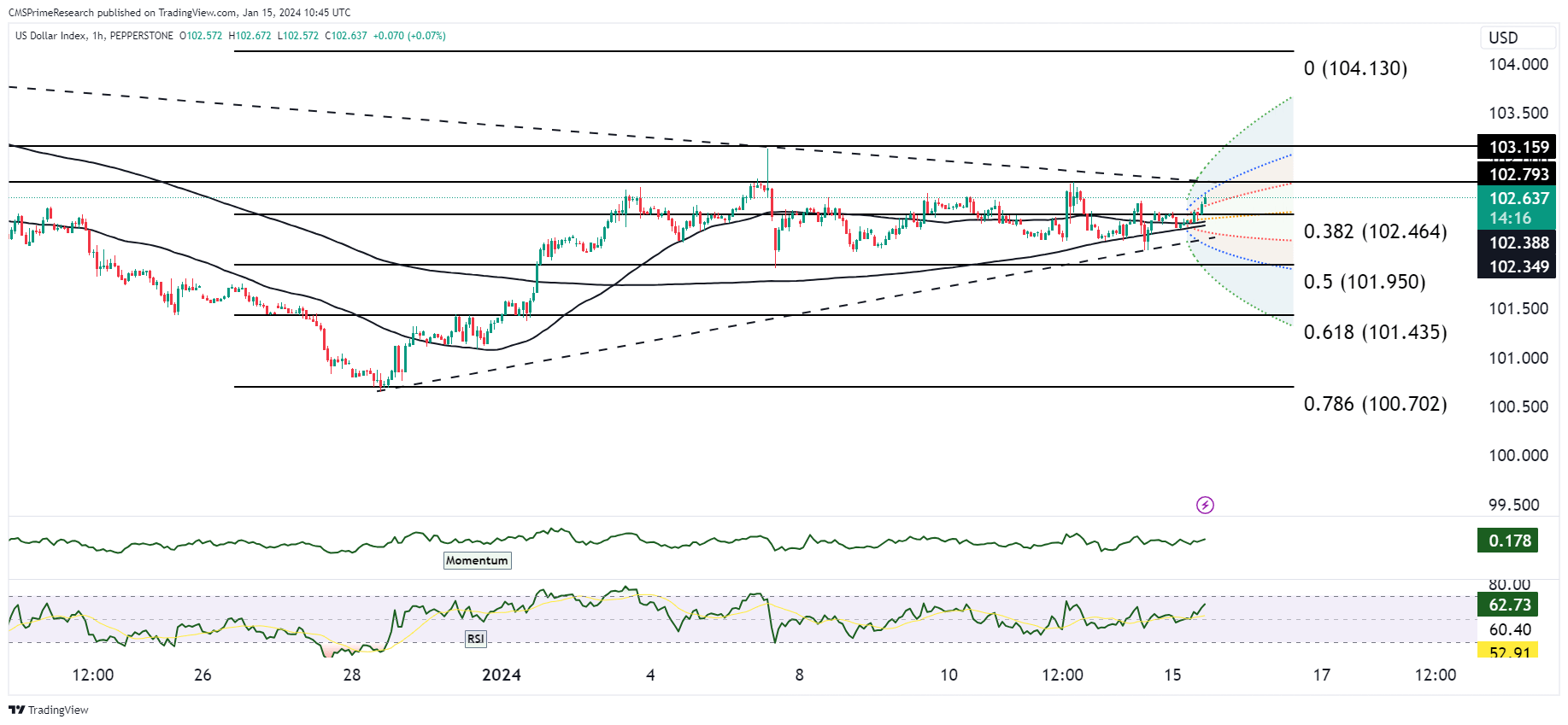

Dollar Index:

As of January 22, 2024, several factors are influencing the USD prices. The Federal Reserve’s expected pivot to rate cuts this year and how quickly these might be implemented is a key factor .Traders have priced in a 67% chance of a 25 basis point rate cut in March .The value of the USD against other currencies is also influenced by several factors, including interest rates, inflation, and the country’s level of economic health .The tension between the US and China could make Asian markets more appealin. The ongoing shift from coal and oil to natural gas for energy will also impact economies and their currencies. The GBP/USD pair is trading above 1.2700 early Monday, and the rising tension in the Red Sea might boost safe-haven asset demand and cap the upside of GBP/USD

Monetary Policy and Interest Rates: Central banks, especially the Federal Reserve (Fed) and the European Central Bank (ECB), are anticipated to cut rates in 2024, affecting the value of the USD. The economic divergence between the US and Europe suggests a potentially more aggressive stance from the ECB. Despite a dip in headline inflation, the Federal Reserve has maintained a hawkish stance, but the focus has shifted toward cuts, allowing yields to fall, pushing the dollar lower and supporting stocks.

Economic Growth and Inflation Trends: Real GDP growth in the US is forecasted to slow down to 0.7% in 2024, with consumer spending expected to rise at a more muted pace. Inflation, although moderating, is likely to remain above the Fed’s 2% target through 2024. Core PCE prices are forecasted to rise 2.4% in 2024, down from 3.4% in 2023.

Global Economic Outlook: A slowing global economy and easing inflation pressures are contributing to a more volatile and uncertain environment for the USD. The dollar fell sharply in October 2023 after the Fed hinted at stopping rate hikes, which sparked a rally in risk assets.

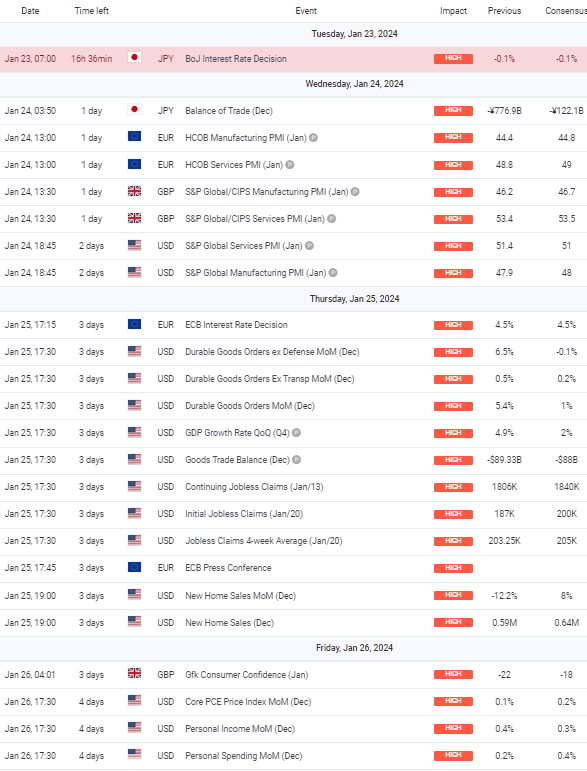

Upcoming Events for the week:

The upcoming week’s financial events are packed with high-impact data releases that are expected to stir currency markets globally. The week begins with a key interest rate decision from the Bank of Japan (BoJ), which is anticipated to maintain its ultra-loose monetary policy stance. This decision, in conjunction with the trade balance data, could potentially weaken the JPY if the market perceives a continuation of the BoJ’s dovish stance, especially against a backdrop of trade surplus reduction.

In Europe, the HICP (Harmonised Index of Consumer Prices) data will be closely watched as an indicator of inflation pressures. With the ECB’s interest rate decision also due, any deviation from expectations in the HICP figures or a surprise rate change could significantly move the EUR. If the ECB adopts a more hawkish tone or hints at future rate hikes to combat inflation, the euro could strengthen.

For the USD, a slew of data including S&P Global PMIs, durable goods orders, GDP growth rate, and jobless claims will offer insights into the economic health of the United States. The market will be particularly attentive to the GDP figures; a strong showing here, combined with healthy durable goods orders, could signal robust economic activity, potentially bolstering the USD. Conversely, higher jobless claims could temper this optimism and apply downward pressure on the dollar.

Overall Market Sentiment: The week’s sentiment is expected to be a complex mosaic, reflecting responses to central bank decisions and economic reports.

For the JPY, the sentiment might be somewhat cautious or negative, considering the BoJ’s likely stance, with a breakdown potentially around 30% Positive 50% Negative 20% Neutral.

The EUR sentiment could skew positive if the ECB signals a more aggressive approach to inflation, potentially

55% Positive 25% Negative 20% Neutral.

The sentiment for the USD is likely to be mixed, hovering at

40% Positive 40% Negative 20% Neutral

As positive economic data could be offset by any negative surprises in jobless claims or if the GDP growth does not meet the high expectations set by the consensus.

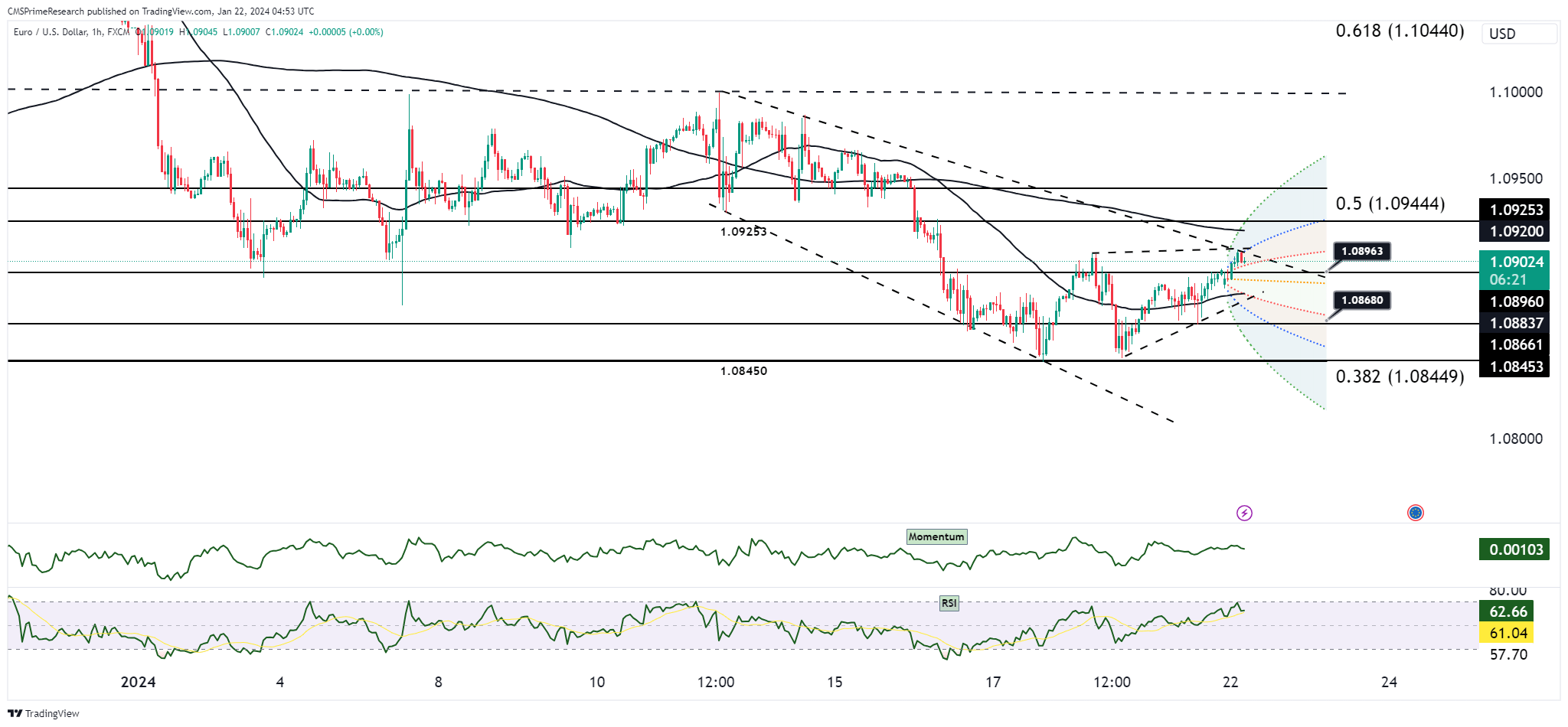

EUR USD Outlook:

EURUSD: Week Ahead Technical and Fundamental Forecast

Scenario 1: Bullish Outcome

Fundamental Analysis:

- If the ECB Interest Rate Decision reflects a more hawkish stance than anticipated, with a possible rate hike, the EUR could strengthen.

- Positive outcomes in the Eurozone Manufacturing and Services PMIs could signal a robust economy, bolstering the EUR.

- Should U.S. economic data (like GDP, Durable Goods, and Jobless Claims) come out weaker than expected, the USD could weaken, supporting a EUR/USD rise.

Technical Analysis:

- A fundamental bullish sentiment may push EUR/USD to break above the resistance near the 1.09253 level.

- Sustained upward momentum could see the pair aiming for the 0.5 Fibonacci level at 1.09444, followed by the 0.618 level at 1.10440.

- The RSI moving above the 60 level could indicate increasing bullish momentum, supporting the upward price action.

Scenario 2: Bearish Outcome

Fundamental Analysis:

- If the ECB decides to keep rates unchanged or communicates a dovish outlook, the EUR could face downward pressure.

- Disappointing Manufacturing and Services PMI data from the Eurozone could contribute to EUR weakness.

- Strong U.S. economic figures, particularly an increase in GDP and better-than-expected Durable Goods Orders, could drive the USD higher against the EUR.

Technical Analysis:

- Negative fundamental pressures could lead to EUR/USD breaking below the recent support around 1.08680.

- A bearish move might then target the lower levels of the descending channel, potentially testing the 0.382 Fibonacci level at 1.08449.

- A falling RSI, particularly if it goes below the 50 midpoint, would support a bearish scenario.

Scenario 3: Consolidation Outcome

Fundamental Analysis:

- Mixed signals from both the Eurozone and U.S. economic data releases could result in uncertain market sentiment, leading to consolidation.

- If key economic indicators like the ECB Interest Rate Decision or U.S. GDP growth come in line with expectations, major movements might be limited.

Technical Analysis:

- In a scenario where fundamentals do not provide clear direction, EUR/USD may continue to trade within the current range, bounded by 1.09253 resistance and 1.08680 support.

- The pair could oscillate around the central pivot of the Fibonacci retracement levels, near 1.08963.

- RSI hovering around the 50 level would indicate a lack of momentum, reinforcing a consolidation pattern.

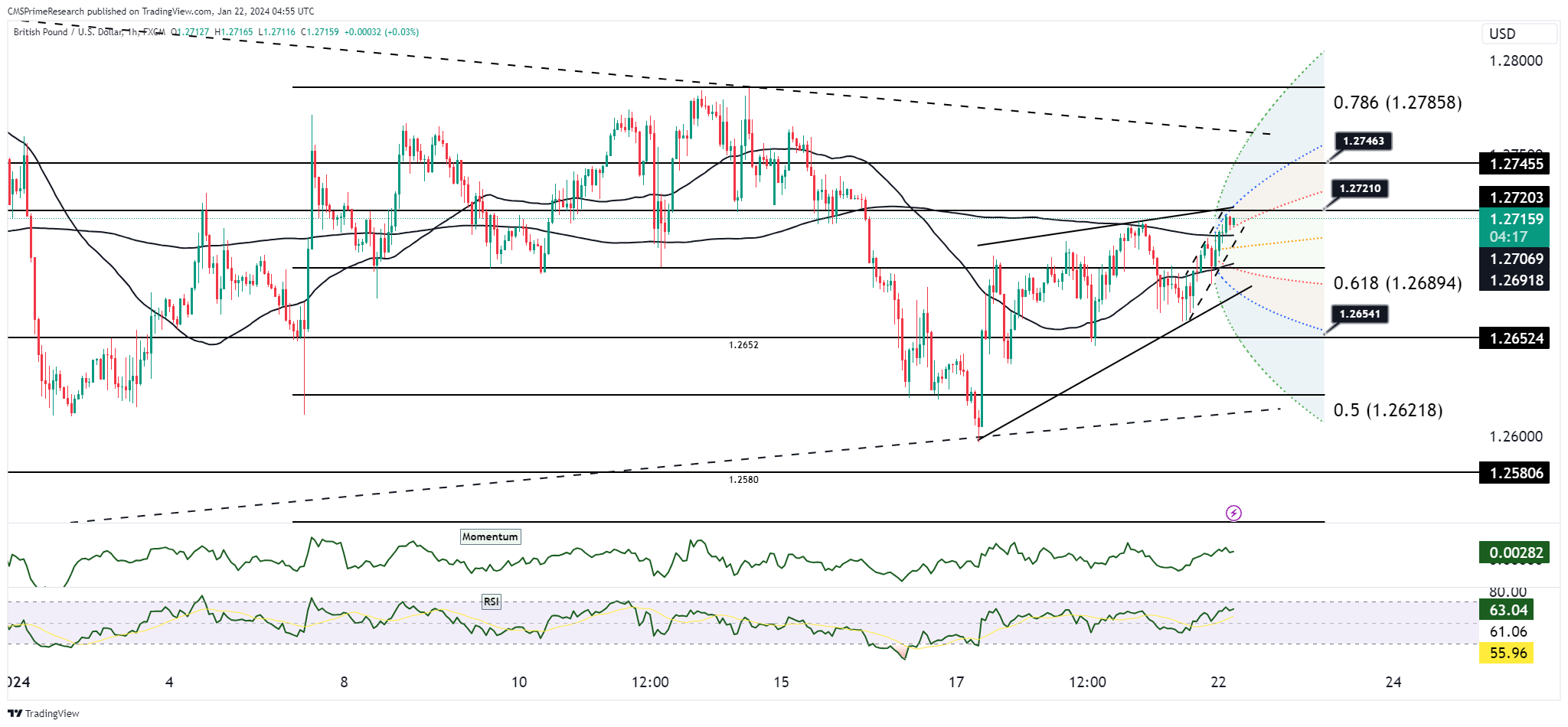

GBP USD Outlook:

GBPUSD: Week Ahead Technical and Fundamental Forecast

Scenario 1: Bullish Outcome for GBP/USD

Fundamental Analysis:

- A better-than-expected release of the UK’s S&P Global/CIPS Manufacturing PMI and Services PMI could indicate economic resilience, strengthening the GBP.

- Concurrently, if U.S. economic data such as GDP Growth Rate and Durable Goods Orders show weakness, this could lead to USD depreciation.

Technical Analysis:

- Positive fundamentals for the GBP could result in a break above the current resistance level at 1.27210.

- The pair may then aim for the Fibonacci retracement levels of 0.786 at 1.27858, with the momentum indicated by the RSI remaining above the 60 level.

- A bullish crossover in the moving averages on the chart could reinforce this upward trajectory.

Scenario 2: Bearish Outcome for GBP/USD

Fundamental Analysis:

- If the UK’s PMI data disappoints, suggesting contraction or slower growth, it could exert bearish pressure on the GBP.

- Should U.S. economic data come out stronger than expected, the USD would likely gain against the GBP.

Technical Analysis:

- In response to negative fundamentals, GBP/USD might retreat towards the support level at 1.26541.

- A break below this level could see the pair testing the next support at 1.25806.

- A declining RSI, moving below the 50 level, would suggest increasing bearish momentum.

Scenario 3: Consolidation Outcome for GBP/USD

Fundamental Analysis:

- Mixed economic data from both the UK and U.S. might result in a lack of clear directional movement.

- If PMI figures and other key economic releases align with market expectations, significant price fluctuations may be limited.

Technical Analysis:

- The GBP/USD could enter a consolidation phase, trading within a range bounded by the 1.27210 resistance and 1.26541 support levels.

- The RSI remaining around the mid-50s would suggest a balance between buying and selling pressure.

- Price action hovering around the central pivot of the identified Fibonacci levels, near 1.26918, could indicate market indecision.

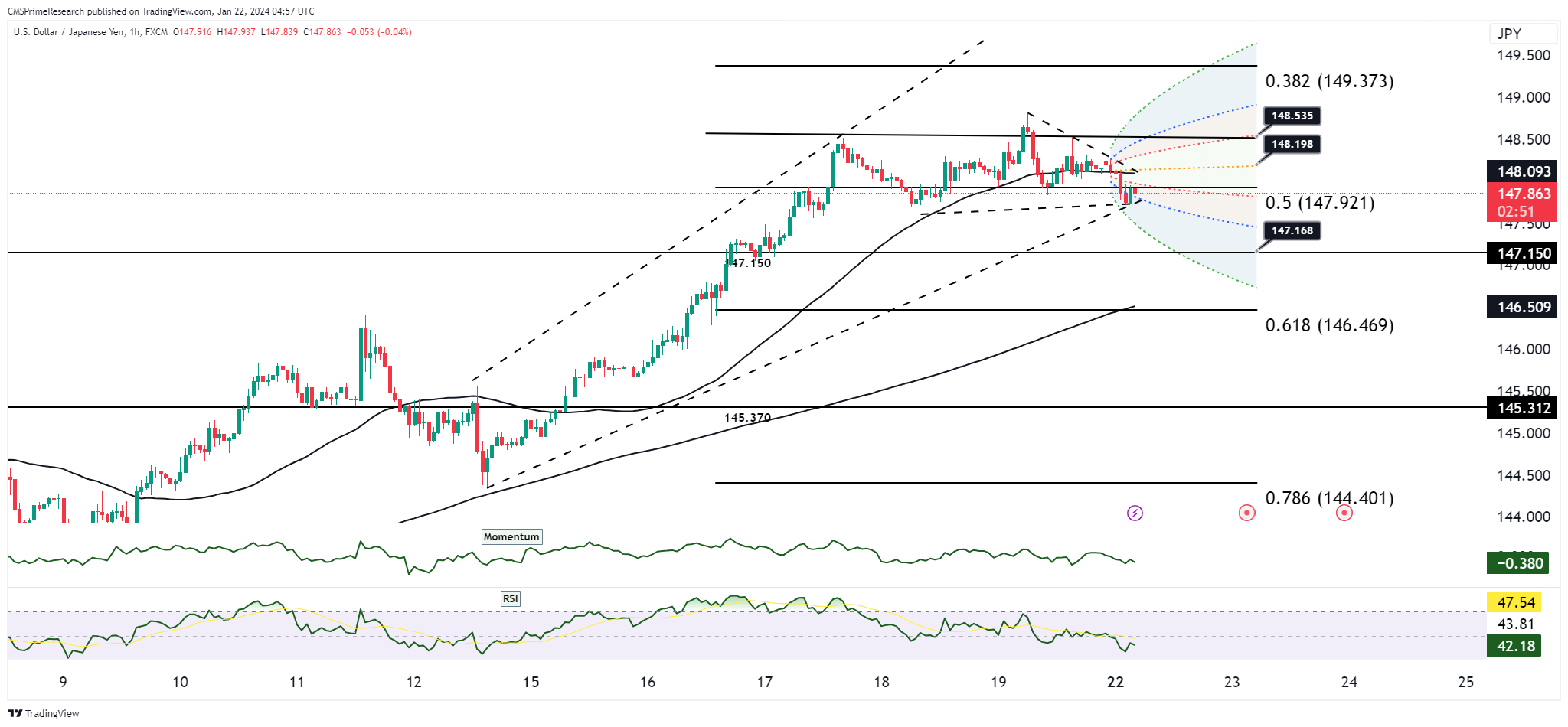

USD/JPY Outlook:

USDJPY: Week Ahead Technical and Fundamental Forecast

Scenario 1: Bullish Outcome for USD/JPY

Fundamental Analysis:

- If the BOJ Interest Rate Decision is more dovish than anticipated, it could lead to JPY weakness.

- Strong U.S. economic data, especially the GDP Growth Rate and Durable Goods Orders, could reinforce USD strength.

Technical Analysis:

- A fundamental bullish push could see USD/JPY breaking resistance at 147.921, the 0.5 Fibonacci level.

- Further bullish momentum could challenge the 0.382 Fibonacci level at 149.373.

- The RSI moving further above 50 would indicate growing bullish momentum, while a crossover in the moving averages would provide additional confirmation.

Scenario 2: Bearish Outcome for USD/JPY

Fundamental Analysis:

- An unexpectedly hawkish BOJ could lead to JPY appreciation.

- If U.S. economic data disappoints, particularly if the GDP Growth Rate and Durable Goods Orders are weaker than expected, it could pressure the USD.

Technical Analysis:

- Negative fundamentals could drive USD/JPY to break below the current support around 147.168, the 0.618 Fibonacci level.

- A sustained bearish trend could target the 0.786 Fibonacci level at 144.401.

- The RSI dropping below the mid-level of 50 would confirm increasing bearish momentum.

Scenario 3: Consolidation Outcome for USD/JPY

Fundamental Analysis:

- Mixed outcomes from both the U.S. and Japan’s economic data may lead to uncertain market sentiment, with no clear direction for the currency pair.

- If the BOJ Interest Rate Decision and U.S. economic data meet market expectations, significant currency movements may be restrained.

Technical Analysis:

- USD/JPY may consolidate between the 0.618 Fibonacci level at 147.168 and the 0.5 level at 147.921.

- The RSI remaining around 50 could indicate a lack of momentum, reinforcing the consolidation pattern.

- Price action may hover around these Fibonacci levels, reflecting indecision in the market until further economic cues emerge.

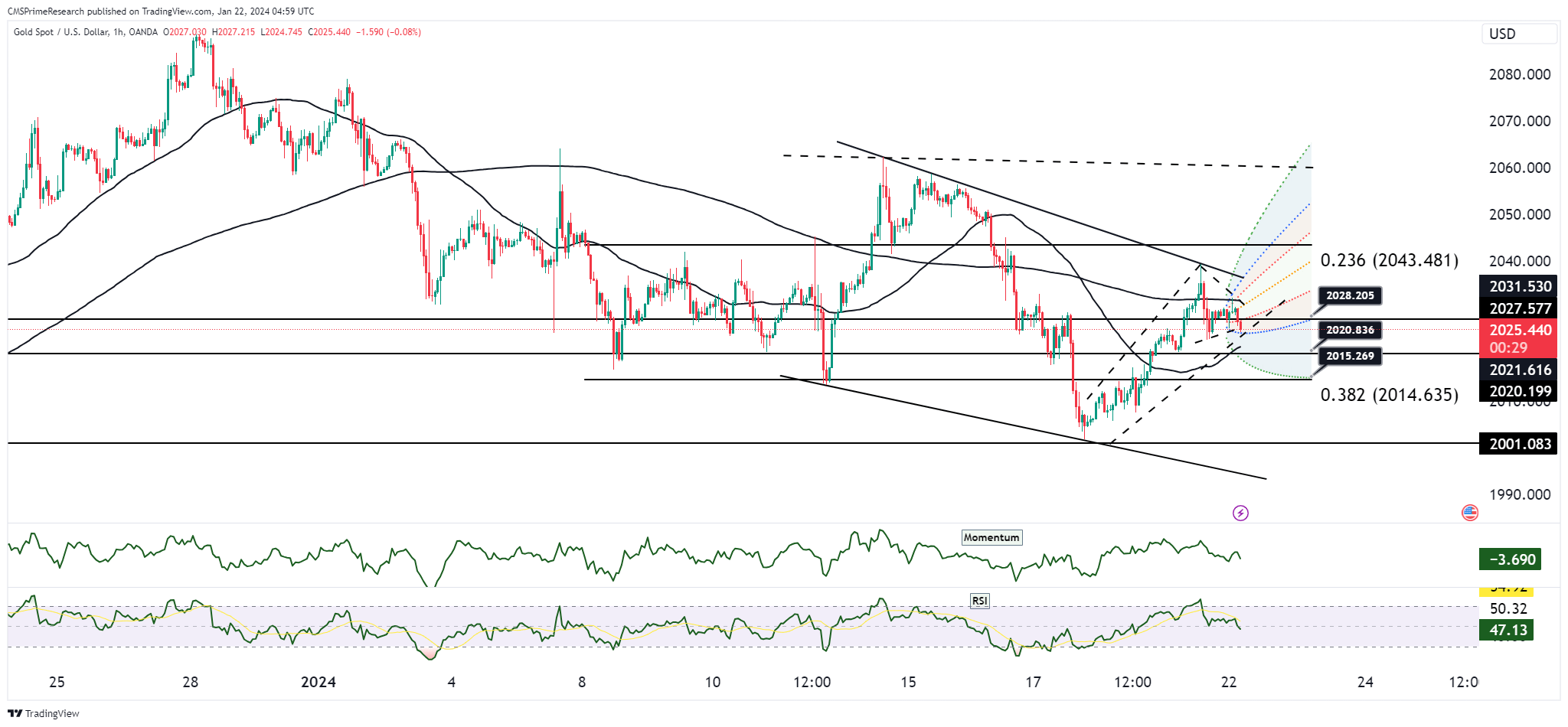

XAU/USD Outlook:

XAUUSD (Gold): Week Ahead Technical and Fundamental Forecast

Scenario 1: Bullish Outcome for XAU/USD

Fundamental Analysis:

- If the ECB Interest Rate Decision results in a rate hike, it could lead to a stronger EUR and potentially weaken the USD, which may boost XAU/USD.

- Negative U.S. data releases such as a lower GDP Growth Rate or disappointing Durable Goods Orders could lead to a weaker USD, increasing the appeal of gold.

Technical Analysis:

- Gold may react positively, targeting the first resistance at the 0.236 Fibonacci level of 2043.481.

- With sustained bullish momentum, a move towards the next psychological level of 2050 could be possible.

- The RSI moving above 60 would support this bullish scenario, indicating increasing buying pressure.

Scenario 2: Bearish Outcome for XAU/USD

Fundamental Analysis:

- A hawkish stance from the U.S. Federal Reserve or strong U.S. economic data could strengthen the USD, putting pressure on gold prices.

- Simultaneously, if the ECB takes a dovish position, the resulting strength in USD could push XAU/USD lower.

Technical Analysis:

- Gold could fall below the recent support around the 0.382 Fibonacci level of 2014.635.

- Further downside momentum might test the next support level near 2000, a significant psychological barrier.

- A declining RSI, particularly if it moves below 50, would confirm a bearish trend.

Scenario 3: Consolidation Outcome for XAU/USD

Fundamental Analysis:

- Mixed or as-expected economic data from both the U.S. and Eurozone might lead to a lack of clear direction, resulting in a consolidation for gold prices.

- If market participants do not perceive new catalysts in the economic releases, gold may trade within a narrow range.

Technical Analysis:

- XAU/USD could continue to trade within the range set by the Fibonacci levels of 0.236 (2043.481) and 0.382 (2014.635).

- The RSI remaining near the 50 level would suggest a balance between buyers and sellers, indicative of a consolidation phase.

- Price could oscillate around the pivot of 2020.836, which is currently acting as a central point of the recent price range.

Risk based Sentiments

EUR Risk Sentiment: Cautiously optimistic, with potential for strength if Eurozone retail sales outperform, though ECB policy shifts remain a key risk.

GBP Risk Sentiment: Tentatively positive with reliance on favorable employment data to uphold momentum, but wary of counteracting forces from US economic indicators.

JPY Risk Sentiment: Neutral with a cautious lean, as inflation data could prompt a reassessment of the BoJ’s policy stance, offset by global risk dynamics.

USD Risk Sentiment: Uncertain and sensitive to upcoming retail and inflation reports, with potential volatility from interest rate speculation and geopolitical events.

XAU Risk Sentiment: Cautiously bullish with gold poised as a hedge against inflation concerns, yet vulnerable to shifts in USD strength and risk appetite.

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.