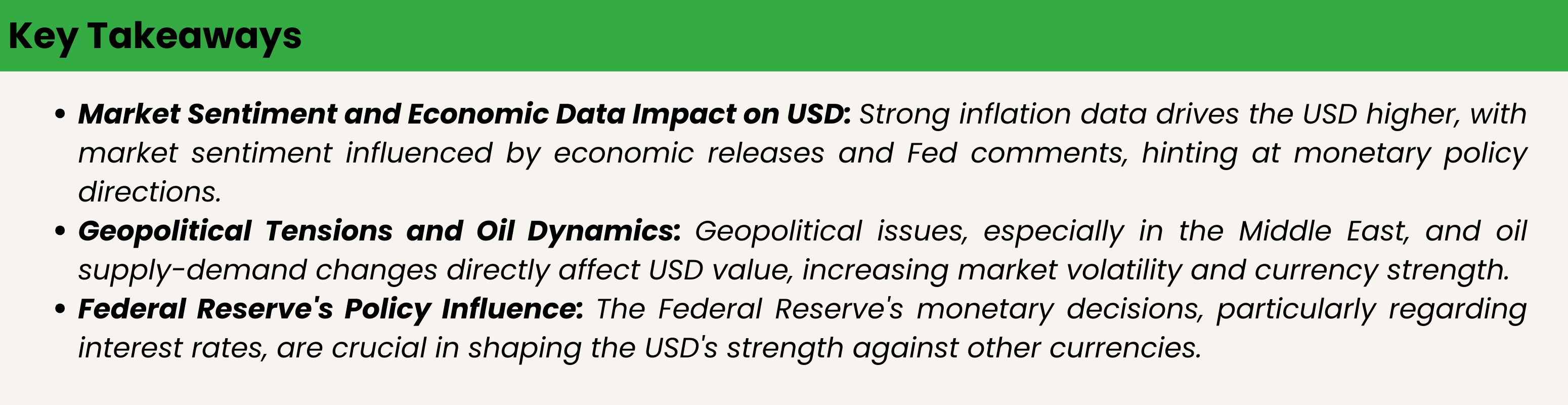

Dollar Index:

As of February 19, 2024, several key factors are impacting the value of the US dollar (USD) in the global financial markets.

Market Sentiment and Economic Outlook

Market sentiment, influenced by economic data releases, Fed speakers’ comments, and global economic outlooks, affects the USD. For instance, the release of FOMC minutes, PMI data, and earnings reports can sway investor sentiment and, consequently, the USD’s value.

Economic Data and Inflation

The USD has been climbing, reaching a three-month high, driven by stronger-than-expected inflation data. This suggests that inflation remains a significant concern, influencing the Federal Reserve’s monetary policy decisions. The persistence of inflation, especially in the services sector, has been noted, although it is on a downward trajectory.Economic indicators such as unemployment claims and manufacturing PMI are closely watched by investors for signs of economic health and the potential direction of monetary policy

Geopolitical Issues

Geopolitical tensions, particularly in the Middle East, have historically had a direct impact on the USD. Current tensions are stoking bullishness in oil markets, with oil prices fluctuating in response to these concerns as well as demand outlooks.Such geopolitical issues can lead to increased volatility in currency markets as investors seek safe-haven assets like the USD in times of uncertainty

Oil Supply and Demand

Changes in oil supply and demand directly impact the USD, especially in its exchange rates with currencies of oil-exporting countries. The recent dip in oil prices due to concerns over demand, despite ongoing Middle East tensions, highlights the sensitivity of the USD to oil market dynamics.

Federal Reserve Policies

The Federal Reserve’s monetary policy, particularly the federal funds rate, plays a crucial role in influencing the USD’s value. The rate affects inflation, short and long-term interest rates, and foreign currency exchange rates. Market expectations of interest rate cuts or hikes can significantly impact the USD’s strength against other currencies

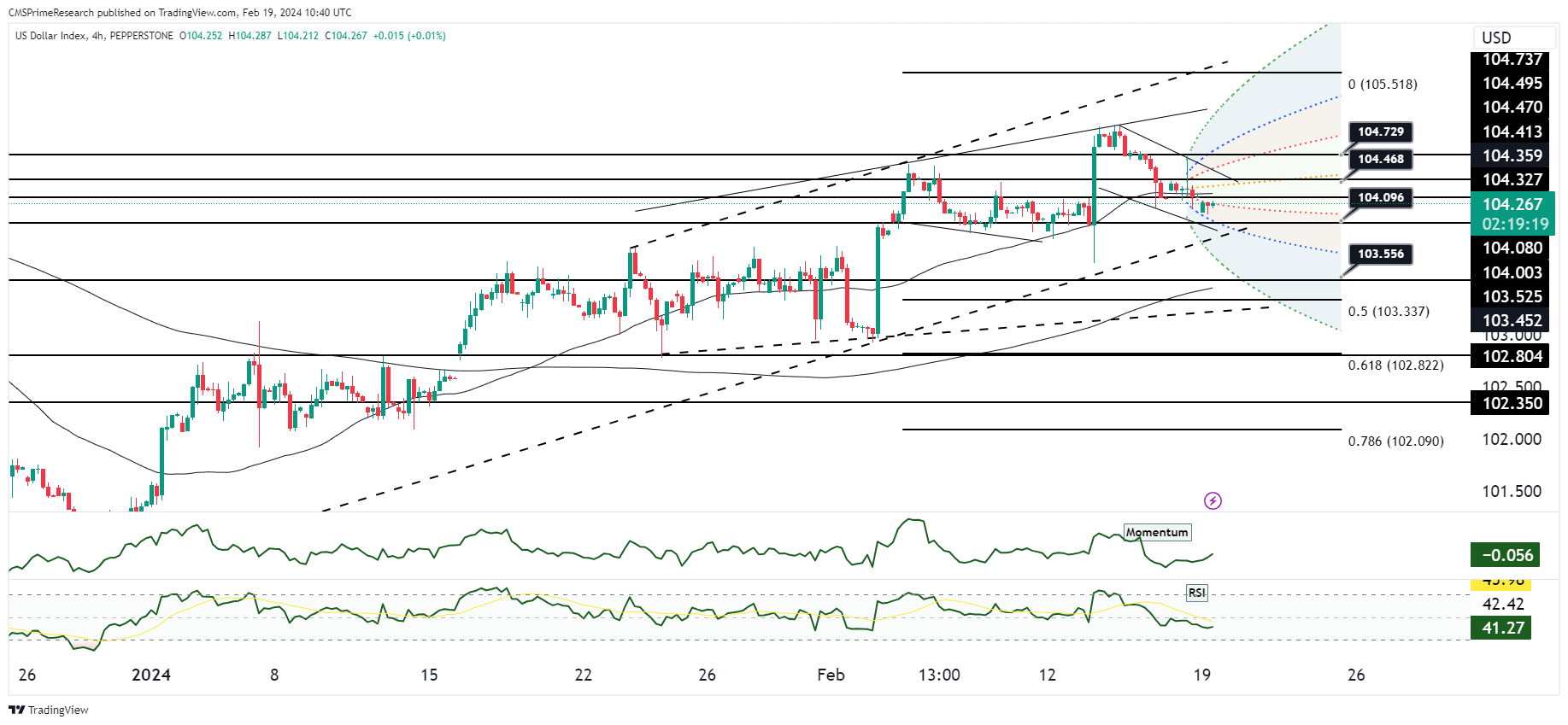

Upcoming Events for the week:

The release of the FOMC minutes in the United States will be crucial. Traders will parse the document for any signs of the Federal Reserve’s future policy direction. Given the balance of recent US economic data, the minutes may lean towards a hawkish tone, which could support the USD as it would imply continued or heightened interest rate hikes.

In the Eurozone, manufacturing and services PMI data will offer insights into the economic health of the region. Should these figures come in below expectations, it could pressure the EUR as it would suggest a slowdown in economic activity. Conversely, if the data surpasses forecasts, it would signal resilience in the Eurozone economy, potentially bolstering the euro.

The GBP will be under scrutiny with its own set of PMI data. The services sector appears robust, which is essential for the UK economy, heavily reliant on services. Positive data here could lend support to the GBP.

Overall Market Sentiment:

- For the JPY, the strong trade balance could result in a positive market sentiment, with an estimated breakdown of 60% Positive, 20% Negative, and 20% Neutral.

- The USD sentiment will be highly influenced by the FOMC minutes, with a potential sentiment breakdown of 50% Positive, 30% Negative, and 20% Neutral, pending the interpretation of the Fed’s tone.

- For the EUR, market sentiment will depend on the PMI releases, with an estimated sentiment breakdown of 40% Positive, 40% Negative, and 20% Neutral if the data meets expectations.

- The GBP sentiment, bolstered by the services PMI, could be optimistic, with a sentiment breakdown of 55% Positive, 25% Negative, and 20% Neutral, assuming the data confirms the services sector’s strength.

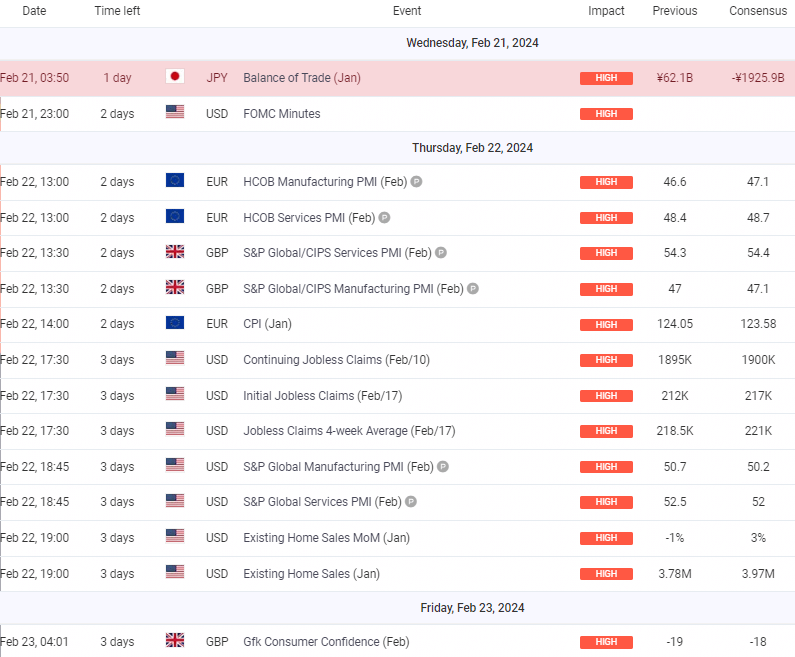

EUR USD Outlook:

EURUSD: Week Ahead Technical and Fundamental Forecast

Technical Scenarios for EUR/USD

Scenario 1: Bullish Breakthrough

- If EUR/USD overcomes the resistance at 1.07806, this could signal a bullish breakthrough, potentially heading towards the 1.08303 level.

- Confirmation would be indicated by the RSI moving above 50 and a Momentum indicator that continues to rise.

- Overcoming the 1.08303 level could see the pair targeting higher resistance at around 1.08525.

Scenario 2: Bearish Trend Continuation

- A downward move through the support at 1.07181 could suggest a continuation of the bearish trend.

- A bearish RSI and decreasing Momentum would support this move, with the pair potentially heading to test the 1.06486 support.

- Further bearish momentum could push EUR/USD towards the next Fibonacci extension levels.

Scenario 3: Range-Bound Trading

- The pair may continue to trade within the bounds of the current Fibonacci retracement levels, particularly between 1.07181 and 1.07806.

- A flattening RSI and stable Momentum would indicate consolidation in the market, with traders possibly awaiting further cues.

Fundamental Scenarios for EUR/USD

Scenario 1: Strengthening Euro on PMI Data

- Robust HCOB Manufacturing and Services PMI data could strengthen the Euro, particularly if the figures exceed market expectations.

- This scenario would likely lead to a bullish sentiment for the EUR/USD pair.

Scenario 2: Fed Minutes Influence

- If the FOMC minutes suggest a more hawkish stance than anticipated, the USD could strengthen, leading to bearish pressure on EUR/USD.

- Traders may react negatively to hints at more aggressive rate hikes, pushing the pair lower.

Scenario 3: Market Reaction to Jobless Claims

- Higher than expected U.S. jobless claims could weaken the USD as they may signal a softening labor market.

- Conversely, lower than expected claims would bolster the USD, potentially leading to a bearish scenario for EUR/USD.

Overall Market Sentiment

- Positive Sentiment: 40% – Based on the possibility of strong Eurozone PMI figures and a dovish interpretation of the Fed’s minutes.

- Negative Sentiment: 35% – Considering the potential impact of hawkish Fed minutes and favorable U.S. economic data.

- Neutral Sentiment: 25% – Reflecting the possibility that mixed fundamental data may result in indecisive market movements.

These sentiment percentages are based on the current technical analysis and upcoming economic events. They represent an analytical perspective of market sentiment that could evolve with the release of new data and changing market dynamics.

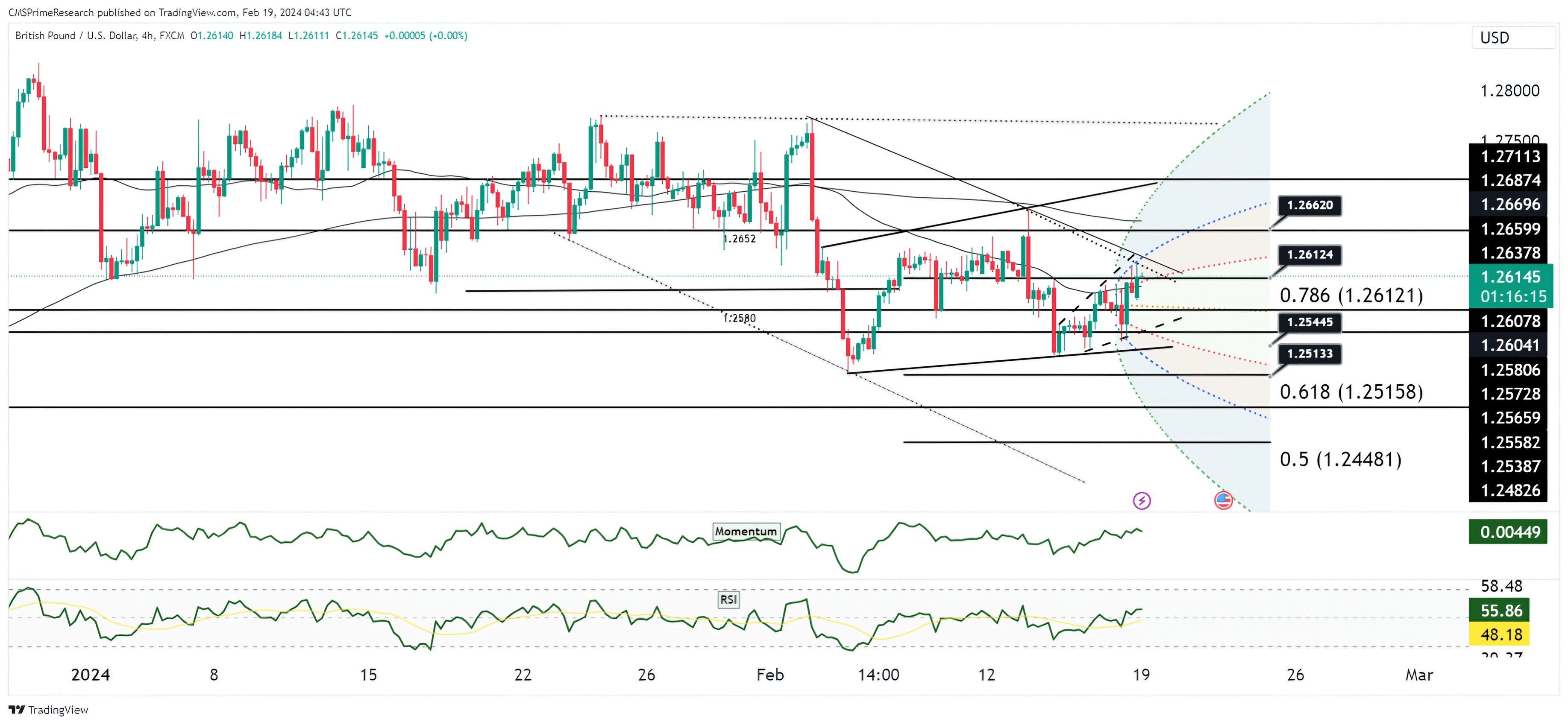

GBP USD Outlook:

GBPUSD: Week Ahead Technical and Fundamental Forecast

Technical Scenarios for GBP/USD

Scenario 1: Bullish Reversal

- A break above the current resistance level of 1.26124 could signal a bullish reversal, aiming for the next target at 1.26620.

- This would likely be supported by an RSI crossing above 50 and increasing Momentum.

Scenario 2: Bearish Continuation

- Failure to break above 1.26124 and a move below the 0.618 Fibonacci level of 1.25158 could extend the bearish trend.

- The RSI trending below the mid-line and a declining Momentum would corroborate this scenario.

Scenario 3: Consolidation

- The pair may remain between the 1.25158 and 1.26124 levels if no significant market catalysts emerge.

- A flat RSI and stable Momentum would indicate a lack of clear directional bias.

Fundamental Scenarios for GBP/USD

Scenario 1: Strengthening on Services PMI

- A stronger than anticipated S&P Global/CIPS Services PMI for the UK could boost GBP, given the services sector’s weight in the British economy.

Scenario 2: Weakening on Consumer Confidence

- A drop in UK consumer confidence could signal a bearish outlook for GBP, as it may suggest reduced spending and economic activity.

Scenario 3: Mixed Impact from Economic Data

- Mixed signals from various economic data releases (e.g., strong PMI data but weak consumer confidence) could lead to a lack of clear direction.

Overall Market Sentiment

- Positive Sentiment: 45% – Considering the potential for strong services sector data to boost GBP.

- Negative Sentiment: 30% – Reflecting the risk of falling consumer confidence and other possible negative data impacting GBP.

- Neutral Sentiment: 25% – Acknowledging the possibility of mixed data leading to a non-committal market stance.

USD/JPY Outlook:

USDJPY: Week Ahead Technical and Fundamental Forecast

Technical Scenarios:

Bullish Continuation:

- Price breaks above the current resistance level around 150.309 and continues the uptrend.

- Targets the next resistance levels at 151.166 and possibly extends to 152.335 if momentum persists.

- RSI remains above the mid-level, indicating potential for further upside.

Consolidation:

- Price action remains within the current range, bounded by support at approximately 148.910 and resistance around 150.309.

- Sideways movement within the channel, with the RSI oscillating without clear direction.

Bearish Reversal:

- Price breaks below the support level at 148.910.

- Potential target levels could be 147.620 followed by further downside if bearish pressure increases.

- RSI trends downwards, breaking below the mid-level, confirming bearish sentiment.

Fundamental Scenarios:

Positive Sentiment:

- Economic indicators outperform expectations, particularly the S&P Global Manufacturing PMI and Services PMI showing robust economic activity.

- USD strength is confirmed by better-than-expected jobless claims and FOMC minutes reflecting a strong economic outlook, pushing USD/JPY higher.

Neutral Sentiment:

- Mixed economic data, with some indicators meeting expectations while others show slight deviations.

- The market may weigh the outcomes, resulting in limited directional movement and possible consolidation in the currency pair.

Negative Sentiment:

- Economic data disappoints, with figures such as jobless claims rising more than expected, and PMIs indicating a slowdown.

- Combined with a potentially dovish tone in the FOMC minutes, this could lead to USD weakness, and a bearish scenario for USD/JPY.

Overall Market Sentiment Percentages:

Bullish: 55%

- The bullish sentiment is primarily due to the current technical structure which shows USD/JPY trading above key support levels with a tendency towards an uptrend continuation pattern.

- Upcoming high-impact economic events such as the S&P Global Manufacturing PMI and Services PMI are anticipated to potentially reflect continued economic growth and could strengthen the USD against the JPY if they report favorably.

- FOMC minutes may reiterate a strong economic outlook or hint at continued monetary policy tightening, which typically bolsters the currency.

Neutral: 30%

- The neutral sentiment accounts for the possibility of mixed economic data outcomes, where some key indicators might align with forecasts, suggesting a stable but not overly optimistic economic condition.

- The potential for consolidation within the current price range is also factored in, as traders might take a cautious stance ahead of the FOMC minutes, leading to reduced volatility and a wait-and-see approach.

Bearish: 15%

- The bearish sentiment is less pronounced but still relevant due to potential uncertainties in global economic conditions that could lead to risk-off movements, negatively impacting the USD/JPY pair.

- Unexpectedly high jobless claims or a dovish tone in the FOMC minutes could undermine confidence in the USD, prompting a shift towards the JPY, which is often seen as a safe-haven currency.

- Any negative surprises in the data, such as a significant decline in PMI figures, could trigger bearish momentum, although the current technical trend and market positioning may limit the downside potential.

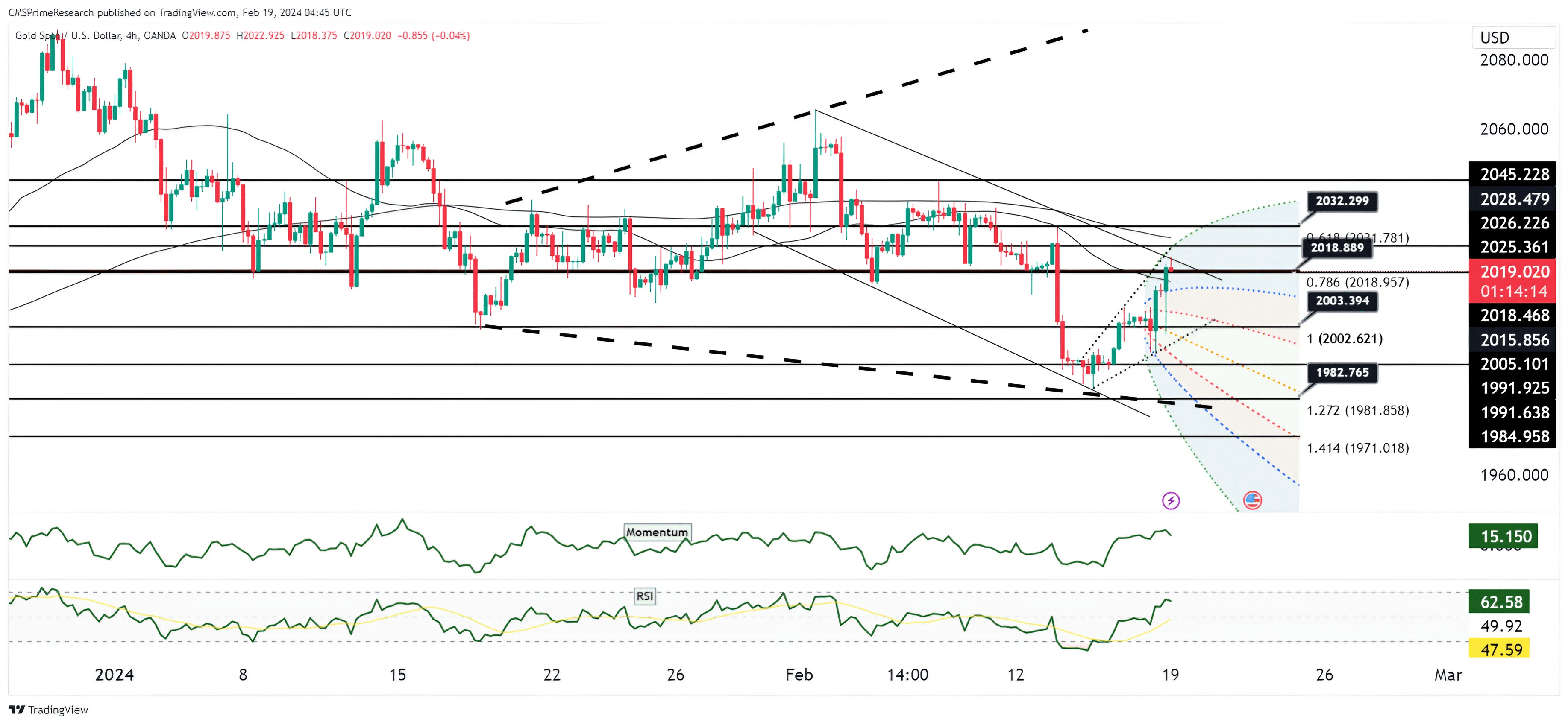

XAU/USD Outlook:

XAUUSD (Gold): Week Ahead Technical and Fundamental Forecast

Technical Scenarios for XAU/USD (Gold)

Bullish Scenario:

- The price is currently testing a Fibonacci retracement level, with the 0.618 level at 2032.299 appearing to act as resistance.

- If the price breaks above this level, the next target could be the 0.786 level at 2018.957, followed by a retest of recent highs around 2026 to 2045.228.

- The RSI is showing some upward momentum without being overbought, which could support a short-term rally.

Bearish Scenario:

- Failure to breach the 0.618 Fibonacci level could result in a pullback, with potential support near at 2003-2009.

- The price is within a descending channel, which may continue to exert downward pressure.

Neutral Scenario:

- The price may continue to consolidate within the channel, bouncing between the Fibonacci levels of 0.618 (2032.299) and 2003.

- The RSI hovering around the mid-level suggests indecision, which may lead to a sideways movement in the short term.

Fundamental Analysis for XAUUSD

Bullish Drivers:

- FOMC Minutes: If the minutes are dovish, indicating a slower pace of interest rate hikes, it could weaken the USD and be bullish for gold.

- Jobless Claims: Higher than expected jobless claims could signal economic weakness, potentially driving investors towards safe-haven assets like gold.

Bearish Drivers:

- CPI Data: Higher inflation figures may prompt a more aggressive stance from the Fed, boosting the USD and pressuring gold prices.

- PMI Data: Strong manufacturing and services PMI data could reflect economic strength, reducing gold’s appeal as a safe haven.

Neutral Drivers:

- Balance of Trade: If the trade balance data is in line with consensus, it may have a muted impact on the USD and gold.

- Consumer Confidence: Neutral consumer confidence figures could result in little to no significant movement for gold as the market had already priced in the expectations.

Overall Market Sentiment

Based on the technical patterns and fundamental events scheduled for the upcoming week, the sentiment for XAUUSD could be quantified as follows:

- 40% Positive: This reflects the potential for a bullish movement if key resistance levels are breached and if fundamental data supports a weaker USD.

- 35% Negative: There is a substantial chance of bearish movement given the prevailing descending channel pattern and potential for strong US economic data to boost the USD.

- 25% Neutral: A considerable degree of neutrality persists due to the potential for mixed economic data and the RSI indicating a lack of clear directional momentum.

Risk based Sentiments-What to Look out for?

USD: Anticipate volatility around FOMC minutes; hawkish hints could strengthen USD, while dovish tones may weaken it. Monitor inflation data closely for impact on Fed policy expectations.

EURUSD: Watch for Eurozone PMI data and FOMC minutes; stronger Eurozone data and dovish Fed signals could lift EURUSD, while the opposite may pressure it.

GBPUSD: Observe UK PMI data for economic health indications; positive outcomes could bolster GBP, while strength in USD from FOMC minutes could challenge GBPUSD.

USDJPY: Focus on Japanese trade balance and FOMC minutes; a strong trade surplus may support JPY, but a hawkish Fed outlook could push USDJPY higher.

XAUUSD (Gold): Pay attention to FOMC minutes and inflation figures; dovish Fed minutes or higher inflation could support gold prices, while strong USD momentum may weigh on XAUUSD.

To know more about CMS Prime visit us at https://cmsprime.com

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.