Trend analysis is a fundamental aspect of trading in the currency markets, where identifying the direction of price movements is crucial for making informed trading decisions. In the highly volatile world of forex trading, understanding trends helps traders anticipate market movements, manage risks, and ultimately, make profitable trades. By analyzing trends, traders can determine the overall direction of the market, identify potential entry and exit points, and adapt their strategies accordingly.

Understanding Trend Analysis

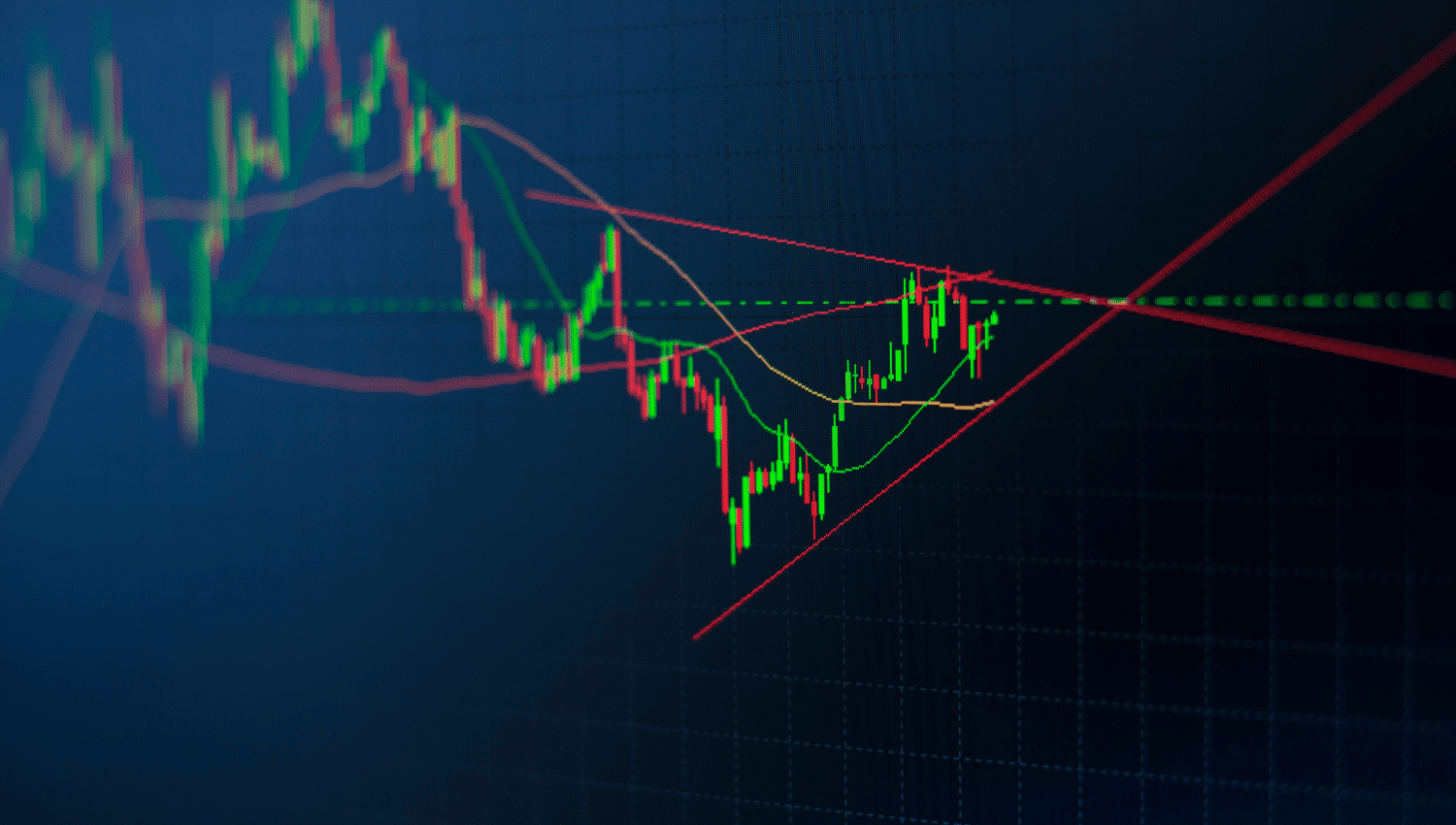

Trend analysis involves studying historical data to identify patterns or trends in the market. These trends can be upward (bullish), downward (bearish), or sideways (neutral). In currency markets, trends are often influenced by a variety of factors, including economic data, geopolitical events, and market sentiment. Traders use various tools and techniques, such as moving averages, trend lines, and oscillators, to identify these trends and make predictions about future price movements.

One of the primary reasons trend analysis is so important in currency markets is that it provides a framework for understanding market behavior. By identifying the direction of the trend, traders can align their positions with the prevailing market sentiment. For example, in an upward trend, traders might focus on buying opportunities, while in a downward trend, they might look for selling opportunities. This alignment with the trend helps reduce the risk of making trades that go against the market’s momentum.

Key Trend Analysis Methods

There are several methods used in trend analysis, each with its own strengths and applications. Moving averages are one of the most popular tools, as they smooth out price data to create a single flowing line that represents the average price over a specific period. This helps traders filter out the noise and focus on the underlying trend. The two most commonly used moving averages are the simple moving average (SMA) and the exponential moving average (EMA). While SMA gives equal weight to all data points, EMA gives more weight to recent prices, making it more responsive to recent market changes.

Another essential tool is trend lines, which are drawn on a chart to connect the highs or lows of a currency pair’s price movement. These lines help traders visualize the direction and strength of a trend. When a currency’s price consistently bounces off a trend line without breaking through it, the trend is considered strong. Conversely, if the price breaks through the trend line, it may signal a potential trend reversal.

Oscillators, such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), are also commonly used in trend analysis. These indicators help traders identify overbought or oversold conditions in the market, which can indicate a potential reversal or continuation of a trend. For instance, an RSI value above 70 might suggest that a currency pair is overbought and could be due for a correction, while an RSI value below 30 could indicate that it is oversold and might rebound.

The Benefits of Trend Analysis in Forex Trading

The primary benefit of trend analysis is its ability to help traders identify and capitalize on market opportunities. By understanding the direction of the trend, traders can make more informed decisions about when to enter or exit a trade. This can significantly increase the likelihood of making profitable trades while minimizing losses. Additionally, trend analysis can help traders manage risk more effectively. By aligning their trades with the prevailing trend, traders can reduce the chances of being caught off guard by sudden market reversals.

Furthermore, trend analysis provides a clear framework for developing trading strategies. Whether a trader is using a trend-following strategy, where they aim to ride the trend as long as possible, or a counter-trend strategy, where they seek to profit from trend reversals, trend analysis is the foundation of these approaches. Without a clear understanding of the trend, it becomes challenging to develop and execute a consistent trading strategy.

Conclusion

In the fast-paced and often unpredictable world of currency markets, trend analysis is an indispensable tool for traders. It provides a structured approach to understanding market movements, identifying opportunities, and managing risks. By mastering trend analysis methods such as moving averages, trend lines, and oscillators, traders can improve their chances of success in the forex market. Whether you’re a novice trader or an experienced professional, incorporating trend analysis into your trading routine is essential for navigating the complexities of the currency markets and achieving long-term profitability.

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.