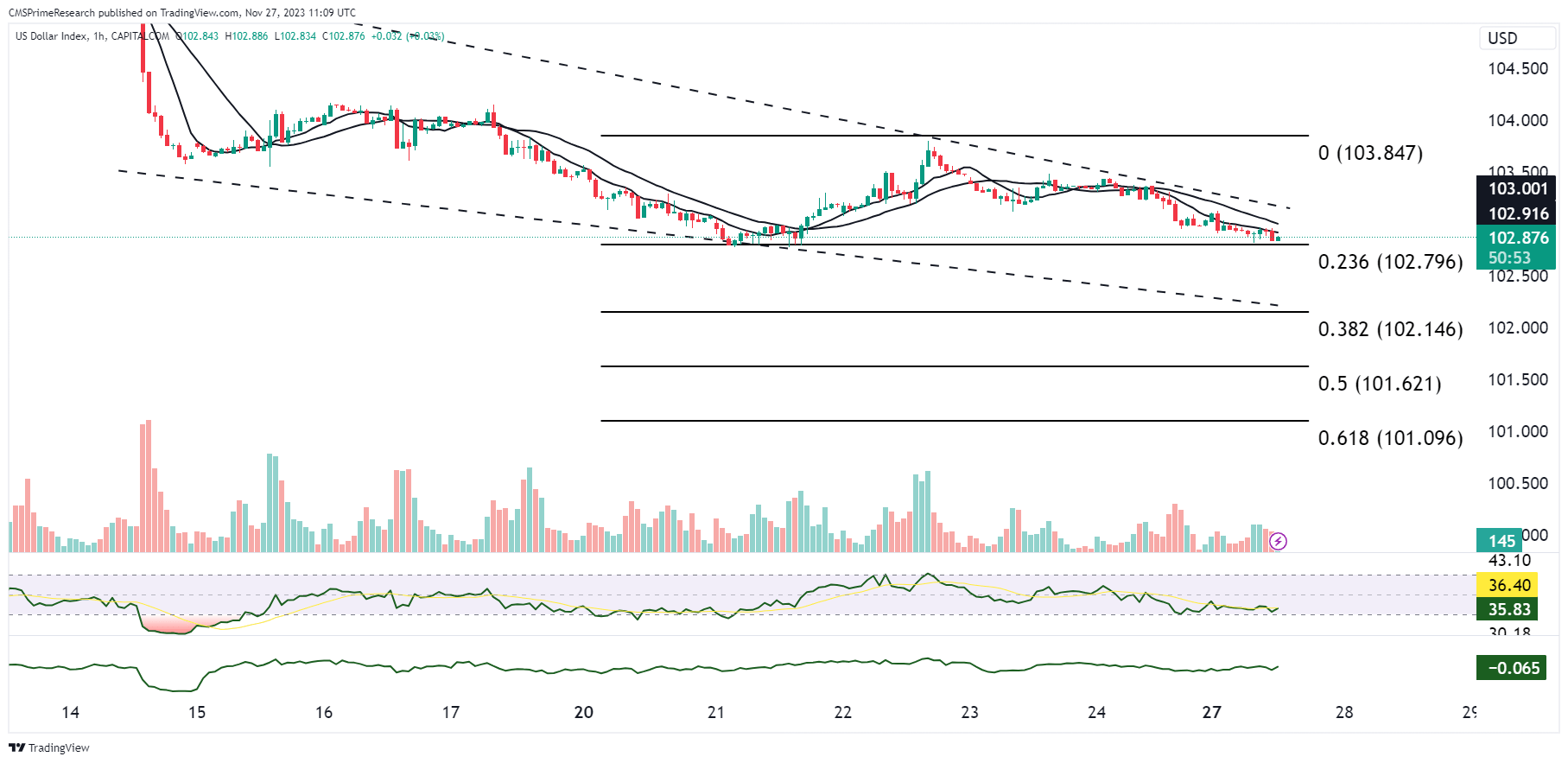

Dollar Index:

As of November 27, 2023, several key events and news are impacting the USD price:

1. GBP/USD may be headed for 1.27, pointing to a possible dollar slump vis-à-vis sterling.

2. Against the pound and euro, the dollar has been weakened, with the latter reaching a high of $1.2620 for more than two months and the euro adding 0.2% at $1.0952.

3. The chance of market pricing is around 23% chance that the Federal Reserve eases monetary policy may start next March.

- The dollar weakened early Monday morning, with UniCredit Research anticipating “moderate dollar weakness” over the next two years as U.S. growth outperformance diminishes and interest rate cuts cause rate differentials between U.S. and other G-10 countries.

- Asian stocks turned to the red and US equity futures fell as the optimism following last week’s equity rally was dimmed by China’s slow industrial profit growth.

- The dollar fell by 3 percent on a basket of major counterparts this month, with the euro up at $1.0952 on Monday, not far from its four month high value of $1.0965, while the dollar weakened against a generally stronger Yen.

In Conclusion, the dollar has weakened against several currencies on several occasions, which is perhaps an indication of anticipated easing of the monetary policy by the Federal Reserve among other factors.

Upcoming Events for the week:

The upcoming week presents several pivotal economic events that can significantly influence currency markets, particularly the USD and EUR pairs. On Monday, November 27, 2023, market participants will be eyeing the New Home Sales data in the United States, with a previous monthly change of 1.23 million units sold and a consensus pointing to a 4% decline. A figure exceeding the consensus could bolster USD as it would indicate a resilient housing market, potentially leading to a bullish sentiment for the USD against other currencies. Conversely, a disappointing outcome could amplify concerns about economic slowdown, prompting a bearish response.

Midweek on Wednesday, November 29, the spotlight shifts to trade balance and GDP growth rate data. The Goods Trade Balance previously recorded a $87.7B deficit, with consensus estimates leaning towards a narrower deficit of $92B, which could imply an improvement in net exports that may support the USD. The GDP Growth Rate Quarter over Quarter for Q3 is expected to show a rise to 5% from the prior 2.1%. A higher GDP growth rate could signal robust economic activity, possibly reinforcing USD strength, while a lower than anticipated figure could induce weakness against pairs like EUR/USD.

Towards the end of the week, attention turns to the European Union, with the Unemployment Rate for October and Inflation Rate Year Over Year for November set to be released on Thursday, November 30. The Unemployment Rate is anticipated to remain steady at 6.5%, while inflation is expected to inch up to 2.9% from 2.8%. These figures are critical for the EUR, with higher inflation potentially prompting a hawkish stance from the ECB, strengthening the EUR, especially if the Core PCE Price Index in the U.S., a key inflation indicator, underperforms its forecast of 0.3% against the previous 0.2%. Such scenarios are likely to cause heightened volatility in the EUR/USD pair, with traders positioning themselves to capitalize on these economic cues.

EUR USD Outlook:

Firstly, the upcoming release of the European Unemployment Rate and the Inflation Rate Year Over Year will be particularly influential for the EUR/USD currency pair. With the unemployment rate expected to hold steady and inflation projected to increase, these indicators suggest economic stability and potential upward pressures on prices within the Eurozone. An unemployment rate that remains flat could indicate a labor market that is not overheating, whereas an uptick in inflation may signal growing consumer demand, potentially prompting the European Central Bank (ECB) to consider tightening monetary policy. If inflation rates exceed expectations, traders might anticipate a more hawkish ECB, bolstering the Euro against the Dollar. On the flip side, if the inflation rate is lower than forecasted, it could raise concerns about the strength of the Eurozone’s recovery, leading to a bearish sentiment for the Euro.

Secondly, the Core Personal Consumption Expenditures (PCE) Price Index in the U.S. is a significant factor to watch. As the Federal Reserve’s preferred gauge of inflation, a higher than expected reading could reinforce the narrative of persistent inflationary pressures, potentially leading to a stronger USD as market participants price in more aggressive Fed action. Conversely, a reading below the consensus could dampen the Dollar’s strength as it might suggest a moderation in inflation that could sway the Fed to ease its tightening regime.

In the evaluation of these events, traders will likely scrutinize deviations from consensus figures, as larger discrepancies can result in heightened market volatility. They will also consider the broader economic context, including the pace of economic recovery post-pandemic, geopolitical tensions, and central bank policy trajectories. The cumulative effect of these data releases will drive trader bias and sentiment, with positive surprises for the Eurozone potentially driving the EUR/USD higher, while stronger U.S. data could have the opposite effect, reinforcing the Dollar’s position against the Euro.

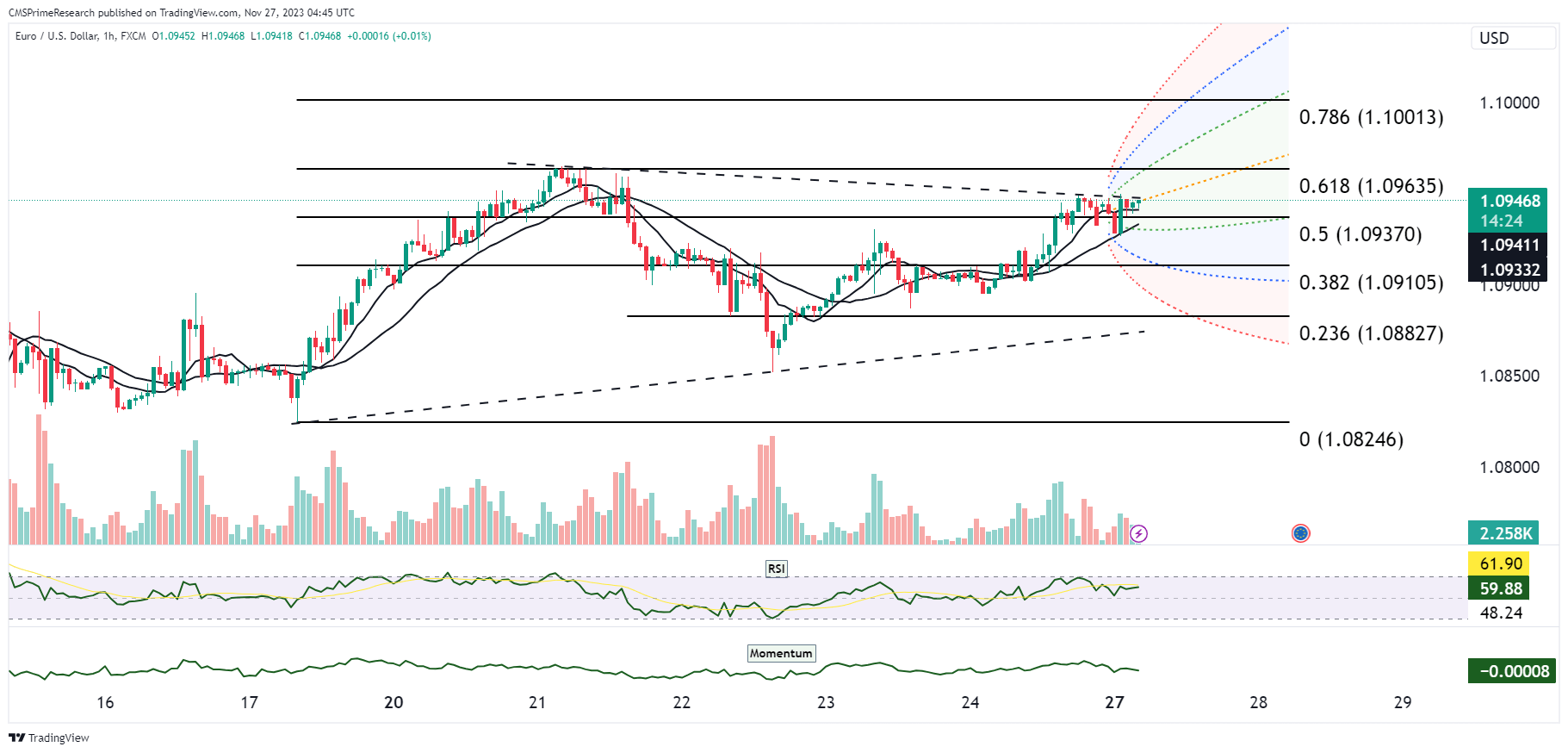

EUR/USD Technical Snapshot:

Scenario 1: Bullish Breakout

- Technical Indicators: EUR/USD surmounts the 1.0965 resistance, targeting the 1.1081 level marked by the 76.4% Fibonacci retracement of the July to October decline.

- Fundamental Catalysts: Positive Eurozone data or dovish remarks from Fed Chair Powell could fuel a rally. A breakout above 1.0965 could trigger stop-loss orders and propel the pair towards 1.1081.

Scenario 2: Consolidation

- Technical Indicators: Failure to breach 1.0965 may see EUR/USD enter consolidation. The pair might oscillate within the 1.0853 to 1.0965 range.

- Fundamental Catalysts: Absence of significant economic data or market-moving news could result in low volatility. Traders might adopt a wait-and-see approach, leading to a neutral stance within the identified range.

Scenario 3: Bearish Reversal

- Technical Indicators: A reversal at the 1.0965 resistance level, breaching the 10-day MA at 1.0901, suggests a potential top formation and a trend reversal.

- Fundamental Catalysts: Strong U.S. economic indicators or hawkish Federal Reserve policy signals could strengthen the dollar, pressuring EUR/USD. A break below 1.0901 could see the pair aiming for the October 3 low of 1.0448.

GBP USD Outlook:

The GBP/USD pair, colloquially known as ‘Cable’, is poised to experience market fluctuations in response to upcoming economic events, particularly those that influence the U.S. dollar, given the lack of significant GBP-centric data releases in the snapshot provided. The U.S. economic indicators, notably the Core PCE Price Index and the GDP growth rate data, will be the primary drivers for Cable’s movement. An upward deviation in the U.S. Core PCE Price Index would underscore persistent inflation, potentially leading to a stronger dollar as market expectations for continued Federal Reserve tightening increase. Such an outcome could result in a depreciation of GBP/USD as the dollar gains. Conversely, a lower than expected PCE could weaken the dollar, offering some lift to the pair as it would indicate a potential slowing in the Fed’s aggressive rate hikes.

Furthermore, the U.S. GDP growth rate, if it exceeds expectations, would signal robust economic momentum, likely bolstering the dollar’s appeal as a growth-linked currency. This scenario could see GBP/USD pressured lower as the economic performance gap between the U.S. and the U.K. widens, especially if U.K. economic data do not exhibit similar vigor. On the contrary, a disappointing GDP print could lead to a softening USD, providing an upward nudge to Cable if the market interprets the data as a sign of economic cooling that could temper the Fed’s hawkish stance.

In evaluating these dynamics, traders will consider not only the deviation from consensus figures but also the interconnected market dynamics and economic interplay. Sentiment spillover from the Eurozone, influenced by the European economic releases, could also affect the GBP/USD pair due to the close economic ties between the U.K. and the EU. For instance, higher Eurozone inflation might strengthen the Euro, which could indirectly influence the GBP through regional correlation effects. Traders will thus remain vigilant to the broader implications of these releases, factoring in global risk sentiment, the relative trajectory of central bank policies, and the overarching economic narratives to inform their bias and positioning on GBP/USD.

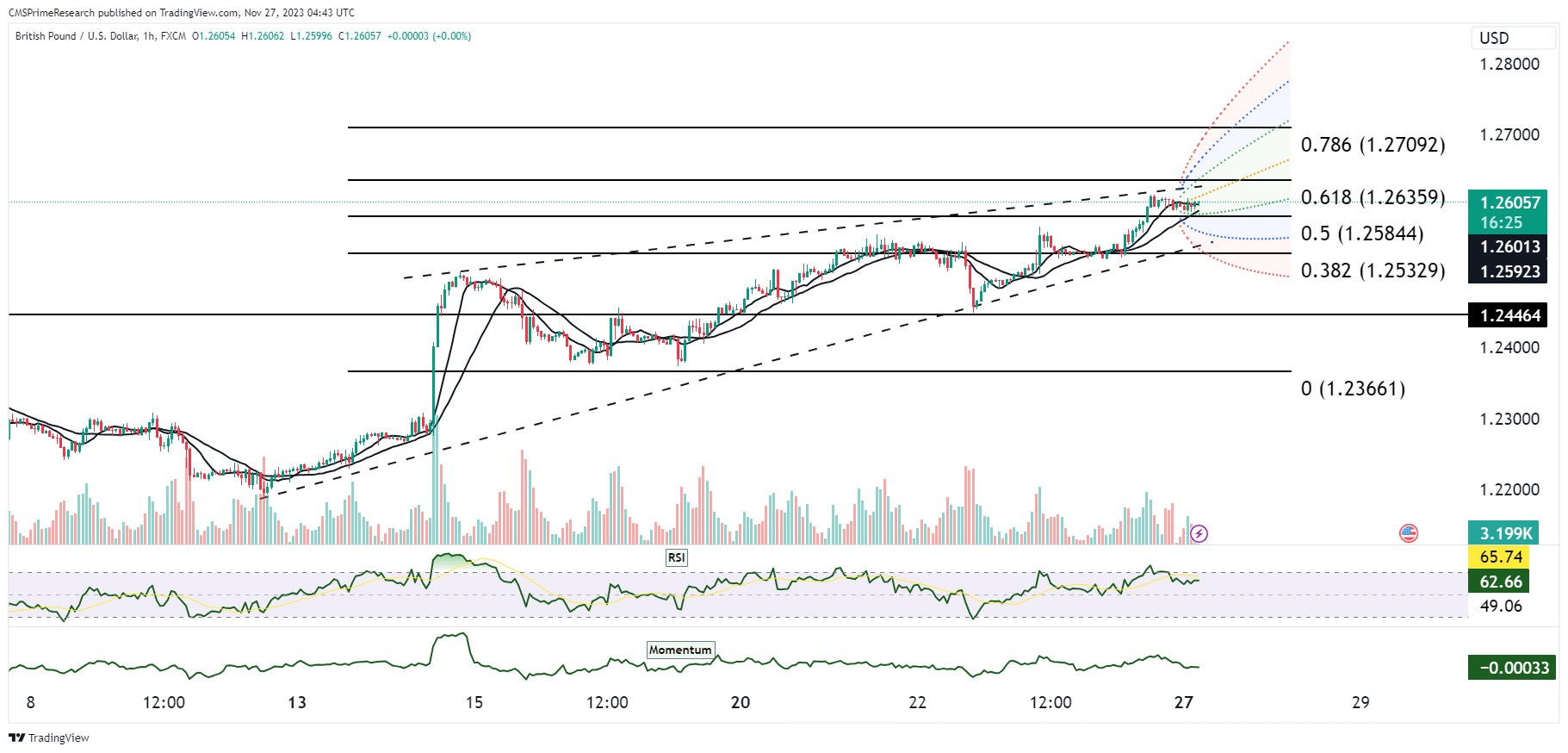

GBP/USD Technical Snapshot:

Scenario 1: Continued Uptrend

- Technical Indicators: GBP/USD targets the next Fibonacci retracement level at 1.2722 following the breach above the 200-day moving average.

- Fundamental Catalysts: A softer Fed rate hike outlook combined with positive UK economic reports could maintain bullish momentum. If the narrative remains unchanged, the 1.2722 level may be attainable.

Scenario 2: Range-Bound Trading

- Technical Indicators: The pair may oscillate between the recent high of 1.2516 and the support level indicated by the December 21 cloud twist at 1.2312.

- Fundamental Catalysts: In the absence of significant news, the pair could see range-bound activity with thin holiday trading conditions potentially limiting directional moves.

Scenario 3: Bearish Reversal

- Technical Indicators: A close below the 10-day moving average of 1.2506 could signal a weakening uptrend, putting initial support levels into focus.

- Fundamental Catalysts: Unexpected hawkish signals from the Fed or disappointing UK economic data could prompt a reversal. This scenario would look for a test of the 1.2506 level and potentially lower if bearish momentum intensifies.

USD/JPY Outlook:

The USD/JPY pair, sensitive to shifts in U.S. economic indicators due to Japan’s typically lower volatility economic data, will likely be affected by the upcoming U.S. Core PCE Price Index and GDP growth rate figures. An increase in the Core PCE Price Index above the forecast may reinforce expectations of persistent inflationary pressures, potentially prompting the Federal Reserve to maintain a hawkish stance. This could result in a stronger USD as market participants anticipate higher interest rates, leading to an appreciation of USD/JPY. Conversely, should the Core PCE Price Index fall below expectations, it might suggest an easing of inflationary pressures, which could lead to a weaker USD as the market scales back expectations for aggressive Fed policy, potentially causing USD/JPY to decline.

Similarly, the U.S. GDP growth rate data will hold considerable sway. A GDP figure that beats expectations would likely enhance the attractiveness of the USD by highlighting robust economic health, possibly leading to a rise in USD/JPY as investors seek yield in a growing economy. If the GDP data disappoints, it could raise concerns over the strength of the U.S. economy, possibly leading to a drop in USD/JPY as the differential in growth prospects between the U.S. and Japan narrows.

In the broader context, traders will need to assess the interconnected market dynamics and economic interplay, such as risk sentiment and the relative policy paths of the Fed versus the Bank of Japan. Additionally, spillover effects from other major economies, especially if there are significant surprises in Eurozone inflation or GDP, could influence global risk appetite, affecting safe-haven currencies like the JPY. Traders will adopt a network-interactive perspective, considering not only the direct impact of U.S. data on USD/JPY but also how shifts in major economies’ data can create cascading effects through global financial markets, influencing the pair indirectly. The evaluation of such events will require a nuanced understanding of global economic linkages, with particular attention to the diverging monetary policies of the Fed and the Bank of Japan.

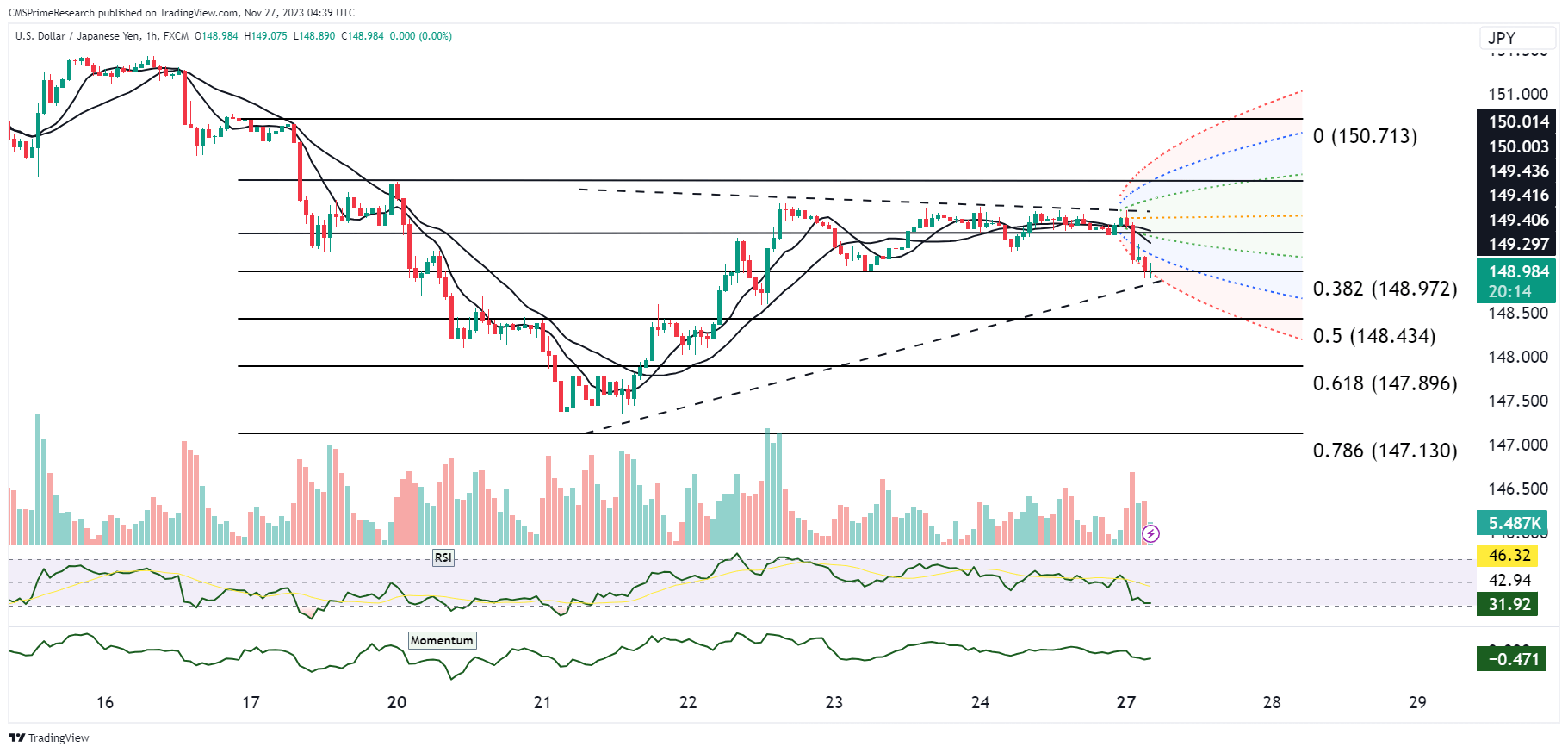

USD/JPY Technical Snapshot

Scenario 1: Bullish Continuation

- Technical Indicators: USD/JPY rebounds from the cloud top at 149.00, aiming for resistance at last week’s high of 149.99 and potentially the 150.10 Fibonacci level.

- Fundamental Catalysts: A risk-off sentiment that bolsters the dollar against the yen, coupled with strong U.S. data and hawkish Fed rhetoric, could drive USD/JPY higher. The expiration of a large option strike at 150 could also provide upward momentum.

Scenario 2: Range-Bound Action

- Technical Indicators: The pair remains confined between the well-tested cloud top support at 149.00 and the resistance around 149.67 to 150.10.

- Fundamental Catalysts: Mixed economic data and market sentiment could result in a lack of directional bias. If upcoming U.S. economic releases meet market expectations, this could reinforce current levels without significant breakouts.

Scenario 3: Bearish Reversal

- Technical Indicators: A break below the cloud top at 149.00 could see the pair test lower supports, possibly toward the early Tokyo low of 149.20.

- Fundamental Catalysts: A surge in Japanese services PPI and rising inflation expectations could support the yen if the Bank of Japan hints at a policy pivot. Additionally, a decline in risk appetite and equity markets could favor the yen as a safe-haven asset.

XAU/USD Outlook:

Gold is often seen as an inflation hedge and a safe-haven asset, so the Core PCE Price Index and GDP growth rate are particularly relevant. An increase in the Core PCE Price Index beyond expectations could boost the USD as it would suggest the Federal Reserve may continue its hawkish monetary policy to combat inflation. This could diminish the appeal of gold, causing XAU/USD to drop. However, if the index is lower than anticipated, indicating a slowdown in inflation, gold may become more attractive as a safe haven, potentially raising XAU/USD as the dollar weakens.

The U.S. GDP growth rate also plays a crucial role. A stronger-than-expected GDP growth rate may lead to a bullish USD as it implies a robust economic environment, which could decrease gold’s allure, lowering XAU/USD. Conversely, a weaker GDP could heighten economic uncertainty, increasing gold’s safe-haven demand and thus pushing XAU/USD higher.

When evaluating the potential impact on XAU/USD, traders will consider the global economic sentiment and risk appetite, as gold often moves inversely to market confidence. They will also monitor the spillover effects from other economies, as unexpected shifts in major markets can influence investor behavior towards safe-haven assets. Traders will adopt a network-interactive perspective, recognizing that the interconnectedness of global financial markets means U.S. economic data can have wider repercussions, influencing gold’s position as a hedge against both currency weakness and economic instability.

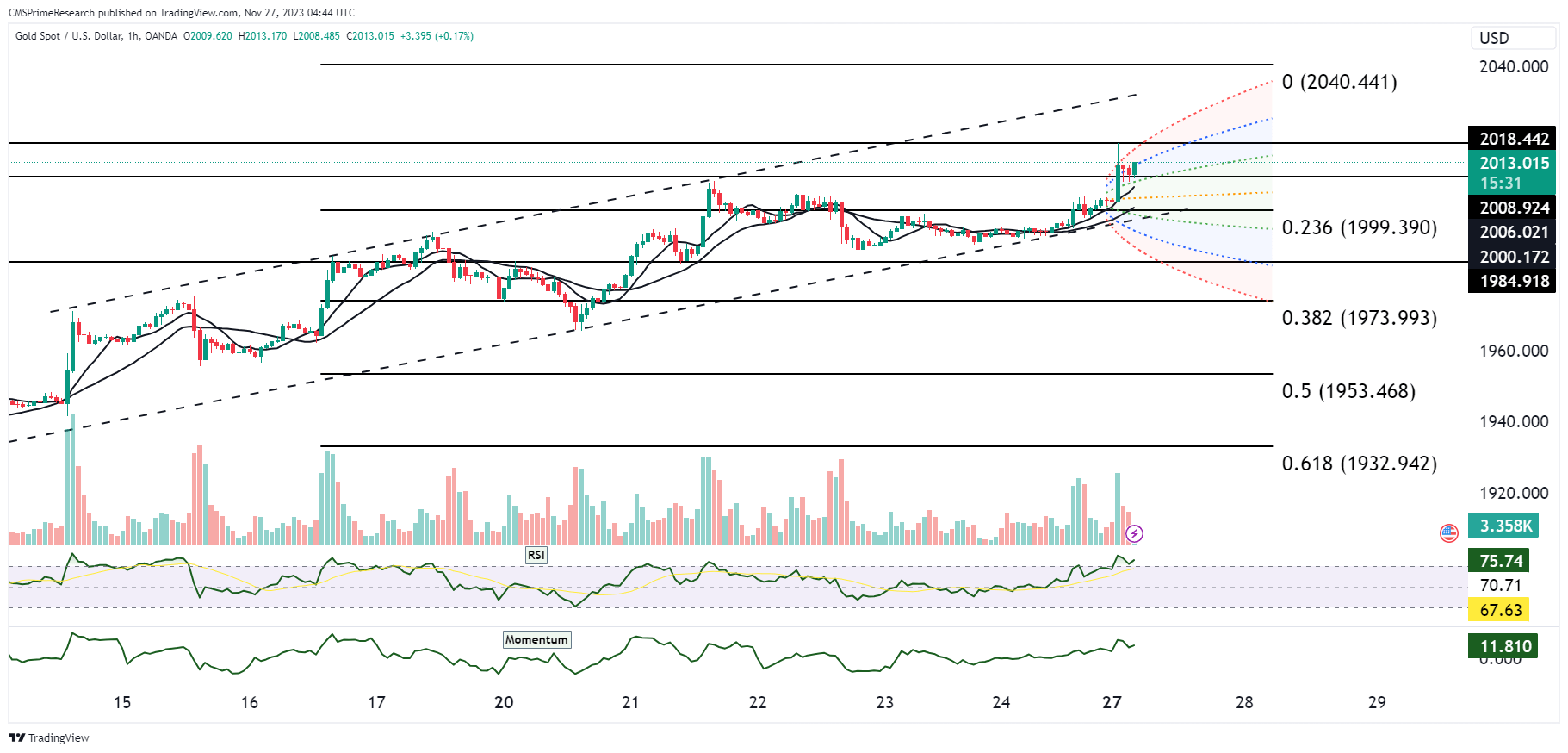

Gold Price Technical Snapshot:

Scenario 1: Bullish Momentum Continues

- Technical Indicators: Gold maintains its upward trajectory, potentially testing the resistance near the recent high at 2040.441 USD.

- Fundamental Catalysts: Weakness in the USD, as indicated by economic events, or dovish Fed commentary, could enhance gold’s appeal. Additionally, if risk aversion persists, gold may continue to act as a safe haven.

Scenario 2: Consolidation within Current Range

- Technical Indicators: Gold price actions remain between the Fibonacci levels of 0.236 (1999.390 USD) and 0 (2040.441 USD), indicating consolidation.

- Fundamental Catalysts: Mixed economic data and uncertainty in market sentiment could result in gold prices consolidating. If upcoming economic data are inconclusive regarding the direction of monetary policy, this could sustain the current price range.

Scenario 3: Correction Towards Key Supports

- Technical Indicators: A pullback from the recent peak could see gold prices retreat towards the Fibonacci retracement level of 0.382 (1973.993 USD).

- Fundamental Catalysts: Stronger than expected U.S. economic data or hawkish shifts in Fed policy stance could boost the USD, leading to a decrease in gold prices. A break below the 0.236 Fibonacci level may confirm a bearish trend reversal.

Volatility Considerations:

Central Bank Policies and Interest Rate Expectations: Of particular importance are the monetary policies of the Fed in the U.S. and the ECB. The values of different currencies may be influenced if there are any indications of changes in interest rate policy, for example, the expected easing of monetary policy by the Fed or more hawkish stance from the ECB. This anticipation has a direct impact on currency pairs, as any possible divergence of policy shifts between the Fed and other central banks.

Economic Data Releases: Among these pivotal elements are upcoming economic indicators like the U.S. Core PCE Price Index, GDP growth rate, and European Union’s Unemployment and Inflation Rates. Immediate and sometimes significant market reactions can result from data that deviates from market expectations. For example, stronger Eurozone inflation than expected would increase the Euro, and stronger U.S. economic indicators would boost the USD.

Global Risk Sentiment and Market Dynamics: The market sentiment overall, affected by elements such as geopolitical issues, the post-pandemic economy worldwide, and stock market performance, is crucial. For instance, an increased risk aversion may be a result of geopolitical instability and raise demand for safe haven currencies like the USD or JPY or for assets such as gold.

Technical Levels and Market Positioning: For instance, if the EUR/USD pair breaks a significant resistance level, it could activate stop-loss orders and cause additional upside movement. On the other hand, a strike to a strong support area could result in a retracement or a consolidation period. Often, trades are put in the market at these technical levels resulting in self-fulfilling movements as the level is hit or passed.

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.