Jackson Hole Economic Symposium: An Introduction

Every year the Federal Reserve Bank of Kansas City organizes the Jackson Hole Economic Symposium, which has been held in Jackson Hole, Wyoming since 1981. This conference has a history. Is considered one of the oldest central banking conferences worldwide. Its primary objective is to facilitate conversations regarding economic and monetary policy matters.

Distinguished individuals such as bankers, policymakers, economists, academics and financial market participants gather at this event from all corners of the globe. The attendees include figures in banking and finance ministries as well as respected academics and prominent players in financial markets. The proceedings of the symposium are closely monitored by market participants due to the impact that unexpected remarks from attendees can have on stock and currency markets.

Each year’s Jackson Hole Economic Symposium revolves around an issue affecting world economies. The purpose of this gathering is to provide a platform for participants to exchange perspectives on policy matters while also discussing the symposium’s topic from a long term viewpoint. Investors closely monitor the symposium discussions, for indications about the future of policy, in countries, especially the United States. This is because it is customary for the Federal Reserve Chair to deliver a speech during the event.

Participants and Attendees at the Jackson Hole Economic Symposium

Central Bank Officials and Their Role in Shaping Monetary Policy

Central bank officials play a crucial role in shaping monetary policy, which is used to manage economic fluctuations and achieve price stability, ensuring low and stable inflation. They attend the Jackson Hole Economic Symposium to discuss pressing economic issues, share insights, and explore potential policy directions. Central banks use interest rates, foreign exchange interventions, and asset purchase programs to influence economic conditions and achieve their objectives.

Economists, Academics, and Financial Experts Participating in Discussions

Economists, academics, and financial experts attend the symposium to engage in open discussions about important economic issues and policy matters. Their participation helps foster a platform for exchanging ideas, debating policy, and forming consensus on potential solutions to critical global economic challenges. By bringing together a diverse range of experts, the symposium facilitates a multi-dimensional analysis of economic trends and their implications. This exchange of viewpoints enhances the depth of understanding and encourages innovative approaches to address complex financial problems.

Market Participants Attending to Gain Insights

Market participants, including currency traders and investors, closely follow the Jackson Hole Economic Symposium for insights into the future of monetary policy in different countries, particularly the US. The symposium has a history of signaling policy shifts, and unexpected remarks from attendees can affect global stock and currency markets. Investors pay special attention to speeches by central bank leaders, such as the Federal Reserve Chair, as these speeches can provide early hints of future monetary policy adjustments.

The Jackson Hole Economic Symposium convenes central bankers, economists, and financial experts worldwide, providing a vital platform for discussions on economic and monetary policies.

Keynote Speech by Central Bank Chair

The Chairs Speech, at the Symposium; Its Significance

The address delivered by the chair of the bank at the Jackson Hole Economic Symposium holds immense importance. This speech not sets the tone for the event but also offers valuable insights into the central banks perspective on current economic conditions and policy strategies. Market participants, investors and policymakers closely follow this speech as it provides indications of shifts in policies and sheds light on the direction of monetary policy.

Discussion on Economic Conditions and Policy Strategies

Traditionally the bank chairs speech focuses on discussing present economic conditions challenges faced and policy strategies employed. It offers insights into how they perceive and assess the economy while outlining their approach to policy. The speech may also touch upon subjects such as analyzing our structure or addressing challenges associated with implementing monetary policies in times of uncertainty.

Influence of Forward Guidance on Currency Markets

Forward guidance plays a role in impacting currency markets. Central banks utilize this tool to communicate their expected course of action regarding policy. By providing a roadmap for interest rate expectations forward guidance aims to shape decision making for households businesses and investors alike. The objective is to prevent surprises that could disrupt markets or cause fluctuations, in asset prices.

The speech given by the chair of the bank, at the Jackson Hole Economic Symposium frequently contains forward guidance, which has the potential to impact stock and currency markets worldwide.

Monetary Policy Insights at the Jackson Hole Economic Symposium

Discussions about Potential Changes in Interest Rates

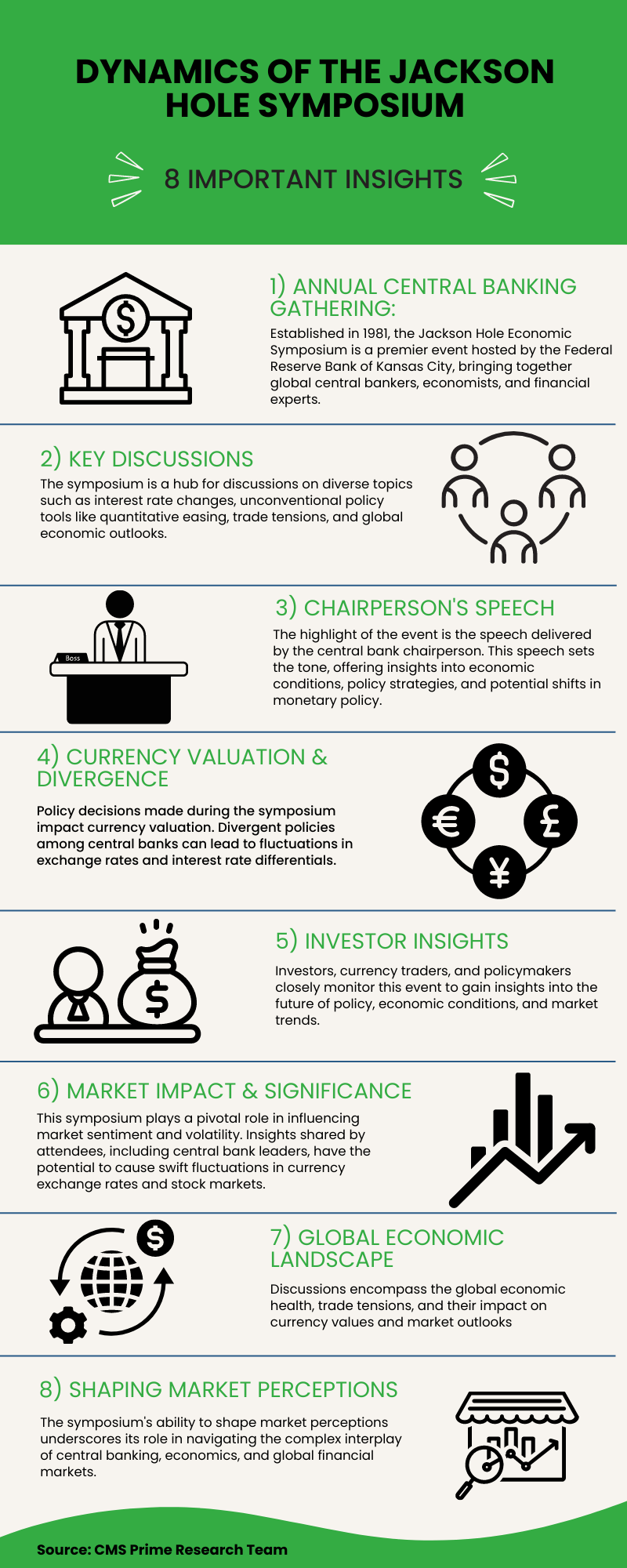

Discussions surrounding the adjustments, in interest rates are a topic at the Jackson Hole Economic Symposium, where central bankers and economists gather to deliberate on monetary policy. Interest rates play a role in managing fluctuations and ensuring price stability maintaining low and steady inflation levels. Changes in interest rates can have consequences on currency valuation and higher interest rates generally contribute to an increase in a country’s currency value while lower interest rates may not be appealing for investment.

Exploration of Quantitative Easing and Other Policy Tools

Furthermore during the symposium there is an exploration of tools for policy such as quantitative easing (QE). This approach involves banks engaging in large scale asset purchases to stimulate activity.

QE has been utilized during times like the crisis and the COVID-19 pandemic when interest rates were close to zero. The discussions at the symposium focus on evaluating the effectiveness of QE and other policy tools in achieving stability and fostering growth.

Influence of Policy Decisions on Currency Valuation

It is important to note that policy decisions made by banks hold influence over currency valuation. For instance changes in interest rates can impact a country’s currency compared to others that offer interest rate offerings. Additionally, implementing monetary policy tools like QE can also have effects on currency markets. The Jackson Hole Economic Symposium offers an opportunity for central bankers and economists to come together and have conversations about how policy decisions can impact the value of currencies and exchange rates.

Insights shared at the symposium, particularly speeches by central bank leaders, hold immense power to swiftly impact currency exchange rates and stock markets, inducing increased market volatility.

Market Volatility and Reactions at the Jackson Hole Economic Symposium

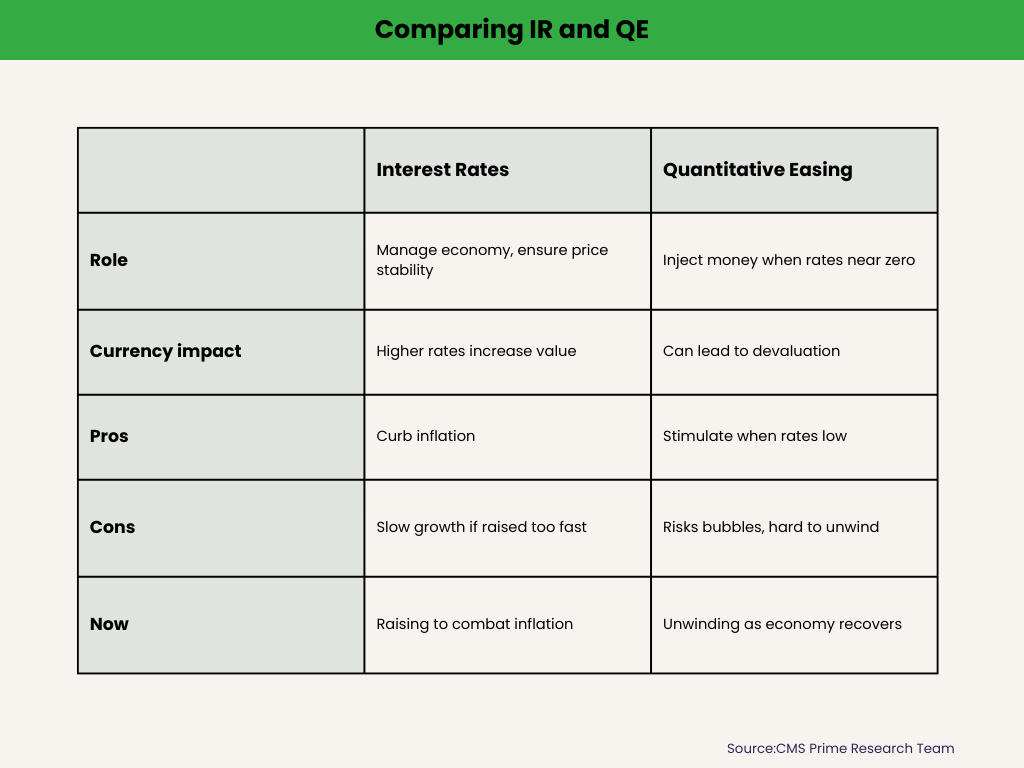

Market Reactions to Unexpected Statements or Surprises

The Jackson Hole Economic Symposium is closely followed by market participants, as unexpected remarks from attendees have the potential to affect global stock and currency markets. For instance, the stock market experienced significant declines following hawkish comments by Federal Reserve Chair Jerome Powell at the 2022 symposium, emphasizing the fight against inflation as the Fed’s top priority.

Rapid Fluctuations in Currency Exchange Rates

Currency exchange rates can be influenced by various factors, including central bank policy decisions and statements made at events like the Jackson Hole Economic Symposium. As a result, the symposium can lead to rapid fluctuations in currency exchange rates, particularly if market participants interpret the discussions as signaling potential policy shifts.

Link between Symposium News and Increased Volatility

The Jackson Hole Economic Symposium has a history of being a catalyst for increased market volatility, as investors and market participants closely watch the event for insights into the future of monetary policy. News and statements from the symposium can lead to significant market reactions, as investors adjust their expectations and positions based on the information shared during the event. This can result in increased volatility in stock and currency markets, as market participants respond to the potential implications of the discussions and speeches at the symposium.

Policy Divergence and Exchange Rates

Effects of Divergent Monetary Policy Stances Among Central Banks

The varying approaches to policy taken by central banks can have significant effects on the global economy impacting exchange rates and financial markets. When central banks in countries adopt strategies, such as tightening or loosening their monetary policies it can lead to fluctuations in currency values and interest rate differences.

Impact on Currency Pairs and Interest Rate Differentials

These differences in interest rates play a role in determining exchange rates. For example higher interest rates in one country can attract capital. Cause the exchange rate to increase. When there is a divergence in monetary policy approaches the differences in interest rates between countries can widen, resulting in increased volatility for currency pairs. Currency traders often take advantage of these differences to profit from both the interest rate differential (known as a carry trade) and potential price appreciation.

Currency Traders’ Adjustments Based on Policy Signals

Currency traders closely monitor signals from banks regarding their policies to make decisions about buying or selling currency pairs. In order to make these decisions traders utilize signal systems that rely on analysis charting tools or news events.

Traders can take advantage of changes in currency values and interest rate differences by analyzing policy signals and adjusting their positions accordingly. This occurs as a result of differing monetary policy approaches.

Global Economic Outlook and Trade Considerations

Discussions about Global Economic Health and Trade Tensions

Discussions regarding the state of the economy and trade tensions are common, at events like the Jackson Hole Economic Symposium. These discussions are crucial for policymakers and market participants as they seek to understand how trade disputes can impact conditions. By analyzing these factors they can formulate policy responses.

Impact on Currencies Closely Tied to International Trade

Currencies that are closely linked to trade can be significantly influenced by trade tensions and global economic trends. For instance heightened trade tensions often result in the appreciation of the US dollar while causing emerging market currencies to depreciate. Additionally changes in conditions can affect exchange rates as investors adjust their expectations and positions based on their perception of the overall health of the world economy.

Market Responses to Perceptions of Global Economic Trends

Market participants closely monitor trends and trade tensions to make well informed investment decisions. As perceptions about these factors change investors may revise their positions in response to risks and opportunities. This adjustment can lead to increased market volatility as investors react to information and reassess their expectations, for both economic growth and trade prospects.

Risk Appetite and Sentiment

Influencing Market Sentiment and Risk Appetite

Factors such as political events and investor perceptions of the economy play a significant role in influencing market sentiment and risk appetite. Events like the Jackson Hole Economic Symposium have the potential to impact market sentiment as discussions on issues and policy matters can shape investors’ outlook on policy and the global economy.

Currency Market Responses to Changes in Sentiment

Fluctuations in currency exchange rates can occur due to changes in market sentiment as investors adjust their positions based on their appetite for risk. When risk appetite is high investors may be more inclined to invest in yielding assets that may also come with increased volatility. Conversely during periods of risk appetite investors tend to seek safe haven assets that are expected to maintain or even increase their value during downturns.

Shifts Towards Safe-Haven Assets Based on Symposium Discussions

Discussions held at the Jackson Hole Economic Symposium can influence investors’ decisions to shift towards safe haven assets especially if these discussions indicate policy shifts or raise concerns about the economy. Safe haven assets such as gold, U.S. Treasuries and the Swiss franc are often favored by investors during times of market instability or uncertainty as they provide a level of protection against risks associated with investments.

Market participants are keeping an eye on the symposium to gain insights into the future of policy and the global economy. Based on their perception of the risks and opportunities discussed during the event they may make adjustments to their positions.

Conclusion:

In summary the Jackson Hole Economic Symposium is a gathering that brings together central bankers, policymakers, economists, academics and financial experts from around the world. Organized by the Federal Reserve Bank of Kansas City this event provides a platform for discussions on economic and monetary policy matters. The highlight of the symposium is the speech delivered by the bank chairperson. This speech holds significance as it sets the tone for the symposium and offers insights into the bank’s perspectives on economic conditions and policy strategies. Discussions at the Jackson Hole Economic Symposium cover a wide range of topics including potential changes in interest rates exploration of unconventional policy tools such as quantitative easing, impact of policy decisions on currency valuation, market volatility and reactions effects of policy divergence on exchange rates global economic outlooks, trade considerations, market sentiment analysis, risk appetite assessment and market responses to economic data releases. One notable impact of this symposium is its ability to influence markets like currency exchange rates and stock markets due to valuable insights shared by central bank leaders and other participants. The historical importance of the event lies in its ability to signify changes in policies and cause fluctuations in currency exchange rates and asset prices. This has garnered attention from market participants, investors and policymakers alike.