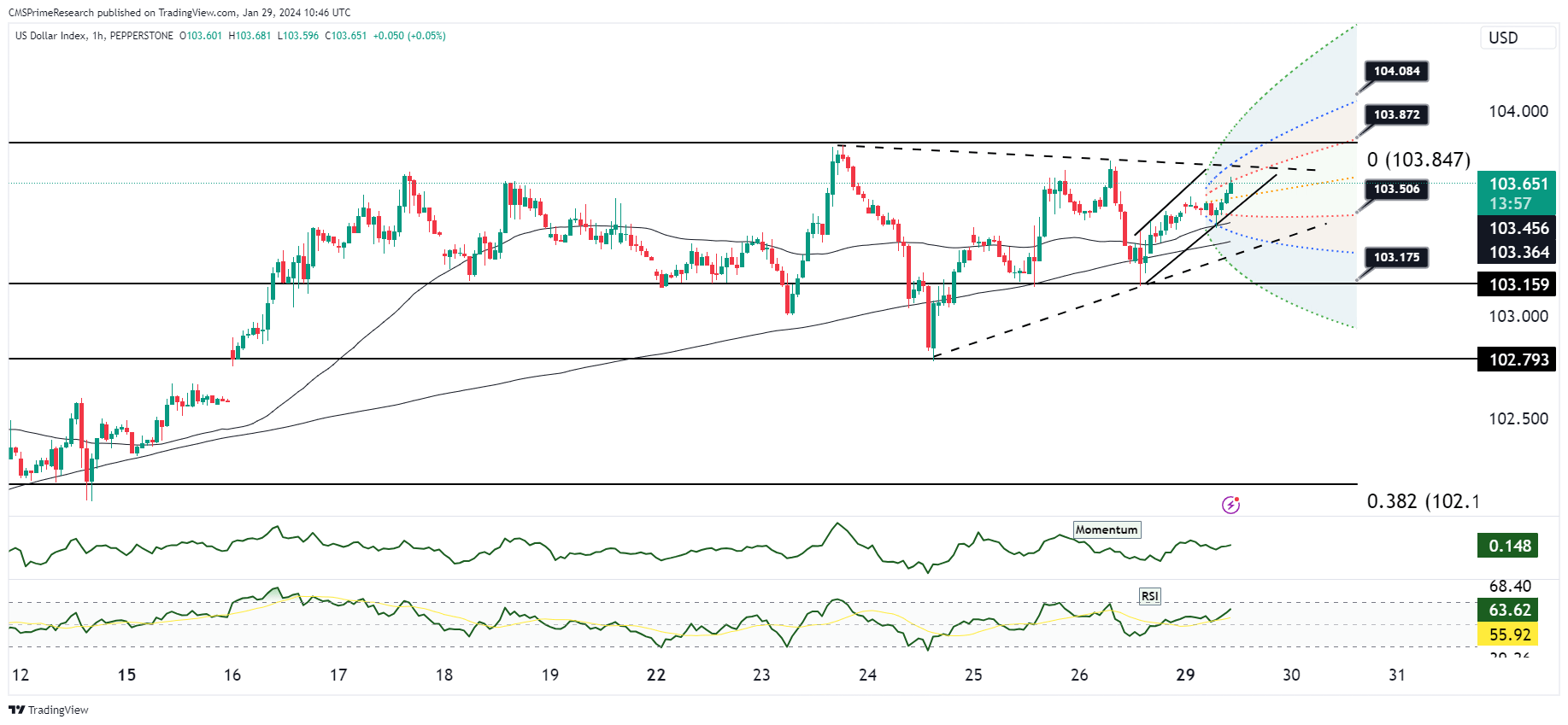

Dollar Index:

As of January 29, 2024, several key events and news are impacting the USD:

Federal Open Market Committee (FOMC) Meeting: The FOMC is set to begin its two-day policy meeting on Tuesday. Investors are nearly certain that the central bank will keep rates steady, with traders in the fed funds futures market assigning an almost 97% probability that the Fed will not cut rates. This anticipation can cause fluctuations in the value of the dollar

Commitment of Traders (COT) Report: The COT report shows how large speculators are positioned across futures markets on the CME exchange. Traders have reduced their short-exposure to US dollar futures by approximately 50% over the past four weeks. This positioning of traders can influence the value of the dollar.

Market Predictions on Rate Cuts: Traders are starting to revise downward their prediction of six rate cuts in 2024 to five cuts. These aggressive market predictions can influence the value of the dollar.

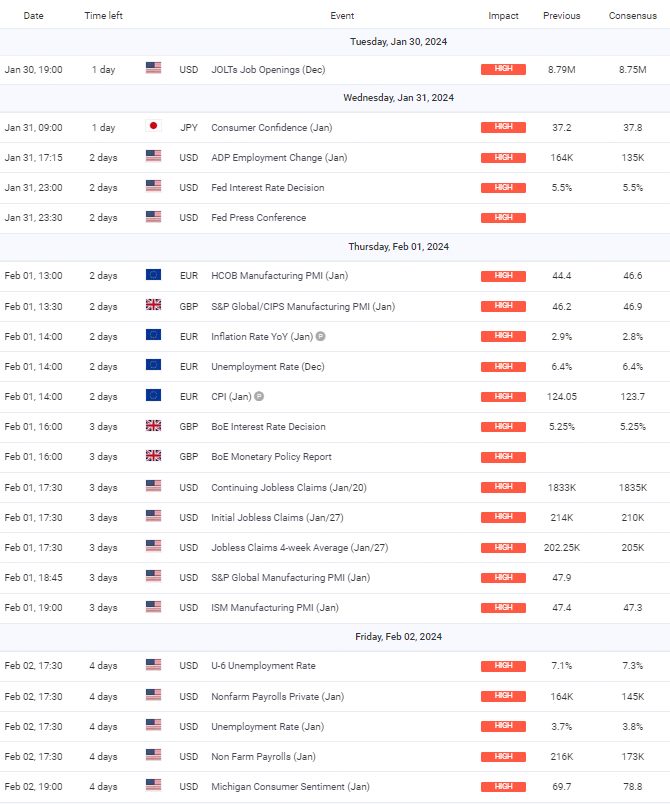

Upcoming Events for the week:

The week ahead is pivotal for currency markets, with a plethora of high-impact events scheduled across major economies. The United States will start with the JOLTS Job Openings, which are expected to be relatively stable, but the ADP Employment Change and the subsequent FOMC Interest Rate Decision and Fed Press Conference will be the focal points. The ADP report is forecasted to show a healthy job growth, which if met or exceeded, should underpin the USD by reinforcing expectations of a robust labor market. The Fed’s decision and commentary will be dissected for future monetary policy clues; any hawkish signals could strengthen the USD as they may indicate continued or heightened rate hikes.

In Europe, the HICP Manufacturing PMI, Inflation Rate, Unemployment Rate, and CPI data will offer a comprehensive look at the Eurozone economy. A forecasted uptick in inflation could pressure the ECB to maintain or intensify its tightening regime, potentially bolstering the EUR. Simultaneously, the UK will be under the spotlight with the BoE Interest Rate Decision and Monetary Policy Report. Consensus expects the BoE to hold rates, but any deviation could induce volatility for the GBP.

Towards the end of the week, the US will release its Non-Farm Payrolls and Unemployment Rate. The Non-Farm Payrolls are expected to show significant job creation, and a lower unemployment rate could give the USD additional support, signaling continued economic strength which may justify further rate hikes.

Overall Market Sentiment: Factoring in the scheduled economic events, the sentiment for the upcoming week could be summarized as follows:

- For the USD, considering the potential for positive job data and the impact of the Fed’s stance, the sentiment might lean towards optimism, with a possible breakdown of: 60% Positive, 20% Negative, and 20% Neutral.

- For the EUR, inflation and unemployment figures will play a critical role, possibly leading to a sentiment of 50% Positive, 30% Negative, and 20% Neutral, if inflation continues to rise, prompting ECB action.

- For the GBP, the sentiment hinges on the BoE’s decisions, with a potential sentiment of 45% Positive, 35% Negative, and 20% Neutral, reflecting the uncertainty surrounding interest rate directions.

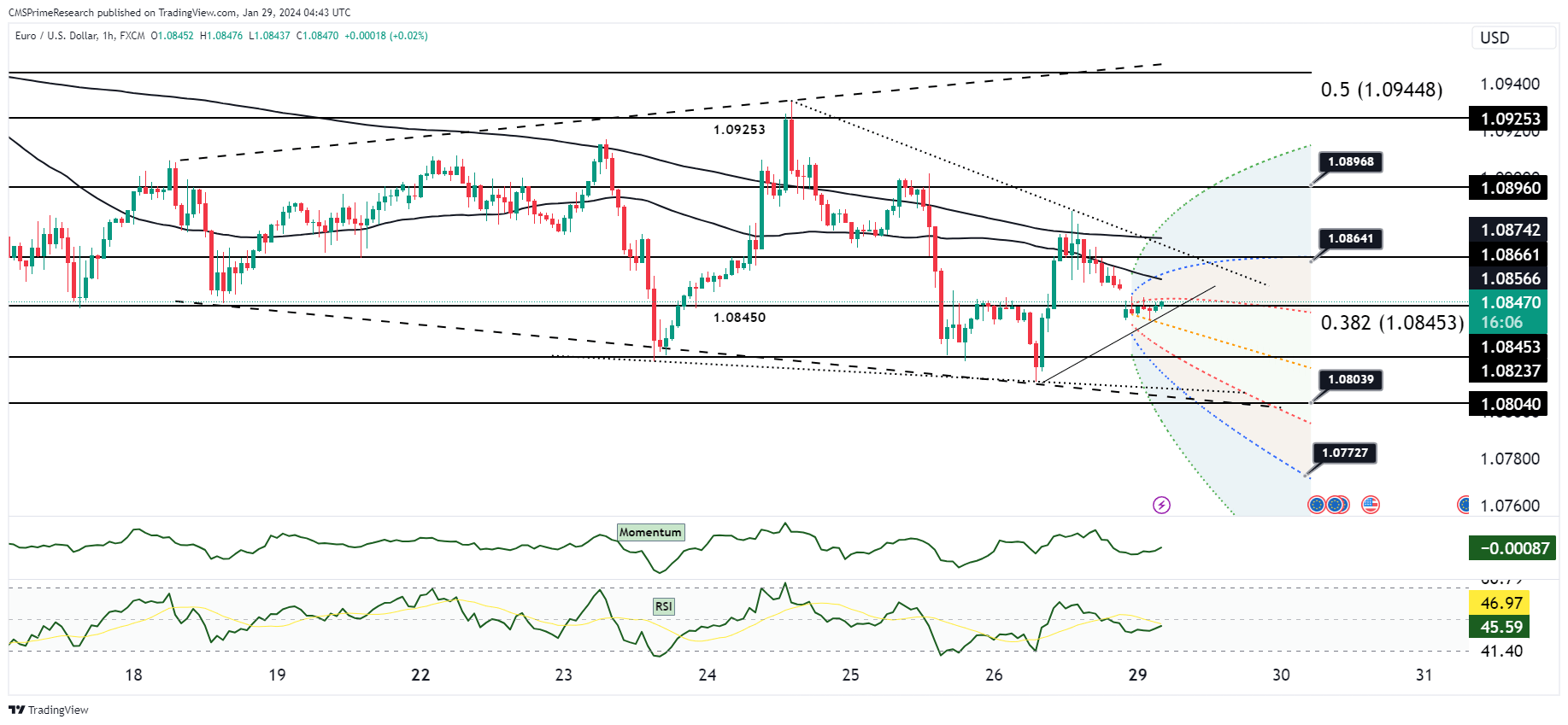

EUR USD Outlook:

EURUSD: Week Ahead Technical and Fundamental Forecast

Technical Scenarios for EUR/USD

Scenario 1: Bullish Breakout

- If the upcoming Eurozone CPI and Inflation Rate data exceed expectations, indicating a strong inflationary pressure, the Euro could appreciate.

- Technical indicators such as a break above the 1.09253 resistance level and a sustained move above the moving averages could confirm this bullish scenario.

- If the Fed adopts a dovish tone or U.S. employment data disappoints, further upward momentum for the EUR/USD pair could be expected.

Scenario 2: Bearish Reversal

- Strong U.S. economic data, particularly if the ADP Employment Change and Non-Farm Payrolls outperform expectations, could bolster the USD.

- A bearish technical confirmation would occur if prices fall below the support level at 1.08450, potentially leading to a test of lower Fibonacci retracement levels.

- Hawkish comments from the Fed could catalyze this bearish sentiment, as higher interest rates typically strengthen the domestic currency.

Scenario 3: Continuation Pattern

- If the economic data from both regions are in line with expectations, or if events counterbalance each other (e.g., strong U.S. job data and high Eurozone inflation), EUR/USD might continue to trade within the current range.

- This scenario would likely be accompanied by oscillation around the moving averages without a clear break above resistance or below support.

- The RSI hovering around the mid-range without extreme readings supports this scenario of continued consolidation.

Fundamental Scenarios for EUR/USD

Positive Data-Driven Momentum

- Euro strengthening if the Eurozone reports higher-than-expected inflation rates, reducing the likelihood of accommodative ECB monetary policy.

- The Euro may further benefit if the U.S. Federal Reserve’s tone is less hawkish than anticipated, reducing the attractiveness of the USD.

Dollar Strength on Economic Robustness

- The U.S. dollar could see gains if job data shows the U.S. economy remains resilient, underscoring the potential for continued Fed rate hikes.

- A strong dollar is also likely if the Fed reaffirms its commitment to curbing inflation, irrespective of market expectations.

Mixed Data Outcome

- Mixed or conflicting data releases could result in a lack of clear direction, with the EUR/USD pair responding to individual data points but not establishing a new trend.

- If both economies show strength, it might lead to a standoff, with neither currency able to assert dominance.

Overall Market Sentiment

- Positive Sentiment: 35% – Reflecting the possibility of stronger-than-expected Eurozone inflation data and a dovish Fed.

- Negative Sentiment: 40% – Considering the potential for robust U.S. employment figures to support the USD.

- Neutral Sentiment: 25% – Indicating the chance of mixed data leading to range-bound trading conditions.

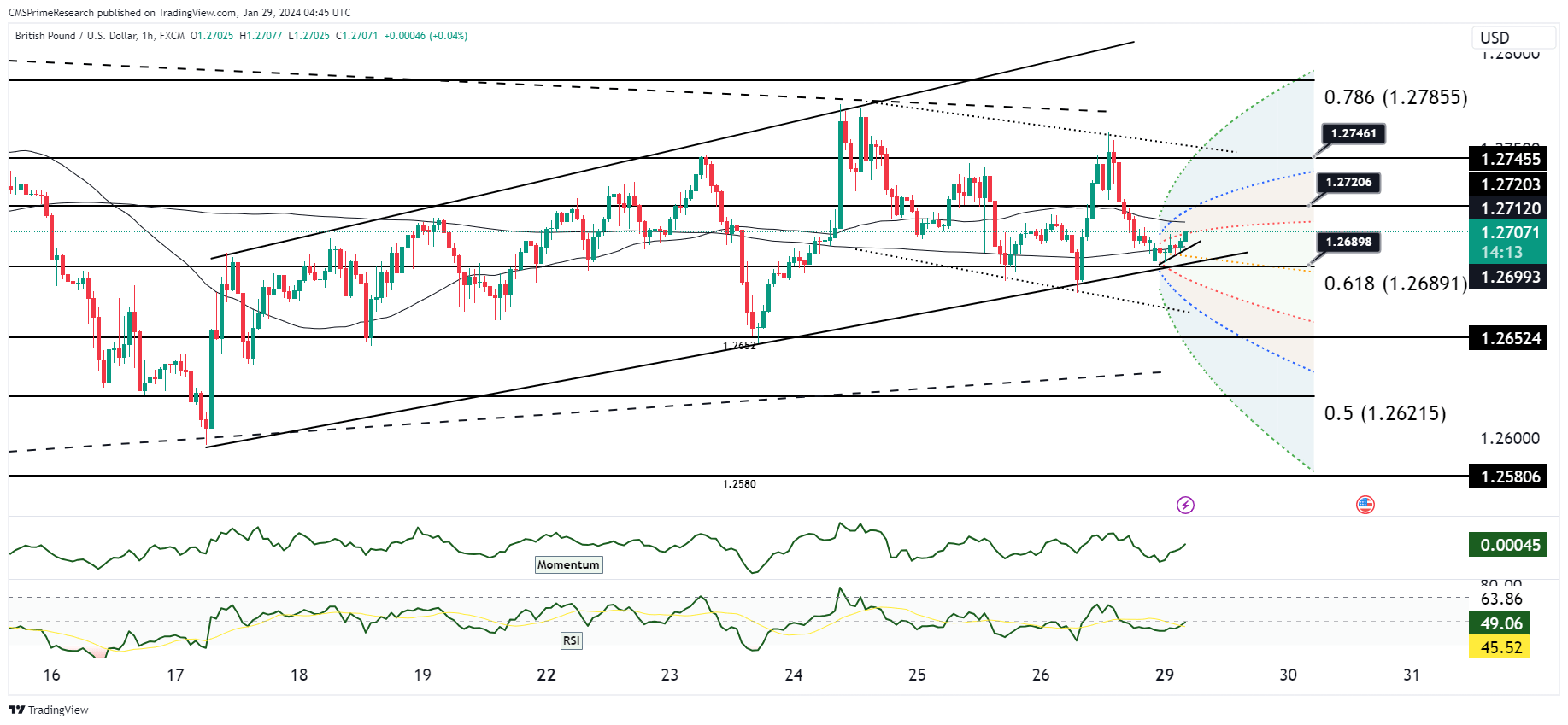

GBP USD Outlook:

GBPUSD: Week Ahead Technical and Fundamental Forecast

Technical Scenarios for GBP/USD

Scenario 1: Bullish Continuation

- A sustained move above the 1.27206 resistance could signal a bullish continuation, particularly if the GBP benefits from a positive outcome of the BoE Interest Rate Decision and Monetary Policy Report.

- A break above the 0.786 Fibonacci level at 1.27855 may further confirm this uptrend.

- Momentum and RSI in a favorable position could support this move if they remain above their median levels.

Scenario 2: Bearish Turnaround

- A reversal below the 0.618 Fibonacci level at 1.26891 could indicate a bearish scenario, potentially triggered by stronger-than-expected U.S. economic figures, like the Non-Farm Payrolls.

- A drop below the moving averages would provide technical confirmation of this bearish sentiment.

- The RSI moving towards an oversold territory could accelerate the downward movement.

Scenario 3: Range-Bound Activity

- In the absence of significant deviations from the consensus in economic data, GBP/USD might oscillate between the 1.27206 resistance and 1.26891 support levels.

- Mixed or neutral data could result in the RSI and momentum indicators hovering around their current mid-range levels, supporting a sideways market.

Fundamental Scenarios for GBP/USD

Positive Economic Developments

- A hawkish stance by the BoE, with an interest rate hike, could boost the GBP if it suggests confidence in the UK’s economic outlook.

- If U.S. data points to economic softening, the GBP could appreciate against the USD.

USD Strength on Economic Optimism

- Robust U.S. jobs data, indicating continued economic strength, could fortify the USD against the GBP.

- A continuation of aggressive Fed rate hikes, as interpreted from the Fed Press Conference, might also favor the USD.

Economic Data Equilibrium

- Should the BoE’s decisions and reports align closely with market expectations, and U.S. data does not surprise to the upside or downside, GBP/USD may see limited volatility.

- Concurrently strong economic indicators from both the UK and the U.S. could result in a tugging match where neither side gains significant ground.

Overall Market Sentiment

- Positive Sentiment: 40% – Accounting for the potential of a hawkish BoE and subdued U.S. data.

- Negative Sentiment: 35% – Considering the possibility of strong U.S. employment figures overshadowing UK economic developments.

- Neutral Sentiment: 25% – Reflecting the potential for mixed or as-expected data to result in a range-bound GBP/USD.

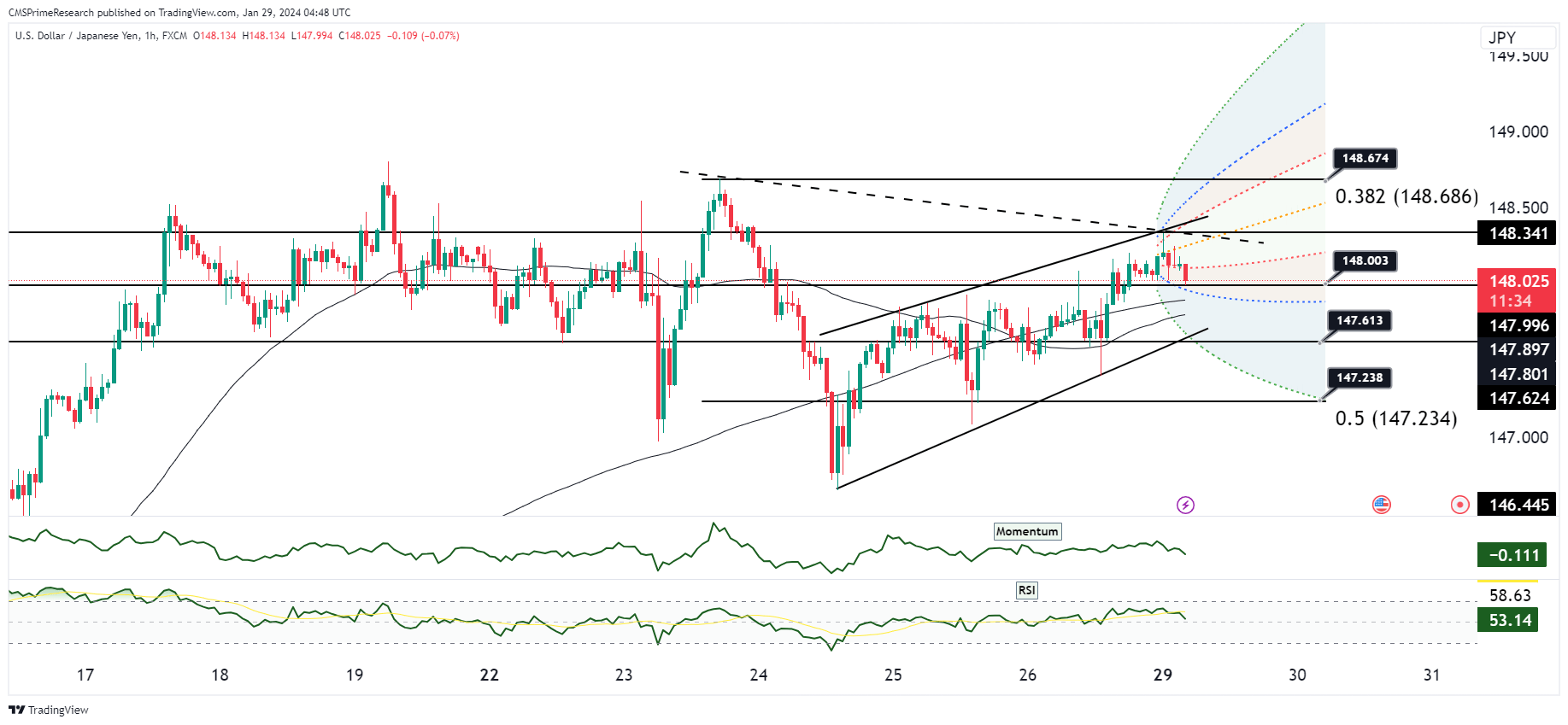

USD/JPY Outlook:

USDJPY: Week Ahead Technical and Fundamental Forecast

Technical Scenarios for USD/JPY

Scenario 1: Bullish Rebound

- A rebound from the 0.5 Fibonacci level at 147.234 and a push above the 148.003 resistance might indicate bullish momentum.

- If the Momentum and RSI indicators turn upwards, this would provide technical confirmation of a bullish scenario.

- A close above the 148.686 level could suggest a continuation towards higher resistance levels.

Scenario 2: Bearish Continuation

- If the price breaks below the 0.5 Fibonacci level and sustains below 147.234, it could signal a continuation of the bearish trend.

- A downward RSI trajectory, moving towards oversold conditions, could enhance the bearish outlook.

- Further confirmation would come from a sustained move below the moving averages.

Scenario 3: Consolidation

- The pair may continue to consolidate around the current price range if the market absorbs the upcoming economic data without significant surprises.

- A sideways RSI, not indicating overbought or oversold conditions, would support this scenario.

- The pair might oscillate between the 147.234 and 148.003 levels, awaiting a catalyst for direction.

Fundamental Scenarios for USD/JPY

Positive Dollar Sentiment

- Strong U.S. economic figures, particularly if the Non-Farm Payrolls and U-6 Unemployment Rate outperform consensus, could drive the USD higher.

- Hawkish remarks from the Fed could also instill confidence in the USD, supporting an upward move.

Yen Strength on Safe-Haven Flows

- If global economic uncertainty rises, typically evidenced by weak consumer sentiment, the JPY could strengthen as a safe-haven currency.

- Additionally, if the Fed’s tone is perceived as dovish, it could weaken the USD against the JPY.

Data Balance

- In the event that U.S. and Japanese economic data points do not deviate significantly from consensus, or if there is mixed data, USD/JPY might not find a clear direction.

- This could lead to a neutral impact on the currency pair, with traders waiting for clearer signals.

Overall Market Sentiment

- Positive Sentiment: 45% – Reflecting the potential for positive U.S. economic data and hawkish Fed communication to support the USD.

- Negative Sentiment: 30% – Considering the possibility of risk-averse market behavior favoring the JPY and a dovish Fed outlook.

- Neutral Sentiment: 25% – Acknowledging the chance of mixed economic outcomes and market consolidation.

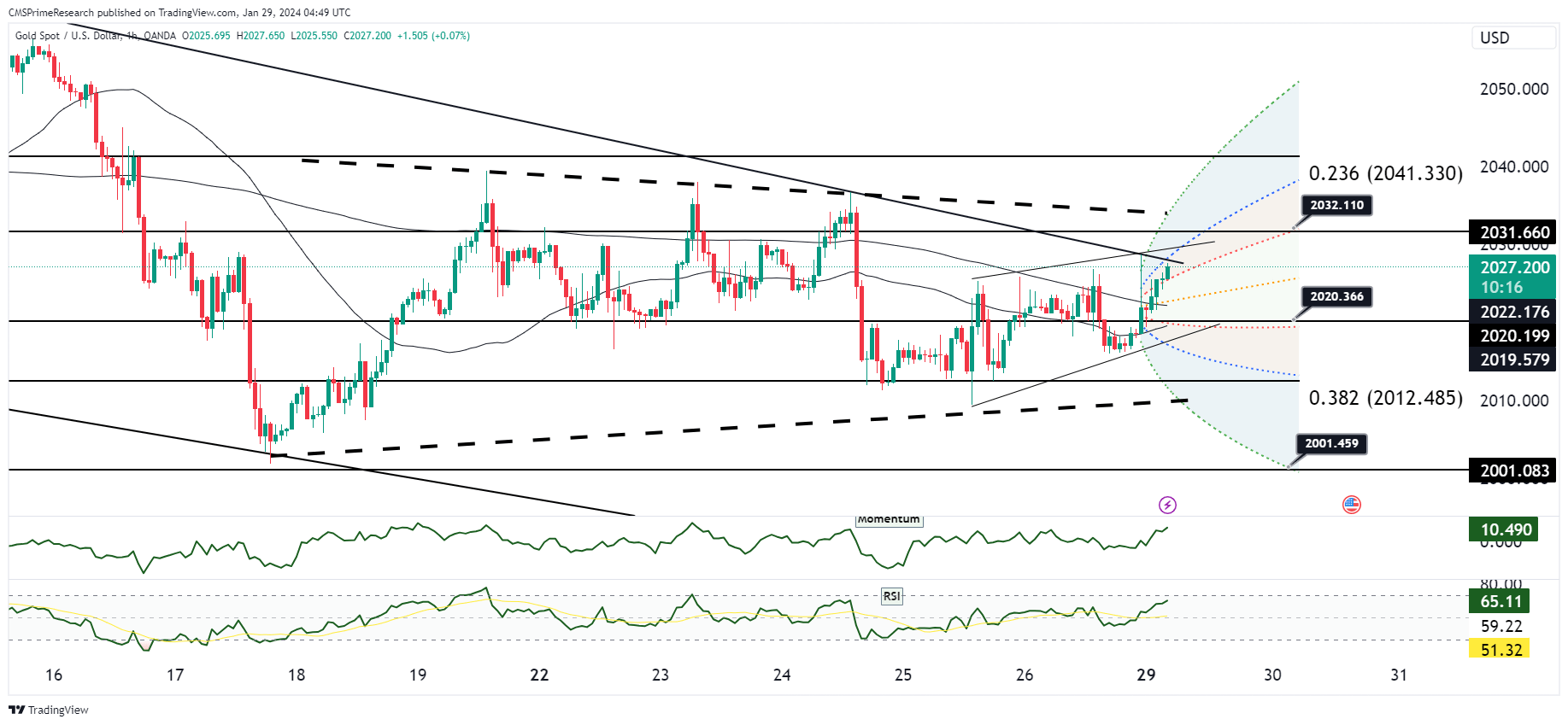

XAU/USD Outlook:

XAUUSD (Gold): Week Ahead Technical and Fundamental Forecast

Technical Scenarios for XAU/USD (Gold)

Scenario 1: Bullish Breakout

- A break above the recent high near the 0.236 Fibonacci level at 2041.330 could signal a continuation of the uptrend.

- Confirmation would come from the RSI advancing further into bullish territory and the Momentum indicator maintaining its upward trajectory.

- A continued rise could target the next resistance levels, potentially near the upper bounds of the current trading channel.

Scenario 2: Bearish Reversal

- A reversal and break below the 0.382 Fibonacci level at 2012.485 may indicate a shift to a bearish sentiment.

- If the RSI turns down, approaching the oversold region, and the Momentum indicator declines, this would support a bearish outlook.

- Further declines could see the price testing support at the 2000 psychological level or the lower trend line.

Scenario 3: Range-Bound Trading

- The price may continue to fluctuate within the established range, bounded by the 0.236 level at 2041.330 and the 0.382 level at 2012.485.

- The RSI and Momentum indicators remaining steady without significant changes could indicate a lack of conviction in the market, supporting this scenario.

Fundamental Scenarios for XAU/USD (Gold)

Positive Gold Sentiment

- If upcoming high-impact U.S. data shows weakness, particularly in job figures or consumer sentiment, this could lead to a flight to safety, benefiting gold.

- A dovish Fed could also reduce the appeal of the USD, making gold more attractive to investors.

Dollar Strength

- Strong U.S. economic data, suggesting continued recovery and potential for further rate hikes, could bolster the USD, putting pressure on gold prices.

- A hawkish stance from the Fed could increase the opportunity cost of holding gold, leading to a pullback in prices.

Data Balance

- Mixed or as-expected data releases may not provide a clear directional catalyst, possibly leading to gold prices consolidating within the current range.

- Balanced sentiment between risk and safety could see gold maintaining its current levels as investors seek to hedge against uncertainty.

Overall Market Sentiment

- Positive Sentiment: 40% – Reflecting the chance of economic uncertainty and dovish central bank policies which could increase gold’s appeal.

- Negative Sentiment: 35% – Considering the potential for strong U.S. economic data and a hawkish Fed that may dampen gold’s attractiveness.

- Neutral Sentiment: 25% – Acknowledging the possibility of gold prices oscillating within a range in response to mixed economic signals.

Risk based Sentiments

- EUR Risk Sentiment: Moderate risk appetite with potential upside from inflation data but mindful of ECB’s response to price pressures.

- GBP Risk Sentiment: Guarded due to BoE policy uncertainty, with risk sentiment hinging on interest rate decisions.

- JPY Risk Sentiment: Low risk as traders eye the BoJ’s stance on inflation, with the potential for a policy shift injecting volatility.

- USD Risk Sentiment: Mixed, with a slight tilt towards risk-taking ahead of FOMC meeting and labor market data.

- XAU Risk Sentiment: Cautiously optimistic as gold could benefit from dovish Fed expectations and any weak U.S. economic data.

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.