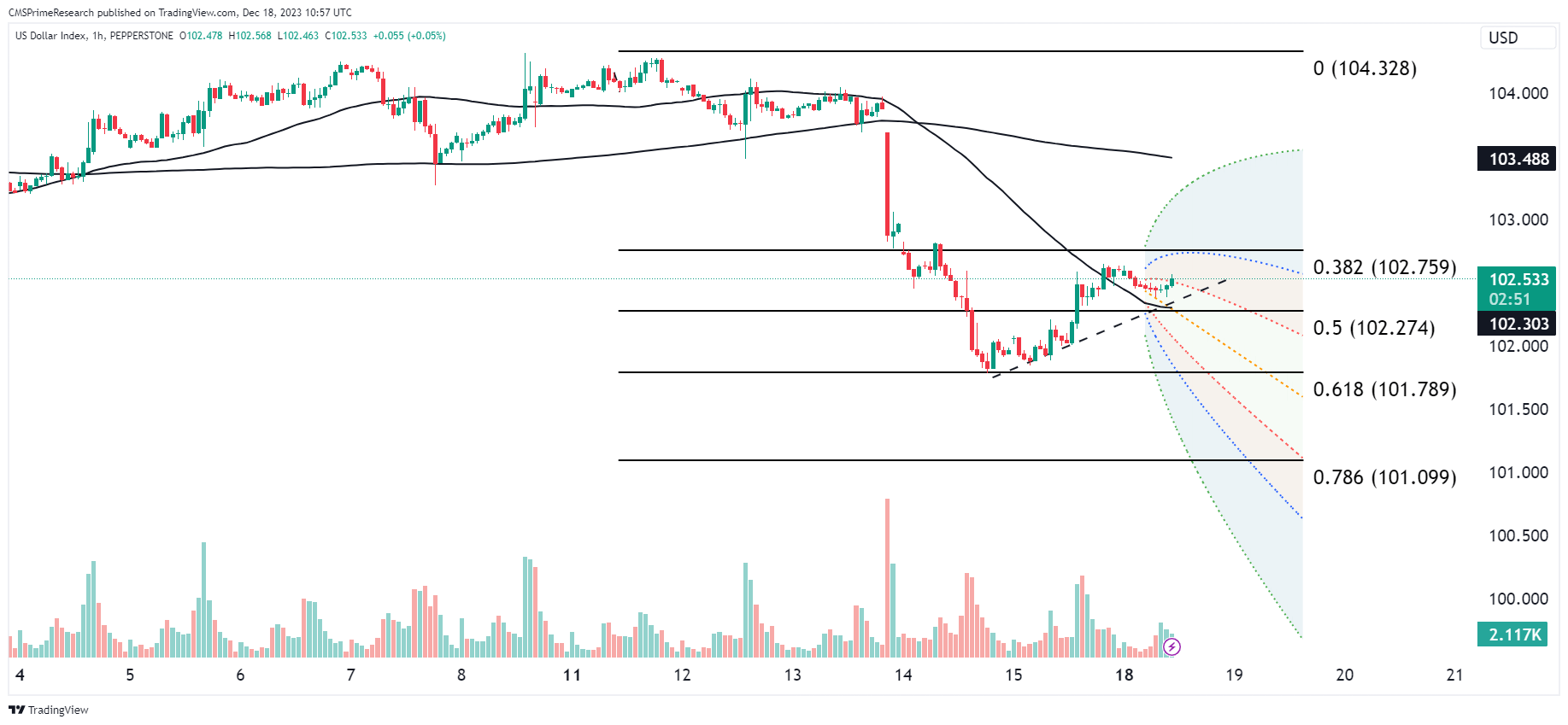

Dollar Index:

As of December 18, 2023, several key economic events and news are impacting the US Dollar (USD) price:

Federal Reserve’s Stance on Interest Rates: The Federal Reserve’s voting members, John Williams and Raphael Bostic, have pushed back against market expectations of a series of rate cuts next year. Williams stated that the Fed isn’t currently discussing rate cuts, while Bostic suggested that the US central bank will likely cut rates twice next year, starting in the third quarter. This is in contrast to market expectations of six rate cuts starting in March, totaling 150 basis points.

UK Inflation Report: The GBP/USD pair is on hold ahead of the latest UK inflation report due on Wednesday. The UK inflation has been moving lower over the past months, and a further move lower will increase pressure on the Bank of England Governor to acknowledge that rates will move lower next year.

Inflation and Unemployment Projections: The Congressional Budget Office expects inflation to nearly hit the Federal Reserve’s 2% target rate in 2024, as overall growth slows. Unemployment is expected to rise into 2025.

Bank of Japan Meeting: The Bank of Japan has kicked off a two-day meeting that could be crucial in determining the USD’s performance against the yen.

USD Performance Against Other Currencies: The US Dollar Index (DXY), which measures the value of the dollar against a basket of six foreign currencies, traded slightly higher by 0.04% at 102.59.

These events and news are contributing to the current volatility in the USD price. It’s important to note that currency values can be influenced by a variety of factors, including economic indicators, geopolitical events, and market sentiment, among others.

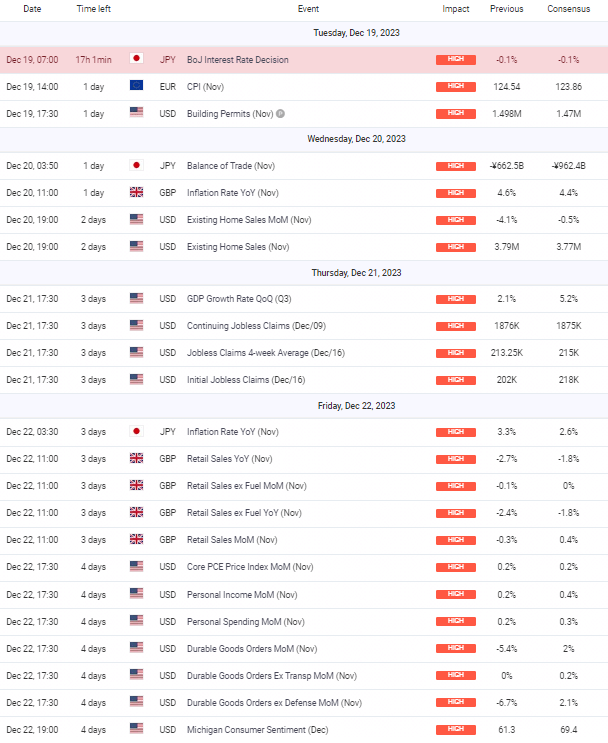

Upcoming Events for the week:

In the case of consumer-related metrics like Retail Sales, Personal Income, and Spending, these figures provide insights into consumer behavior, which is a significant driver of economic health. Data that surpasses or falls short of consensus can lead to immediate market reactions, as they may hint at future economic trends and influence currency strength. Traders and investors often adjust their market positions in anticipation of such data releases, resulting in increased market volatility. It’s also important to note that while these indicators are influential, the actual market impact will depend on the overall economic context, prevailing market sentiment, and geopolitical developments that may temper or amplify the effects of these economic releases.

EUR USD Outlook:

The EUR/USD currency pair, often influenced by comparative economic releases from both regions, may face heightened volatility surrounding the upcoming economic events. The Eurozone’s CPI data, a key inflation indicator, is of particular interest. Should the CPI deviate significantly from the consensus, it could affect the European Central Bank’s monetary policy stance. Higher-than-expected inflation may lead to a hawkish outlook, potentially strengthening the EUR as markets anticipate possible interest rate hikes to curb inflation. Conversely, lower inflation figures might suggest a dovish tilt, potentially weakening the EUR against the USD as it may delay any tightening measures.

For the USD, the release of GDP growth data, jobless claims, and core PCE Price Index will be pivotal. Strong GDP growth could underpin the USD by signaling economic resilience, possibly prompting the Federal Reserve to maintain or escalate its rate normalization path to manage inflation and growth. In contrast, if jobless claims rise unexpectedly or if the core PCE Price Index— the Fed’s preferred inflation measure—falls short of expectations, it could indicate underlying economic softness, potentially leading to a weaker USD as traders price in a more cautious Fed approach. Market participants may adopt a strategy of caution leading up to these releases, with potential for rapid adjustments post-publication. The interplay between these data points will guide the short-term market bias for EUR/USD, with a watchful eye on any divergence between the economic trajectories of the Eurozone and the U.S. and the subsequent central bank policy implications.

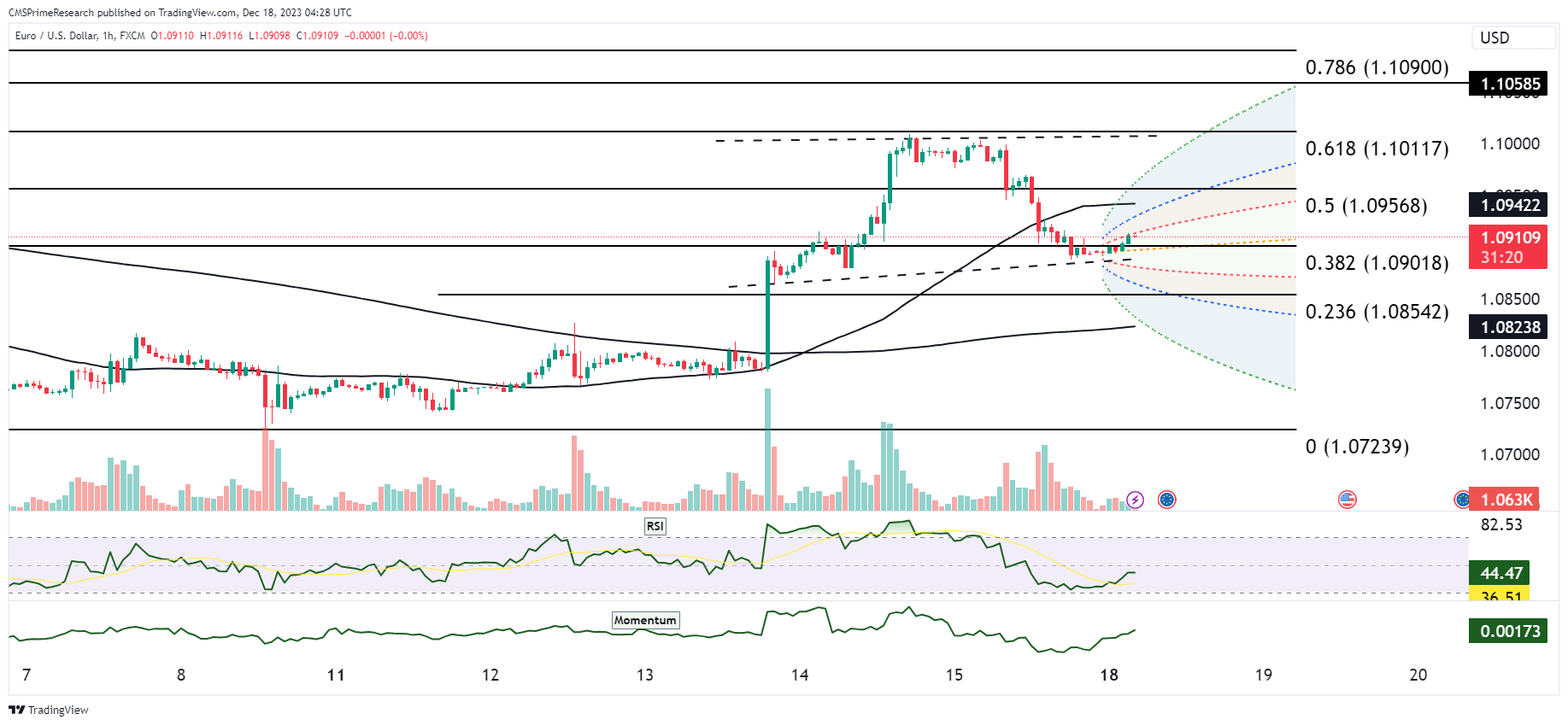

EUR/USD Technical Snapshot:

Scenario Analysis for EUR/USD: Week Ahead Forecast

Scenario 1: Bullish Surge

– Technical Indicators: A break above the 0.382 Fibonacci level at 1.09018 suggests a potential rally towards the 0.786 level at 1.10900.

– Fundamental Catalysts: Weaker-than-expected U.S. economic data or dovish tones from the upcoming Federal Reserve announcements could weaken the dollar. Simultaneously, positive Eurozone data, especially in CPI and trade balance, could drive EUR strength.

Scenario 2: Consolidation

– Technical Indicators: EUR/USD may continue to consolidate around the 0.5 Fibonacci level at 1.09568 if it remains within the recent price channel.

– Fundamental Catalysts: Mixed data releases or market anticipation ahead of key economic events, such as GDP figures and central bank decisions, could lead to a period of consolidation.

Scenario 3: Bearish Retraction

– Technical Indicators: A move below the 0.236 Fibonacci level at 1.08542 could indicate a bearish reversal, potentially retesting lower support levels.

– Fundamental Catalysts: Strong U.S. economic indicators, including GDP growth and positive labor market data, may reinforce bullish USD sentiment. If the Fed remains hawkish and the European Central Bank’s announcements are more dovish than expected, the euro could face downward pressure.

GBP USD Outlook:

In the UK, the focus will be on Inflation Rate Year-over-Year, Retail Sales, and Retail Sales excluding Fuel data. Inflation figures that exceed expectations could lead to a bullish sentiment for the GBP as markets might anticipate a more aggressive interest rate hike policy from the Bank of England to counteract inflationary pressures, thereby attracting investment into the GBP. On the other hand, weaker-than-anticipated inflation or a decline in Retail Sales could signal economic slowing, prompting bearish sentiment as it could imply a delay in any potential rate hikes, thus potentially depreciating the GBP against the USD.

For the USD, the market will closely monitor the GDP growth rate and jobless claims as indicators of economic health. A robust GDP growth rate could strengthen the USD, reflecting a resilient economy, whereas an increase in jobless claims might imply economic headwinds, potentially weakening the USD. The volatility expectation for GBP/USD leading up to these releases is elevated, as traders will position their portfolios based on the anticipated economic trajectory indicated by these data points. A divergence in economic performance—whereby the UK shows stronger-than-expected data and the US shows weaker-than-expected data, or vice versa—could lead to pronounced movements in the currency pair. Market participants operating under an economic framework will factor these indicators into their predictive models, adjusting their bias for Cable accordingly. They will be vigilant of the release timings, ready to interpret the data in the context of global economic sentiment and cross-market dynamics that may also influence the pair’s movement.

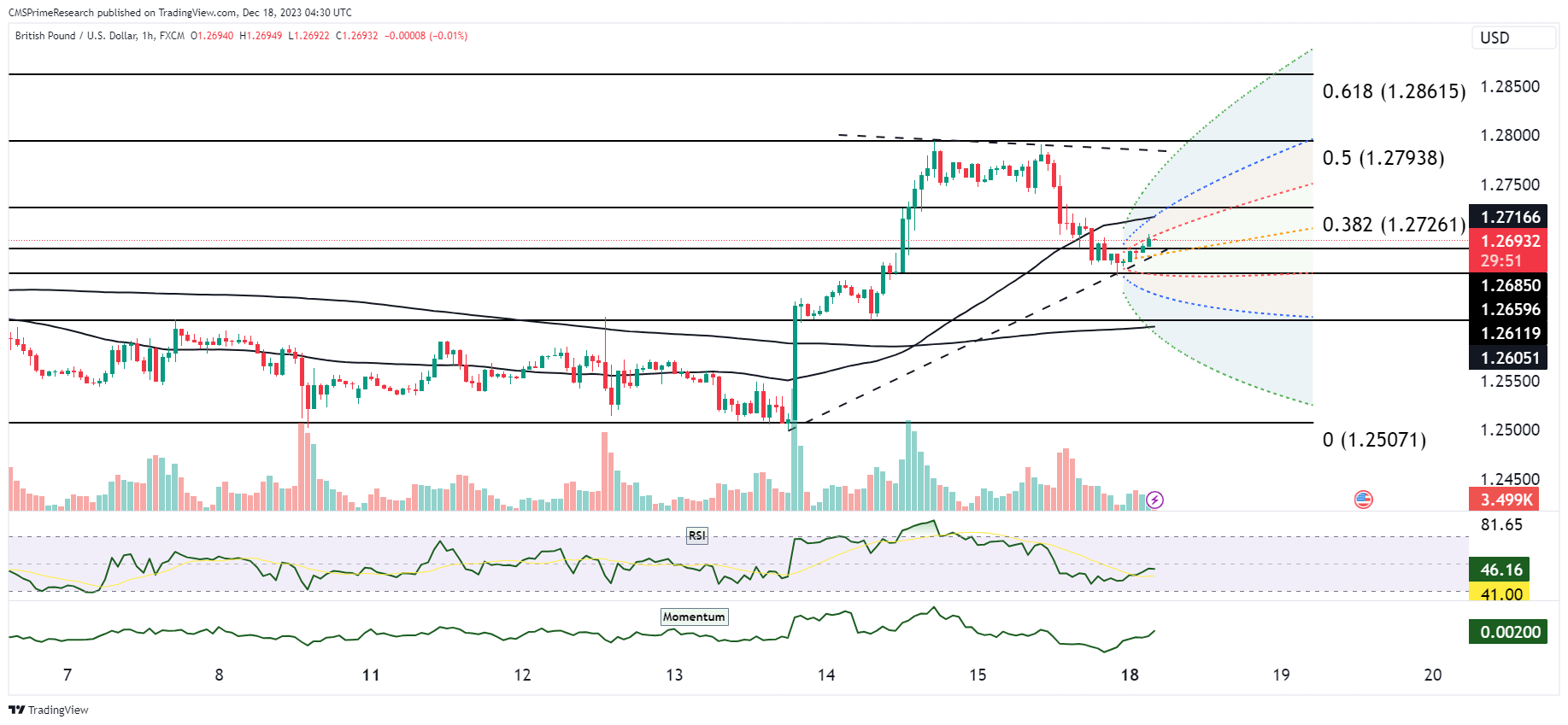

GBP/USD Technical Snapshot:

Scenario 1: Bullish Trajectory

- Technical Indicators: If GBP/USD breaks above the 0.382 Fibonacci level at 1.27261, it could aim for the 0.618 level at 1.28615, indicating a bullish trend.

- Fundamental Catalysts: A weaker-than-expected U.S. CPI or building permits could weaken the dollar. Simultaneously, strong UK inflation data could reinforce a bullish outlook for the pound.

Scenario 2: Consolidation

- Technical Indicators: The currency pair might continue to trade around the 0.5 Fibonacci level at 1.27938, suggesting consolidation within this range.

- Fundamental Catalysts: With high-impact events like the BoJ interest rate decision and various US and UK data releases, mixed results could lead to uncertainty and range-bound trading for GBP/USD.

Scenario 3: Bearish Turn

- Technical Indicators: Falling below the 0 Fibonacci level at 1.25071 could indicate a bearish reversal, potentially exploring supports at lower Fibonacci retracement levels.

- Fundamental Catalysts: Strong U.S. economic data, especially in growth figures or labor markets, may strengthen the dollar. Conversely, if UK data underperforms expectations, it could drive the pound lower against the dollar.

USD/JPY Outlook:

The USD/JPY pair is often sensitive to shifts in monetary policy and economic health indicators from both the United States and Japan. The impending Bank of Japan’s Interest Rate Decision will be a critical focus for JPY. Should the Bank of Japan opt for a change in rates, especially an increase which is not currently anticipated by the consensus, the JPY could sharply appreciate due to the potential for increased yields on Japanese investments. This could lead to a decrease in the USD/JPY rate. Conversely, an affirmation of the status quo or a dovish signal could lead to JPY weakness, and thus, a rise in the USD/JPY rate. Additionally, the U.S. data releases on GDP, jobless claims, and personal spending will be pivotal. Stronger-than-expected U.S. data could bolster the USD as it may indicate ongoing economic momentum and support the case for further Federal Reserve tightening, which would likely lead to USD/JPY appreciation.

Volatility in USD/JPY is expected to be elevated around these economic announcements. Traders and investors will be scrutinizing the divergence between the Federal Reserve’s and the Bank of Japan’s monetary policy stances. A hawkish Fed coupled with a dovish BoJ would likely lead to a higher USD/JPY, while the opposite would lead to a lower USD/JPY. Market participants employing an economic framework will be assessing not just the data but also the potential policy responses. They will prepare for scenarios where the outcomes either confirm or defy the current market pricing of future monetary policy paths, which is intricately linked to interest rate differentials between the two currencies. The anticipation of this data may lead to cautious positioning, with the potential for swift repositioning in response to the actual releases, thereby defining the short-term market bias for the currency pair.

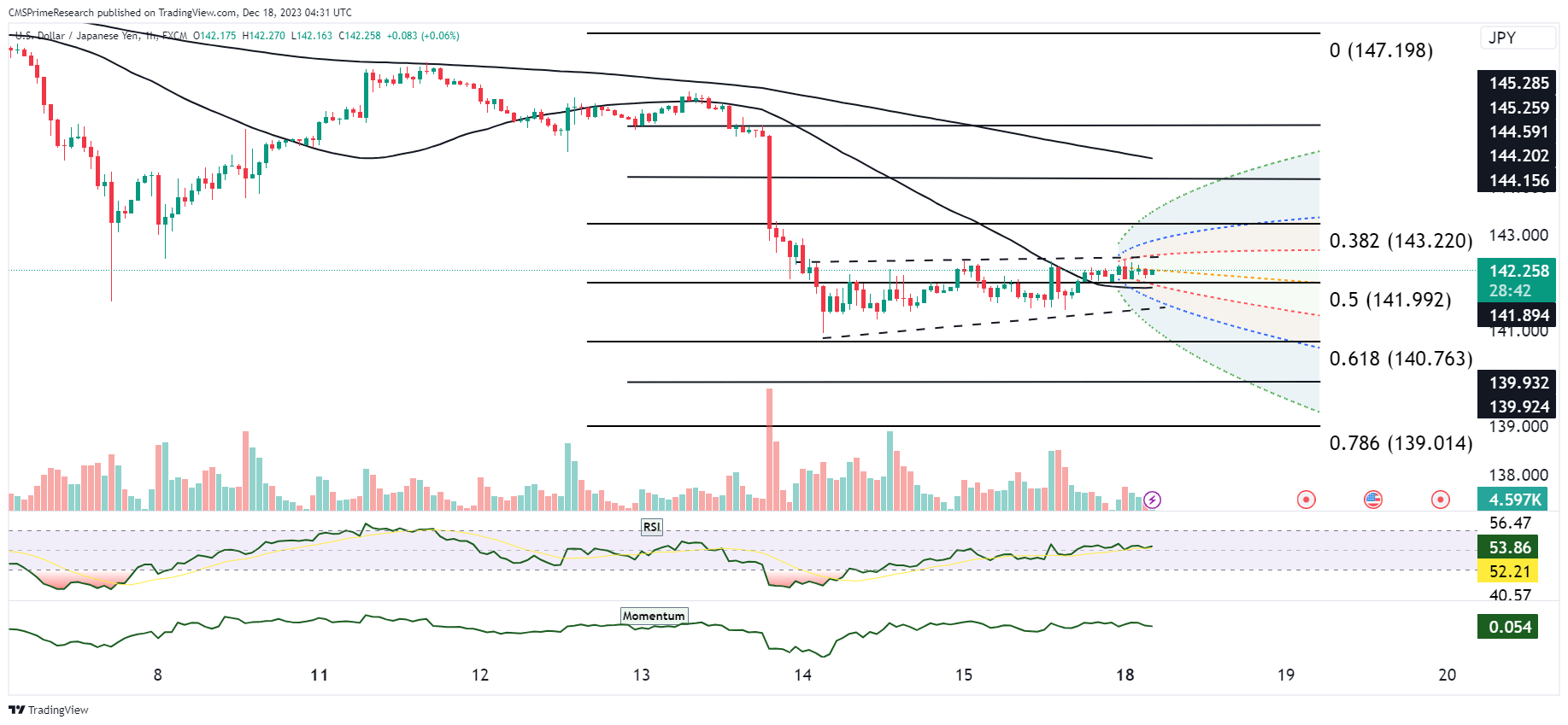

Scenario 1: Bullish Breakout

- Fundamental Analysis: If the upcoming US GDP growth rate exceeds expectations, coupled with a dovish stance from the Bank of Japan (BoJ) interest rate decision, we could see a surge in USD strength against the JPY.

- Technical Forecast: Look for a breach above the current consolidation pattern on the chart. A clear break above the Fibonacci 0.382 level could signal a move towards the 0.5 or higher Fibonacci retracement levels.

Scenario 2: Bearish Reversal

- Fundamental Analysis: Conversely, if US economic data underperforms (e.g., higher jobless claims or lower personal income) and the BoJ delivers a surprise hawkish tone, the JPY could strengthen.

- Technical Forecast: A bearish scenario would involve a rejection at the current resistance level and a move back towards the lower bound of the trading range. A break below the 0.618 Fibonacci level could see further downside towards the 0.786 level.

Scenario 3: Continuation of Consolidation

- Fundamental Analysis: Mixed signals from both economies or data coming in line with consensus may lead to continued uncertainty and range-bound trading for the USD/JPY pair.

- Technical Forecast: In this case, expect the pair to continue oscillating within the bounds of the current consolidation pattern, with key levels to watch being the Fibonacci retracement levels of 0.382 and 0.618 for potential pivots.

XAU/USD Outlook:

The XAU/USD, representing the gold to U.S. dollar exchange rate, is poised for potential volatility in response to the upcoming U.S. economic data releases. Gold is traditionally seen as a hedge against inflation and currency devaluation, making the U.S. inflation data, notably the core PCE Price Index, a significant determinant of XAU/USD price movements. Should inflation data exceed expectations, suggesting heightened inflationary pressures, gold may appreciate as investors seek its refuge against the diminishing value of fiat currency, leading to an increase in XAU/USD. Conversely, if inflation appears to be under control or below expectations, the perceived need for this hedge diminishes, potentially leading to a decrease in XAU/USD as the dollar strengthens on the prospect of moderated Federal Reserve tightening.

In the context of the broader economic framework, agents will analyze how the GDP and jobless claims impact risk sentiment, which inversely correlates with gold prices. Robust GDP growth and falling jobless claims could spur risk-on behavior, reducing gold’s attractiveness and pressuring XAU/USD lower as the dollar benefits from positive economic prospects. However, any signs of economic slowdown in the U.S. data might amplify gold’s safe-haven appeal, pushing XAU/USD higher. Market participants will maintain a vigilant stance, incorporating real-time data into their economic models to gauge the strength of the U.S. economy and the Federal Reserve’s potential policy path. These models will inform their market bias, with a keen understanding that gold’s volatility is often magnified by unexpected economic indicators, leading to swift and pronounced market reactions in the XAU/USD rate.

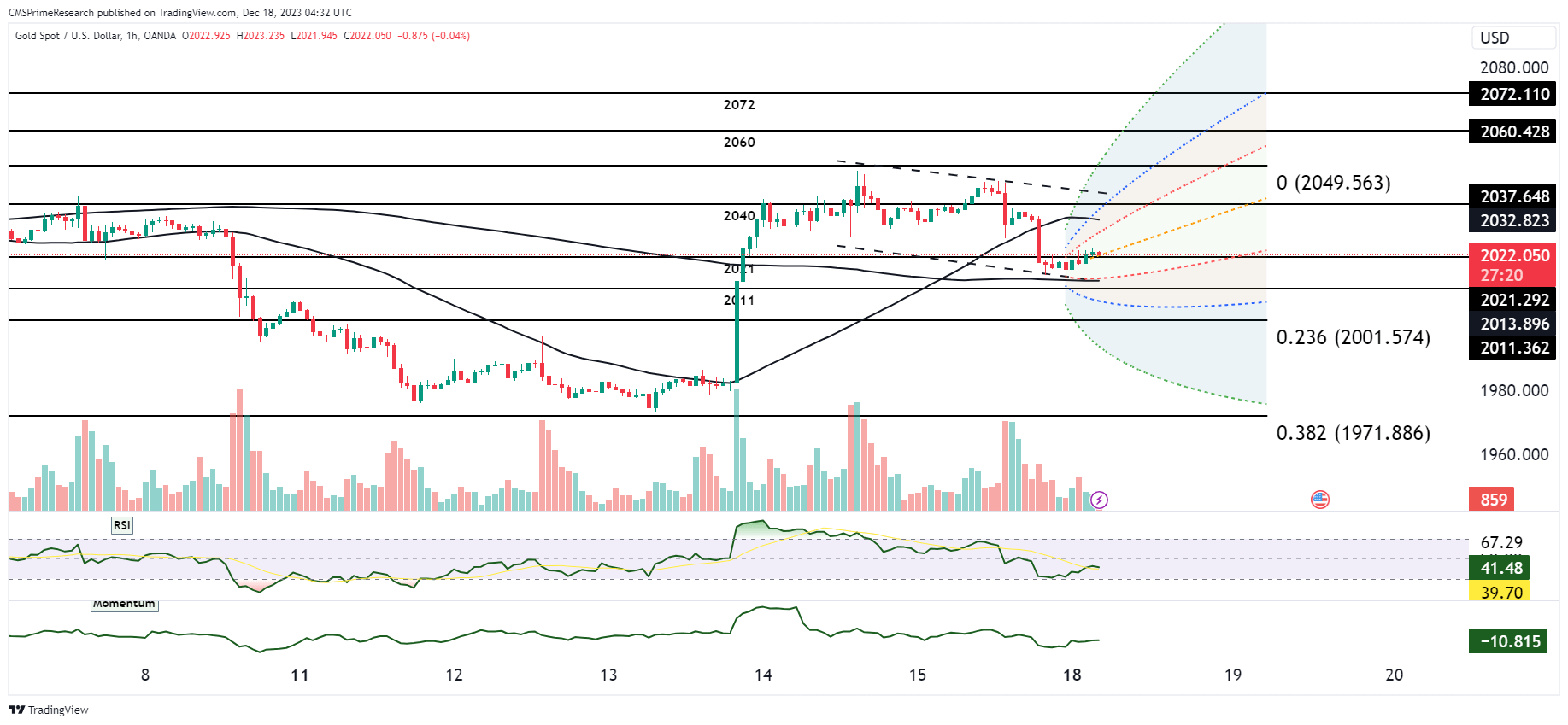

Gold Price Technical Snapshot:

Scenario 1: Bullish for Gold

- Fundamental Analysis: If the US economic data (such as GDP, jobless claims, or personal income) comes in weaker than expected, it could suggest economic slowing, leading investors to seek safe-haven assets like gold.

- Technical Forecast: A weaker dollar could lead to a breakout above the current resistance levels on the technical chart. If gold breaks above the 0 level of the Fibonacci extension, it could target the next resistance levels marked by the Fibonacci lines at 0.236 or higher.

Scenario 2: Bearish for Gold

- Fundamental Analysis: Strong US economic data, suggesting a robust economy, could strengthen the dollar and diminish gold’s appeal. Moreover, if the market interprets the economic data as a trigger for the Federal Reserve to continue with or intensify monetary tightening, it could lead to lower gold prices.

- Technical Forecast: Gold prices may face rejection at the current levels and could retreat towards the support levels. A move below the current Fibonacci 0 level could see gold targeting the 0.236 retracement level, with further downside potential to the 0.382 level if the bearish momentum is strong.

Scenario 3: Sideways Movement

- Fundamental Analysis: Mixed or as-expected economic data may lead to uncertainty, with traders and investors taking a wait-and-see approach. This could result in gold prices moving sideways.

- Technical Forecast: In this scenario, gold might continue to consolidate within the current trading range. Key levels to watch would be the recent highs and lows, with the potential for the price to oscillate between the Fibonacci 0 level as a pivot point and the 0.236 level for support and resistance.

Volatility Considerations:

Central Bank Monetary Policies and Interest Rate Decisions: The stances and actions of major central banks, particularly the Federal Reserve, European Central Bank, and Bank of Japan, significantly influence currency values. Any divergence in their policy directions can cause substantial volatility, as it affects yield differentials and investment flows between currencies. For instance, an unexpected hawkish turn by one central bank while others maintain or increase dovishness can lead to rapid shifts in currency pairs. This interplay can trigger a contagion effect, where a policy change in one region spills over and affects global markets.

Economic Data Releases and Indicators: Key economic indicators such as GDP growth rates, inflation figures, jobless claims, and retail sales provide insights into the health and direction of economies. Surprises in this data, whether positive or negative, can lead to swift market reactions. For example, higher-than-expected inflation may prompt expectations of more aggressive monetary policy, affecting currencies and commodities like gold. The interconnectedness of global markets means that significant data releases in one country can influence investor sentiment and economic expectations worldwide, potentially leading to contagion effects.

Geopolitical Developments and Global Risk Sentiment: Geopolitical events and shifts in global risk sentiment can lead to sudden changes in market dynamics. For example, escalating tensions in a particular region can lead to a flight to safety, benefiting currencies like the USD and safe-haven assets like gold. Conversely, a de-escalation of risks or positive geopolitical developments can enhance risk appetite, influencing currency and commodity markets. These shifts can have contagion effects as they alter the flow of capital across borders and affect investor confidence globally.

Currency Specific Factors and Cross-Market Dynamics: Each currency pair has unique drivers that can cause volatility. For instance, the GBP/USD pair may be influenced by specific UK economic data or political developments, while USD/JPY is sensitive to Japanese monetary policy and U.S. economic indicators. Additionally, cross-market dynamics, such as the relationship between the U.S. dollar and commodity prices, can also contribute to contagion risk. A significant movement in one currency pair or market can have a knock-on effect on others, as traders adjust their portfolios in response to changing conditions.

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.