The British pound surged to a new 2024 high of 1.3298 against the U.S. dollar on Wednesday following the Federal Reserve’s decision to cut interest rates by a substantial 50 basis points (bps). The Fed’s aggressive move boosted the pound, which gained 0.74% to 1.3259, with a trading range of 1.3298-1.3157 throughout the day. The market had largely anticipated the possibility of such a large rate cut, with futures markets pricing in a 60% chance of a 50bps reduction to signal the beginning of a broader easing cycle.

The Federal Reserve’s rate cut decision was driven by its growing confidence in managing inflation, even as inflationary pressures ease. Policymakers expect further rate cuts in the future, forecasting another 50bps reduction by 2024, although not all members of the committee were in agreement. Fed Governor Michelle Bowman dissented, favoring a smaller rate cut instead.

As the spotlight now turns to the Bank of England (BoE), market participants are closely monitoring the central bank’s next move. The UK’s core Consumer Price Index (CPI) data, released earlier today, came in above expectations, pushing the likelihood of a BoE rate cut to the lower end of the market’s predicted range of 20% to 40%. While the BoE’s decision remains uncertain, many traders speculate that the central bank might follow the Fed’s aggressive approach in its own monetary policy meeting on Thursday.

The broader outlook for the pound remains promising, even in light of potential easing from the BoE. Despite the dovish sentiment on both sides of the Atlantic, the pound may continue to benefit from its current rate advantage over the U.S. dollar. With the Fed projected to cut rates by a total of 250bps by the end of 2025 and the BoE expected to reduce rates by 186bps, the pound’s edge in interest rates could lend ongoing support to GBP/USD, even amid a UK easing cycle.

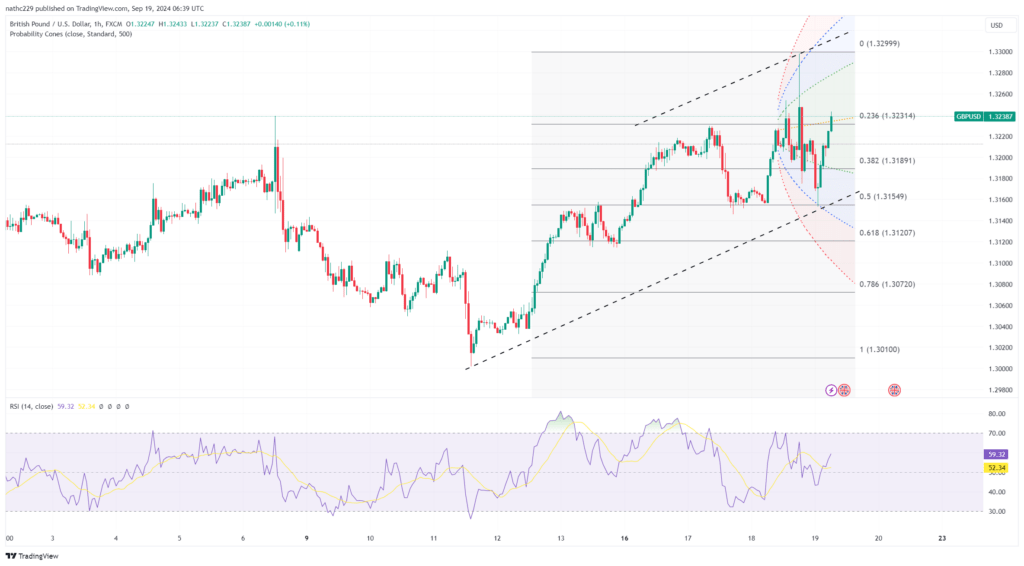

From a technical perspective, key support for GBP/USD lies at 1.3228, which represents the 23.6% Fibonacci retracement of the recent rally from 1.3003 to 1.3298, while 1.3157 marks the Wednesday low. On the upside, resistance remains at the post-Fed high of 1.3298, with additional resistance levels at 1.3299, a key weekly high from March 2022, and 1.3437, last seen in February 2022.

As traders digest the Fed’s decision, attention now shifts to the BoE’s policy response. If the BoE adopts a similar dovish stance, sterling could see further volatility. However, with rate cut expectations already factored into the market, the pound may continue its upward trajectory, supported by the ongoing rate differentials between the UK and the U.S.