GBP/USD edged lower on Monday, retreating to 1.2981 as it struggled to maintain gains above the key 1.30 level amid rising U.S. Treasury yields, which boosted the dollar and capped sterling’s advance. The pair continues to trade range-bound between 1.29 and 1.30, with the 100-day moving average (DMA) near 1.2971 acting as an immediate support. The upcoming UK budget on October 30 is a key event that could drive GBP/USD’s direction, with expectations for substantial spending cuts and tax increases, aimed at addressing the large fiscal deficits from pandemic-era policies. These measures are anticipated to have long-term implications for UK growth and inflation, both of which remain focal points for sterling traders.

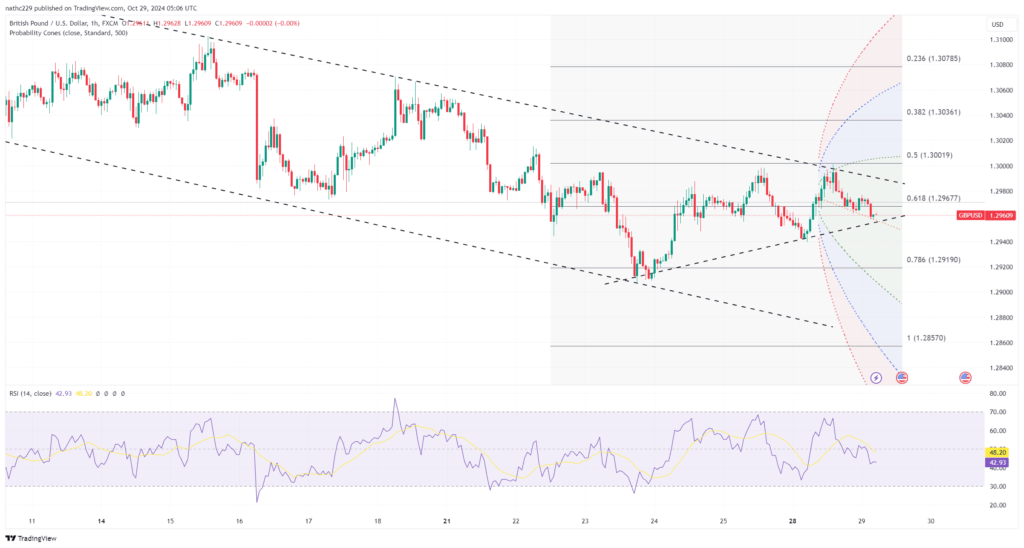

Technically, GBP/USD needs to close above its falling 10-DMA to generate upward momentum. The pair faces resistance at 1.3015 (October 22 high) and 1.3074 (21-DMA), followed by a more substantial barrier at 1.3109, which represents the 38.2% Fibonacci retracement of the 1.3434-1.2908 drop. Support is seen at Monday’s low of 1.2942, followed by the October 23 daily low at 1.2908 and the lower 30-day Bollinger Band at 1.2843. Without a close above the 10-DMA, GBP/USD bulls are likely to encounter difficulties in pushing the pair higher, especially with the dollar’s strength and high U.S. Treasury yields weighing on sentiment.

Looking ahead, GBP/USD’s direction will largely hinge on the outcomes of the UK budget and the upcoming U.S. election on November 5. If the UK budget leans towards aggressive fiscal tightening, GBP/USD may struggle as growth prospects dim. On the other hand, a potential Trump victory in the U.S. election could keep U.S. rates elevated, favoring the dollar and potentially putting further pressure on GBP/USD. For now, sterling bulls must contend with immediate resistance at 1.3015 and look for a strong close above this level to target higher levels near 1.32 in the medium term.