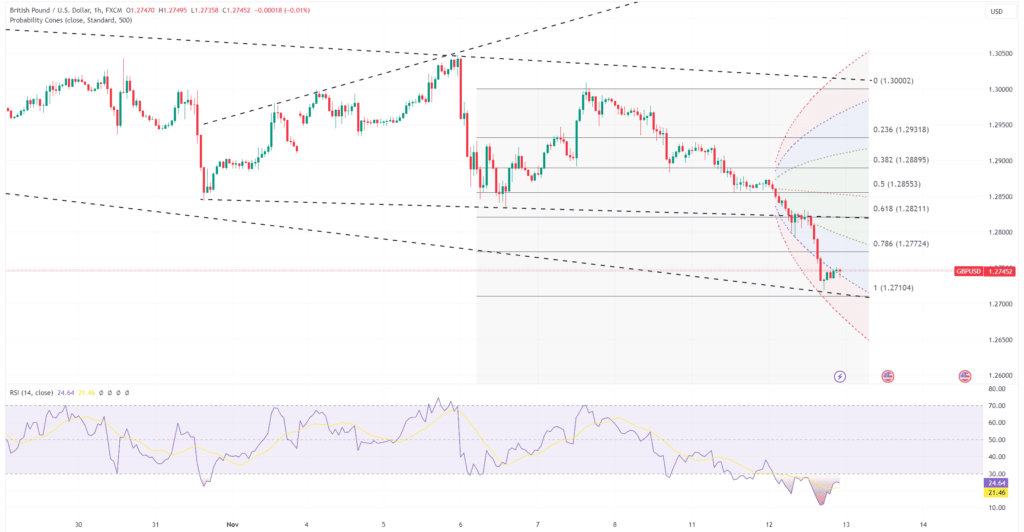

GBP/USD extended its losses on Tuesday, breaking below the 200-day moving average at 1.2819, a critical support level that has now turned resistance. The pair dropped to a session low of 1.2719, trading down 1.04% late in the NY session. This move has heightened bearish sentiment, with the break below 1.2819 signaling further potential for downside. Market positioning data from the IMM reveals a long bias in sterling, but recent price action suggests that many of those positions are likely being unwound as sterling bulls face increasing pressure.

Technically, the breach of the 200-DMA marks a significant shift, bringing support levels at 1.2666, the August 8 low, and the 100-week moving average near 1.2601 into focus. Resistance is now situated at 1.2785, the 10-hour moving average, followed by the former 200-DMA support at 1.2819. Further sterling weakness is also bolstered by broader dollar strength, as the greenback tracks U.S. Treasury yields higher. Despite the UK’s interest rate differential over the U.S. projected through 2025, this is having little impact on GBP/USD, as the dollar’s performance remains linked closely to rising yields.

Sterling bulls may find it challenging to regain control unless U.S. Treasury yields pull back significantly. With the “Trump trade” driving U.S. assets and the dollar higher, GBP/USD may continue to trade with a downside bias in the near term, with the next test at 1.2666 as sellers look to maintain pressure.