The Jackson Hole Economic Symposium 2023 witnessed central bank leaders from around the world addressing critical economic issues. Federal Reserve Chair Jerome Powell emphasized the persistent challenge of high inflation and the Fed’s resolute commitment to achieving its 2 percent inflation goal. European Central Bank President Christine Lagarde underscored the need for sustained high interest rates to combat inflation, while Bank of England Deputy Governor Ben Broadbent and Bank of Japan Governor Kazuo Ueda discussed the complexities of managing inflation and trade disruptions. These speeches hold implications for currency markets, interest rate expectations, and economic growth strategies.

Jerome Powell’s Speech

Inflation remains too high

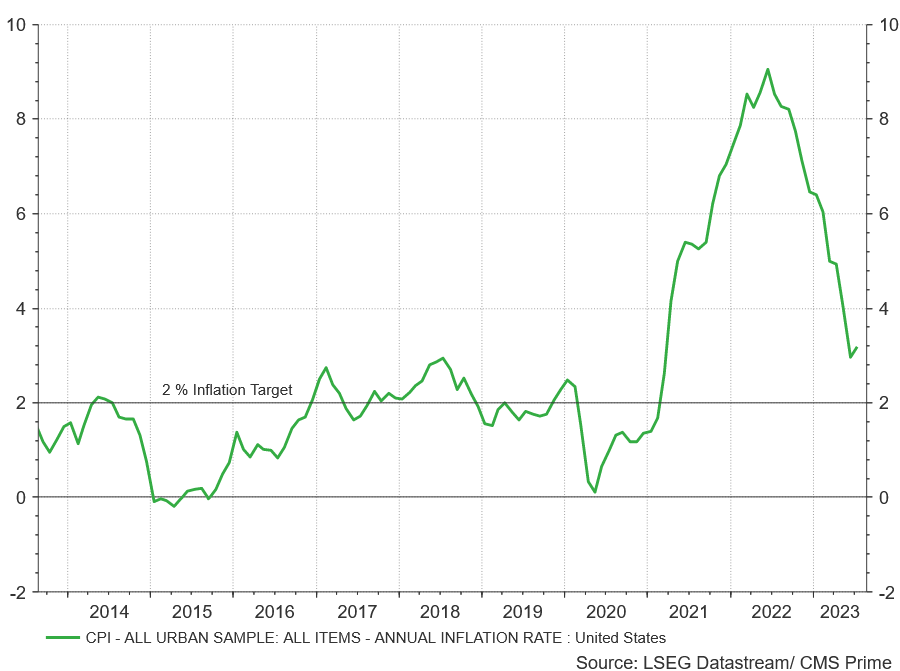

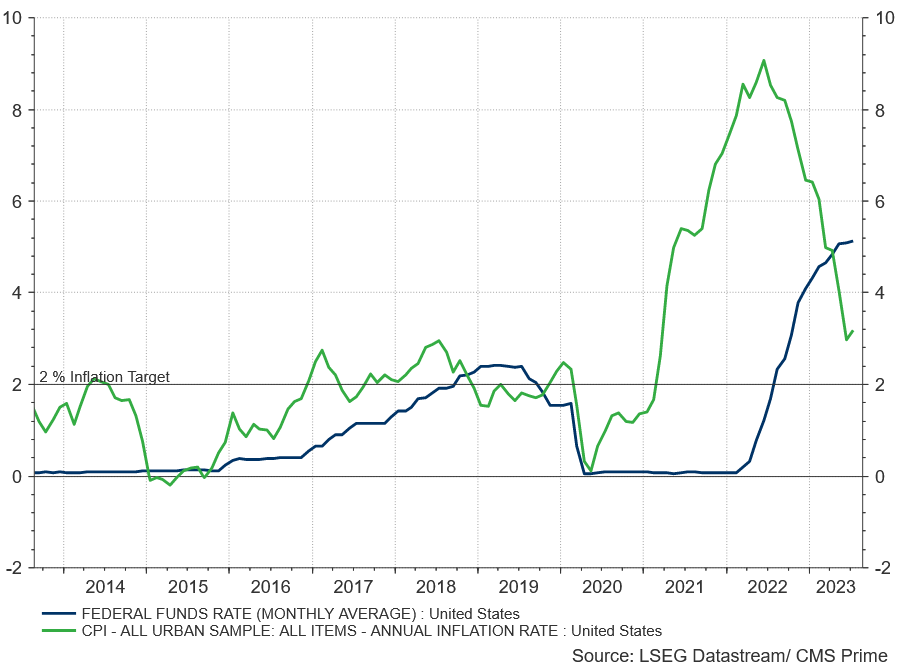

In his speech, at the Jackson Hole Economic Symposium 2023 Federal Reserve Chair Jerome Powell acknowledged that despite a decrease from its peak inflation continues to be too high. Powell emphasized the bank’s commitment to reducing inflation and achieving their goal of 2 percent. He expressed concern about the progress seen in the nonhousing services sector, an area he has been closely monitoring for some time. The persistence of inflation emphasizes the importance of the Feds efforts to address this issue and maintain price stability in the economy.

Fed’s commitment to tightening policy

Powell also highlighted the Feds dedication to tightening policy as a means to address inflation. Over the years, they have taken steps in tightening their policy stance with the aim of bringing inflation down to their targeted level. These actions have involved raising interest rates, which have helped reduce inflation from its peak but still remains above their desired level. The Fed’s actions demonstrate their determination, in tackling inflation and ensuring an environment.

Prepared to raise rates further if necessary

Powell in his speech mentioned that if necessary the central bank is ready to increase interest rates with the aim of bringing inflation down to its target level. He highlighted the Feds intention of maintaining a policy until they’re confident that inflation is consistently moving towards their desired objective. This statement indicates the Feds willingness to take measures when required in order to achieve their inflation goal and ensure stability.

Data-dependent decision-making

Powell also emphasized the significance of data driven decision making, in determining actions on interest rates by the bank. He made it clear that their decisions regarding rate hikes will be based on data as well as considering the evolving outlook and associated risks. This approach demonstrates the Feds commitment to making informed and carefully considered decisions based on up to date information. It also emphasizes the importance of monitoring indicators and adjusting policies accordingly in response to changing conditions.

No change in the inflation target

Despite speculations about a change in the Fed’s inflation target Powell dismissed suggestions and stated that they will maintain their 2 percent target. This statement confirms that the central bank is dedicated to keeping prices stable. By sticking to an inflation goal the Federal Reserve intends to establish a predictable structure, for managing monetary policies, which is crucial, for building trust and encouraging economic development.

In his speech, at the Jackson Hole Economic Symposium 2023 Federal Reserve Chair Jerome Powell acknowledged that despite a decrease from its peak inflation continues to be too high. Powell emphasized the bank's commitment to reducing inflation and achieving their goal of 2 percent.

Christine Lagarde, President of the European Central Bank (ECB)

Interest rates to stay high as long as necessary:

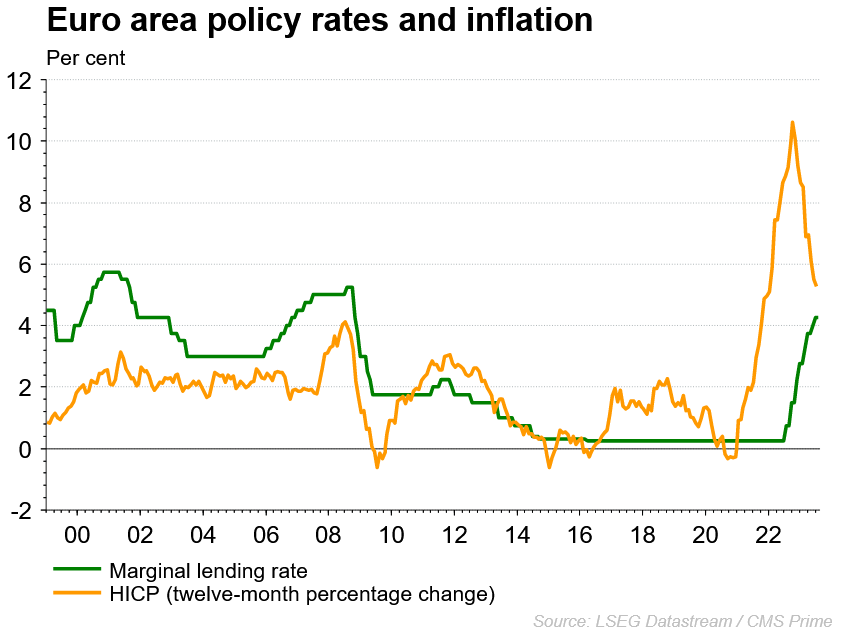

Interest rates will remain elevated, for as necessary according to Christine Lagarde, the President of the European Central Bank (ECB). During her speech at the Jackson Hole Economic Symposium 2023 Lagarde emphasized that the European Union needs to keep interest rates high in order to effectively combat inflation. While progress has been made in curbing inflation Lagarde emphasized that there is still work to be done. This statement underscores the ECBs commitment to maintaining price stability and preventing inflation in the economy.

ECB’s efforts to manage a stagnating economy:

Lagardes speech coincided with the ECBs efforts to manage a sluggish economy grappling with inflation. Within one year the central bank has raised its benchmark rate from minus 0.5% to 3.75% – marking the increase since the introduction of the euro in 1999. This proactive monetary policy approach reflects the ECBs determination to address inflation related challenges and foster economic growth across EU member states.

Disruptions to the global and European economies

A significant portion of Lagardes speech was devoted to discussing disruptions faced by both European economies. These disruptions may necessitate keeping interest rates higher for a duration than previously anticipated prior to the pandemic.

These challenges encompass the requirement to increase investments in energy and tackle climate change, the surge in trade barriers following the pandemic and the predicaments arising from these disruptions. Through addressing these matters Lagarde emphasizes the interdependent nature of the economy and underscores the significance of taking into account a diverse set of factors when formulating monetary policy choices.

Interest rates will remain elevated, for as necessary according to Christine Lagarde, the President of the European Central Bank (ECB). During her speech at the Jackson Hole Economic Symposium 2023 Lagarde emphasized that the European Union needs to keep interest rates high in order to effectively combat inflation

Bank of England Deputy Governor Ben Broadbent

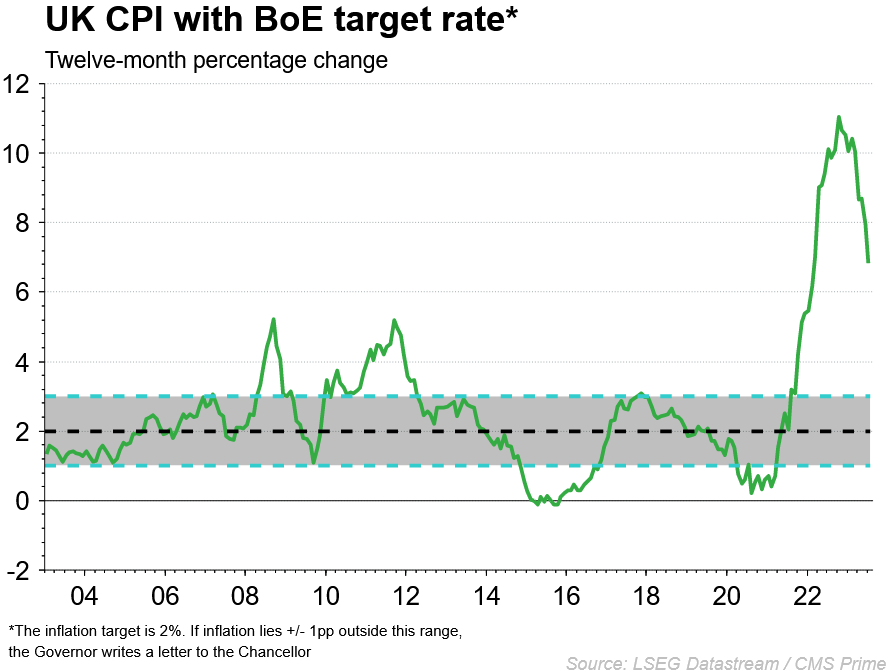

Interest rates may have to stay high for some time

In his speech Bank of England Deputy Governor Ben Broadbent highlighted that interest rates may have to stay high for some time due to the knock-on effects of the surge in prices. He mentioned that pressures on employers to push up wages, which has led to record growth in pay, were unlikely to fade away as rapidly as they emerged. As a result, he stated that “monetary policy may well have to remain in restrictive territory for some time yet”, this suggests that the Bank of England is prepared to maintain higher interest rates to address inflation and support economic stability.

Economic costs of restricting trade

Broadbent’s speech also focused on the economic costs of restricting trade, using the experience of the UK as an example,he discussed the various challenges and consequences of trade restrictions, highlighting the importance of understanding the implications of such policies on the economy. By examining the UK’s experience, Broadbent aimed to provide insights into the potential risks and costs associated with trade restrictions, which can inform policymakers and help them make better decisions in the future.

Bank of Japan Governor Kazuo Ueda

Inflation remains below target

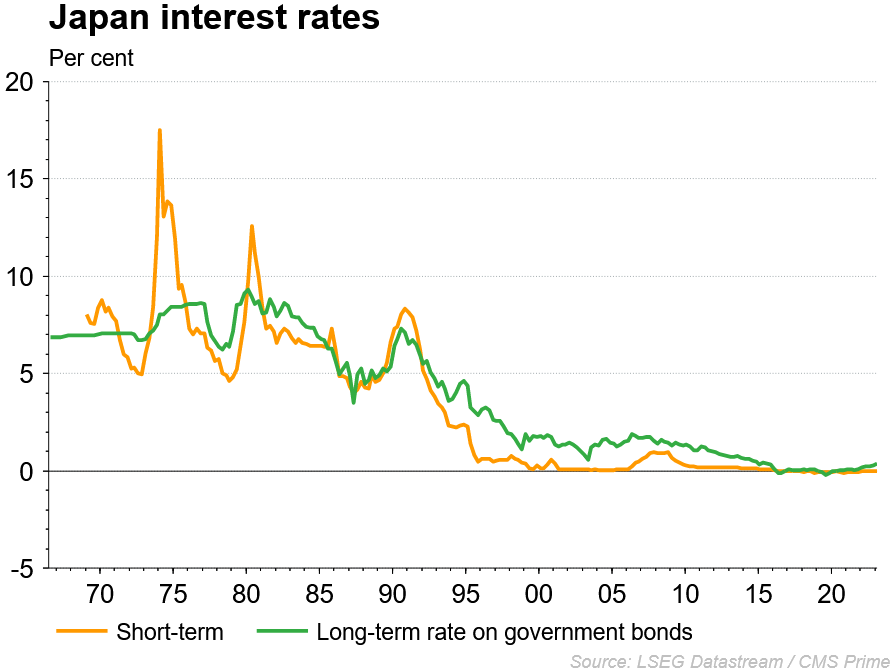

In his speech at the Jackson Hole Economic Symposium 2023, Bank of Japan Governor Kazuo Ueda highlighted that underlying inflation in Japan remains “a bit below” the central bank’s 2% target. This indicates that Japan’s economy is still facing challenges in achieving its desired inflation rate, which is essential for maintaining price stability and supporting economic growth.

Continuation of monetary easing policy

Due to the below-target inflation, Ueda explained that the Bank of Japan is sticking with its current monetary easing framework.This approach aims to stimulate economic growth and help Japan achieve its inflation target. By maintaining its easing policy, the Bank of Japan demonstrates its commitment to addressing the challenges posed by low inflation and supporting the country’s economic stability.

Impact on Currency Markets

The speeches delivered by the four bankers during the Jackson Hole Economic Symposium 2023 could have effects, on currency markets;

- Varying approaches to policies; The speeches indicate that central banks are adopting strategies in response to inflation challenges in their respective countries. While the Federal Reserve, European Central Bank and Bank of England are focused on tightening policy to address inflation rates, the Bank of Japan is maintaining its current easing framework due to below target inflation levels. This divergence in policy approaches could lead to fluctuations in currency exchange rates as investors adjust their positions based on interest rate differentials and expectations.

- Expectations regarding interest rates; The speeches suggest that interest rates may remain high or continue to rise in the United States, European Union and United Kingdom while Japan is likely to maintain its low interest rate environment. These expectations can impact currency markets since higher interest rates often attract capital inflows leading to currency appreciation while lower interest rates can result in capital outflows and currency depreciation.

- Growth and trade dynamics; The central bankers discussed economic issues and challenges during their speeches, including disruptions affecting global and regional economies, the importance of investing in renewable energy sources as well as the economic consequences associated with trade restrictions. Various factors have the potential to influence currency markets. They can exert an impact by affecting growth prospects well as trade flows. Consequently these aspects play a role in determining currency demand and exchange rates.

Conclusion:

The speeches delivered by central bank leaders at the Jackson Hole Economic Symposium 2023 collectively illuminate the diverse challenges facing global economies and the corresponding policy responses. With central banks navigating varying levels of inflation and economic disruptions, they are poised to influence currency markets through divergent monetary policies. As the central bankers underscore the significance of data-driven decision-making and the complexities of addressing economic disruptions, their unified commitment to maintaining price stability and fostering growth remains the underlying theme in an ever-interconnected global financial landscape.

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.