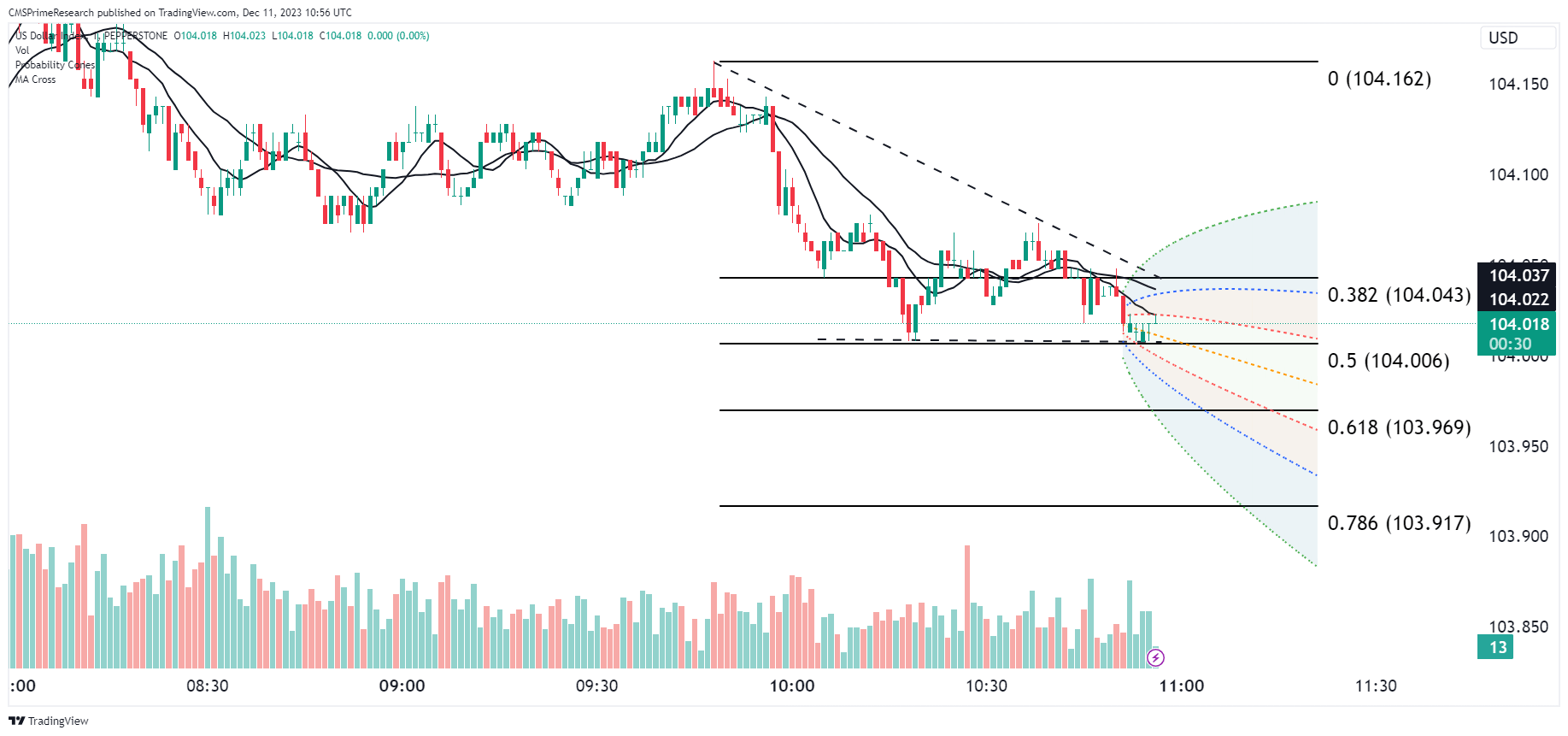

Dollar Index:

As of December 11, 2023, several economic events and news are impacting the US dollar (USD):

Anticipated Inflation Data and Federal Reserve Meeting: Investors are cautious ahead of inflation data from India and the US and the US Federal Reserve monetary policy meeting later this week. These events could potentially impact the USD.

US Job Market: The US added 199,000 jobs in November 2023, which was better than the forecast of 185,000 jobs. This positive job market data could strengthen the USD as it indicates a healthy US economy.

US Federal Reserve’s Monetary Policy: Goldman Sachs forecasts the U.S. Federal Reserve delivering the first rate cut in the third quarter of next year, earlier than its previous forecast of the fourth quarter, citing better inflation news. This could potentially impact the USD as interest rate cuts usually lead to a depreciation of the currency.

Oil Market Fluctuations: The price of benchmark U.S. oil has risen to $71.63 per barrel, which could potentially influence the USD due to the interconnectedness of oil prices and the US economy.

China’s Economic Data: China’s consumer prices data showed that CPI inflation fell the fastest in three years in November. This could potentially impact the USD due to the significant economic relationship between the US and China.

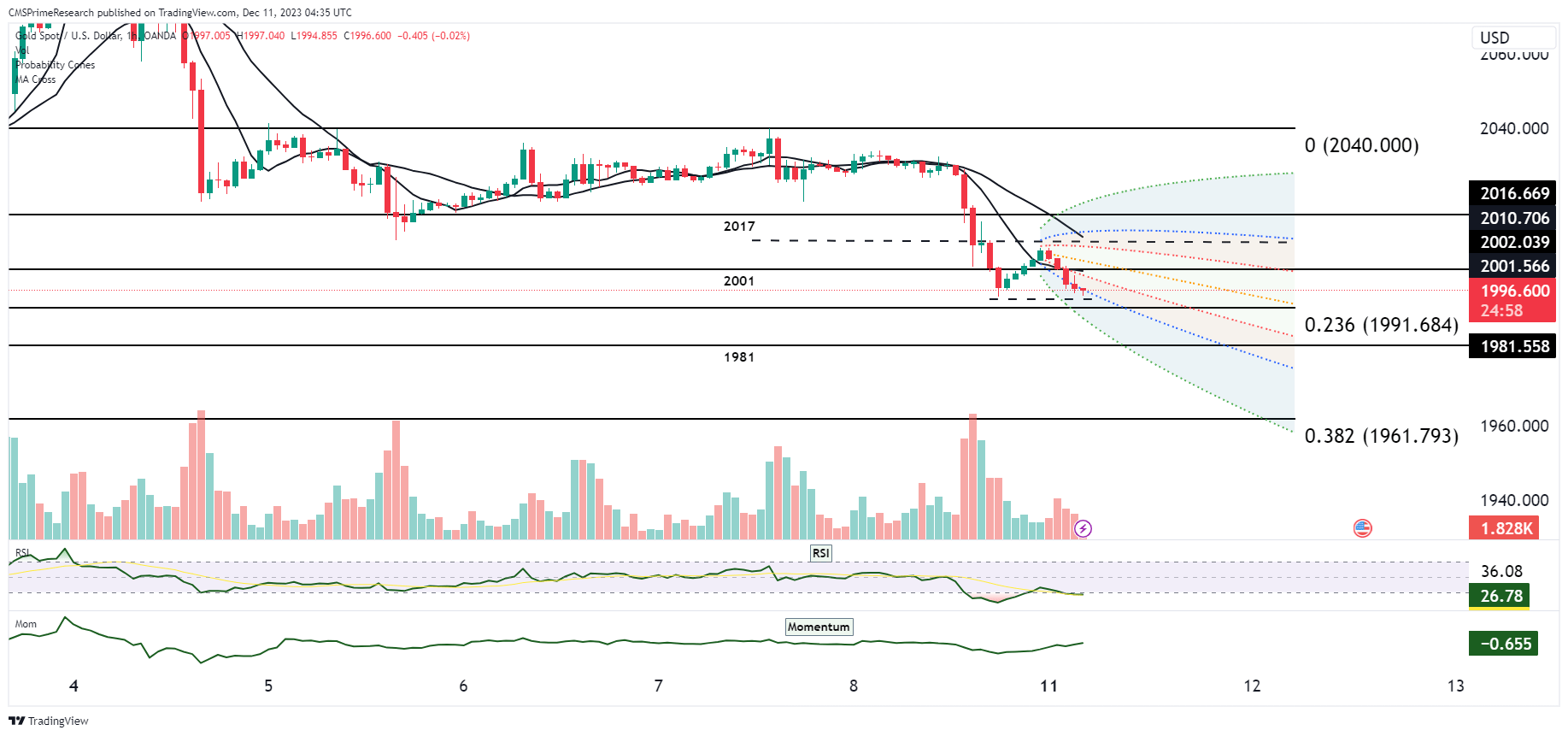

Upcoming Events for the week:

This week poses an crucial and one of the most volatile of the year with Key Central Bank Decisions and Major Economic Data’s.

Key events like the U.S. Consumer Price Index (CPI) data, Federal Open Market Committee (FOMC) interest rate decision, and Fed Press Conference are critical for the USD. CPI data reflect inflation levels, and any deviation from expectations can cause volatility in the currency as markets reassess the potential for future rate hikes. Higher-than-expected inflation figures typically lead to a stronger dollar on expectations of continued aggressive monetary policy tightening, whereas lower figures might suggest a nearing end to rate hikes, potentially weakening the USD. The FOMC decision and subsequent press conference will provide direct insights into the Fed’s economic outlook and policy direction. If the Fed signals a pause in rate hikes or a more dovish stance, it could result in a weaker dollar, as less aggressive monetary tightening diminishes the currency’s yield advantage. Conversely, a more hawkish tone, suggesting further rate increases to combat inflation, could strengthen the USD.

For pairs like the GBP/USD, events such as the UK’s Unemployment Rate and Employment Change will be in focus. Strong labor market data typically bolster the pound as they suggest economic resilience, potentially prompting the Bank of England to adopt a more hawkish stance. This could lead to an appreciation of the GBP against the USD, especially if the U.S. data leans dovish. However, if UK employment data disappoints, indicating economic weakness, the GBP could weaken, particularly if paired against a USD bolstered by hawkish Fed communication.

The EUR/USD pair will similarly be affected by the ECB Interest Rate Decision and subsequent press conference. Should the ECB take a more aggressive stance on inflation than the Fed, the euro could appreciate against the dollar. In contrast, a more cautious or dovish ECB could see the EUR depreciate against a potentially hawkish USD. In summary, the interplay of these events will shape market expectations and influence the strength or weakness of the involved currencies. Traders will closely monitor these releases, adjusting their positions in anticipation of or in reaction to these economic indicators and policy decisions, leading to potentially heightened volatility and trend formation in the currency markets.

EUR USD Outlook:

The Consumer Price Index (CPI) data from the U.S. serve as a key indicator of inflation and play a critical role in shaping the Federal Reserve’s monetary policy. If the CPI figures reveal higher inflation than expected, the market might anticipate continued or even more aggressive interest rate hikes by the Fed to curb inflation. This would typically bolster the USD as higher interest rates tend to attract more foreign capital to U.S. denominated assets, increasing demand for the dollar. Conversely, if the CPI data show a cooling in inflation, it might suggest a slower pace of rate hikes or a potential pause, which could weaken the USD against the EUR as investors seek higher yields elsewhere.

The Fed’s Interest Rate Decision and subsequent press conference will further clarify the central bank’s stance. A hawkish Fed, signaling further rate increases or a commitment to maintaining current rates to combat inflation, would likely strengthen the USD against the EUR. On the other hand, a dovish tone indicating a more cautious approach to rate hikes could lead to a softer USD, as the currency’s interest rate advantage diminishes.

The European Central Bank’s (ECB) actions and commentary during the same period will also contribute to EUR/USD movements. If the ECB indicates a tightening policy in response to inflation or economic growth concerns, it could lead to an appreciation of the euro against the dollar, especially if the Fed’s stance is more dovish. A strong response from the ECB might also influence European bond yields, which, if they rise, could attract investment into euro-denominated assets, further strengthening the EUR.

However, if the ECB takes a more cautious or dovish stance compared to the Fed, the spillover effect could lead to a depreciation of the EUR against the USD. Investors tend to move capital towards currencies with higher relative yields, so a stronger policy response from the Fed would make USD assets more attractive.

For the EUR/USD pair, a significant deviation from expected CPI or interest rate decisions in the U.S. could trigger a market reaction that extends beyond the dollar, influencing global risk sentiment and asset prices. For instance, a surprisingly high U.S. inflation figure could raise fears of a more pronounced global inflationary environment, potentially leading to a broader market sell-off and a flight to safety, which traditionally benefits the USD as a safe-haven currency.

Conversely, a lower-than-expected inflation rate might alleviate some concerns about global inflation, leading to an increased appetite for riskier assets, including European equities and bonds, which could support the EUR.

In conclusion, the EUR/USD pair will be impacted by the relative policy stances of the Fed and ECB, the data’s implications for economic health and inflation, and the subsequent risk sentiment that arises. Traders and investors will need to monitor these events closely, as they can lead to significant volatility and trend shifts in the currency markets.

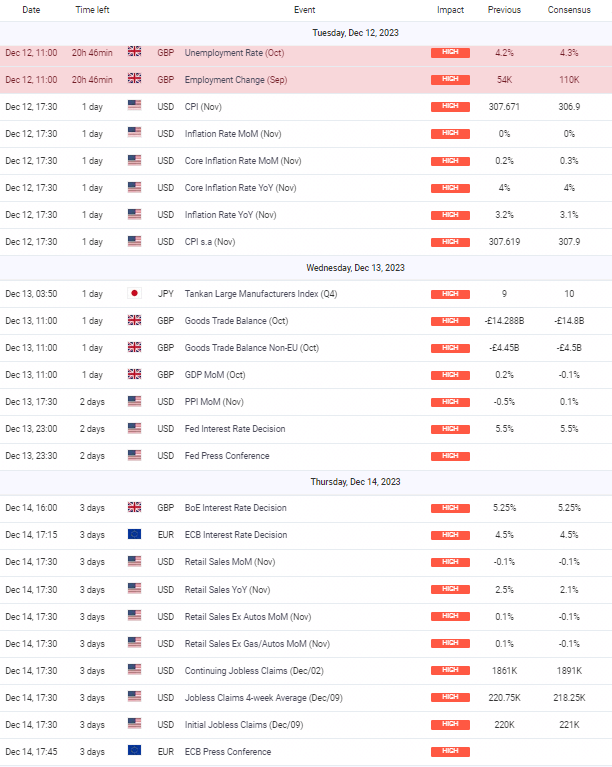

EUR/USD Technical Snapshot:

Scenario Analysis for EUR/USD: Week Ahead Forecast

Scenario 1: Bullish Breakout

- Technical Indicators: EUR/USD breaks above the 0.236 Fibonacci level at 1.08107, with the potential to test the 0.786 level at 1.08656.

- Fundamental Catalysts: If U.S. CPI data indicates a slowdown in inflation, the dollar could weaken, giving the euro a boost. Additionally, positive employment change data from the Eurozone could support the euro’s rise.

Scenario 2: Consolidation and Sideways Movement

- Technical Indicators: The pair may consolidate within the recent trading range, bounded by the 0.236 and 0.618 Fibonacci levels, due to converging moving averages.

- Fundamental Catalysts: Mixed data from both the Eurozone and U.S. economies could result in a lack of clear directional movement, with the market weighing various signals.

Scenario 3: Bearish Downturn

- Technical Indicators: Failure to breach the 0.236 Fibonacci level and a move below the 0.382 level at 1.06766 could signal a bearish trend, with potential to target lower Fibonacci levels.

- Fundamental Catalysts: Stronger-than-expected U.S. inflation data or a hawkish Fed stance could strengthen the dollar. Conversely, weak data from the Eurozone, such as disappointing retail sales or employment figures, could pressure the euro.

GBP USD Outlook:

The UK’s employment data, including the Unemployment Rate and Employment Change, will likely have a direct impact on the GBP. Positive labor market data could strengthen the GBP as it suggests economic resilience and could prompt the Bank of England (BoE) to consider tightening monetary policy to manage inflationary pressures, making the GBP more attractive to investors seeking yield.

However, if the US CPI data indicates higher inflation, expectations for continued aggressive monetary policy by the Federal Reserve could strengthen the USD, potentially causing GBP/USD to fall. Should the US CPI come in lower than expected, indicating a potential slowing in the Fed’s rate hike cycle, the USD could weaken, potentially causing GBP/USD to rise if the UK employment data is strong or meets expectations.

The Federal Reserve’s interest rate decision and press conference are pivotal events that can cause significant spillover effects. A hawkish Fed, hinting at further rate hikes, can lead to a stronger USD as investors anticipate higher returns from dollar-denominated assets. This could weaken GBP/USD, especially if the BoE’s policy stance is relatively more dovish or less decisive.

In contrast, a dovish Fed could lead to capital flows into assets denominated in other currencies, including the GBP, if the BoE is perceived to be on a more hawkish path or if the UK economic data suggests a stronger economic outlook compared to the US. This would likely cause GBP/USD to rise.

For example, a significantly higher-than-expected US CPI could raise global inflation concerns, prompting a flight to safety and possibly strengthening the USD across the board due to its safe-haven status, which could negatively impact GBP/USD.

On the other hand, if the US CPI is lower than expected, alleviating some inflation concerns, this could improve risk sentiment globally. Investors might seek higher yields in other markets, benefiting the GBP if the UK’s economic outlook is favorable, potentially leading to an appreciation of GBP/USD.

In summary, GBP/USD will be influenced by the interplay between UK labor market data and the Federal Reserve’s policy actions and signals. The pair is likely to experience volatility around these events as market participants adjust their expectations for monetary policy and economic performance in both the UK and the US.

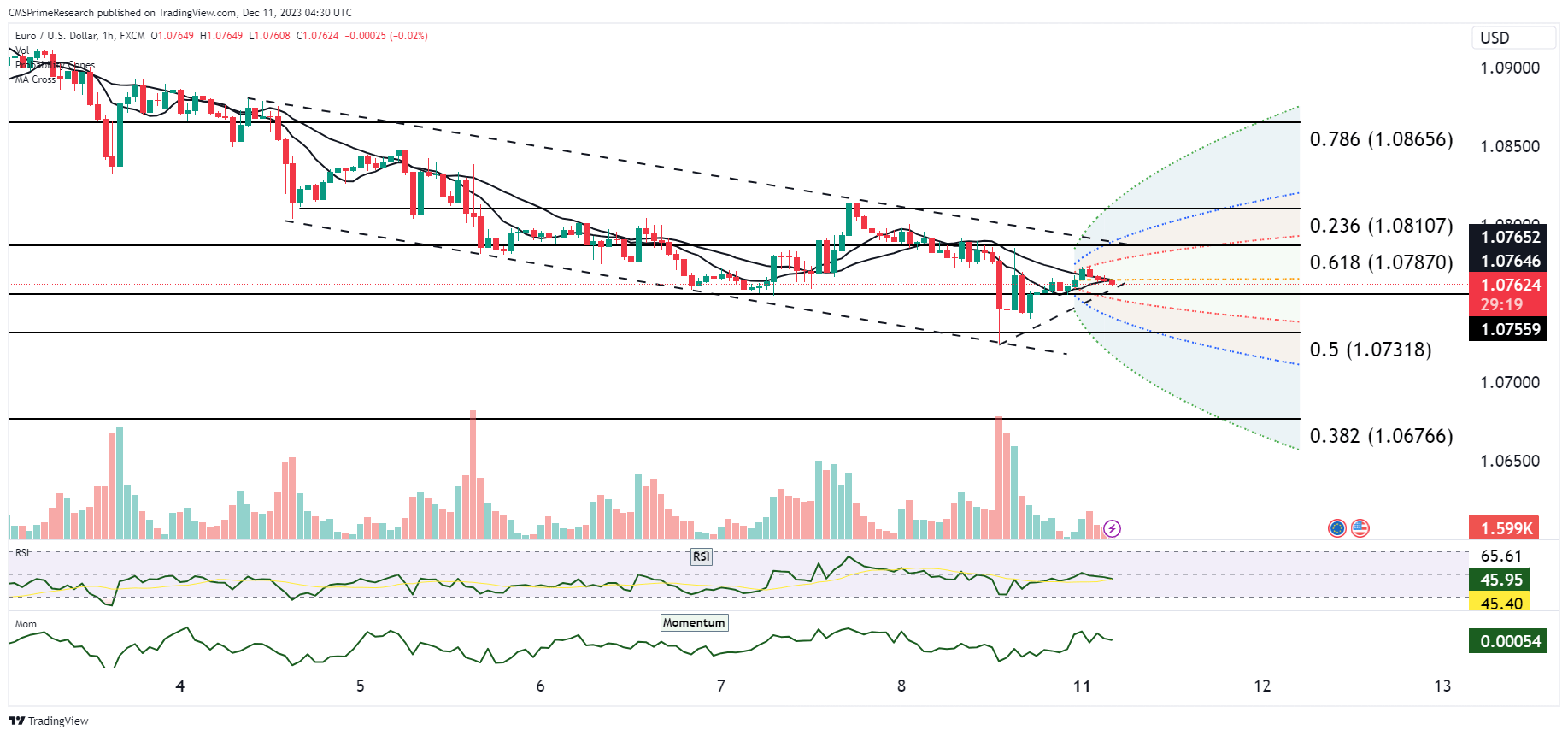

GBP/USD Technical Snapshot:

Scenario 1: Bullish Breakout

- Technical Indicators: A move above the 0.618 Fibonacci level at 1.25944 could signal a bullish trend, aiming for the 0.786 level at 1.26908.

- Fundamental Catalysts: Positive UK employment data or a higher than expected unemployment rate could weaken the pound, however, if US CPI and core inflation data show a deceleration in inflation, it could result in dollar weakness, contributing to a GBP/USD rally.

Scenario 2: Range-Bound Trading

- Technical Indicators: The currency pair might oscillate around the 0.5 Fibonacci level at 1.25267, indicating consolidation within the current price channel.

- Fundamental Catalysts: In the absence of significant deviations from expected economic data, the GBP/USD may trade within a range. This could be reinforced by balanced market sentiment ahead of the Fed and BoE interest rate decisions.

Scenario 3: Bearish Decline

- Technical Indicators: Failure to break the 0.5 Fibonacci level, followed by a decline below the 0.382 level at 1.24591, could suggest a bearish momentum, potentially targeting lower support levels.

- Fundamental Catalysts: Stronger than anticipated US inflation figures and hawkish remarks from the Fed could boost the dollar. Conversely, disappointing UK data, particularly if the BoE takes a less hawkish stance than expected, could pressure the pound.

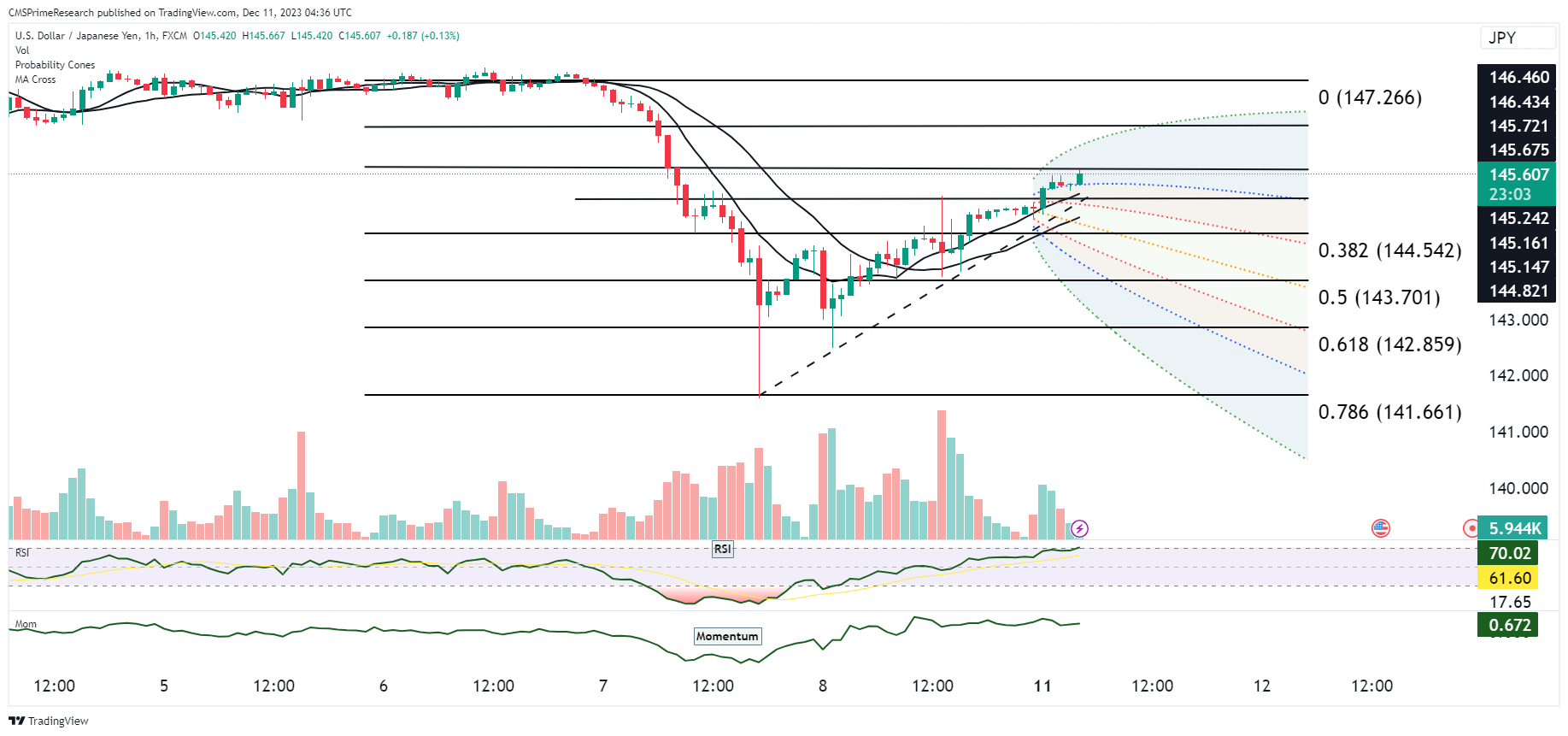

USD/JPY Outlook:

For USD/JPY, the US CPI data release is a crucial event. A higher-than-expected CPI reading would indicate persistent inflationary pressures, which could lead the Federal Reserve to continue its hawkish stance with interest rate hikes, thus strengthening the USD. Given that Japan’s interest rates have remained persistently low, a widening interest rate differential would make the USD more attractive than the JPY, leading to a rise in USD/JPY.

Conversely, if the CPI data show a deceleration in inflation, suggesting the possibility of a dovish turn by the Fed, the USD could weaken. In this scenario, USD/JPY could potentially decline, especially if investors start to seek safety in the yen, which is often considered a safe-haven currency during times of uncertainty or reduced risk appetite.

The FOMC’s interest rate decision and the subsequent press conference are also pivotal for USD/JPY. A strong commitment by the Fed to tackle inflation with further rate hikes could see the USD/JPY moving higher, as yield-seeking capital flows into higher-yielding US assets. If the Fed signals a more cautious approach or a pause in the rate hike cycle, it could lead to capital outflows from the USD, potentially benefiting the JPY.

Japan’s Tankan Large Manufacturers Index will also provide insight into the health of the Japanese manufacturing sector, which could influence the JPY. Stronger than expected data could lend support to the yen, while weaker data could weaken it, especially if paired with a strong USD narrative from the Fed.

For instance, an unexpectedly high US inflation number could raise concerns of global inflationary pressures and potentially lead to risk-off market behavior. In such a scenario, the yen might strengthen against the USD due to its safe-haven appeal, despite the interest rate differential.

Conversely, lower-than-expected inflation in the US might reduce concerns about aggressive rate hikes by the Fed, improving global risk sentiment. This could lead to a weaker yen if investors move towards riskier assets, thereby potentially increasing USD/JPY.

In summary, the interplay between the US and Japanese economic indicators and central bank policies will significantly influence the USD/JPY currency pair.

Scenario 1: Bullish Trend Continuation

- Technical Indicators: USD/JPY moves above the current resistance level, testing the 0 Fibonacci level at 147.266.

- Fundamental Catalysts: A higher-than-expected US CPI or a strong Jobs Openings report could reinforce expectations of the Fed maintaining a hawkish stance, bolstering the dollar against the yen.

Scenario 2: Consolidation

- Technical Indicators: The pair may consolidate between the 0.382 Fibonacci level at 144.542 and the 0 Fibonacci level at 147.266, as the market digests incoming data.

- Fundamental Catalysts: Mixed economic indicators or cautious market sentiment ahead of the Fed’s interest rate decision could lead to narrow trading ranges.

Scenario 3: Bearish Reversal

- Technical Indicators: A break below the 0.382 Fibonacci level could suggest a bearish turn, with the potential to test the 0.618 level at 142.859.

- Fundamental Catalysts: Surprising dovish remarks from the Fed or significantly lower-than-expected US inflation data could weaken the dollar, while an unexpectedly strong Tankan Large Manufacturers Index could boost the yen.

XAU/USD Outlook:

The US Consumer Price Index (CPI) data is a critical determinant of gold prices. If inflation figures come in higher than expected, it could lead to a short-term drop in gold prices (XAU/USD) as markets anticipate more aggressive rate hikes by the Federal Reserve, which would bolster the USD. However, in the medium to long term, persistent inflation may actually increase the appeal of gold as an inflation hedge, potentially pushing XAU/USD higher.

On the other hand, if the CPI data shows a cooling of inflation, expectations of a less aggressive rate hike path may weigh on the USD, which could lead to a rise in gold prices. The perception that the Fed might ease up on rate increases can decrease the opportunity cost of holding non-yielding assets like gold, making it more attractive to investors.

The Federal Reserve’s interest rate decision and subsequent press conference will provide further direction. A hawkish Fed, indicating the likelihood of continued rate hikes to tackle inflation, could initially strengthen the USD, pressuring XAU/USD downward. Conversely, dovish signals from the Fed could lead to a softer USD and a rally in gold prices.

Moreover, global central banks’ reactions to the Fed’s policy moves could create spillover effects. If other central banks are perceived to be less aggressive than the Fed, the resulting strength in the USD could push XAU/USD lower. If other central banks match or exceed the Fed’s hawkishness, it could lessen the USD’s relative strength and support higher gold prices.

For example, significantly higher US inflation could increase fears of global inflation, which might lead to a flight to traditional safe havens like gold, pushing XAU/USD higher. Conversely, if US inflation is more contained than expected, reducing the urgency of rate hikes, it could improve risk sentiment and encourage investment in riskier assets at the expense of safe havens like gold, potentially leading to lower gold prices.

In summary, the interplay of US inflation data, Federal Reserve policy decisions, and global central bank reactions will significantly influence the direction of XAU/USD.

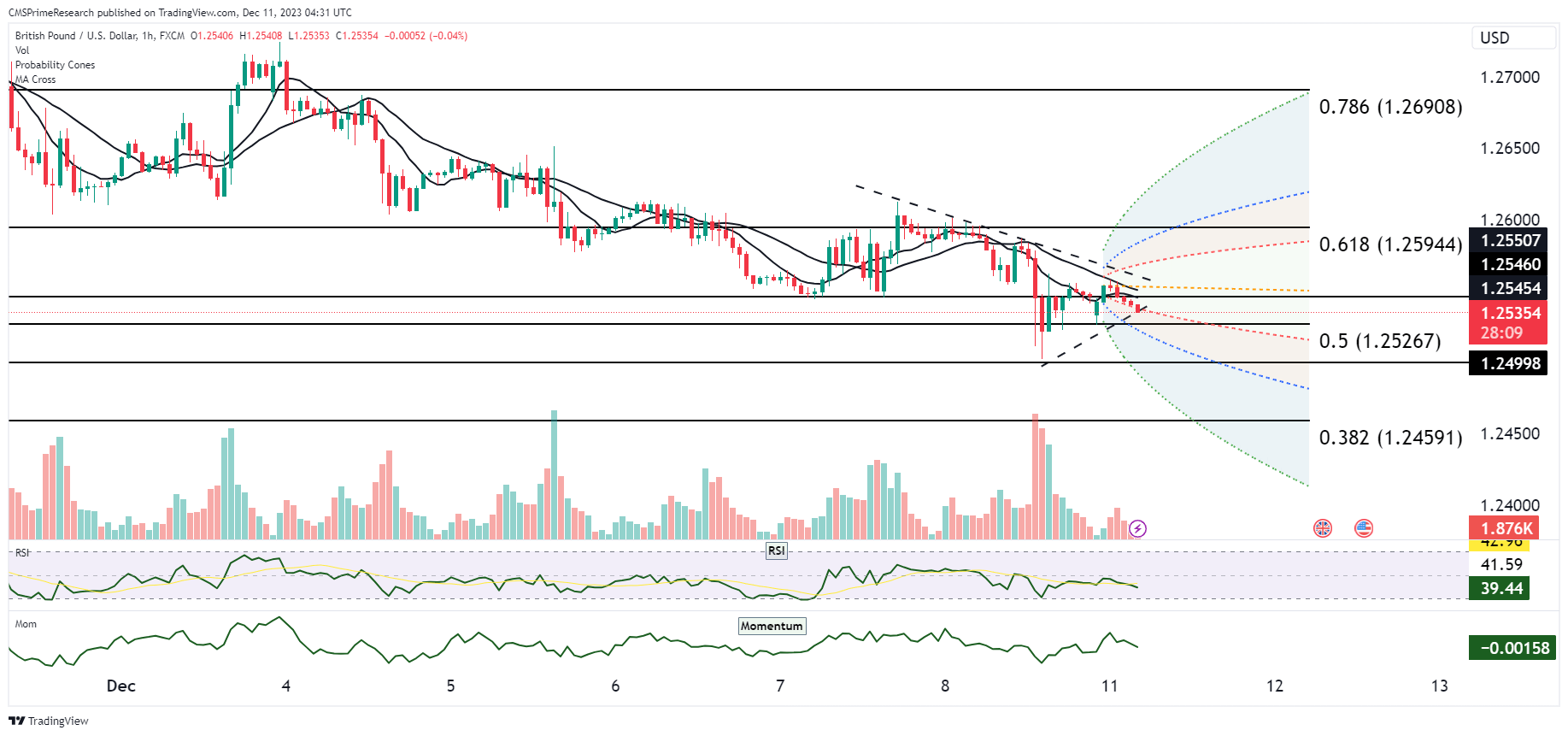

Gold Price Technical Snapshot:

Scenario 1: Bullish Momentum

- Technical Indicators: Gold prices breaking above the 0 level at 2040.000 USD could signal a strong bullish trend, targeting further highs.

- Fundamental Catalysts: Weaker-than-expected U.S. CPI data could lead to a weaker dollar, enhancing gold’s appeal. Negative real yields often make gold, a non-interest-bearing asset, more attractive.

Scenario 2: Consolidation Phase

- Technical Indicators: XAU/USD may hover around the key psychological level of 2000 USD, indicating a period of consolidation.

- Fundamental Catalysts: Market players could adopt a wait-and-see approach ahead of the Fed interest rate decision, leading to gold trading within a tight range.

Scenario 3: Bearish Correction

- Technical Indicators: A reversal from the current levels could see gold prices decline towards the 0.236 Fibonacci retracement level at 1991.684 USD.

- Fundamental Catalysts: Strong U.S. economic data, including higher CPI or positive labor market insights, could strengthen the dollar and put pressure on gold prices. Additionally, a hawkish stance from the Fed could further drive a bearish scenario for gold.

Volatility Considerations:

Central Bank Policies and Interest Rate Decisions: The stances and decisions of central banks, particularly the US Federal Reserve (Fed) and the European Central Bank (ECB), are pivotal. The direction of interest rates affects yield differentials between currencies and can cause significant capital flows, which in turn drive volatility in currency pairs. Hawkish stances indicating rate hikes can strengthen a currency, while dovish signals can weaken it.

Inflation Data: Inflation indicators, such as the Consumer Price Index (CPI), play a critical role in shaping market expectations for central bank actions. Higher-than-expected inflation typically leads to expectations of tighter monetary policy, affecting currencies by driving up yields. Inflation data can also impact gold prices, with higher inflation potentially increasing gold’s attractiveness as an inflation hedge.

Economic Indicators: Employment data, manufacturing indexes, trade balances, and other economic indicators provide insights into the health of economies. Strong data can bolster a currency by suggesting economic resilience and potential for monetary policy tightening. Conversely, weak data can lead to a currency’s depreciation if it implies economic softness and a possible accommodative policy response.

Market Sentiment and Risk Appetite: Global economic outlooks, geopolitical tensions, and cross-market contagion risks influence investor sentiment and risk appetite. In times of uncertainty or risk-averse sentiment, safe-haven currencies like the USD and JPY, as well as gold, may see increased demand. Conversely, positive risk sentiment can lead to capital flows into riskier assets, affecting the value of these safe havens and the currencies of emerging markets.

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.