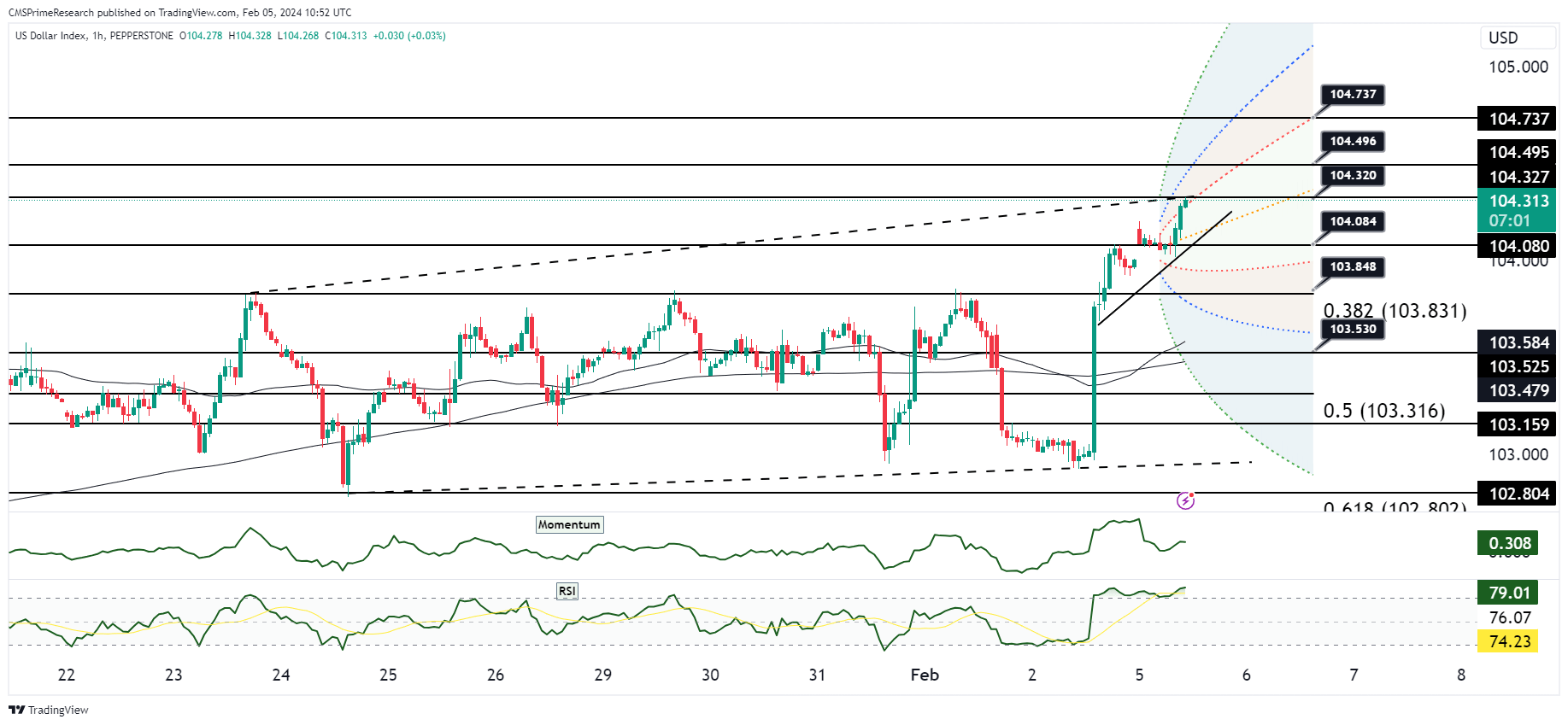

Dollar Index:

As of Feb 05, 2024, several key events and news are impacting the USD:

Labor Market: The U.S. labor market has shown strong numbers, with U.S. employers adding 353,000 workers in January, nearly double Wall Street consensus estimates. This could create a constructive environment for the U.S. dollar.

Global Uncertainty: Global uncertainty and potential interest rate cuts by the US Federal Reserve could lead to a rise in gold prices, which could in turn weaken the USD

Inflation Trends: Inflation data has shown a modest rise in December, with the Personal Consumption Expenditures (PCE) price index increasing by 0.2% for the month, maintaining an annual inflation rate under 3% for the third consecutive month. This trend suggests inflation is trending lower, which aligns with the Federal Reserve’s target, potentially influencing its monetary policy decisions

Federal Reserve’s Monetary Policy: The Federal Reserve is closely monitoring inflation rates and other economic indicators to guide its monetary policy decisions. The market’s expectation, post-inflation data, was leaning towards the anticipation of a rate cut, with the rate futures market pricing in about a 47% chance of easing at the March meeting. This adjustment in expectations follows the data that showed inflation was contained, which could potentially ease monetary policy sooner than later

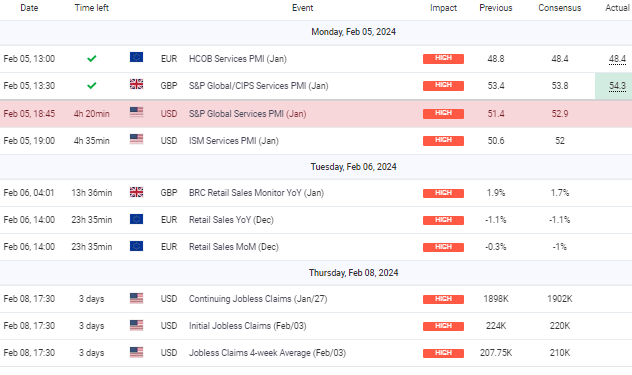

Upcoming Events for the week:

For the week depicted, several key data points have already been released, setting the stage for currency market reactions. In the Eurozone, the HICP Services PMI came in at expectations, potentially stabilizing the EUR as it indicates a steady service sector, which is crucial for economic growth. Conversely, the UK’s GBP S&P Global/CIPS Services PMI outperformed expectations significantly, suggesting a more robust service sector than anticipated. This could provide a bullish sentiment for the GBP as it might decrease the likelihood of further monetary easing by the Bank of England.

In the US, the S&P Global Services PMI and the ISM Services PMI both underperformed relative to consensus estimates, which could introduce bearish sentiment toward the USD in the short term. Investors may interpret this as a sign of a slowing service sector, potentially leading to cautious or dovish tones from the Federal Reserve in future communications.

Looking ahead, the GBP will be influenced by the BRC Retail Sales Monitor Year-on-Year, which has already shown a modest improvement over expectations. This could sustain the positive momentum for the GBP. For the Eurozone, retail sales figures have indicated a contraction both monthly and yearly, which may weigh on the EUR as it reflects a potential slowdown in consumer spending.

The latter part of the week will bring focus back to the US with jobless claims data. If the actual figures align with the forecast, suggesting a stable job market, it could mitigate some of the earlier negative sentiment from the services sector data, potentially offering some support to the USD.

Overall Market Sentiment: Given the actual and anticipated data:

- The EUR might see a sentiment of 40% Positive, 40% Negative, and 20% Neutral, reflecting concerns from the retail sales figures but stability in the service sector.

- The GBP could experience a more positive sentiment of 60% Positive, 20% Negative, and 20% Neutral, buoyed by the stronger services PMI and retail sales data.

- The USD sentiment is expected to be mixed at 45% Positive, 35% Negative, and 20% Neutral, balancing the underperformance in service sector PMIs with a potentially stable job market outlook.

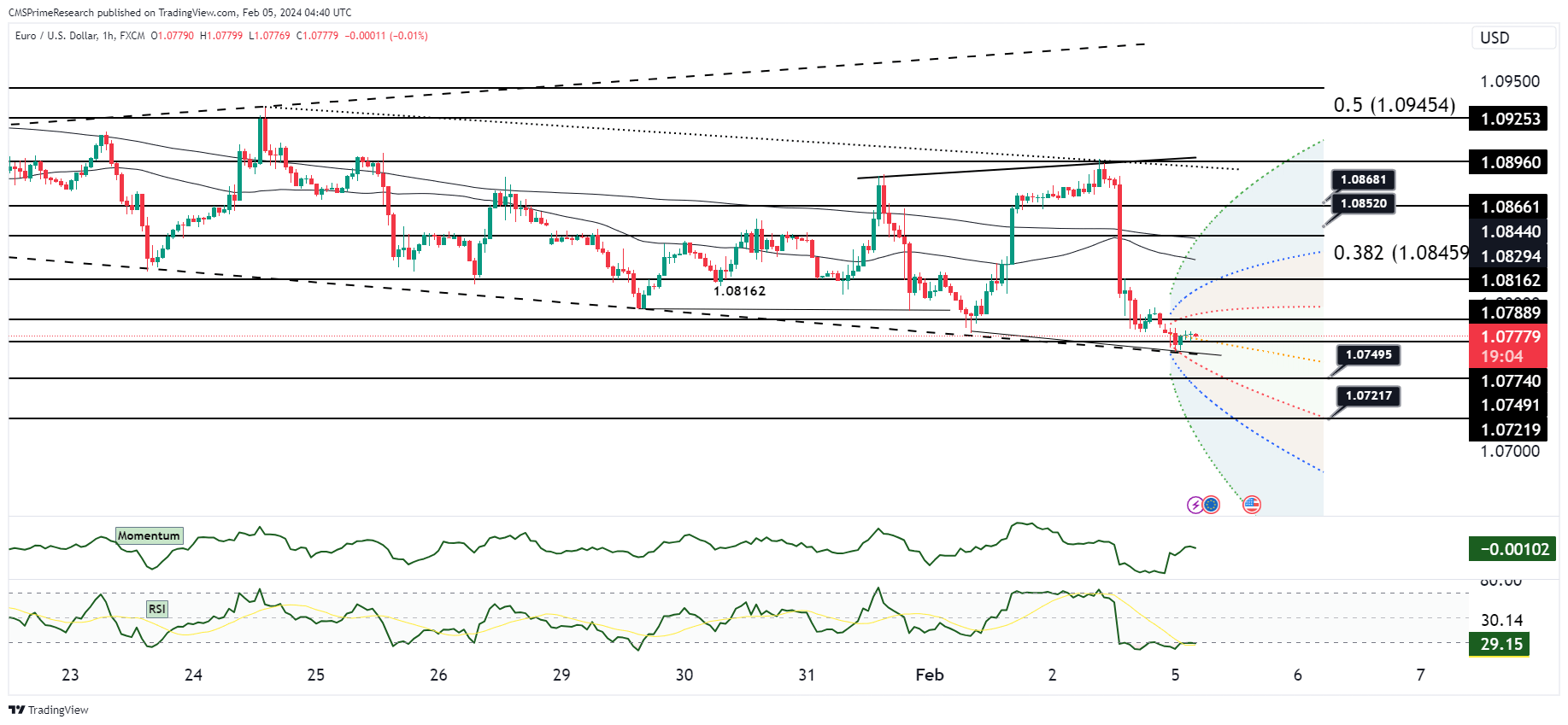

EUR USD Outlook:

EURUSD: Week Ahead Technical and Fundamental Forecast

Technical Scenarios for EUR/USD

Scenario 1: Bullish Recovery

- If EUR/USD rebounds from the support level around 1.07495 and breaks above the 0.382 Fibonacci retracement level at 1.08459, it could indicate a bullish recovery.

- A rising RSI and Momentum above their mid-lines would support this positive outlook.

- The pair might then aim for the 1.08520 pivot point, with potential to approach the next resistance near 1.08960.

Scenario 2: Bearish Continuation

- A break below the 1.07495 support level could signal a bearish continuation, especially if the Momentum indicator turns downward and the RSI heads towards oversold territory.

- The pair could then test the next support level, possibly around the 1.07217 area.

- Sustained bearish movement might lead to further downside probing towards the lower end of the current trading channel.

Scenario 3: Range-Bound Conditions

- In the absence of significant fundamental catalysts, EUR/USD might continue to trade within the range established by the 1.07495 support and the 0.382 Fibonacci level at 1.08459.

- RSI and Momentum indicators remaining flat and around their mid-lines would likely accompany this scenario, indicating indecision in the market.

Fundamental Scenarios for EUR/USD

Positive Euro Outlook

- Strong performances in the upcoming Eurozone Service PMI and Retail Sales data might boost the Euro.

- If the data significantly surpasses market expectations, this could lead to a bullish sentiment for the EUR.

Dollar Dominance

- If U.S. Services PMI and Jobless Claims figures show a robust economy, it could strengthen the USD against the EUR.

- Hawkish interpretations from the Fed Press Conference might also lend support to the USD.

Mixed Economic Data

- Should the economic releases from both the U.S. and the Eurozone come out mixed or align with consensus, significant currency moves might be limited.

- A scenario where neither economy outshines the other could result in a neutral impact on the EUR/USD pair.

Overall Market Sentiment

- Positive Sentiment: 35% – Considering the potential for Eurozone data to exceed expectations and boost the Euro.

- Negative Sentiment: 40% – Reflecting the possibility of strong U.S. economic figures and ongoing Fed hawkishness favoring the USD.

- Neutral Sentiment: 25% – Acknowledging the likelihood of mixed or as-expected economic data leading to a range-bound EUR/USD.

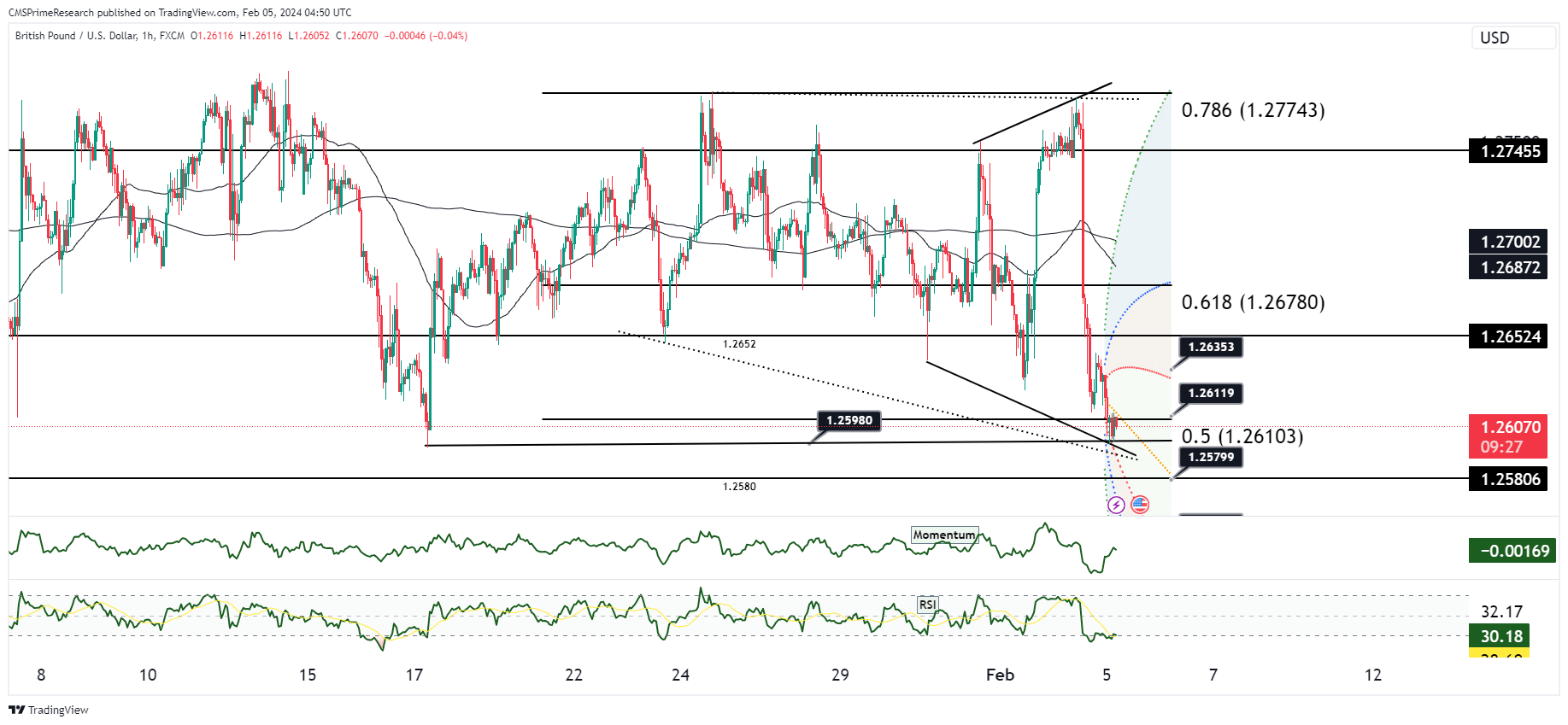

GBP USD Outlook:

GBPUSD: Week Ahead Technical and Fundamental Forecast

Technical Scenarios for GBP/USD

Scenario 1: Bullish Retracement

- A reversal from the recent lows and a move above the 0.5 Fibonacci retracement level at 1.26103 could indicate a bullish retracement.

- The RSI moving away from oversold conditions, coupled with a rise in Momentum, would support a bullish scenario.

- Potential targets could include the 0.618 level at 1.26780, with further upside possibly challenging the 1.25980 pivot point.

Scenario 2: Bearish Continuation

- If GBP/USD breaks below the recent low around the 1.25806 level, it could confirm a bearish continuation.

- A downward RSI trend and decreasing Momentum would likely accompany a further drop.

- The next key support levels could be at the previous significant lows or psychological round figures below the current price.

Scenario 3: Consolidation Phase

- The pair may enter a consolidation phase, trading sideways between the 1.26103 and 1.25806 levels.

- Flattening RSI and Momentum indicators would suggest a lack of directional strength, typical of a consolidation pattern.

Fundamental Scenarios for GBP/USD

Strengthening Pound

- Positive readings from the upcoming UK Services PMI could lend support to the GBP, especially if the figures surpass market expectations.

- Better-than-expected Retail Sales data could also contribute to a more positive outlook for the GBP.

Dominant Dollar

- Strong U.S. Services PMI data or lower-than-expected jobless claims could push the USD higher against the GBP.

- A hawkish interpretation of the latest Fed communications might reinforce USD strength.

Mixed Signals

- Mixed economic releases, with some indicators showing strength and others weakness, may lead to uncertain trading conditions.

- In such a scenario, GBP/USD could lack clear direction as traders digest contrasting signals.

Overall Market Sentiment

- Positive Sentiment: 30% – Considering the potential for UK economic indicators to come in stronger than anticipated, which could boost the GBP.

- Negative Sentiment: 45% – Reflecting the possibility that robust U.S. data could continue to underpin the USD.

- Neutral Sentiment: 25% – Acknowledging the likelihood of a mixed economic picture that might lead to a lack of conviction in the market and range-bound trading.

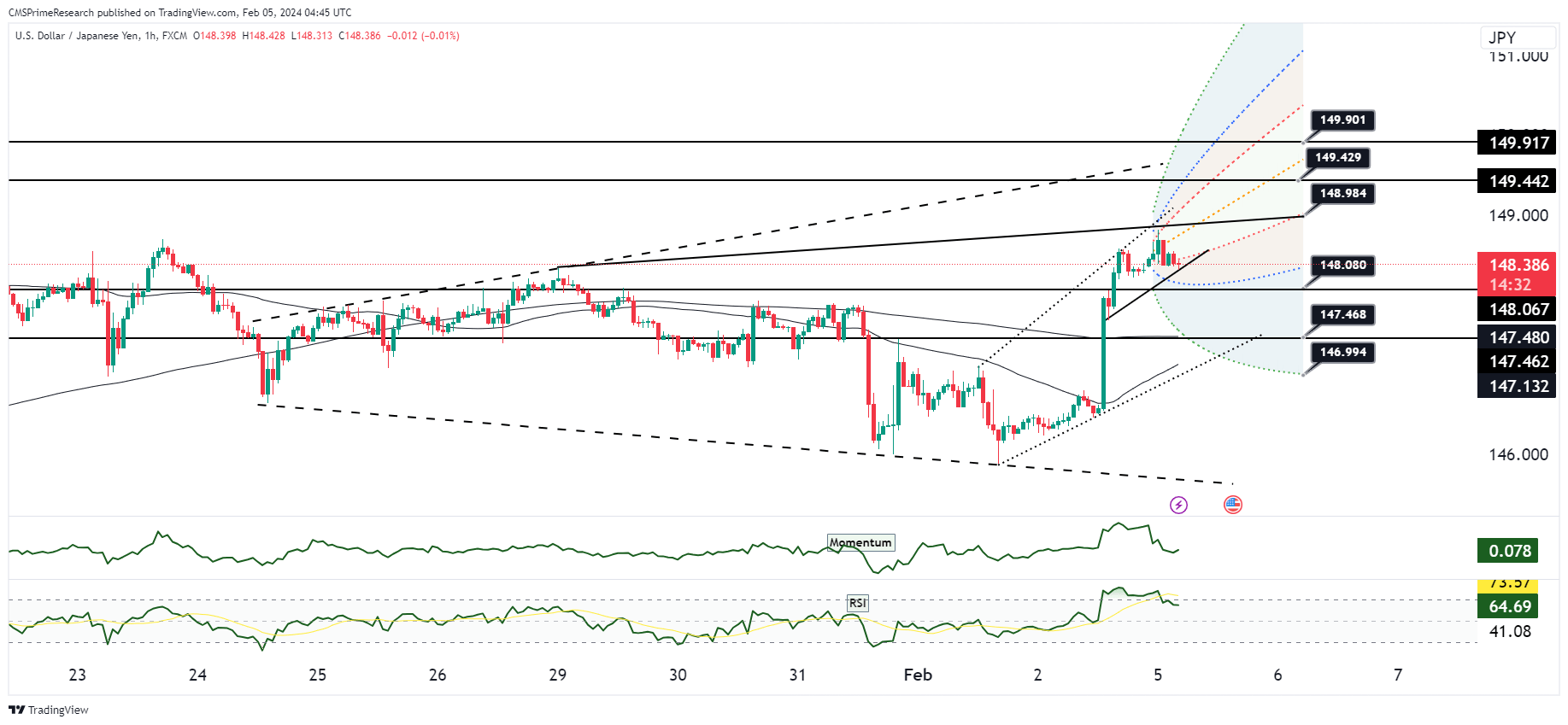

USD/JPY Outlook:

USDJPY: Week Ahead Technical and Fundamental Forecast

Technical Scenarios for USD/JPY

Scenario 1: Bullish Continuation

- If USD/JPY sustains above the 148.080 pivot point and breaks past the recent high at 148.984, it could indicate a bullish continuation.

- The RSI maintaining above the mid-line and Momentum indicator trending upward would support this outlook.

- The pair could aim for the next resistance levels, possibly towards the 149.429 or even the 149.901 levels.

Scenario 2: Bearish Reversal

- A break below the support level at 147.468 could signal a bearish reversal.

- Accompanied by a downward RSI trend and declining Momentum, the pair could test lower support near the 146.994 level.

- Further bearish momentum might see USD/JPY challenging the lower boundaries of the current trading channel.

Scenario 3: Range-Bound Trading

- The pair may continue to trade within the range defined by 148.080 and 147.468 levels.

- A flattening RSI and Momentum indicators would suggest market indecision and a potential consolidation phase.

Fundamental Scenarios for USD/JPY

Strengthening Dollar

- Positive U.S. economic data, particularly if the upcoming jobless claims are better than expected, could strengthen the USD.

- A stronger dollar would likely push USD/JPY higher, especially if combined with a positive services PMI.

Yen Gains

- If U.S. data disappoints, especially with higher jobless claims, the yen could strengthen as a safe-haven currency.

- Weaker U.S. fundamentals could lead to a pullback in USD/JPY as traders seek refuge in the yen.

Mixed Data Outcome

- Mixed economic data, with U.S. jobless claims and service PMI showing conflicting trends, may result in an unclear direction for USD/JPY.

- In such a case, the currency pair might not see a strong trend and could oscillate within the recent range.

Overall Market Sentiment

- Positive Sentiment: 45% – Anticipating the potential for a stronger USD driven by positive economic data and supportive market conditions.

- Negative Sentiment: 30% – Considering the chance of risk-aversion due to weaker-than-expected U.S. data, which could increase demand for the yen.

- Neutral Sentiment: 25% – Recognizing the possibility of market consolidation if the incoming data does not provide clear direction.

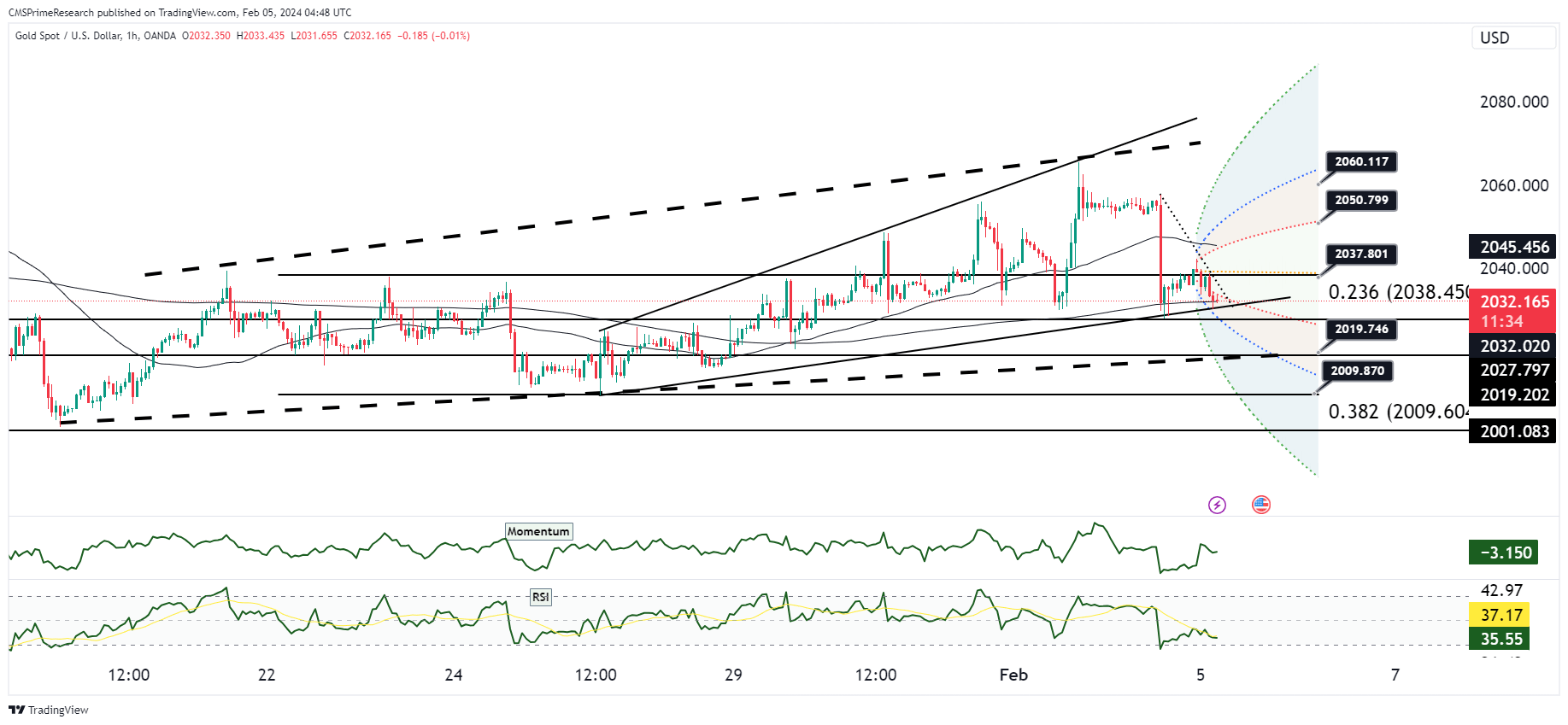

XAU/USD Outlook:

XAUUSD (Gold): Week Ahead Technical and Fundamental Forecast

Technical Scenarios for XAU/USD (Gold)

Scenario 1: Bullish Reversal

- A bounce off the 0.382 Fibonacci level at 2009.604 and a break above the 2038.450 pivot point could indicate a bullish reversal.

- Confirmation would come from the RSI moving above the mid-line and the Momentum indicator trending upwards.

- The next resistance to watch would be around the 2050.799 mark, with potential to extend gains towards the 2060.117 level.

Scenario 2: Bearish Continuation

- If gold breaks below the 2009.604 support, it could signal a bearish continuation.

- A declining RSI and decreasing Momentum would support the bearish scenario.

- The price could then aim for lower support levels, possibly near the psychological level of 2000.

Scenario 3: Consolidation

- Gold may enter a consolidation phase, trading sideways between the 0.382 Fibonacci level at 2009.604 and the 2038.450 pivot point.

- Sideways RSI and Momentum indicators would suggest market indecision, which is characteristic of a consolidation pattern.

Fundamental Scenarios for XAU/USD (Gold)

Increased Demand for Gold

- Weaker-than-expected U.S. service sector data or higher jobless claims could lead to a flight to safety, increasing demand for gold.

- A dovish outlook from the Fed, implying lower interest rates for longer, might also push gold prices higher.

Strengthening USD

- Strong U.S. economic data, suggesting resilience and a possible continuation of interest rate hikes, could strengthen the USD and weigh on gold prices.

- Positive service sector growth and declining jobless claims could dampen gold’s appeal as a hedge against economic uncertainty.

Mixed Economic Data

- Mixed economic data from the U.S. might lead to uncertain trading conditions for gold.

- Conflicting signals from economic releases could result in a lack of clear direction for gold prices, leading to range-bound trading.

Overall Market Sentiment

- Positive Sentiment: 35% – Considering the potential for economic uncertainty and dovish central bank policies to boost gold’s safe-haven appeal.

- Negative Sentiment: 40% – Reflecting the possibility that strong U.S. economic data could bolster the USD and reduce demand for gold.

- Neutral Sentiment: 25% – Acknowledging the likelihood of mixed economic data leading to indecision and sideways price movement.

Risk based Sentiments-What to Look out for?

USD: Monitor labor market strength and Federal Reserve’s policy signals closely, as these could sway USD sentiment significantly in either direction this week.

EURUSD: Focus on Eurozone service PMI and retail sales data versus U.S. economic indicators, especially services PMI and jobless claims, to gauge directional momentum.

GBPUSD: Pay attention to UK services PMI and retail sales outcomes, contrasting them with U.S. economic health indicators for potential GBP strength or USD resurgence.

USDJPY: Observe U.S. jobless claims and service sector performance closely; stronger data may bolster USD, while weaker figures could enhance JPY’s safe-haven appeal.

XAUUSD (Gold): Watch for U.S. economic data impacts on USD strength and Federal Reserve’s interest rate narrative, as these will influence gold’s demand as a safety asset.

To know more about CMS Prime visit us at https://cmsprime.com

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.