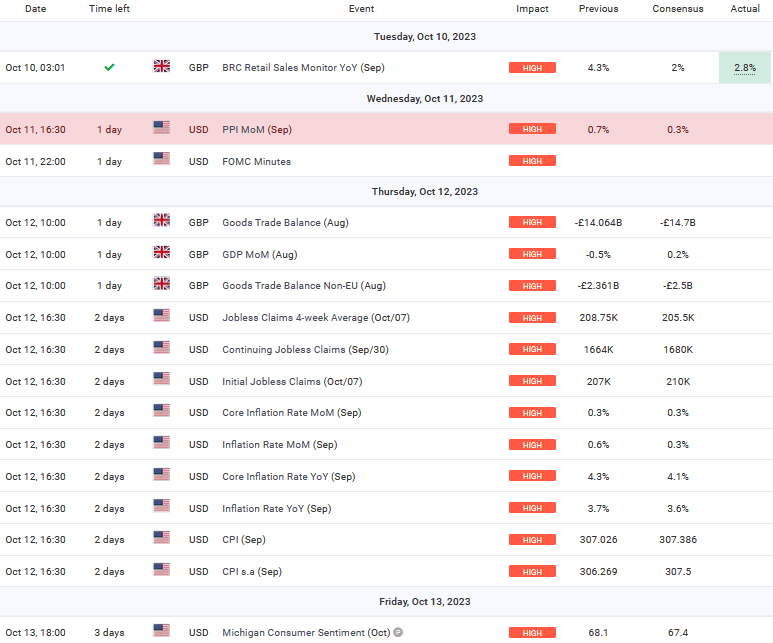

Upcoming Events for the week:

US PPI MoM (Sep) (Oct 11, 16:30):

- Market Impact Criteria:

- Inflationary Pressures: A higher Producer Price Index (PPI) can indicate rising inflationary pressures in the US economy.

- Impact on Currency Markets: A higher-than-expected PPI may strengthen the USD, as it can suggest that inflation is increasing, potentially leading to a more hawkish monetary policy stance by the Federal Reserve.

US FOMC Minutes (Oct 11, 22:00):

- Market Impact Criteria:

- Policy Guidance: The FOMC Minutes provide insights into the Federal Reserve’s monetary policy discussions, offering guidance on future policy actions.

- Impact on Currency Markets: The minutes may lead to volatility in the USD if they contain hints about future interest rate decisions or economic assessments.

UK Goods Trade Balance (Aug) (Oct 12, 10:00):

- Market Impact Criteria:

- Trade Health: The trade balance reflects the health of the UK’s trade relations and can influence economic sentiment.

- Impact on Currency Markets: A worse-than-expected trade balance might weaken the GBP as it suggests trade challenges, potentially impacting GBP/USD.

UK GDP MoM (Aug) (Oct 12, 10:00):

- Market Impact Criteria:

- Economic Growth: GDP data reflects the pace of economic growth in the UK.

- Impact on Currency Markets: Stronger-than-expected GDP growth may support the GBP, potentially leading to GBP/USD appreciation.

US Continuing Jobless Claims (Sep/30) and Initial Jobless Claims (Oct/07) (Oct 12, 16:30):

- Market Impact Criteria:

- Labor Market Health: These data points reflect the health of the US labor market.

- Impact on Currency Markets: Strong economic data can boost the USD, potentially leading to GBP/USD depreciation if the USD strengthens.

US Inflation Rate MoM (Sep) (Oct 12, 16:30):

- Market Impact Criteria:

- Inflation Data: The month-over-month inflation rate reflects short-term inflationary pressures.

- Impact on Currency Markets: Higher-than-expected inflation may strengthen the USD, potentially impacting GBP/USD.

US Michigan Consumer Sentiment (Oct) (Oct 13, 18:00):

- Market Impact Criteria:

- Consumer Sentiment: The Michigan Consumer Sentiment Index gauges consumer confidence, influencing consumer spending and economic activity.

- Impact on Currency Markets: Stronger consumer sentiment may support the USD, potentially impacting GBP/USD.

Traders and investors should carefully consider these events and their potential impacts on the USD and GBP, paying attention to both actual data releases and market reactions. Factors like inflation, trade balances, and consumer sentiment can significantly influence currency markets and should be closely monitored for trading decisions.

The EUR/USD pair may be influenced by the High Impact U.S. Producer Price Index (PPI) for September...A lower-than-expected PPI could potentially weaken the U.S. Dollar (USD) and lead to EUR/USD strength.

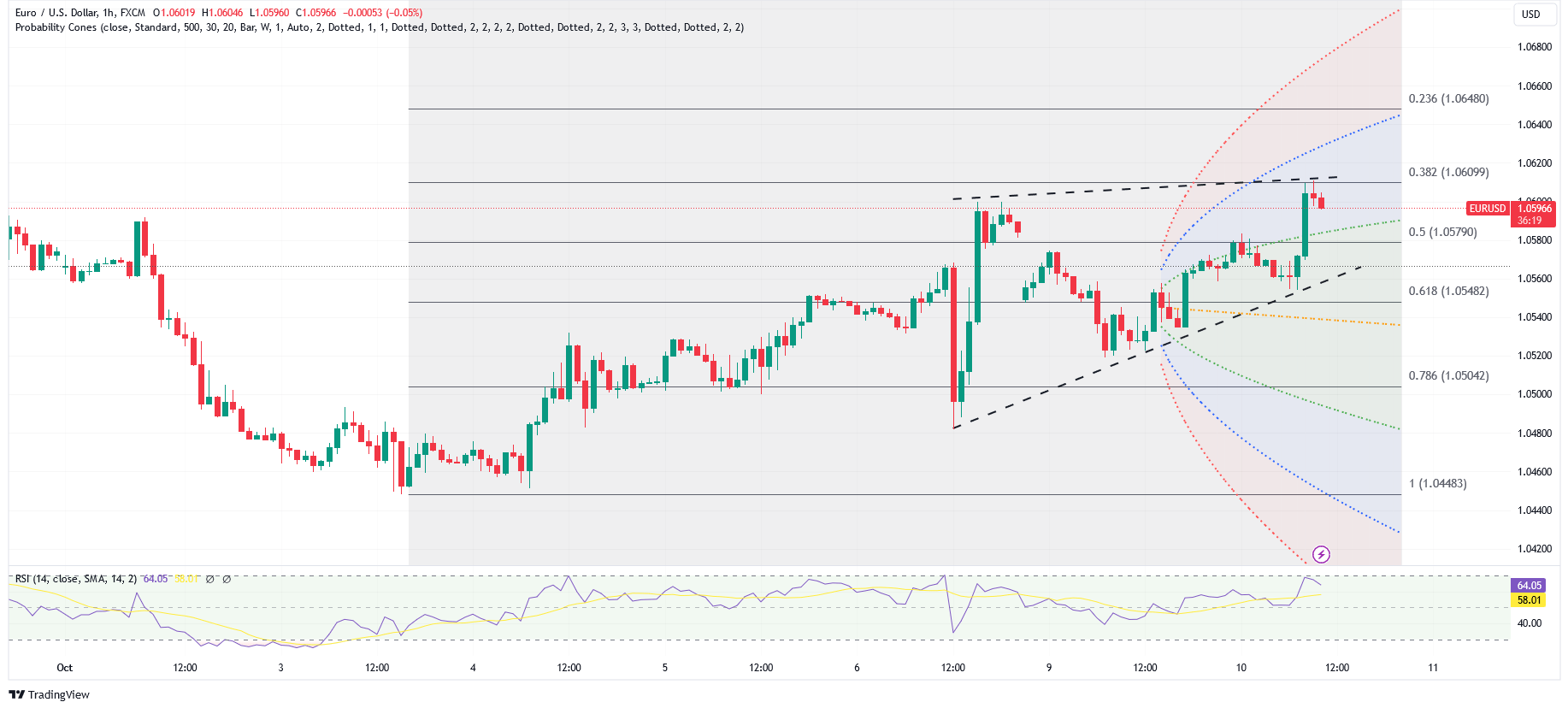

EUR USD Outlook:

Firstly, on October 11th, the EUR/USD pair may be influenced by the High Impact U.S. Producer Price Index (PPI) for September. The previous reading was 0.70%, while the consensus forecast suggests a decrease to 0.30%. A lower-than-expected PPI could potentially weaken the U.S. Dollar (USD) and lead to EUR/USD strength.

Secondly, on the same day, the release of the FOMC Minutes from the U.S. Federal Reserve’s latest meeting can have a significant impact on EUR/USD. These minutes provide insights into the Fed’s monetary policy discussions. Any indications of a more dovish stance or concerns about the economy may weaken the USD and favor EUR/USD appreciation.

Moving forward, on October 12th, the UK’s Goods Trade Balance and GDP MoM for August will be released. While these events are not directly related to EUR/USD, they can indirectly affect market sentiment. A significant deviation from expectations in these UK economic indicators could influence investor sentiment and potentially impact the Euro (EUR), which may, in turn, affect EUR/USD.

Additionally, on the same day, several high-impact U.S. economic indicators will be released. The Continuing Jobless Claims, Initial Jobless Claims, and Inflation Rate MoM for September can influence the USD and, consequently, EUR/USD. Traders should monitor these figures closely and consider any deviations from consensus forecasts, as they can lead to currency movements.

Lastly, on October 13th, the U.S. Michigan Consumer Sentiment for October will be released. A lower-than-expected consumer sentiment figure could indicate potential economic concerns, leading to USD weakness and favoring EUR/USD strength.

Technical Snapshot:

Scenario 1: Bullish Movement

- Potential upward movement to test 1.05867.

- Further testing at 1.06014 if momentum persists.

- Additional bullish tests at 1.06120.

- Possible upward movement towards 1.06218 and 1.06505.

Scenario 2: Bearish Movement

- Possibility to decline and test 1.05541 and 1.05300.

- If bearishness persists, further tests at 1.05178 and 1.05025.

- 1.04913 identified as a bearish support level.

Market Momentum & RSI

- Short-term momentum: bearish.

- RSI indicates oversold zone: slight bearishness in the short term.

- Possible short-term range: 1.04529 to 1.06120.

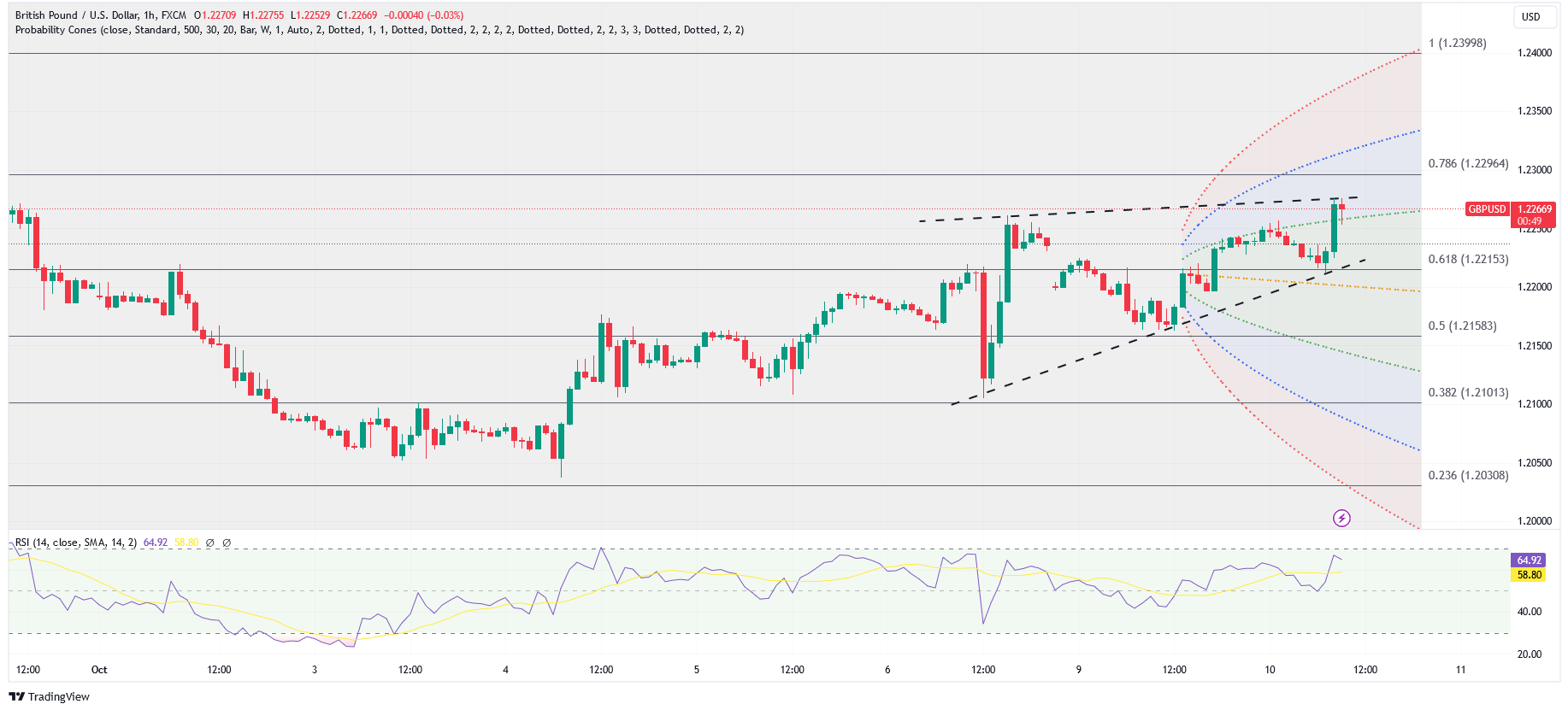

GBP USD Outlook:

Firstly, on October 12th, two significant economic events in the UK are the Goods Trade Balance and GDP MoM for August. These events can influence investor sentiment towards the British Pound (GBP) and, in turn, affect GBP/USD. If the Goods Trade Balance shows a significant deviation from the consensus forecast of -£14.7 billion and the GDP MoM exceeds the expected 0.20% growth, it could lead to GBP strength and potentially result in GBP/USD appreciation.

On the same day, October 12th, several high-impact U.S. economic indicators will be released, including Continuing Jobless Claims, Initial Jobless Claims, and the Inflation Rate MoM for September. These data points can have a direct impact on the U.S. Dollar (USD), thereby influencing GBP/USD. Traders should closely monitor these figures for any deviations from consensus forecasts, as they can lead to currency movements in GBP/USD.

Additionally, on October 13th, the U.S. Michigan Consumer Sentiment for October will be released. A lower-than-expected consumer sentiment figure could indicate potential economic concerns and lead to USD weakness, potentially favoring GBP/USD strength.

GBP/USD Technical Snapshot:

- Short-term bullish trend.

- Testing support at 1.2230.

- Above 200 and 50-day moving averages.

Scenario 1: Bullish Movement

- May continue to 1.2280.

- Potential reach: 1.2303.

- Further bullishness might test 1.2334.

Scenario 2: Bearish Movement

- May decline to 1.2203 or 1.2176.

- If 1.2148 doesn’t hold, might test 1.2125 and 1.2085.

- Significant support: 1.2063.

Momentum & RSI

- Short-term momentum: nearly bullish but ranging.

- RSI: heading towards overbought zone.

- Market may range between 1.2037 and 1.2303.

- Note: RSI indicates a bearish range bias.

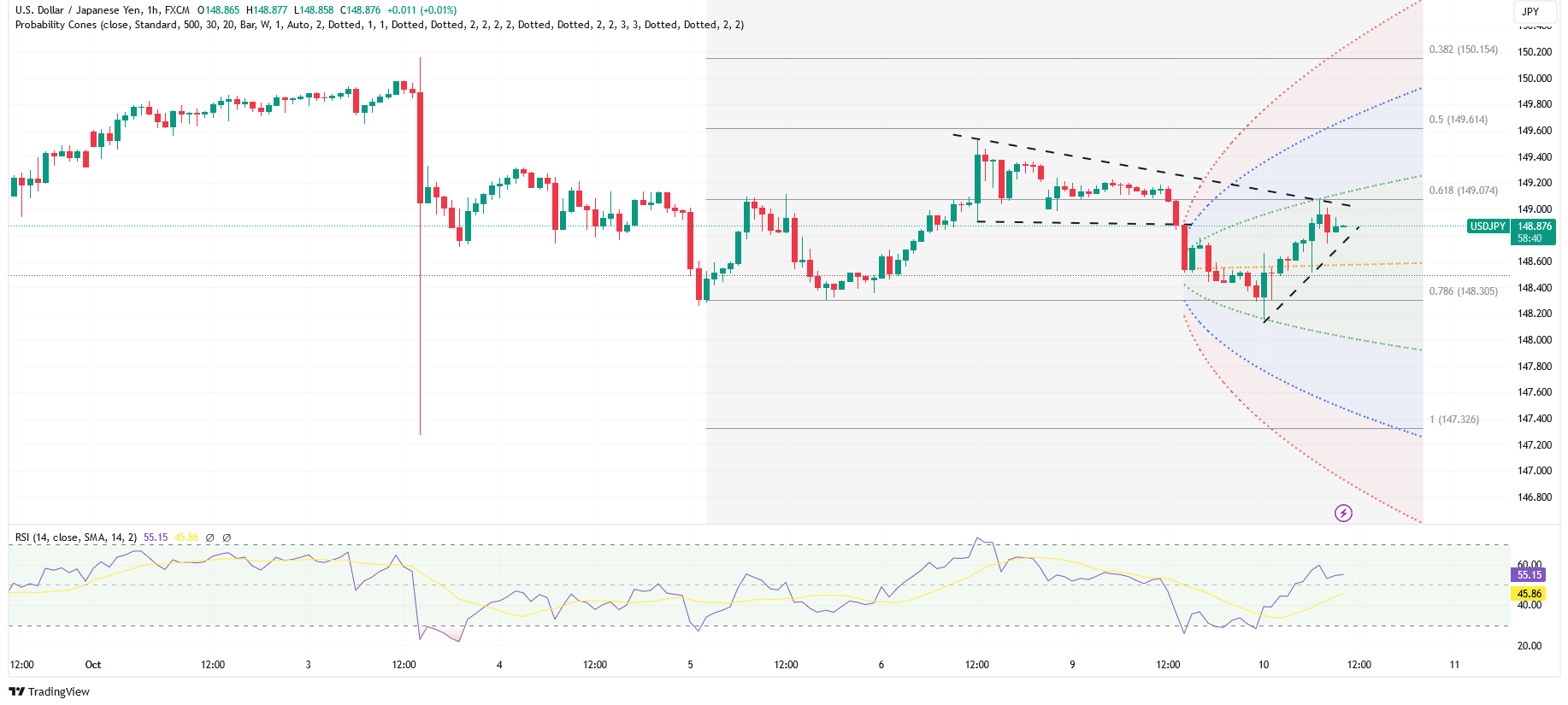

USD/JPY Outlook:

The U.S. PPI MoM for September is a High Impact event that can influence the USD/JPY pair. The previous reading was 0.70%, while the consensus forecast suggests a decrease to 0.30%. A lower-than-expected PPI could potentially weaken the U.S. Dollar (USD) against the Japanese Yen (JPY), leading to USD/JPY depreciation.

The release of the FOMC Minutes from the U.S. Federal Reserve’s latest meeting is a pivotal event for USD/JPY. These minutes provide insights into the Fed’s monetary policy discussions. Any indications of a more dovish stance or concerns about the economy may weaken the USD and favor USD/JPY depreciation.

The Continuing Jobless Claims, Initial Jobless Claims, and the Inflation Rate MoM for September can directly impact the U.S. Dollar (USD) and, consequently, USD/JPY. Traders should closely monitor these figures for any deviations from consensus forecasts, as they can lead to currency movements in USD/JPY.

Lastly,the U.S. Michigan Consumer Sentiment with a lower-than-expected consumer sentiment figure could indicate potential economic concerns, leading to USD weakness and potentially favoring USD/JPY

USD/JPY Technical Snapshot

- Currently trading at 148.740.

- Between 50 and 200 Day Moving Averages, suggesting bearish range momentum.

Scenario 1: Bullish Movement

- Possible retest of 148.900.

- If bullish, might test 148.913.

- Top resistances: 149.200, 149.454, and 149.584.

Scenario 2: Bearish Movement

- May test down to 148.404 and 148.112.

- Further downside could target 147.866.

- Additional support: 147.548 and 147.231.

Momentum & RSI

- Exhibiting bearish range momentum.

- Possible oversold market due to pullback from highs.

- RSI nearing oversold zone.

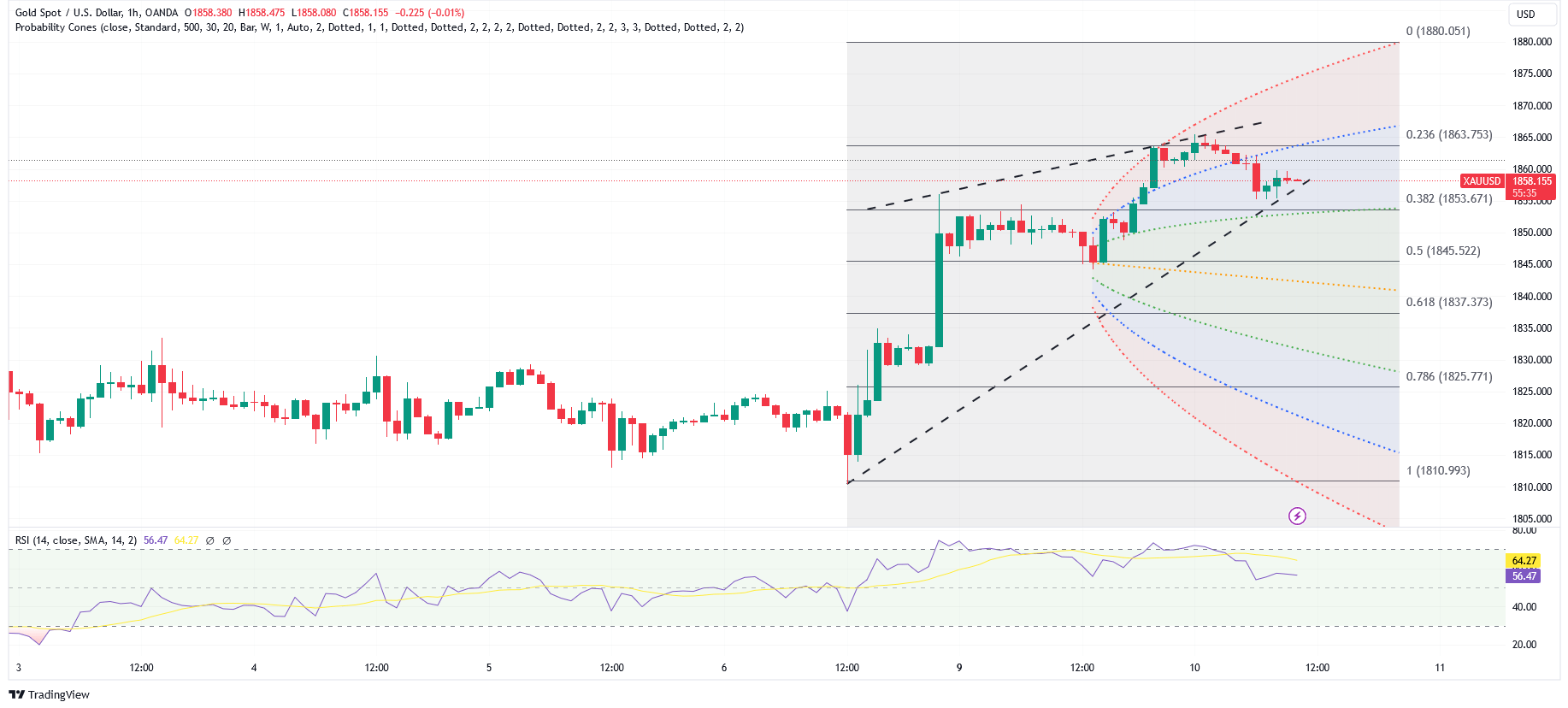

XAU/USD Outlook:

The U.S. Producer Price Index (PPI) for September is a High Impact event that can influence the price of Gold (XAU/USD). The previous reading was 0.70%, while the consensus forecast suggests a decrease to 0.30%. A lower-than-expected PPI could potentially weaken the U.S. Dollar (USD), leading to a potential increase in demand for Gold as a safe-haven asset, which could drive up the price of XAU/USD.

The release of the FOMC Minutes from the U.S. Federal Reserve’s any indications of a more dovish stance or concerns about the economy may weaken the USD and potentially result in higher Gold prices.

The Continuing Jobless Claims, Initial Jobless Claims, and the Inflation Rate MoM for September can also have a direct impact on the U.S. Dollar (USD) and, consequently, the price of Gold (XAU/USD). Traders should closely monitor these figures for any deviations from consensus forecasts, as they can lead to movements in the XAU/USD price.

If the U.S. Michigan Consumer Sentiment is lower-than-expected consumer sentiment figure then this could indicate potential economic concerns, leading to USD weakness. In such cases, Gold, often seen as a hedge against economic uncertainty, may experience upward pressure.

Gold Price Technical Snapshot:

– Trading at 1867, bearish but range trading.

– Between 200-day and 50-day MAs; bearish range zone.

Scenario 1: Bearish Movement

– May decline to test 1853.

– Further tests: 1847, 1843, 1837.

– Major support: 1829.

Scenario 2: Bullish Movement

– Could test resistance: 1866.

– Main resistance: 1874.

– Further resistances: 1881, 1884, 1892.

Momentum & Possible Range

– Short-term: bullish yet ranging, bearish reversal potential.

– Possible ranging: 1800 to 1874.

Volatility Considerations:

- Federal Reserve’s Monetary Policy: The Federal Reserve’s stance on interest rates and its future policy decisions, as hinted in the FOMC Minutes, can significantly impact the volatility of the USD and other related currency pairs. Traders and investors should closely watch for any indications of a more dovish or hawkish stance, as this can lead to sudden market movements.

- Economic Data Releases: High-impact economic data releases, such as the US PPI, GDP, jobless claims, and inflation rate, can introduce volatility into the currency markets. Deviations from consensus forecasts in these data points can lead to rapid currency movements, affecting USD-related pairs like EUR/USD, GBP/USD, and USD/JPY.

- Global Geopolitical Events: Geopolitical conflicts, like the ongoing Middle East conflict mentioned in the article, can drive investors to seek safe-haven assets, leading to increased volatility in currency pairs. Traders should monitor geopolitical developments and their potential impact on safe-haven currencies like the USD.

- Market Sentiment and Consumer Confidence: The Michigan Consumer Sentiment Index and consumer sentiment in general can influence market sentiment and risk appetite. A significant change in consumer confidence can affect currency pairs like USD/JPY, as it may reflect economic concerns or optimism. Traders should consider the impact of sentiment on market volatility.

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.