Dollar Index:

As of March 04th, 2024, the latest news impacting the USD revolves around various global economic events and market trends.

Currency Markets Steady: The U.S. dollar weakened slightly at the start of the week, which is packed with significant events such as Britain’s budget, a European Central Bank meeting, U.S. jobs data, and important political moments in both China and the U.S.

Inflation Rates: The annual inflation rate in the United States was 3.1% for the 12 months ending January, a slight decrease from the previous rate of 3.4%.

This moderation in inflation rates is a critical factor for the Federal Reserve’s monetary policy decisions, which in turn affect the value of the USD. The inflation rate is a significant indicator of the economy’s health and influences consumer spending, investment, and pricing strategies across sectors

Economic Indicators and Forecasts: MUFG’s 2024 outlook report suggests a cautious approach to the U.S. economy, indicating a potential for a mild recession. The outlook emphasizes the importance of Federal Reserve policies, bank lending practices, and fixed income market strategies, suggesting that the economic segments are currently out of sync. This uncertainty could have implications for the USD as investors and traders gauge the potential impact on interest rates and economic growth.

AI and Semiconductor Sector Surge: The U.S. stock market, particularly the AI and semiconductor sectors, surged with companies like Nvidia, AMD, Broadcom, and Marvell Technology gaining over 4%.

China’s Annual Parliament Meeting: China is set to announce its 2024 growth target and outline its strategy for supporting the slowing economy at the nation’s most high-profile annual political gathering this week.

These insights suggest that the USD’s strength is closely tied to domestic inflation dynamics and broader economic indicators, with investor sentiment being swayed by economic releases and central bank communications.

Upcoming Events for the week:

The week ahead is filled with significant economic data that will likely influence the currency markets. Starting with the UK, the BRC Retail Sales Monitor showed a larger decline than expected, which could signal weaker consumer confidence and spending, potentially weighing on the GBP. In the Eurozone, the HICP Services PMI came in below consensus, which might dampen sentiment towards the Euro, as it suggests a slowdown in the service sector, a key driver of economic growth.

Midweek, the focus will shift to the U.S. with the ADP Employment Change and JOLTS Job Openings. The ADP report underperformed relative to expectations, which may raise concerns about the labor market’s health, potentially weakening the USD if investors interpret this as a sign that the Federal Reserve might slow down its pace of rate hikes. However, JOLTS Job Openings exceeded expectations significantly, indicating a strong labor demand, which could counterbalance the negative sentiment from the ADP data and support the USD.

Towards the end of the week, all eyes will be on the ECB Interest Rate Decision and the subsequent press conference. The market expects rates to hold steady, so any deviation could result in significant EUR volatility. The USD will again come into focus with key labor market indicators, including Nonfarm Payrolls, the Unemployment Rate, and the U-6 Unemployment Rate. Strong employment figures, particularly a higher than expected Nonfarm Payrolls, could reaffirm confidence in the U.S. economy and potentially lead to a stronger USD.

Overall Market Sentiment:

- The GBP could see negative market sentiment due to disappointing retail sales data, with an estimated breakdown of 30% Positive, 50% Negative, and 20% Neutral.

- For the EUR, sentiment will be largely dependent on the ECB’s actions and comments, but going into the meetings, the sentiment might be cautiously optimistic at 40% Positive, 40% Negative, and 20% Neutral, given the mixed signals from the services PMI.

- The USD sentiment is expected to be cautiously optimistic, at around 55% Positive, 25% Negative, and 20% Neutral, balancing the strong JOLTS data with the underwhelming ADP employment change, and anticipating labor market data releases later in the week.

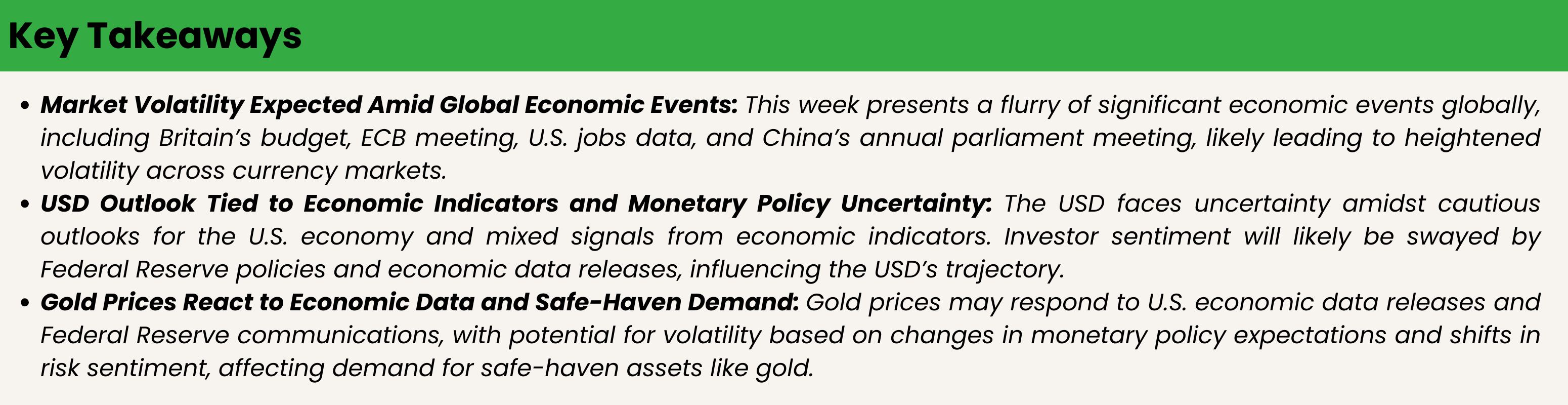

EUR USD Outlook:

EURUSD: Week Ahead Technical and Fundamental Forecast

Technical Scenarios for EUR/USD:

Bullish Scenario:

- EUR/USD breaks above the immediate resistance level of 1.08438, aiming for the 0.618 Fibonacci retracement level at 1.08295, with potential to extend gains towards 1.09128.

- A decisive move above the 0.618 level may see the pair targeting the 1.09382 resistance zone.

- The RSI remains above the 50 level, indicating sustained bullish momentum.

Neutral Scenario:

- The pair consolidates around the current price level, with key support at the 1 (1.07620) Fibonacci level and resistance at 1.08438.

- A lack of directional momentum could result in the pair oscillating between these levels, awaiting fundamental catalysts.

- The RSI hovers around the 50 mark, suggesting indecision in the market.

Bearish Scenario:

- Failure to hold above the 1.07620 level could see EUR/USD decline towards the 1.272 Fibonacci level at 1.07139.

- A breach below this support level might lead to further selling pressure, targeting the 1.414 Fibonacci level at 1.06889.

- The RSI drops below 50, confirming a bearish momentum.

Fundamental Scenarios for EUR/USD:

Positive Data Outcomes:

- Strong U.S. services PMI data and employment figures could reinforce USD strength, pushing EUR/USD towards the bearish scenario.

- Hawkish testimony from Fed Chair Powell or an increase in JOLTS Job Openings may also provide upward momentum for the USD.

Neutral Data Outcomes:

- If both EU and U.S. data releases align with consensus, the EUR/USD might experience limited fundamental-driven volatility, following the neutral technical scenario.

- Market participants could then focus on technical levels and broader market sentiment in the absence of significant data surprises.

Negative Data Outcomes:

- Disappointing U.S. economic figures, especially in the labor market, could weaken the USD, favoring a bullish scenario for EUR/USD.

- A dovish stance from Fed Chair Powell or weaker than expected U.S. services data could contribute to USD softness.

ECB Interest Rate Decision Impact:

- The European Central Bank’s decision on interest rates will be a significant event for EUR/USD.

- If the ECB raises rates or signals a more hawkish monetary policy stance, the EUR could strengthen against the USD, aligning with the bullish scenario.

- Conversely, a dovish ECB stance or a decision to hold rates steady could weaken the EUR, supporting the bearish scenario.

Overall Market Sentiment:

Taking into account the upcoming ECB interest rate decision and the provided economic events and technical chart, the sentiment for EUR/USD in the upcoming week could likely be distributed as follows:

- Positive: 40% – The potential for a hawkish ECB decision or disappointing U.S. data could drive bullish sentiment for the EUR.

- Negative: 35% – Strong U.S. data or a dovish ECB could increase bearish sentiment for the EUR.

- Neutral: 25% – In the event of mixed or as-expected data releases, the market may lack a clear directional bias.

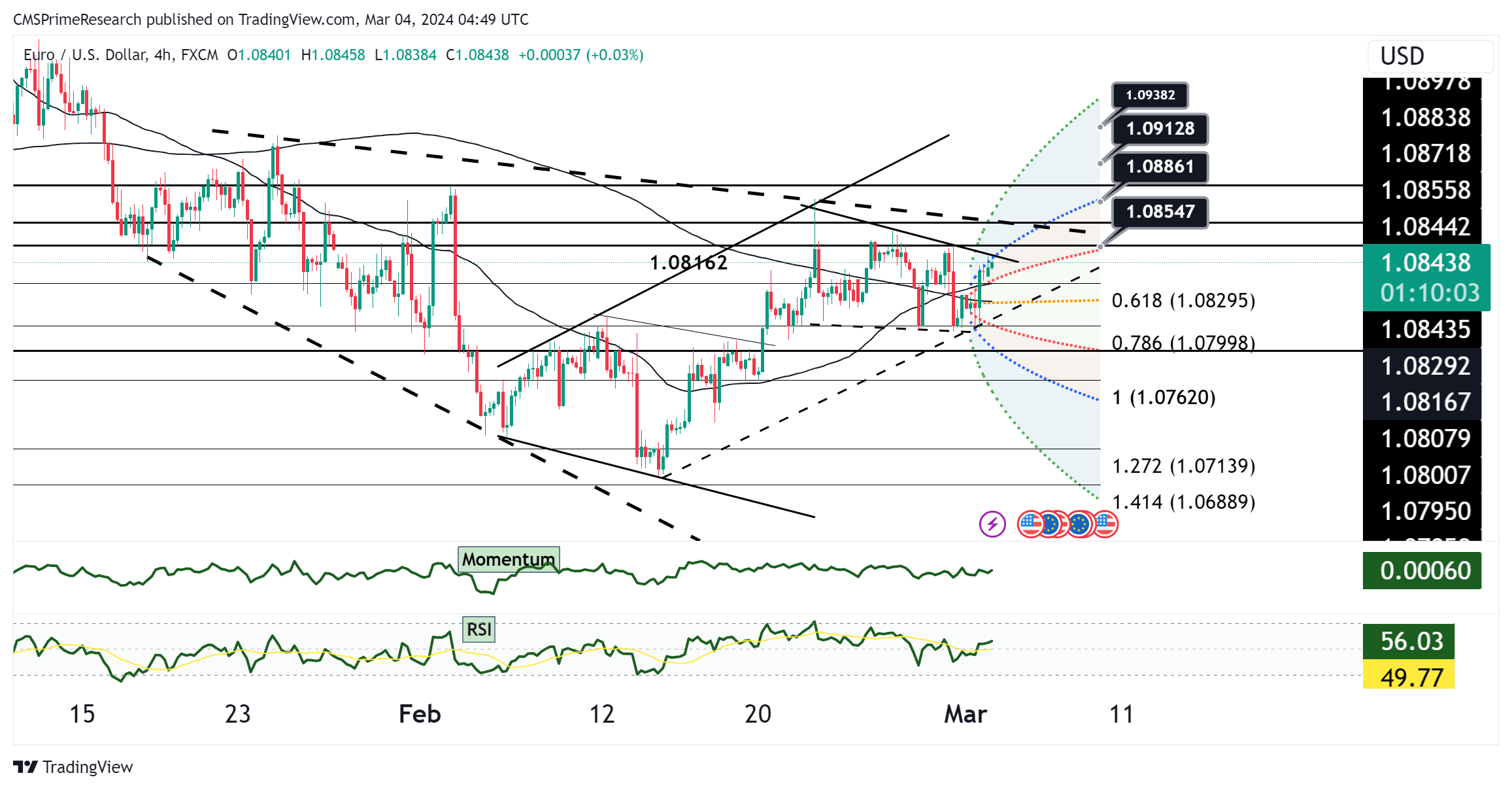

GBP USD Outlook:

GBPUSD: Week Ahead Technical and Fundamental Forecast

Technical Scenarios for GBP/USD:

Bullish Scenario:

- GBP/USD moves above the immediate resistance at 1.26620, targeting the 1.27089 level, with an extended upside potentially towards 1.27433.

- A breakout above these levels could see the pair testing the 1.27481 zone.

- The RSI above the 50 threshold supports the potential for continued upward momentum.

Neutral Scenario:

- The pair could consolidate within the current trading range, with key support at 1.26113 and resistance at 1.26620.

- The RSI hovering around the midpoint suggests a lack of clear directional bias, indicating a period of sideways movement.

Bearish Scenario:

- A break below the support level at 1.26113 could signal a bearish turn, with further downside towards the lower trendline around 1.2580.

- If the RSI moves below the 50 level, it would confirm bearish momentum, potentially leading to declines towards 1.2550.

Fundamental Scenarios for GBP/USD:

Positive Data Outcomes:

- Strong U.S. economic data, particularly the ADP Employment Change and Non-Farm Payrolls, could bolster the USD, leading to a bearish scenario for GBP/USD.

- Hawkish remarks from Fed Chair Powell or higher JOLTS Job Openings could further support USD strength.

Neutral Data Outcomes:

- If data releases from both the UK and the US meet or balance out consensus expectations, the impact may be limited, leading to the neutral technical scenario.

- In this case, traders would likely focus more on technical levels rather than fundamental developments.

Negative Data Outcomes:

- Disappointing U.S. employment data could weaken the USD, supporting a bullish scenario for GBP/USD.

- A dovish tilt from Fed Chair Powell or weaker-than-expected service sector data could exert downward pressure on the USD.

ECB Interest Rate Decision Impact:

- The ECB’s interest rate decision will primarily affect the Euro, but it can also have an indirect impact on GBP/USD through EUR/GBP cross-currency dynamics.

- A hawkish ECB could strengthen the Euro, which might lead to GBP weakness if traders move funds from GBP to EUR.

- Conversely, a dovish ECB could weaken the Euro and potentially strengthen GBP against the USD if traders seek alternatives to the Euro.

Overall Market Sentiment:

Incorporating the ECB’s interest rate decision and other economic events, the sentiment for GBP/USD in the upcoming week could be divided as follows:

- Positive: 30% – A scenario where GBP benefits from either a hawkish ECB lifting the Euro or from weak U.S. data weakening the USD.

- Negative: 50% – A higher likelihood of GBP/USD weakness if U.S. data is strong or if the ECB decision strengthens the Euro, leading to a bearish GBP/USD as a cross-effect.

- Neutral: 20% – A possibility of range-bound trading if the upcoming economic data and central bank decisions meet market consensus.

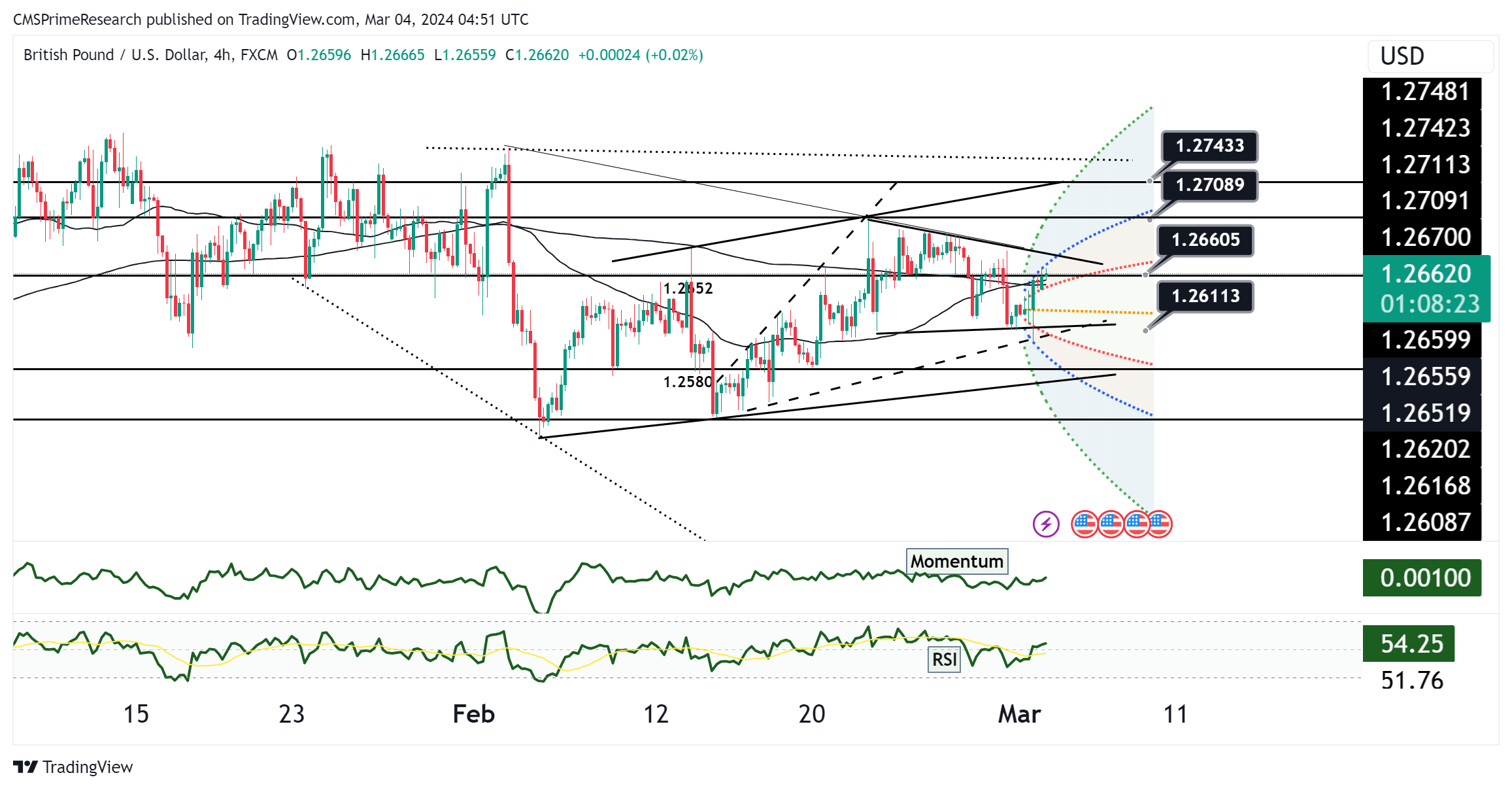

USD/JPY Outlook:

USDJPY: Week Ahead Technical and Fundamental Forecast

Technical Scenarios for USD/JPY:

Bullish Scenario:

- USD/JPY continues to hold above the support level at 150.219, potentially targeting resistance levels at 150.783 and then 151.277.

- A clear break above 151.277 could open the path towards 151.784.

- The RSI remains above the 50 level, which could indicate that there is enough bullish momentum to support further upside.

Neutral Scenario:

- The pair may consolidate around the current level, trading within the range marked by support at 150.219 and resistance around 150.783.

- The RSI hovering around the 50 mark might suggest a neutral market sentiment with no clear directional momentum.

Bearish Scenario:

- A break below the support at 150.219 could lead to a test of the lower support at 149.455.

- If the RSI falls below the 50 level, it could confirm a bearish momentum, potentially leading to further declines.

Fundamental Scenarios for USD/JPY:

Positive Data Outcomes:

- Strong U.S. economic data, particularly from the ADP Employment Change, Non-Farm Payrolls, and ISM Services PMI, could strengthen the USD, pushing USD/JPY higher towards the bullish scenario.

- Hawkish testimony from Fed Chair Powell or an uptick in JOLTS Job Openings may also support USD appreciation.

Neutral Data Outcomes:

- If the economic data matches consensus expectations, USD/JPY could follow the technicals more closely, with a likelihood of the pair experiencing limited fundamental-driven volatility.

- Market participants may then concentrate on technical analysis and broader market sentiment in the absence of significant data surprises.

Negative Data Outcomes:

- Weaker than anticipated U.S. employment figures or services sector data could lead to USD weakness, which would support a bearish scenario for USD/JPY.

- Any dovish signals from Fed Chair Powell could exacerbate the downward pressure on the USD.

Overall Market Sentiment:

Considering the upcoming economic events and technical posture, the sentiment for USD/JPY in the upcoming week could be estimated as follows:

- Positive: 45% – There is a reasonable chance for USD/JPY to trend higher if U.S. economic data is robust and supports USD strength.

- Negative: 30% – There is a possibility for a bearish trend if U.S. data disappoints, leading to USD weakness.

- Neutral: 25% – There is a potential for range-bound trading if the upcoming economic data releases align with the market consensus.

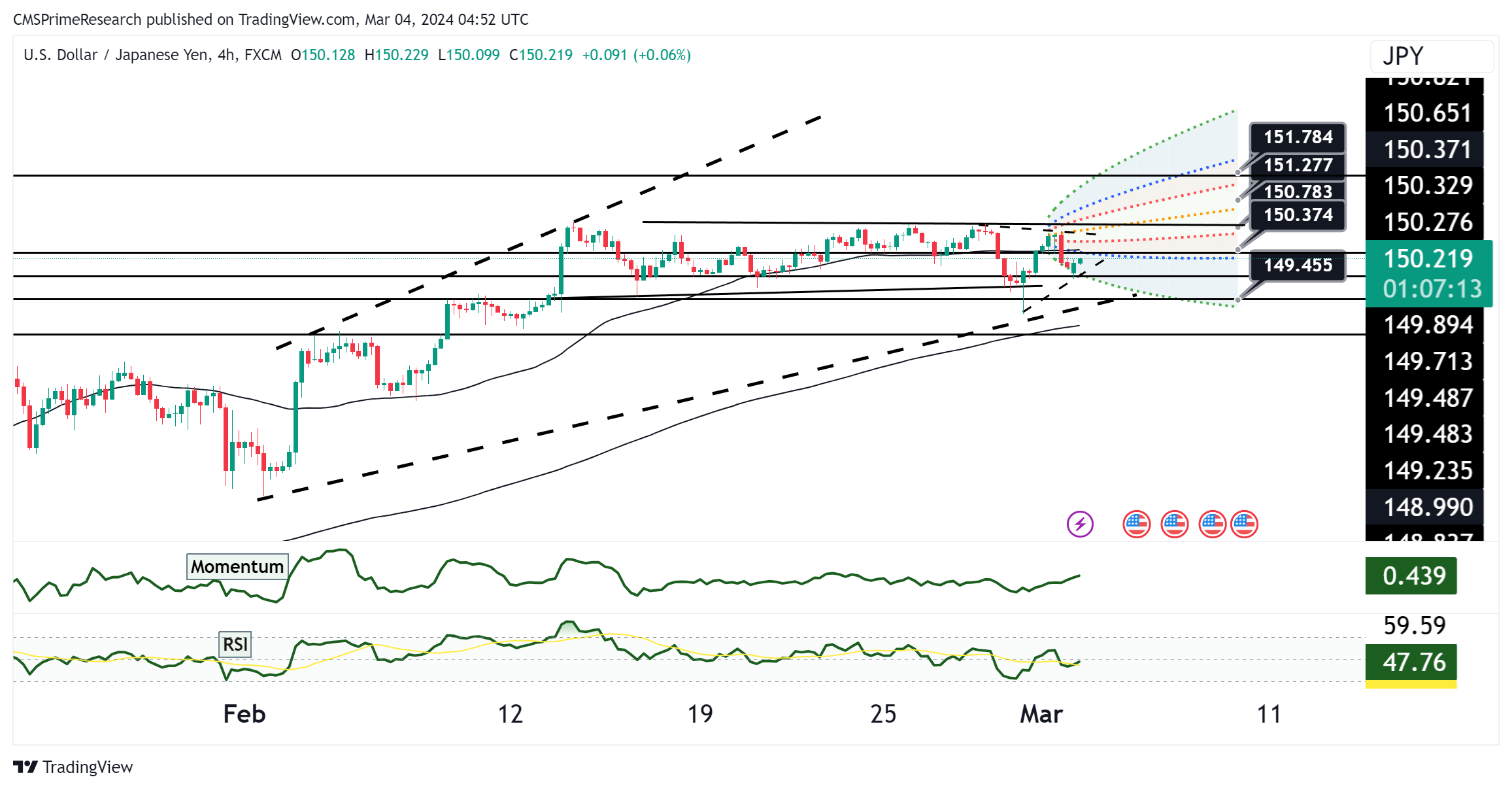

XAU/USD Outlook:

XAUUSD (Gold): Week Ahead Technical and Fundamental Forecast

Technical Scenarios for XAU/USD:

Bullish Scenario:

- Gold prices could continue to rise, targeting the Fibonacci level of 0.618 at 2090.126, with the potential to reach higher towards 2100 to 2115 level.

- A sustained move above this level may see gold testing the resistance at 2093.046.

- The RSI above 50 supports the bullish momentum, suggesting the possibility of further upward movement.

Neutral Scenario:

- XAU/USD might consolidate around the current levels with support found near the 1 Fibonacci level at 2060.966.

- The pair could trade within a range, limited by the nearby Fibonacci levels, as the RSI hovers around the midpoint, indicating indecision.

Bearish Scenario:

- A reversal could see gold prices decline towards the 1.272 Fibonacci level at 2040.203, with a further drop potentially towards the 1.414 level at 2029.364.

- If the RSI moves below 50, it would confirm a bearish momentum shift, supporting the potential for a downward trend.

Fundamental Scenarios for XAU/USD:

Positive Data Outcomes:

- Strong U.S. economic data, particularly in labor markets (Non-Farm Payrolls, ADP Employment Change) and services PMI, could boost the USD, applying bearish pressure on gold prices.

- Hawkish remarks from Fed Chair Powell could increase expectations for interest rate hikes, bolstering the USD and weighing on gold.

Neutral Data Outcomes:

- If economic data releases meet consensus expectations, the impact on gold might be muted, possibly leading to a neutral technical scenario.

- In this situation, traders might rely more on technical analysis, with gold prices potentially showing limited reaction to the economic data.

Negative Data Outcomes:

- Disappointing U.S. economic figures could weaken the USD, making gold more attractive as a safe-haven asset and supporting a bullish scenario.

- Dovish signals from Fed Chair Powell or poor job data could lead to risk-averse behavior, favoring gold.

Overall Market Sentiment:

Considering the upcoming economic data and the technical position of XAU/USD, the market sentiment for the upcoming week could be estimated as follows:

- Positive: 40% – There is a significant likelihood that gold may rally if U.S. economic data disappoints, weakening the USD and increasing demand for safe-haven assets like gold.

- Negative: 35% – There is a possibility that gold may retreat if the U.S. data strengthens the USD, leading to lower gold prices.

- Neutral: 25% – There is a chance that gold may not show a strong directional move and instead trade within a range if the economic data aligns with expectations.

Risk based Sentiments-What to Look out for?

EUR/USD: Monitor the ECB Interest Rate Decision closely. This decision will directly influence the EUR/USD exchange rate, with any unexpected moves by the ECB likely to cause significant volatility.

GBP/USD: Pay attention to UK retail sales data and the broader impact of Britain’s budget announcements. These will be key in determining the GBP’s strength against the USD, with poor retail sales potentially indicating weaker consumer confidence.

USD Index (DXY): U.S. jobs data, including Nonfarm Payrolls and the Unemployment Rate, will be crucial. These indicators will give insights into the health of the U.S. labor market, which can significantly sway the Dollar’s value.

USD/JPY: U.S. economic data, especially the ADP Employment Change and Non-Farm Payrolls, will be pivotal. Strong data could reinforce USD strength, while weak figures might lead to JPY gains against the USD.

XAU/USD (Gold): Keep an eye on U.S. economic releases and Federal Reserve communications. Gold prices are sensitive to changes in U.S. monetary policy expectations and economic health indicators, with strong U.S. data potentially pressuring gold lower.

To know more about CMS Prime visit us at https://cmsprime.com

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.