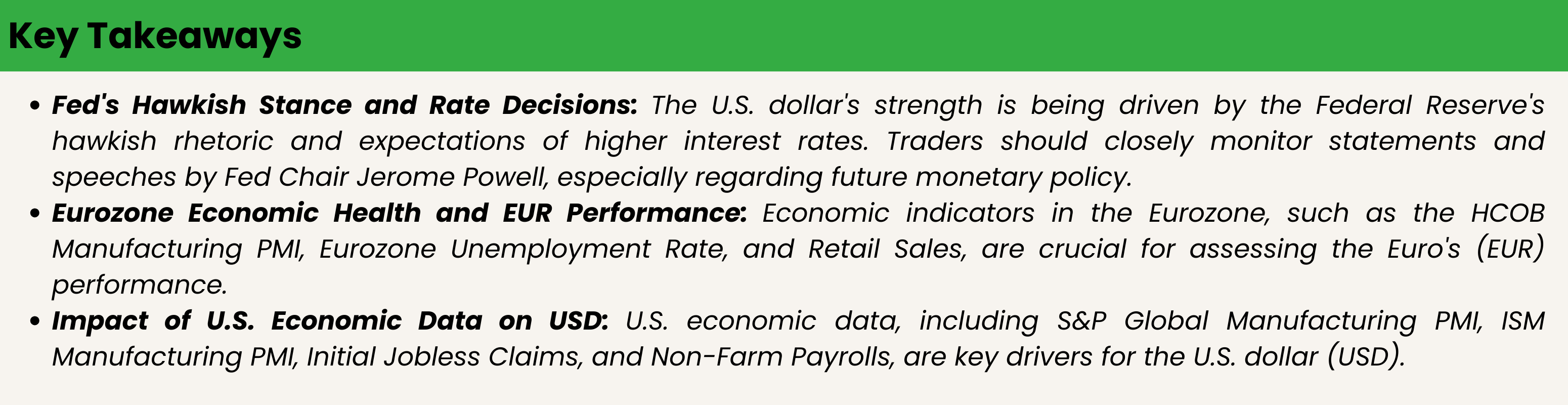

Dollar Index:

As of October 2, 2023, the U.S. dollar index (DXY) is close to a 10-month peak, with the index last at 106.21.

The dollar’s strength is attributed to persistently hawkish Federal Reserve rhetoric and a surge in U.S.

Treasury yields, with the U.S. 10-year yield at 4.619%, close to a 17-year peak of 4.688% reached last week.

The dollar’s firm position is also influenced by expectations of higher U.S. interest rates, which tend to boost the value of a country’s currency by attracting more foreign capital

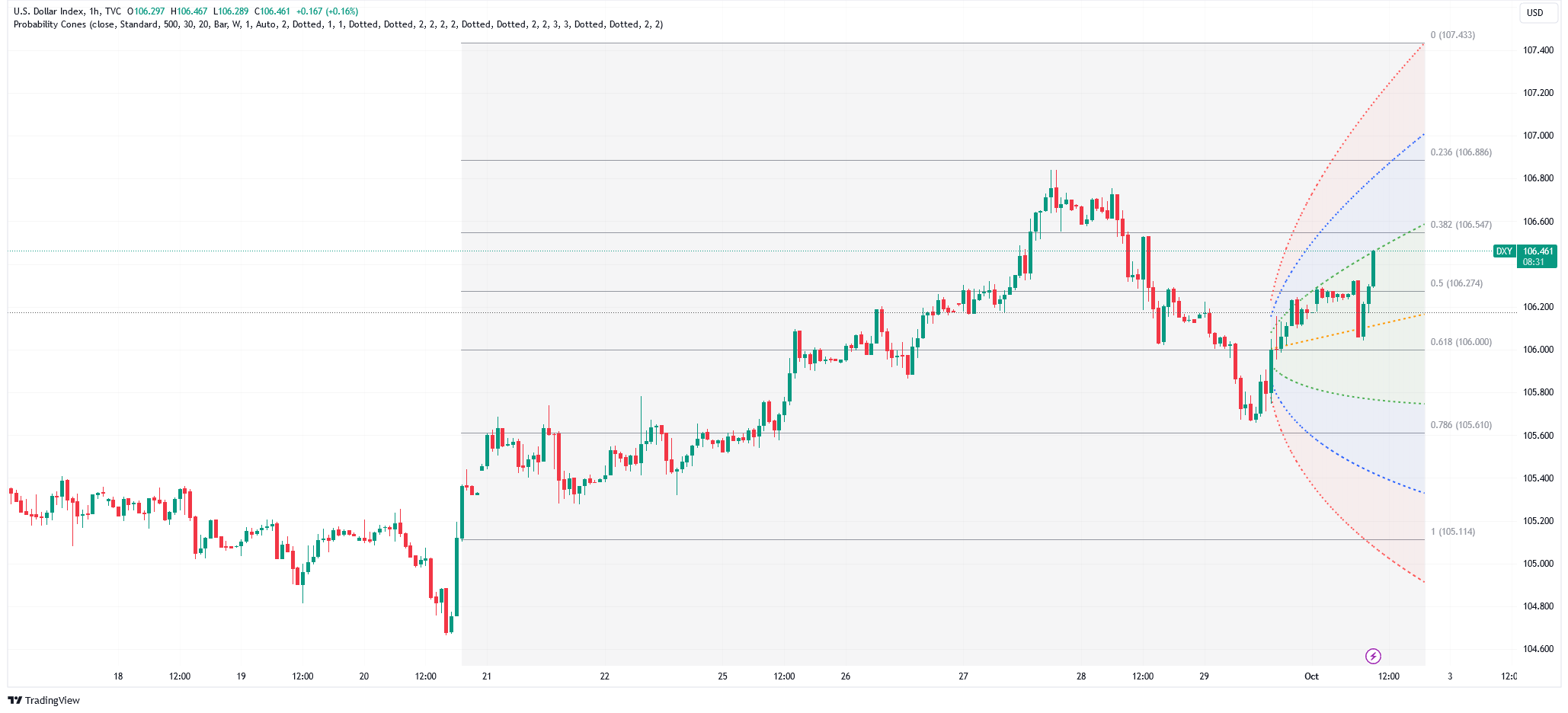

Upcoming Events for the week:

Eurozone HCOB Manufacturing PMI (Sep):

- Market Impact Criteria:

- Deviation from Consensus: A significant deviation from the consensus PMI figure of 43.4 could lead to market volatility.

- Manufacturing Health: The PMI reflects the health of the Eurozone manufacturing sector.

- Currency Market Impact: The EUR may react to the HCOB Manufacturing PMI data. A lower-than-expected PMI figure could lead to EUR depreciation, while a higher figure might support the EUR.

Eurozone Unemployment Rate (Aug):

- Market Impact Criteria:

- Deviation from Consensus: A substantial deviation from the consensus unemployment rate of 6.40% could influence market sentiment.

- Labor Market Health: The unemployment rate reflects the health of the Eurozone labor market.

- Currency Market Impact: The EUR may react to the unemployment rate data. Significant deviations from consensus could impact the EUR’s performance. A lower rate may support the EUR, while a higher rate could lead to EUR depreciation.

US S&P Global Manufacturing PMI (Sep):

- Market Impact Criteria:

- Deviation from Consensus: A significant deviation from the consensus PMI figure of 48.9 can impact market sentiment.

- Manufacturing Health: The PMI reflects the health of the US manufacturing sector.

- Currency Market Impact: The USD may react to the S&P Global Manufacturing PMI data. A higher-than-expected figure could strengthen the USD, while a lower figure may lead to USD depreciation.

US ISM Manufacturing PMI (Sep):

- Market Impact Criteria:

- Deviation from Consensus: A significant deviation from the consensus PMI figure of 47.7 can influence market sentiment.

- Manufacturing Health: The ISM Manufacturing PMI is a key indicator of the US manufacturing sector’s health.

- Currency Market Impact: The USD may react to the ISM Manufacturing PMI data. Deviations from consensus may impact the USD’s strength.

US Fed Chair Powell Speech:

- Market Impact Criteria:

- Forward Guidance: Any hints or guidance on future monetary policy can significantly influence market sentiment.

- Currency Market Impact: The USD can react to Chairman Powell’s statements, especially if he provides insights into the Fed’s monetary policy direction. Powell’s comments may affect the USD’s strength and overall market sentiment.

Eurozone Retail Sales MoM (Aug):

- Market Impact Criteria:

- Deviation from Consensus: A substantial deviation from the consensus figure (-0.30%) can influence market sentiment.

- Consumer Spending: Retail sales data reflects consumer spending patterns in the Eurozone.

- Currency Market Impact: The EUR may react to the Retail Sales MoM data. Stronger-than-expected retail sales may support the EUR, while weaker figures could lead to EUR depreciation.

US S&P Global Services PMI (Sep) and ISM Services PMI (Sep):

- Market Impact Criteria:

- Deviation from Consensus: Significant deviations from consensus figures can influence market sentiment.

- Service Sector Health: These PMI indicators reflect the health of the US services sector.

- Currency Market Impact: The USD may react to these PMI data releases. Stronger-than-expected figures could support the USD, while weaker data may lead to USD depreciation.

US Initial Jobless Claims (Sep/30):

- Market Impact Criteria:

- Deviation from Consensus: A significant difference from the consensus number (210K) can affect USD strength.

- Labor Market Sentiment: Jobless claims data can impact market sentiment about the US labor market.

- Currency Market Impact: The USD’s performance will likely depend on how actual jobless claims figures align with consensus. Strong data may support the USD, while weak figures could lead to USD depreciation.

Eurozone ECB Guindos Speech:

- Market Impact Criteria:

- Forward Guidance: Insights into ECB’s monetary policy direction can influence the EUR.

- Currency Market Impact: The EUR may react to Vice President Guindos’ speech, especially if he provides guidance on ECB policy. His comments may affect the EUR’s strength and Eurozone sentiment.

US Unemployment Rate (Sep) and Non-Farm Payrolls (Sep):

- Market Impact Criteria:

- Deviation from Consensus: Significant deviations from consensus figures can influence market sentiment.

- Labor Market Health: These indicators reflect the health of the US labor market.

- Currency Market Impact: The USD’s performance will likely depend on how these labor market indicators align with market expectations. Strong data may support the USD, while weak figures could lead to USD depreciation.

The U.S. dollar's strength is being driven by the Federal Reserve's hawkish rhetoric and expectations of higher interest rates. Traders should closely monitor statements and speeches by Fed Chair Jerome Powell, especially regarding future monetary policy. Any hints of policy tightening or a surprise rate hike by the Fed can significantly impact the USD's strength and cause EUR/USD depreciation.

EUR USD Outlook:

The HCOB Manufacturing PMI reflects the health of the Eurozone’s manufacturing sector. Even though the figure remained at 43.4, it’s crucial to watch for any future deviations from consensus as a shift toward lower values could indicate a weakening sector, potentially leading to EUR depreciation. The Eurozone’s unemployment rate remained stable at 6.40%. Significant deviations from this rate could affect the EUR, with a lower rate potentially strengthening the currency and a higher rate having the opposite effect. The S&P Global Manufacturing PMI for the US increased to 48.9. Any further increase in this figure might support the USD, while a decline could weaken the currency. The US ISM Manufacturing PMI slightly increased to 47.7. Monitoring deviations from this figure will be essential as stronger manufacturing data could strengthen the USD.

Remarks by Fed Chair Powell can significantly impact market sentiment and the USD. Any indication of future monetary policy shifts may lead to USD volatility. The Eurozone’s retail sales data for August decreased by 0.30%. A figure below consensus might weaken the EUR, while an improvement could have the opposite effect.

These PMI figures reflect the health of the US services sector. Deviations from consensus could influence the USD, with stronger data potentially supporting the currency. The number of initial jobless claims remains essential for assessing the US labor market. A figure above consensus might weaken the USD, while a lower figure could strengthen it.

Any guidance on ECB policy provided by Vice President Guindos could affect the EUR’s strength and Eurozone sentiment.These indicators reflect the health of the US labor market. Deviations from consensus could lead to USD volatility, with strong data potentially supporting the currency.

In summary, traders should closely monitor these events and data releases, comparing them to consensus expectations to gauge potential movements in the EUR/USD pair. Factors like manufacturing data, employment figures, and central bank speeches can significantly impact the exchange rate, so it’s crucial to stay informed and consider these criteria when making trading decisions.

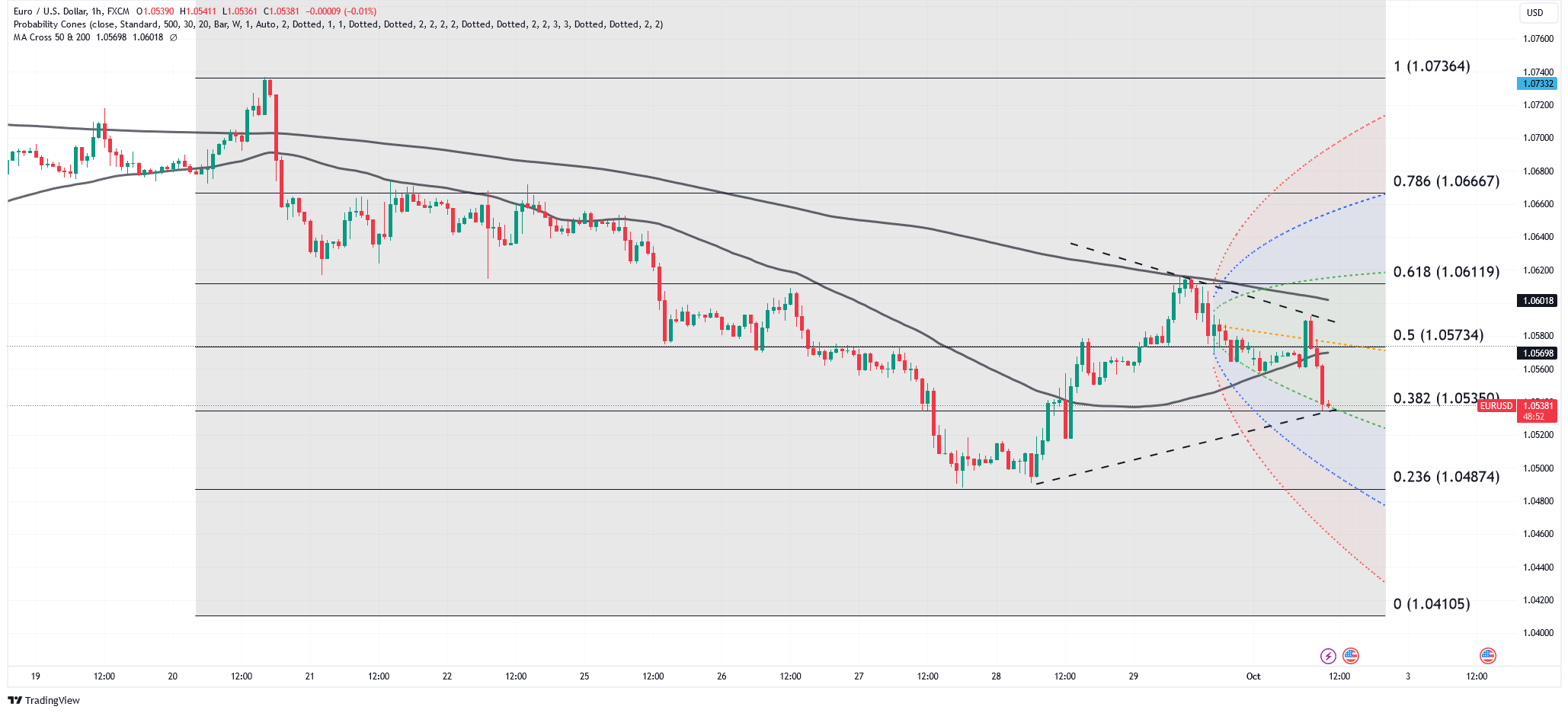

Technical Summary:

Scenario 1 (Bullish)

- If prices keep going up, they might reach levels between 1.05678 and 1.05867.

- A successful test there could push prices even higher to around 1.06210 and 1.06218.

- Beyond that, we could see prices aiming for 1.06302, and if the momentum continues, levels of 1.06700 and 1.06889 are possible.

Scenario 2 (Bearish)

- Alternatively, if prices turn around from where they are now, they could drop to the 1.05140 level.

- If that level holds, we might see prices go down further towards 1.04913 and then potentially to 1.04712, which is a significant support level.

- Depending on market sentiment, prices could even dip to levels between 1.04529 and 1.04772, with 1.03972 being a major support level – a break below which could indicate a bearish market sentiment.

- In a bearish market, prices may revisit the 1.03589 levels seen in November 2022

GBP USD Outlook:

Firstly, in the Eurozone, the GBP/USD currency pair may be influenced by the High Impact HCOB Manufacturing PMI for September. The previous reading for this indicator was 43.5, while the consensus forecast suggests a slight drop to 43.4. Any deviation from this consensus could have implications for the Euro (EUR) and, in turn, affect GBP/USD.

Secondly, the Unemployment Rate announcement for August in the Eurozone, with a previous value of 6.40% and a consensus forecast of 6.40%, may not cause immediate currency fluctuations. However, if the actual figure deviates significantly from the expected 6.40%, it could indirectly impact market sentiment and potentially influence the GBP/USD pair.

Shifting focus to the United States, the S&P Global Manufacturing PMI for September is expected to rise from a previous value of 47.9 to a forecasted 48.9. Similarly, the ISM Manufacturing PMI is anticipated to increase from 47.6 to 47.7. These higher-than-previous and forecasted readings could boost the U.S. Dollar (USD) against the Pound (GBP), signaling economic strength.

Furthermore, the speech by Fed Chair Jerome Powell scheduled for the evening of October 2nd is a crucial event for GBP/USD traders. While there are no specific numerical values associated with speeches, Powell’s remarks can provide insights into the Federal Reserve’s monetary policy. Any hints of policy tightening or a more hawkish stance could strengthen the USD and potentially weaken GBP/USD.

Lastly, the highly anticipated Non-Farm Payrolls (NFP) report for September, set to be released on October 6th, is a key event for GBP/USD traders. The previous NFP figure was 187K, and the consensus forecast for the upcoming release is 163K. A figure significantly different from this forecast could drive USD strength or weakness, impacting GBP/USD accordingly.

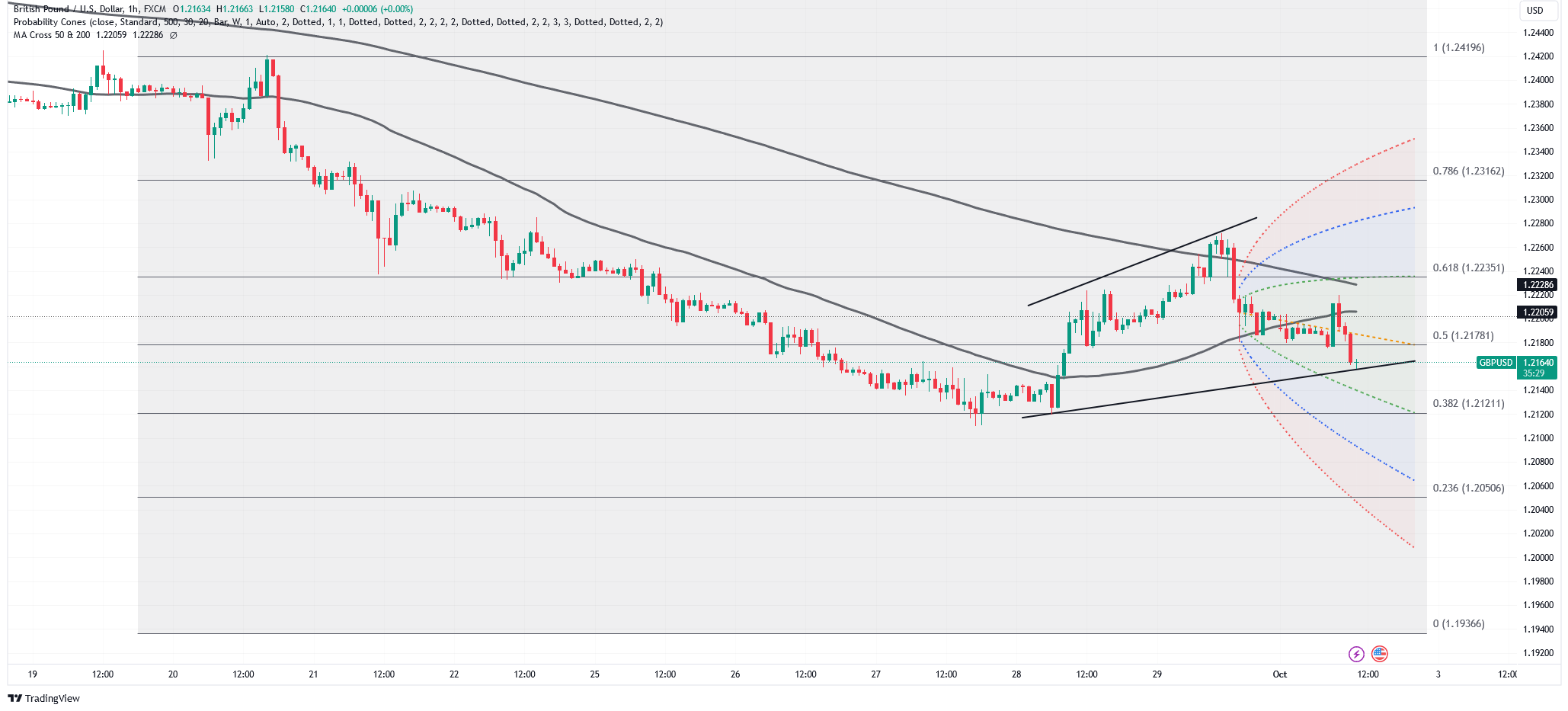

Technical Summary:

Scenario 1 (Bullish)

- If the price successfully retests 1.2228, it could move upwards to resistance levels at 1.2280, 1.2303, 1.2320

- The highest resistance to watch for is at 1.2391.

Scenario 2 (Bearish)

- Alternatively, if prices go down, they might test support at 1.2148.

- A successful test there could lead to further declines to 1.2116.

- The 1.2037 level is significant as strong support.

- If bearishness continues, prices could reach a range between 1.1998 and 1.1919, with 1.1919 as a major support level.

USD/JPY Outlook:

Firstly, the USD/JPY pair may be influenced by the High Impact events in the Eurozone and the United States on October 2nd. The HCOB Manufacturing PMI for September in the Eurozone, with a previous value of 43.5 and a consensus forecast of 43.4, might have a limited direct impact on USD/JPY. However, it can indirectly affect market sentiment and risk appetite. In the U.S., both the S&P Global Manufacturing PMI and the ISM Manufacturing PMI are expected to rise compared to their previous readings. A positive surprise in these manufacturing PMIs could strengthen the U.S. Dollar (USD) and potentially lead to USD/JPY appreciation.

Secondly, the speech by Federal Reserve Chair Jerome Powell scheduled for October 2nd is a significant event for USD/JPY traders. While it does not come with numerical values, Powell’s comments can provide valuable insights into the future monetary policy direction of the Federal Reserve. Any indications of a hawkish stance or potential policy tightening could boost the USD and consequently strengthen USD/JPY.

Moving ahead, the Non-Farm Payrolls (NFP) report for September, set to be released on October 6th, is a pivotal event for USD/JPY. The previous NFP figure was 187K, and the consensus forecast for the upcoming release is 163K. A reading significantly different from this forecast can have a substantial impact on USD/JPY. A higher-than-expected NFP figure could contribute to USD strength and potential appreciation

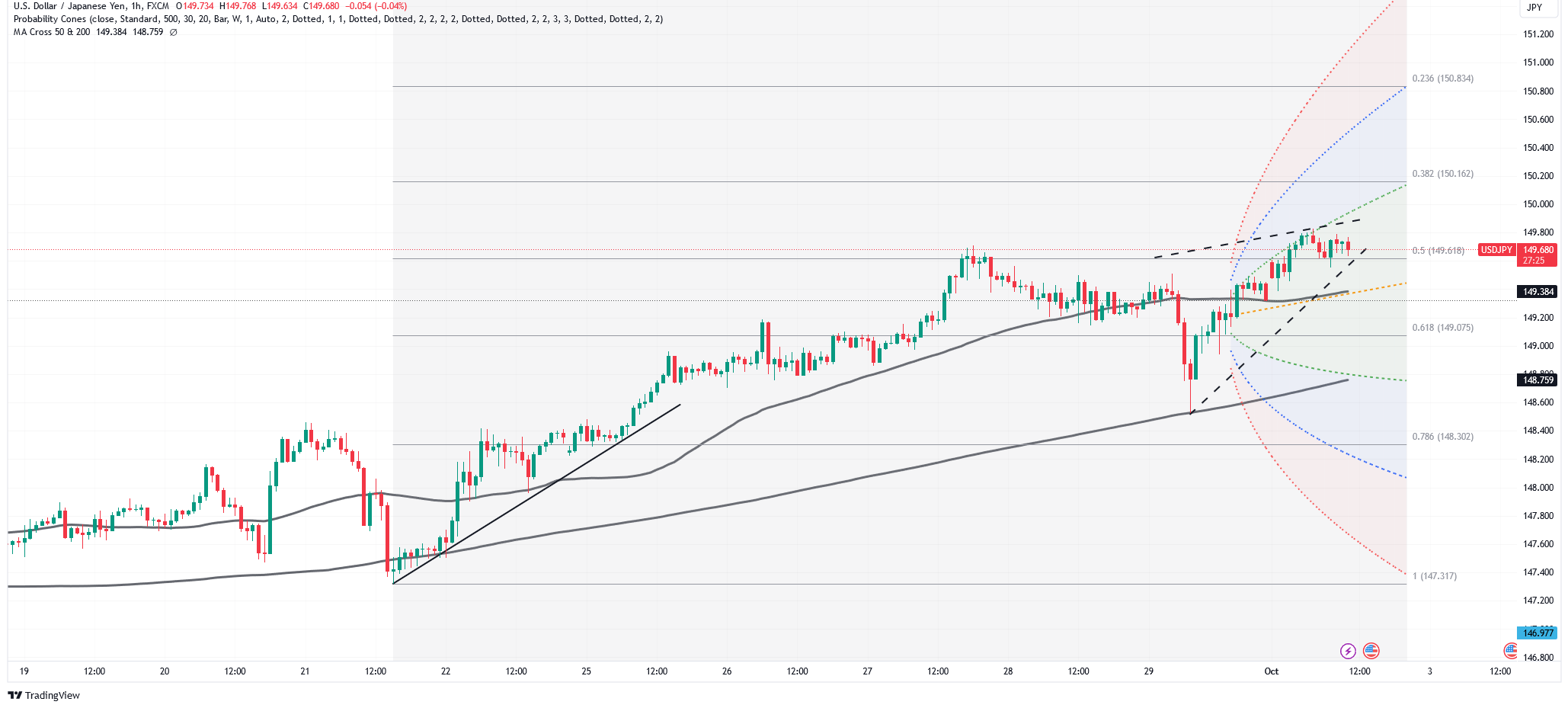

Technical Summary:

Scenario 1 (Bearish)

- Possible downward movement in price.

- Testing of 148.913 level.

- Further tests at the 61.8% Fibonacci level at 148.404.

- If successful, potential for continued decline targeting 148.112 to 147.231.

- Critical support level at 146.934.

- Major support at 146.274.

Scenario 2 (Bullish)

- Suggests a bullish scenario with higher price movement.

- Price may rise to retest 150.362 level.

- Successful retest could lead to more upward momentum to 151.026 to 151.944 levels.

- If these levels are surpassed, potential for further climb to test 153 level.

XAU/USD Outlook:

Firstly, Gold prices may react to the High Impact events in the Eurozone and the United States on October 2nd. The HCOB Manufacturing PMI for September in the Eurozone, with a previous reading of 43.5 and a consensus forecast of 43.4, may not have a direct and immediate impact on Gold. However, it can indirectly affect investor sentiment and risk appetite. In the U.S., both the S&P Global Manufacturing PMI and the ISM Manufacturing PMI are expected to show improvement. A positive surprise in these manufacturing PMIs could potentially strengthen the U.S. Dollar (USD) and lead to a temporary dip in Gold prices, as they often have an inverse relationship.

Secondly, the speech by Federal Reserve Chair Jerome Powell scheduled for October 2nd is a critical event for Gold traders. Powell’s comments can provide insights into the future direction of U.S. monetary policy. Any hints of a hawkish stance or the possibility of tightening policy could boost the USD and potentially put downward pressure on Gold prices.

Moving forward, the Non-Farm Payrolls (NFP) report for September, set to be released on October 6th, is a key driver for Gold prices. The previous NFP figure was 187K, and the consensus forecast for the upcoming release is 163K. A figure significantly different from this forecast can have a substantial impact on Gold. A stronger-than-expected NFP report could strengthen the USD and potentially lead to a decrease in Gold prices.

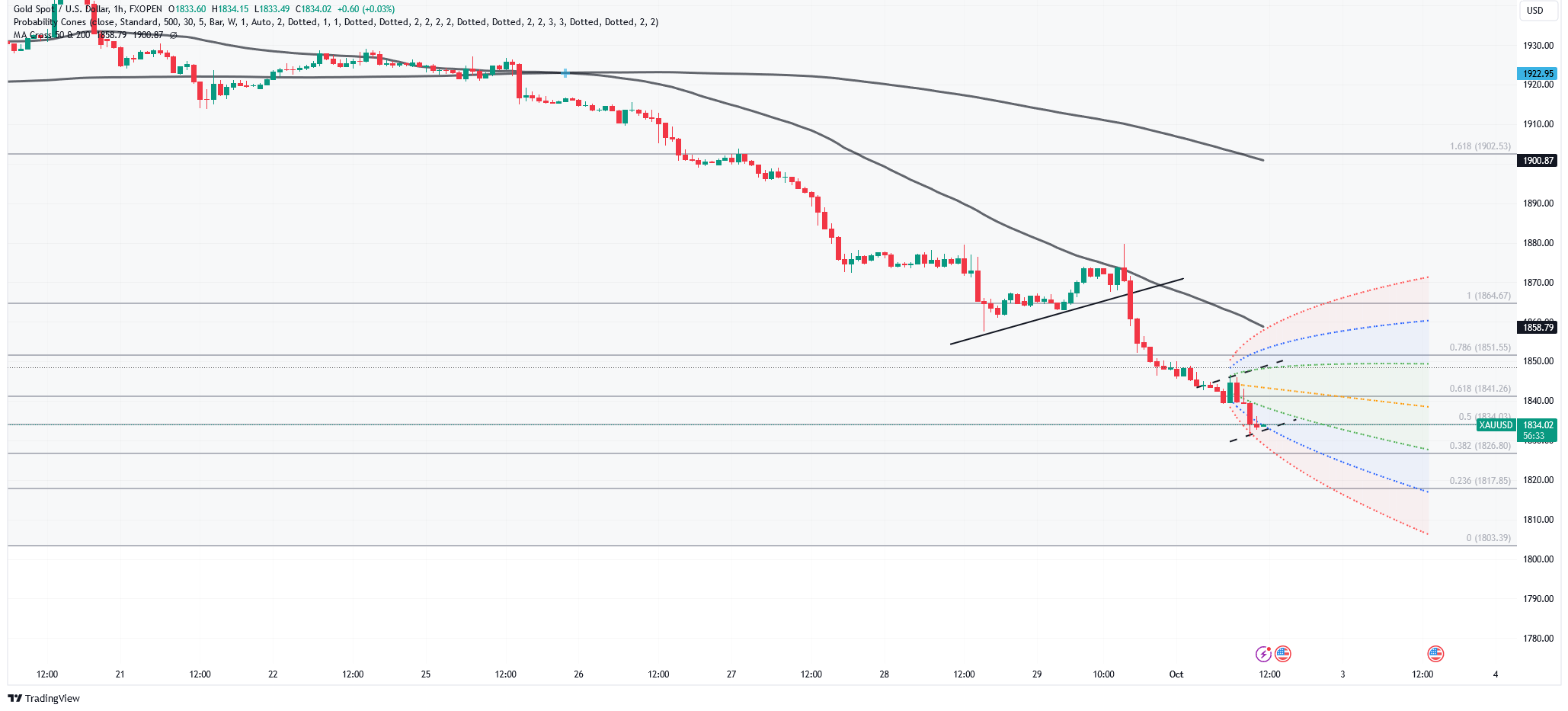

Technical Summary:

Scenario 1 (Bullish)

- Price could go up and test 1847.40.

- If momentum continues, it may reach 1861.30.

- Further bullish movement might lead to retesting 1866.47.

- A critical level to watch is 1874.

Scenario 2 (Bearish)

- Alternatively, gold’s price could drop and test 1820.

- If bearish trends persist, it might reach 1812, which is a significant support.

- Continued bearishness could push it down to 1796 and 1773 levels.

Volatility Considerations:

Federal Reserve Communication: Given the U.S. dollar’s strength attributed to hawkish Federal Reserve rhetoric, closely monitor any statements or speeches by Fed Chair Jerome Powell. Any indications of a more hawkish stance or hints at future monetary policy changes can lead to significant volatility in currency markets, particularly affecting the USD.

Economic Data Releases in Eurozone and U.S.: The release of economic data, such as manufacturing and services PMI, unemployment rates, retail sales, and Non-Farm Payrolls, can trigger market volatility. Pay special attention to deviations from consensus figures, as these releases reflect the health of respective economies and can impact the strength of the Euro (EUR) and the U.S. Dollar (USD).

Interest Rate Decisions: The U.S. Federal Reserve’s interest rate decision is a critical event. While the consensus expects the Fed to maintain its current rate, any unexpected rate changes, such as a rate hike, can cause sharp and sudden movements in currency markets. Be prepared for heightened volatility around the time of interest rate announcements.

Technical Levels: Technical analysis should be used to identify crucial support and resistance levels in currency pairs, such as EUR/USD and GBP/USD, as well as in commodities like gold. These technical levels can serve as triggers for price reversals or breakout movements, potentially leading to increased volatility.

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.