The global markets are navigating turbulent waters, marked by a significant downturn in key indices, driven by growing recession fears in the United States and broader economic uncertainties. This week, investors are poised for a high-stakes period of volatility, as they scrutinize economic data, central bank decisions, and geopolitical developments.

Market Performance Recap

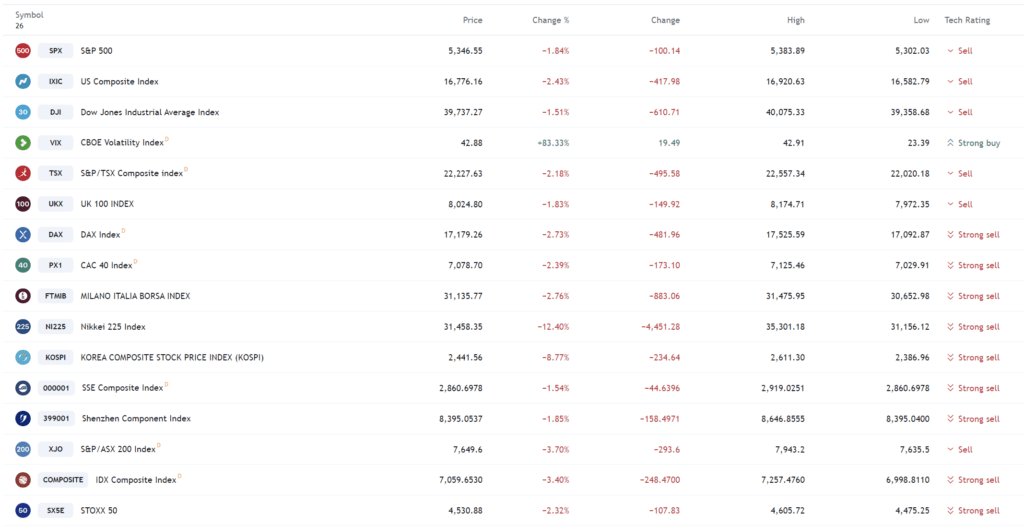

Japan’s Nikkei Index: The Nikkei 225 experienced its worst drop since 1987, plummeting 12.4% on Monday. This dramatic decline, triggered by concerns over the US economy, saw the index close at 31,458.42, down 4,451.28 points. The broader TOPIX index fell 12.8%, highlighting the widespread selling pressure. This decline is a continuation of the sell-off from last week, exacerbated by the Bank of Japan’s recent interest rate hike aimed at combating inflation driven by a weak yen.

US Markets: US futures pointed to a sharp decline, with Dow e-minis down 1.54%, S&P 500 e-minis down 2.19%, and Nasdaq 100 e-minis down 3.47%. Last week’s weak jobs report and shrinking manufacturing activity fueled recession fears, prompting a sell-off in tech and growth stocks. Notably, Apple fell 7.3% after Berkshire Hathaway halved its stake in the company, and Nvidia dropped 6.8% due to delays in its AI chip launch.

European Markets: European stocks opened lower, with Germany’s DAX down 2.5%, France’s CAC 40 down 2.4%, and the UK’s FTSE 100 down 2%. The pan-European STOXX 600 index fell 2.2%, its lowest since February. Investors are wary of a slowdown in US economic growth, with energy and financial stocks among the hardest hit sectors.

Asian Markets: Beyond Japan, other Asian markets also suffered. Taiwan’s Taiex dropped 8.4%, driven by a sharp decline in tech stocks, including TSMC. South Korea’s Kospi fell over 9%, with Samsung shares down 10.3%. Singapore’s Straits Times Index and Australia’s All Ordinaries both declined over 3%.

Economic Outlook and Central Bank Actions

US Federal Reserve: The Fed is under immense scrutiny as traders now see a 91.5% probability of a 50 basis point rate cut in September. This shift in expectations follows a weak jobs report that activated the “Sahm Rule,” a reliable recession indicator. The market anticipates aggressive rate cuts, which could lower the year-end rates to 4-4.25% from the current 5.25-5.50%. Fed officials, including Chicago Fed President Austan Goolsbee and San Francisco Fed President Mary Daly, will provide further insights this week.

Bank of Japan: The BOJ’s decision to raise its benchmark interest rate last week has contributed to the market turmoil. This move was partly in response to prolonged yen weakness, which has driven inflation above the central bank’s 2% target. Investors will be closely monitoring any further BOJ statements or actions.

Reserve Bank of Australia: The RBA is expected to hold rates at 4.35% during its Tuesday meeting but may adopt a less hawkish tone due to soft inflation data and global economic concerns. Traders are pricing in a 75% chance of a rate cut by November.

Key Economic Data

US: The final July S&P Global services and composite PMIs, ISM non-manufacturing PMI, June trade data, and weekly jobless claims are on the docket. These reports will provide critical insights into the health of the US economy and the potential for further rate cuts.

Europe: Final euro zone services and composite PMIs, June producer prices, and retail sales will be released. Germany will publish industrial orders, output data, and final July CPI and HICP. These indicators will help assess the economic momentum in the region.

Asia: China’s July trade data, including exports and imports, will be closely watched for signs of economic recovery. The Caixin July services PMI is due on Monday. Japan’s calendar includes final July services and composite PMIs, June household spending, and trade data.

Market Sentiment and Volatility

Risk Aversion: The global sell-off reflects heightened risk aversion as investors grapple with recession fears. The CBOE Volatility Index (VIX), Wall Street’s “fear gauge,” has surged to 35.19, the highest since May 2022, indicating increased market anxiety. Safe-haven assets like gold have seen fluctuating demand, with spot prices rising slightly amid profit-taking and rate cut expectations.

Bond Yields: US Treasury yields have declined, with the 2-year yield dropping to 3.845% and the 10-year yield to 3.787%. This flight to safety underscores investor concerns about economic stability.

Currency Markets: The US dollar has weakened, with the dollar index hitting a four-month low. The yen has strengthened against the dollar, trading at 146.54, reflecting intervention by Japanese authorities and narrowing interest rate differentials. The euro has also gained ground, trading at $1.0908, amid expectations of rate cuts by the Fed.

Sectoral Impact

Technology Stocks: The tech sector has been particularly vulnerable, with major companies like Apple and Nvidia experiencing significant losses. The Philadelphia semiconductor index saw its biggest two-day drop since March 2020, driven by Intel’s announcement of workforce cuts and dividend suspensions.

Energy and Financials: Energy stocks have been hit by declining oil prices, with Brent crude falling to $76.04 per barrel. Financials, including banks and financial services, have also faced pressure due to economic uncertainties and rate cut expectations.

Geopolitical Factors

Middle East Tensions: The ongoing crisis in the Middle East in response to threats could impact oil prices and investor sentiment, especially if tensions escalate.

China: Weak economic data from China, the world’s largest oil importer, has contributed to the decline in oil prices and overall market sentiment. Investors are watching for any additional stimulus measures from Chinese authorities to support economic recovery.

Summary of Asset Class Performance

The past week has been marked by significant volatility across various asset classes, driven primarily by recession fears in the United States and broader economic uncertainties. Here’s a comprehensive summary of the performance of key asset classes:

Equities

Global Equities:

- Japan: The Nikkei 225 experienced its worst drop since 1987, plunging 12.4% on Monday. This drastic decline was primarily due to concerns over the US economy and a recent interest rate hike by the Bank of Japan.

- US: US stock index futures fell sharply, with Dow e-minis down 1.54%, S&P 500 e-minis down 2.19%, and Nasdaq 100 e-minis down 3.47%. Tech stocks were hit hard, with Apple down 7.3% and Nvidia down 6.8%.

- Europe: European markets saw significant declines, with Germany’s DAX down 2.5%, France’s CAC 40 down 2.4%, and the UK’s FTSE 100 down 2%. The STOXX 600 index dropped 2.2%, reaching its lowest level since February.

- Asia: Other Asian markets also suffered, with Taiwan’s Taiex dropping 8.4%, South Korea’s Kospi falling over 9%, and Singapore’s Straits Times Index and Australia’s All Ordinaries both declining over 3%.

Bonds

- US Treasuries: US Treasury yields fell as investors sought safe-haven assets. The 2-year yield dropped to 3.845%, and the 10-year yield to 3.787%, reflecting increased demand for government bonds amid economic uncertainty.

Currencies

- US Dollar: The dollar index fell to a four-month low, indicating a broad weakening of the currency. The dollar/yen pair dropped to 146.54, influenced by Japanese FX intervention and changing expectations for US Federal Reserve policy.

- Euro: The euro strengthened against the dollar, trading at $1.0908, as investors adjusted their positions based on shifting economic data and rate cut expectations.

Commodities

- Oil: Oil prices declined significantly, with Brent crude falling to $76.04 per barrel and US crude oil for September delivery closing at $73.52 per barrel. This drop was driven by weaker economic data from the US and China, the world’s largest oil importer.

- Gold: Gold prices were volatile, initially rising due to safe-haven demand but later falling due to profit-taking. Spot gold ended down 0.4% at $2,433.74 per ounce, while US gold futures edged up 0.2% to $2,475.30.

Cryptocurrencies

- Bitcoin: Bitcoin hit its lowest level in five months, reflecting broader risk aversion in financial markets. Major crypto-linked stocks like Coinbase Global and Microstrategy also saw significant declines.

Volatility

- CBOE Volatility Index (VIX): The VIX, a key measure of market anxiety, surged to 35.19, the highest level since May 2022. This increase underscores the heightened uncertainty and risk aversion among investors.

Outlook

The coming week is expected to remain volatile as markets digest a slew of economic data and central bank decisions. Key indicators to watch include:

- US final July S&P Global services and composite PMIs, ISM non-manufacturing PMI, June trade data, and weekly jobless claims.

- European final services and composite PMIs, producer prices, and retail sales.

- China’s July trade data and Caixin services PMI.

Central bank communications, especially from the US Federal Reserve , will be crucial in shaping market expectations. Additionally, geopolitical developments, particularly in the Middle East, could further impact investor sentiment and market performance.

The global markets are bracing for a highly volatile week as recession fears, central bank actions, and geopolitical developments continue to dominate headlines. Investors are likely to remain cautious, with a focus on safe-haven assets and defensive sectors. The heightened volatility and uncertainty underscore the need for a balanced approach, combining risk management with opportunities for long-term growth.

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.