Introduction:

The future of the Forex market is being shaped by technological advancements, especially in the fields of artificial intelligence (AI), machine learning (ML) and algorithmic trading. These technologies are revolutionizing how Forex markets operate, providing new prospects for traders and investors and transforming the industry.

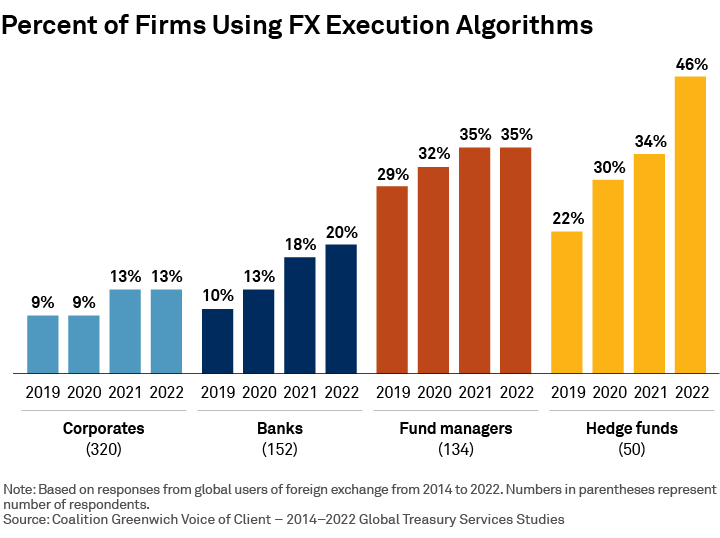

1. Algorithmic Trading and Execution Algorithms; The use of execution algorithms (EAs) in the Forex market has significantly increased as a result of market electronification, enhanced computing power and market fragmentation. EAs have become an established method for executing Forex trades, altering how market participants access the Forex market and carry out orders. They enhance market performance but also introduce new risks. For example, although EAs contribute positively to normal market conditions, there remains a risk of self reinforcing feedback loops triggering sudden price movements.

2. Artificial Intelligence and Machine Learning: AI and ML are causing a stir in the Forex realm due to their ability to analyze vast amounts of data, identify patterns and predict future trends that could potentially lead to profitable trading opportunities.

AI technologies have completely transformed the way people engage in trading, bringing advanced capabilities in recognizing patterns, analyzing data, making decisions and more. In the Forex market, AI relies heavily on machine learning to predict trends. By evaluating historical price data, technical indicators and chart patterns, machine algorithms can identify patterns and trends that provide insights into future price movements.

3.Predictive analytics is another area where AI has made a significant impact. With its ability to swiftly analyze large datasets and uncover patterns based on real time and historical data, AI proves especially valuable in the Forex market. This is crucial given the multitude of factors influencing market trends such as market sentiment, economic indicators and geopolitical events.

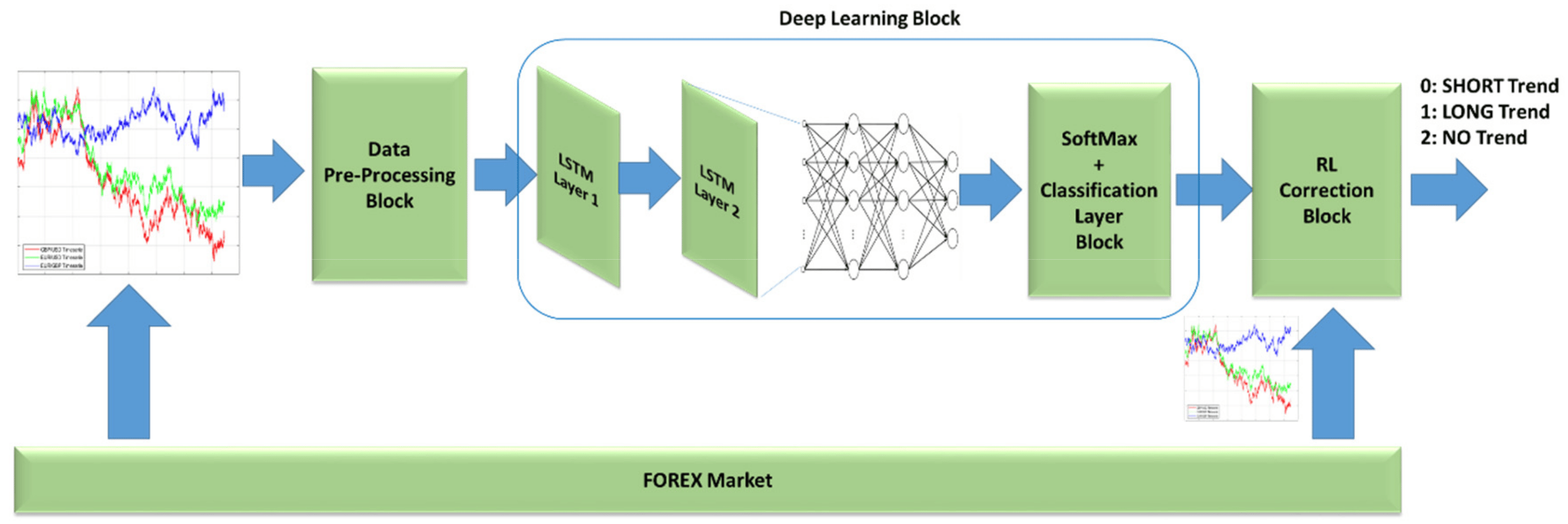

4.Deep learning techniques: which form a subset of machine learning, are being leveraged for trade and trend analysis in the Forex market. These systems assist traders and investors by identifying low risk entry or exit points until there is a reversal in the trend. However beneficial their application may be, it’s important to acknowledge that utilizing AI and ML in Forex trading also poses challenges and raises ethical considerations.These factors include the need for transparency, accountability, the potential impact on job opportunities, the initial high costs involved and the possibility of mechanical failures.

5. Areas for Future Research: There is still scope for further development in employing machine learning techniques to predict currency trends. Future studies could focus on addressing the unresolved concerns and challenges highlighted in existing research.

To summarize, it is likely that the future of Forex markets will see an increased reliance on technology, particularly AI, ML and algorithmic trading. While these advancements offer new prospects for traders and investors, they also bring forth fresh challenges and risks that must be effectively managed.

EA's and Execution Algorithms- What, Why and How

Execution Algorithms (EAs) have become a significant part of the Forex market, transforming the way market participants access and execute orders. These algorithms are computer programs that manage the trading process at high frequency, observing market data and sending back trading instructions often within milliseconds. They have been adopted due to increased computing power, market fragmentation, and the rising electronification of the market.

EAs have several benefits. They can analyze large amounts of data, optimizing price discovery and access to liquidity. They also generate cost savings by minimizing spreads and market impact, deliver on regulatory requirements, introduce trading desk operational efficiencies, and leave transparent audit trails. Furthermore, they eliminate human factors of emotion and psychology, which can lead to errors, and enable rapid order execution, reducing the potential for price fluctuations away from the desired price.

However, while EAs contribute positively to market functioning in normal conditions, they also introduce new risks. One of these risks is the potential for self-reinforcing feedback loops triggering sharp price moves. This can occur when algorithmic trades are correlated, suggesting that the algorithmic strategies used in the market are not as diverse as those used by non-algorithmic traders. This correlation can potentially lead to large price swings and market instability.

Moreover, while EAs can enhance market liquidity and reduce volatility, their impact on exchange rate volatility is not significant. The presence of more algorithmic trading is associated with lower volatility, but the economic magnitude of the effect is small.

In conclusion, while EAs have revolutionized the Forex market and brought numerous benefits, they also introduce new risks. Market participants need to be aware of these risks and implement strategies to mitigate them, such as diversifying their algorithmic strategies and regularly monitoring and adjusting their algorithms in response to changing market conditions.

Benefits of Execution Algorithms

There are several advantages to using Execution Algorithms (EAs) in Forex trading that can enhance the overall trading process;

1. Improved Speed and Efficiency: EAs have the capability to process and analyze large volumes of data within seconds. This allows traders to execute trades at the most favorable price and time, eliminating the need for manual execution and reducing the potential for human errors.

2. Elimination of Emotional Bias; Traders often face challenges associated with emotional bias, where fear and greed can influence decision making and result in unfavorable trading outcomes. EAs mitigate this bias by executing trades based on predefined rules and strategies. By removing emotions from the equation, algorithms assist traders in making more rational and disciplined trading decisions.

3. Backtesting and Optimization; EAs can undergo backtesting and optimization processes to ensure their effectiveness. Backtesting involves running the algorithm on historical data to assess how it would have performed in past market conditions. This enables traders to evaluate the profitability and reliability of the algorithm before using it for live trading purposes. Optimization entails fine tuning the algorithm’s parameters based on historical data to maximize its performance.

4. Portfolio Diversification; EAs have the capacity to trade multiple currency pairs simultaneously, allowing traders to diversify their portfolio effectively.

Traders can use this method to diversify their investments and take advantage of various market opportunities. Moreover, algorithms can continuously monitor and execute trades around the clock, even when the trader is unavailable.

5. Improved Risk Management; Effective risk management is essential in forex trading. With the help of EAs, traders can set pre determined stop loss and take profit levels to limit losses and safeguard profits. Additionally, algorithms can automatically adjust position sizes based on market volatility, allowing traders to manage risk more efficiently.

6. Enhanced Market Liquidity; EAs contribute to improved market liquidity by executing trades frequently, resulting in tighter pricing for end users.

7. Consistency and Discipline; EAs bring consistency and discipline to the trading process by ensuring that the trading plan is strictly followed. They are not influenced by fear, greed or bias when making trading decisions; they only enter or exit trades when specific conditions are met.

8. Ability to Test Historical Data; Forex traders have the ability to test their algorithms using historical market data before engaging in live trading. This allows them to evaluate the effectiveness of their strategies through backtesting and minimize potential risks.

To sum up, automated trading systems (EAs) provide numerous benefits for forex traders. These advantages include faster execution, increased efficiency, elimination of emotional factors, the ability to test and optimize strategies, diversification opportunities, better risk management, improved market liquidity and the promotion of consistency and discipline. Nevertheless, traders should remain cautious about the potential risks involved in utilizing EAs and should establish strong risk management protocols.

The Deep Learning Saga

Deep learning, which falls under the umbrella of machine learning, is increasingly being utilized in the Forex market for analyzing trades and trends. Its purpose is to create systems that assist traders and investors in identifying optimal entry and exit points with minimal risk, as well as predicting potential trend reversals.

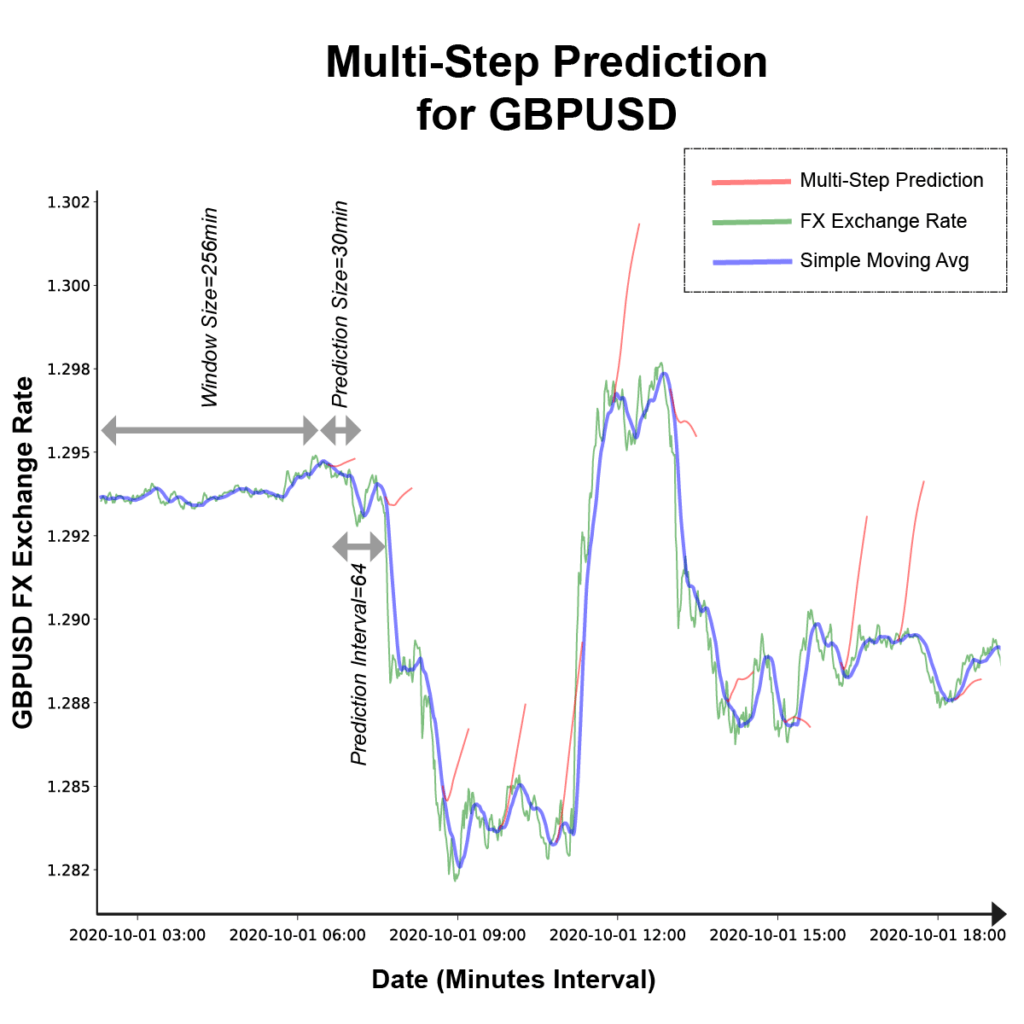

When it comes to forecasting the Forex market, deep learning models like Artificial Neural Networks (ANN), Long Short Term Memory (LSTM), Multi layer Perceptron (MLP Neural Networks) and Radial Basis Function have proven to be more effective than other machine learning models. These models have the ability to learn from large datasets and generate accurate predictions by identifying patterns and trends within the data.

In a particular study, five variations of LSTM were employed as trading strategies; Vanilla LSTM, Stacked LSTM, Bidirectional LSTM, Convolutional Neural Network LSTM (CNN LSTM) and Conv LSTM. The performance of these models was evaluated using metrics such as explained variance score (EVS), maximum error (ME), mean squared error (MSE) and R square (R2). A research paper introduced a system based on deep learning that aims to understand the trends of currency pairs by analyzing the buying and selling of currencies. This system focuses on observing trends for a specific day, considering the previous day and a few days ahead as per user input. It considers both short term and long term trends.

Another study proposed an algorithmic framework for analyzing trade and trend patterns in the Forex market in the short term. The framework combines different techniques, including augmenting currency pairs, using a Deep Predictive Coding Network optimized with a Reptile Search Algorithm.

In summary, researchers are utilizing deep learning models to analyze historical data from the Forex market. These models help identify patterns and trends, enabling traders and investors to make more informed decisions regarding when to enter or exit trades. Although these models can provide high accuracy, it’s essential to note that they are not infallible. Therefore, they should be used alongside other trading strategies and tools to maximize profitability.

Conclusion:

The use of execution algorithms (EAs) and deep learning in Forex trading has significantly transformed the market, offering numerous benefits but also introducing new risks and challenges.

EAs have become a well-established means of Forex execution, driven by the rising electronification of the market, increased computing power, and market fragmentation. They have changed the way market participants access the Forex market and how orders are executed, improving market functioning. However, they also introduce new risks. For instance, while EAs contribute positively to market functioning in normal conditions, the risk of self-reinforcing feedback loops triggering a sharp price move persists.

Deep learning, a subset of machine learning, is being used to develop systems for trade and trend analysis in the Forex market. These systems help traders and investors find low-risk entry points or exit points until the trend reverses. Deep learning models such as Artificial Neural Networks (ANN) have shown a growing trend in their use in the Forex market prediction. However, the application of machine learning techniques for FX market prediction still poses open difficulties.

In conclusion, the use of EAs and deep learning in Forex trading has revolutionized the market, offering numerous advantages such as improved market functioning and aiding in trade and trend analysis. However, these technologies also introduce new risks and challenges, such as the risk of self-reinforcing feedback loops and the difficulties in applying machine learning techniques for market prediction. Therefore, it is crucial for traders and investors to understand these technologies and their implications thoroughly to effectively navigate the Forex market.

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.