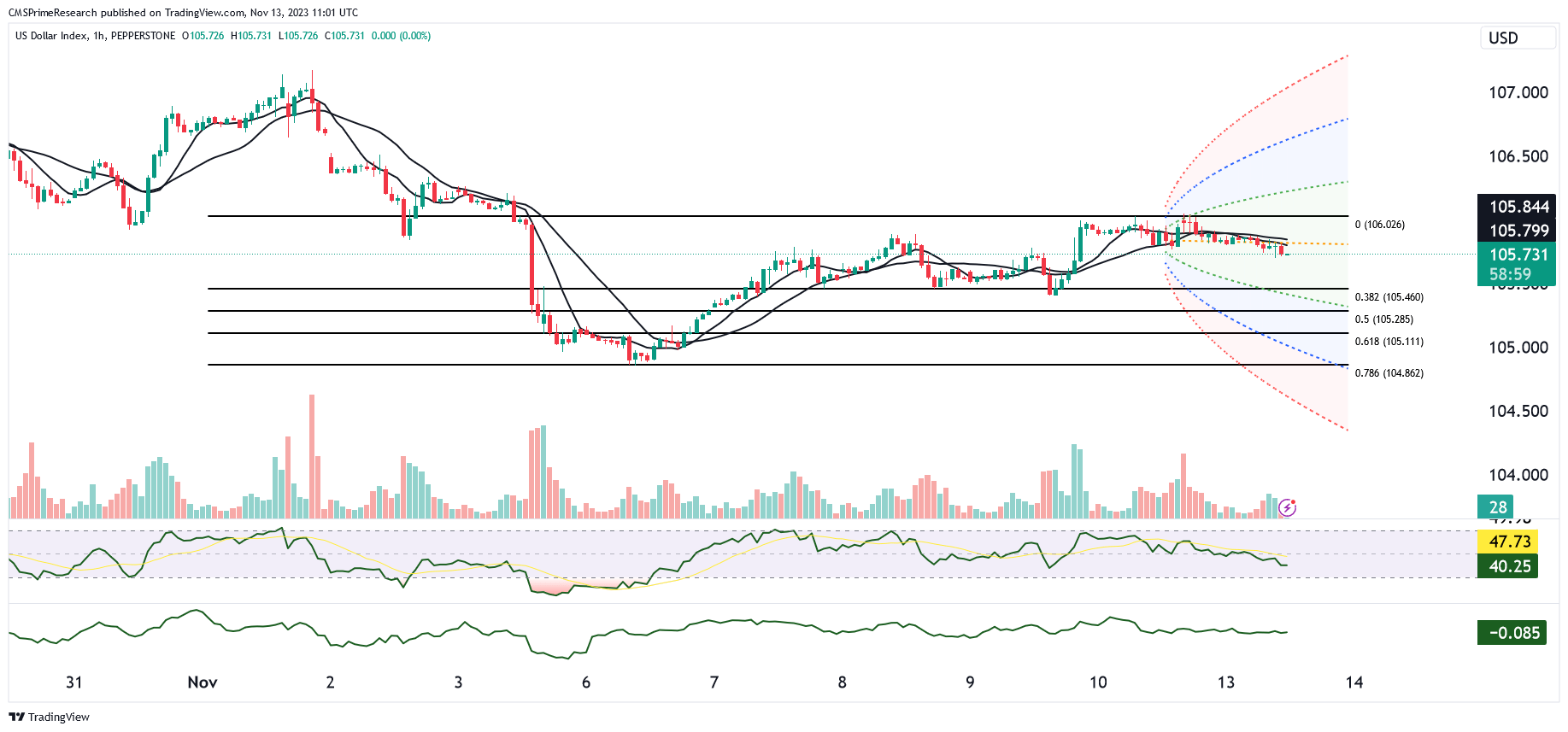

Dollar Index:

Market Movements: The USD has also been affected by movements in other markets. For instance, the AUD/USD, gold, VIX, and Nasdaq have all seen changes due to the Commitment of Traders report (COT) as of November 13, 2023.

Inflation Data: The dollar was steady as traders awaited another batch of inflation data from the United States that is expected to offer further clues this week on whether the Federal Reserve has more work to do to tame price pressures. The dollar index was last mostly flat at 105.80.

- Oil Prices: Oil prices eased on Monday, reversing their rally on Friday, as renewed concerns over waning demand in the United States and China dented market sentiment. Brent crude futures for January were down 35 cents, or 0.4 per cent, at $81.08 a barrel at 0051 GMT, while the US West Texas Intermediate (WTI) crude futures for December were at $76.82, down 35 cents, or 0.5 per cent.

- Bitcoin Market: The largest cryptocurrency, Bitcoin, continues to circle its highest levels in 18 months, with excitement over a possible exchange-traded fund (ETF) approval in the United States driving sentiment. This could potentially impact the USD as it indicates a shift in investor sentiment towards cryptocurrencies.

- Global Market Trends: The USD is also being influenced by global market trends. For instance, shares in Asia gave up early gains while falling US futures partly unwound a Friday rally, ahead of crucial inflation data and a meeting between Joe Biden and Xi Jinping later this week.

- Corporate Earnings: Corporate earnings can also impact the USD. For example, Apple announced financial results for its fiscal 2023 fourth quarter ended September 30, 2023. The Company posted quarterly revenue of $89.5 billion, down 1 percent year over year, and quarterly earnings per diluted share of $1.46, up 13 percent year over year.

- Public Cloud Spending: Gartner forecasts that worldwide public cloud end-user spending is expected to reach $679 billion in 2024, which could potentially impact the USD.

These events and news items indicate a complex interplay of factors that are currently influencing the USD. It’s important to note that currency values can be affected by a wide range of factors, including economic indicators, geopolitical events, and market sentiment, among others.

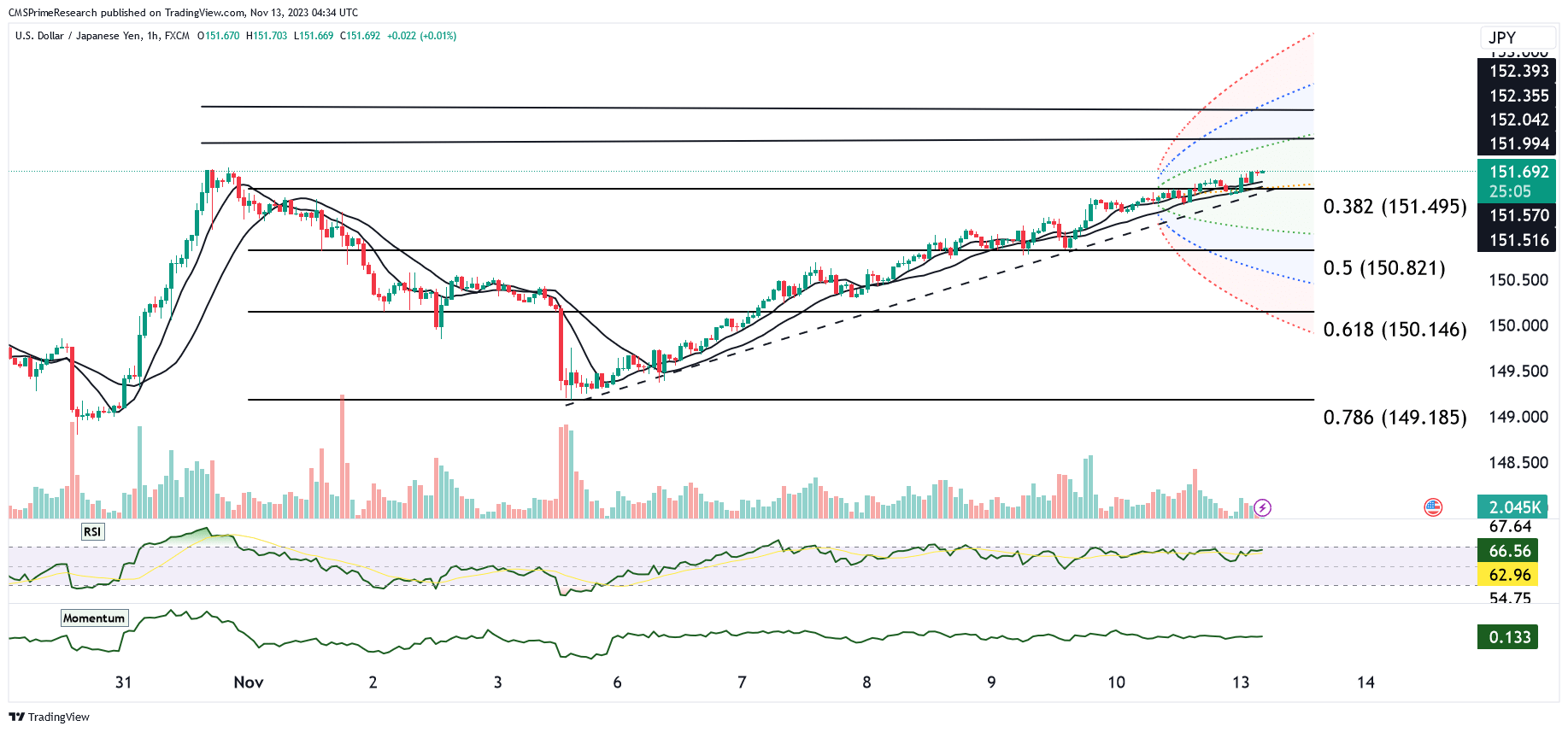

Upcoming Events for the week:

The upcoming financial events for the week of November 13 to 17, 2023, carry significant implications for the currency markets, particularly concerning the Euro (EUR), British Pound (GBP), US Dollar (USD), and Japanese Yen (JPY). On November 13, a speech by an ECB official, Mr. Guindos, may offer insights into the Eurozone’s monetary policy, potentially impacting the EUR. The following day, November 14, brings key labor market reports from the UK, including unemployment and employment change data, which could influence the GBP based on the health of the labor market. Concurrently, the Eurozone’s employment change report for Q3 might affect the EUR, depending on the employment trends observed.

Lastly, on November 15 and 16, the US Producer Price Index (PPI) and jobless claims reports will provide further insight into production costs and the job market’s health, potentially influencing the USD. The week concludes with the Eurozone CPI data on November 17, offering a glimpse into the region’s inflation levels, which could again sway the EUR.

In the US, the CPI and inflation rate data for October, scheduled for November 14, are crucial for assessing inflation levels and their potential impact on the USD. On November 15, Japan’s economic performance will be in focus with its annualized GDP growth and quarterly GDP growth rate reports, which could sway the JPY. The same day, the UK’s inflation rate and the US’s retail sales data will be closely watched for their potential effects on the GBP and USD, respectively.

EUR USD Outlook:

Analyzing the potential impact of upcoming events on the EUR/USD currency pair requires careful consideration of key economic indicators and speeches. Firstly, the ECB’s Guindos speech on November 13, 2023, holds high significance. Market participants will closely scrutinize the speech for insights into the European Central Bank’s monetary policy outlook, which can influence the Euro’s strength. Hawkish tones, suggesting a tighter monetary policy, typically strengthen the Euro, while dovish tones could weaken it.

Secondly, the Eurozone’s Employment Change data, both quarterly and yearly, scheduled for November 14, are crucial. These figures provide insight into the health of the labor market. A higher than expected employment change can signal a robust economy, potentially strengthening the Euro. Conversely, lower figures may indicate economic sluggishness, potentially weakening the Euro.

Thirdly, the U.S. Consumer Price Index (CPI) and Inflation Rate data on November 14 are highly impactful. These are key indicators of inflation in the U.S. A higher than expected CPI or inflation rate could strengthen the Dollar as it might prompt the Federal Reserve to adopt a more aggressive interest rate hike stance to combat inflation. A lower than expected figure, however, might lead to a weaker Dollar, as it could signal a less aggressive monetary tightening by the Fed.

Lastly, the Eurozone’s CPI data on November 17 is another critical event. The Consumer Price Index is a primary inflation indicator, influencing the ECB’s interest rate decisions. An increase in the CPI might lead to expectations of a tighter monetary policy, strengthening the Euro. If the CPI is lower than expected, it might lead to expectations of a more accommodative policy stance, potentially weakening the Euro.

In summary, these events provide valuable insights into the economic health and policy direction of both the Eurozone and the U.S. Any deviation from the expected figures can cause significant volatility in the EUR/USD pair. Market participants should monitor these events closely, as they can offer opportunities for strategic trading decisions based on the resulting economic implications.

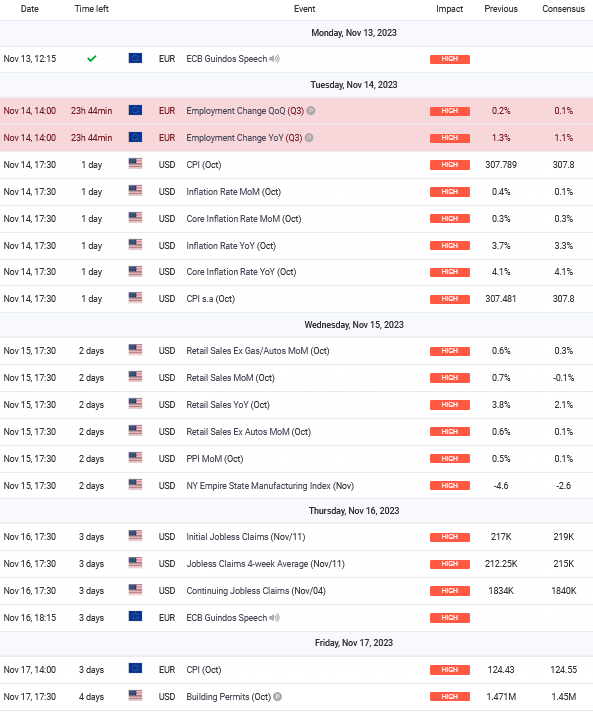

EUR/USD Technical Snapshot:

Scenario 1: Bullish Movement

- Potential upward movement to test levels from 1.07216 to 1.07312 and further up to 1.07708.

Scenario 2: Bearish Movement

- Possibility of a decline to test levels 1.06823.

- If bearishness continues, further tests expected at 1.06613, followed by a significant support at 1.06338.

Market Momentum & RSI

- Short-term momentum: bullish range, with an increasing momentum observed on the weekly timeframe.

- RSI is in the increasing zone, indicating potential short-term bullishness.

- Possible trading range could be anticipated based on current market conditions and technical indicators.

GBP USD Outlook:

Evaluating the impact of the upcoming economic events on the GBP/USD currency pair requires a focus on key indicators that directly affect either the British Pound or the US Dollar. Primarily, the UK’s unemployment rate and employment change figures, due on November 14, are of significant interest. The unemployment rate and employment change are vital indicators of the UK’s economic health. A lower than expected unemployment rate or a lesser decline in employment than anticipated could signal a robust labor market, potentially strengthening the GBP against the USD. Conversely, higher unemployment or a greater loss in employment could weaken the Pound as it indicates economic challenges.

In the context of the US economy, the Consumer Price Index (CPI) and Inflation Rate data, scheduled for release on November 14, are crucial. These are key measures of inflation and significantly influence the Federal Reserve’s monetary policy. An increase in CPI or a higher than expected inflation rate could lead to expectations of more aggressive interest rate hikes by the Fed, which would typically strengthen the USD. If the inflation data comes in below expectations, it could lead to a weaker Dollar, as it may suggest a more dovish approach by the Fed.

Furthermore, the Retail Sales data and the Producer Price Index (PPI) from the US, set for release on November 15, are also pivotal. Retail sales are a primary indicator of consumer spending, while the PPI provides insight into wholesale price changes. Both are significant for gauging economic momentum. Higher retail sales or a higher PPI may reinforce the Dollar’s strength, indicating healthy consumer demand and rising production costs, respectively. Conversely, lower figures could signal economic slowdown, potentially weakening the USD.

Lastly, the CPI data from the Eurozone on November 17, while not directly impacting the GBP/USD, could have an indirect effect. Significant deviations in the Eurozone’s inflation could influence overall market sentiment and risk appetite, indirectly affecting the GBP/USD pair.

In summary, these events are critical to watch for traders and investors. Deviations from the consensus in any of these key data releases can cause notable fluctuations in the GBP/USD exchange rate. The data not only provides a snapshot of current economic conditions but also offers clues about future monetary policy decisions in both the UK and the US.

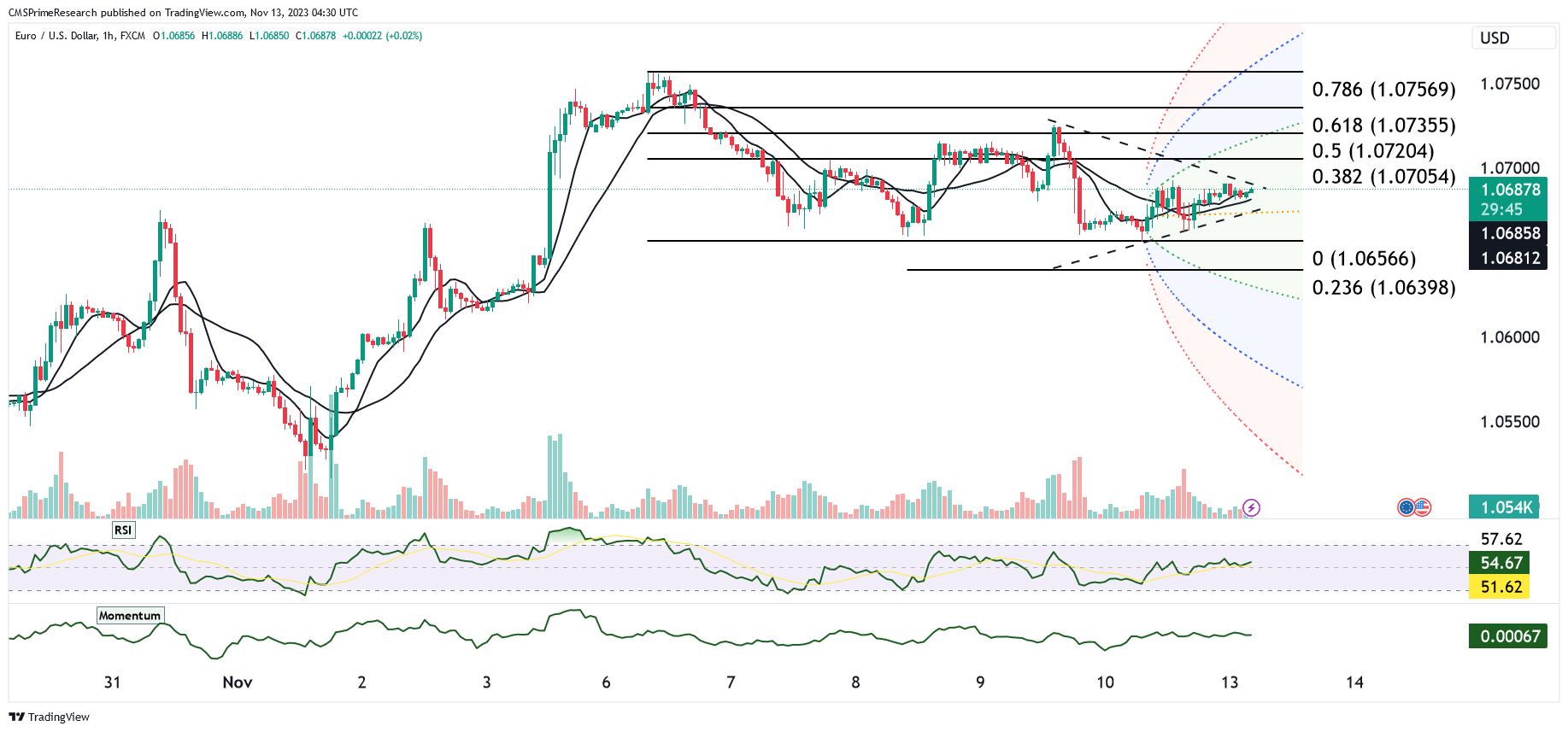

GBP/USD Technical Snapshot:

Scenario 1: Bullish Movement

– Possible upward retest at 1.2255, aiming for resistance at 1.2291, 1.2350, with a critical point at 1.2400.

Scenario 2: Bearish Movement

– Downward trend could test support at 1.2218.

– A breach of this level may lead to further decline towards 1.2197.

– Continuation of bearish momentum might drop prices into the range of 1.2175.

– Major support levels span from 1.2156

Market Conditions and Indicators

– Currently, the pair is above both the 50-day and 200-day moving averages, signaling a bullish but range bound trend.

– The market is strongly above to the 50-day MA, hinting at a possible shift in direction.

– RSI is trending towards the decreasing region, indicating potential downard pressure.

– Despite the downtrend in momentum, traders should remain cautious of a potential bullish short term reversal.

USD/JPY Outlook:

For analyzing the impact on the USD/JPY currency pair, it’s essential to focus on the key events from both the United States and Japan that are most likely to influence these currencies.

Firstly, the U.S. Consumer Price Index (CPI) and Inflation Rate data, due on November 14, are highly significant. The CPI is a crucial measure of inflation and has a direct impact on the Federal Reserve’s policy decisions. A higher than expected CPI or inflation rate would generally lead to a stronger USD, as it suggests that the Federal Reserve might increase interest rates to curb inflation. Conversely, a lower than expected CPI could weaken the USD, indicating a potential slowdown in rate hikes.

Secondly, Japan’s GDP Growth data, both annualized and quarterly, set to be released on November 15, are pivotal for the JPY. These figures give insight into the overall health of Japan’s economy. A higher than expected GDP growth could strengthen the JPY, reflecting a robust economic performance. On the other hand, lower than expected GDP figures could weaken the JPY, indicating a slowing economy.

Furthermore, the U.S. Retail Sales data, both monthly and yearly, along with the Producer Price Index (PPI), also due on November 15, will be closely watched. Retail Sales are an essential indicator of consumer spending, and the PPI measures the average changes in prices received by domestic producers. Higher retail sales or a higher PPI may strengthen the USD, while lower figures could lead to a weaker USD, as they suggest reduced consumer spending and producer profitability.

Lastly, the U.S. Initial Jobless Claims data on November 16 is a significant short-term economic indicator. Higher than expected jobless claims can be a sign of a weakening labor market, potentially weakening the USD. Lower than expected claims, however, might suggest a stronger labor market, potentially strengthening the USD.

In summary, these events provide key insights into the economic health and policy directions of both the U.S. and Japan. Deviations from the expected figures in any of these indicators can cause significant volatility in the USD/JPY pair, presenting opportunities for strategic trading decisions. Market participants should closely monitor these events for indications of economic trends and potential shifts in central bank policies.

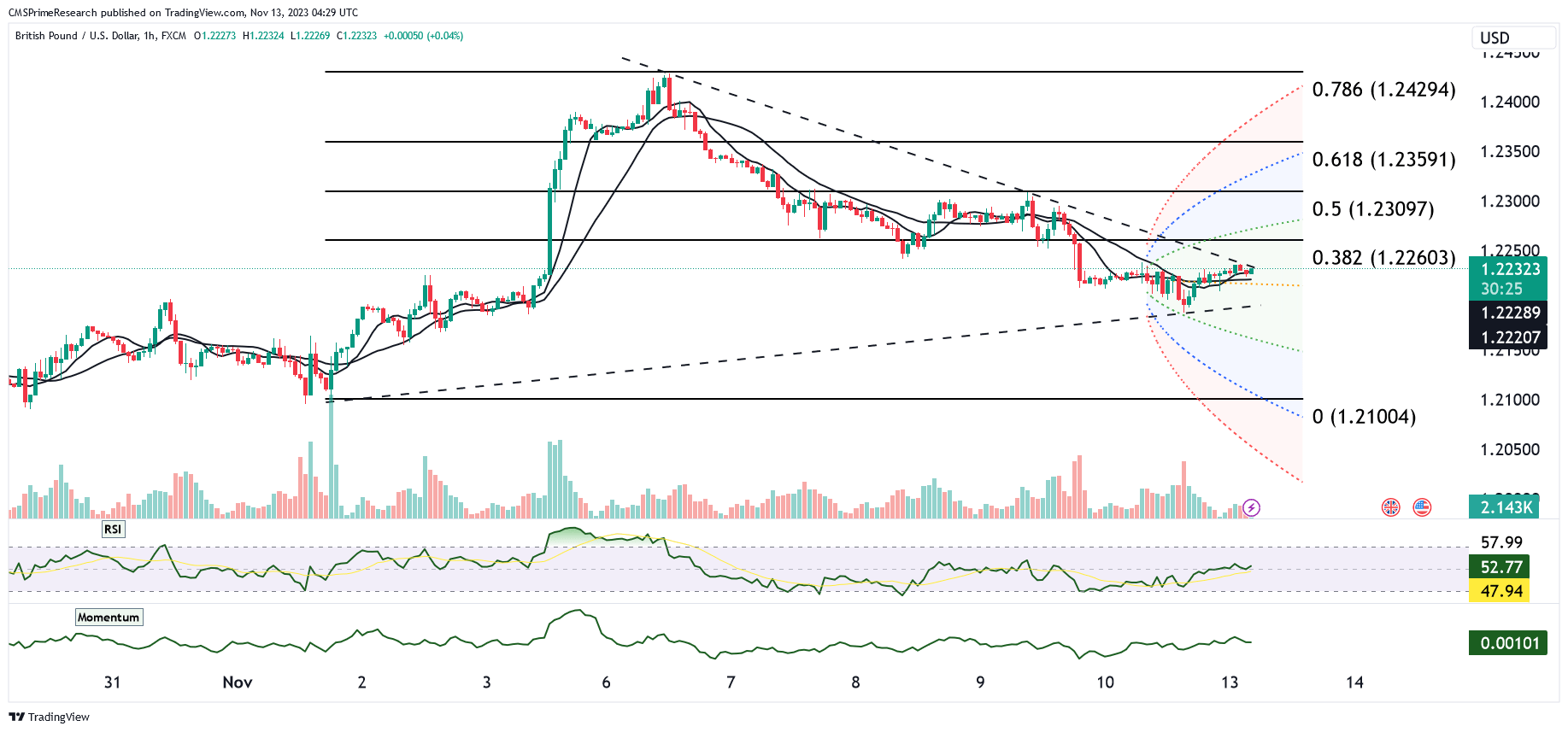

USD/JPY Technical Snapshot

Scenario 1: Bearish Movement

– Potential decline towards 151.500, with additional tests at 151.237 (61.8% Fibonacci level).

– Further decrease might target ranges between 150.868 to 150.650.

– Critical support found at 150.256, and major support level established at 149.980.

Scenario 2: Bullish Movement

– Possibility of an upswing to retest 151.940.

– Success here could propel prices towards 152.250 and then 152.550.

– Surpassing these levels might result in a test of the 153 benchmark.

Market Conditions and Indicators

– The pair is navigating strongly above the 50 and 200-day moving averages, indicating a bullish range momentum.

– RSI is currently in the increasing and near the overbought territory, hinting at potential bearish range-bound movements.

– Overall, the market maintains a bullish short-term momentum

XAU/USD Outlook:

Firstly, the U.S. Consumer Price Index (CPI) and the Inflation Rate Month-over-Month for October, scheduled for release on November 14, are critical. Gold is often considered a hedge against inflation. A higher than expected CPI or inflation rate could lead to an increase in gold prices, as it enhances gold’s appeal as an inflation hedge. Conversely, a lower than expected inflation rate might decrease the appeal of gold, potentially leading to lower prices.

The U.S. Retail Sales data, both Month-over-Month and Year-over-Year for October, and the Producer Price Index (PPI) Month-over-Month for October, set for November 15, also hold importance. Strong retail sales or a higher PPI can indicate economic health, potentially strengthening the USD and pressuring gold prices. Weaker retail sales or a lower PPI, suggesting economic slowdown, might increase gold’s attractiveness as a safe-haven asset, potentially raising its price.

Additionally, the U.S. Initial Jobless Claims data for the week ending November 11, to be released on November 16, can influence gold prices. Higher than expected jobless claims can indicate weakness in the labor market, potentially leading to a weaker USD and higher gold prices. Lower jobless claims, indicating a strong labor market, could strengthen the USD, applying downward pressure on gold prices.

Lastly, the Eurozone CPI for October, due on November 17, while not directly impacting the XAU/USD pair, can influence global market sentiment. Higher inflation in the Eurozone could increase gold’s appeal as a global inflation hedge, potentially raising its price. Conversely, lower inflation could reduce the need for an inflation hedge, potentially lowering gold prices.

In conclusion, these events offer critical insights into the economic conditions of the U.S. and globally. Any significant deviations from the expected data can result in volatility in the XAU/USD pair. Investors and traders in gold should closely monitor these events as they can provide opportunities for strategic decision-making based on their implications on inflation, economic health, and market sentiment.

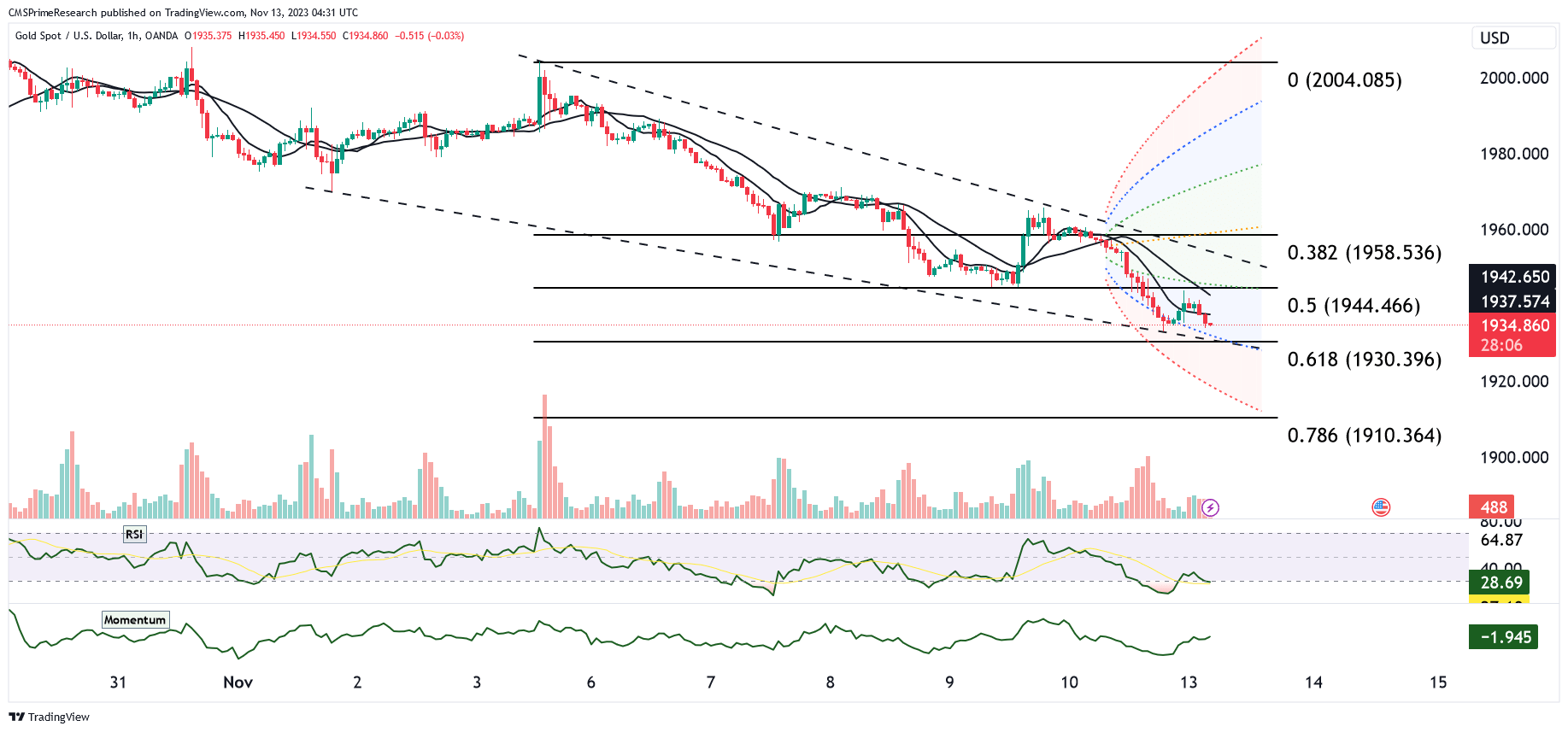

Gold Price Technical Snapshot:

Scenario 1: Bullish Continuation

– Initial upward movement towards 1945.

– Further progression might aim for 1950.

– Persistent bullish momentum could lead to tests of 1962, with significant level at 1970 to watch.

Scenario 2: Bearish Reversal

– Potential decline to 1931.

– Continued bearish pressure might target 1924.50, a crucial support level.

– Further downside could find support in the range of 1917.00 to 1912.50

Market Conditions and Indicators

– Price is trending near both the 200-day and 50-day moving averages, suggesting a neutral market sentiment within a bearish trend.

– The long-term trend remains range bound

Volatility Considerations:

Central Bank Policies and Inflation Data: Central banks’ monetary policies, particularly those of the ECB and the Federal Reserve, are pivotal. The upcoming ECB’s Guindos speech and the U.S. inflation data (CPI and PPI) are significant. These events can provide insights into future interest rate decisions. Higher inflation typically leads to expectations of rate hikes, strengthening the respective currency, while lower inflation might result in a dovish stance, potentially weakening the currency.

Employment and Labor Market Reports: Data such as the U.S. initial jobless claims, the UK’s unemployment rate, and employment change figures play a crucial role. These indicators provide a snapshot of the labor market health in major economies. Stronger employment data generally strengthens the associated currency by indicating economic robustness, whereas weaker employment data can signal economic slowdown, leading to increased market volatility.

Global Economic Performance and GDP Data: Reports on GDP growth, like the upcoming Japanese GDP data, influence the respective currencies. Positive GDP figures can bolster a currency by reflecting economic strength. Conversely, weaker than expected GDP growth can lead to currency depreciation. These reports can significantly impact market sentiment and lead to fluctuations in currency pairs like USD/JPY.

Market Sentiment and External Factors: Factors such as oil prices, corporate earnings (e.g., Apple’s financial results), and trends in alternative investments like Bitcoin influence market sentiment. For instance, rising oil prices often signal higher inflation expectations, affecting currency values. Similarly, strong corporate earnings can boost investor confidence, while increasing interest in cryptocurrencies can divert investment from traditional currencies and assets like gold.

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.