Oil Market Overview

Price Movements and Immediate Causes:

- Oil prices experienced a decline on Tuesday, primarily due to the reduced impact of Hurricane Beryl on U.S. oil infrastructure.

- Brent crude futures fell by 0.6% to $85.26 per barrel, while WTI crude slipped by 0.7% to $81.79 per barrel.

Impact of Hurricane Beryl:

- The hurricane weakened into a tropical storm after hitting the Texas coast, resulting in less damage than anticipated.

- Major refineries along the U.S. Gulf Coast were minimally impacted, and several are preparing to restart operations.

Global Factors:

- Progress on ceasefire negotiations in Gaza has also alleviated concerns about potential disruptions in Middle East oil supply.

- U.S. officials are actively engaged in talks in Cairo, which is contributing to a calming effect on the oil market.

Market Sentiments and Volatility

Supply and Demand Dynamics:

- The resumption of operations at key ports like Corpus Christi and Houston is aiding in stabilizing supply concerns.

- Saudi Arabia’s crude oil supply to China is set to rebound in August, which will help the biggest oil exporter regain market share.

Economic Indicators and Central Bank Actions:

- Market participants are closely monitoring U.S. inflation data and Federal Reserve Chair Jerome Powell’s testimony before Congress. Expectations of a rate cut in September have risen to about 80%.

- Global shares exhibited mixed movements, with European markets slightly down while U.S. futures indicated a positive opening.

Risk Factors

Weather and Geopolitical Risks:

- Despite the minimal impact of Hurricane Beryl, the Atlantic hurricane season poses ongoing risks to U.S. refining and production capacity.

- Record heat in the U.S. is expected to challenge refinery operations, potentially leading to equipment malfunctions and capacity reductions.

Inventory Levels:

- U.S. gasoline and distillate inventories have risen, but there remains limited margin for error given the volatile weather patterns and hurricane forecasts.

Trends and Sentiment Analysis

Energy Sector:

- Energy shares in Europe led the losses, reflecting lower oil prices.

- However, positive market sentiment in the U.S. was bolstered by the prospect of rate cuts and stable corporate earnings.

Currency and Bond Markets:

- The euro held steady close to a four-week high, while the U.S. dollar stabilized near four-week lows.

- Euro zone bond yields inched higher, with the gap between French and German borrowing costs holding steady, reassuring markets of political stability in France.

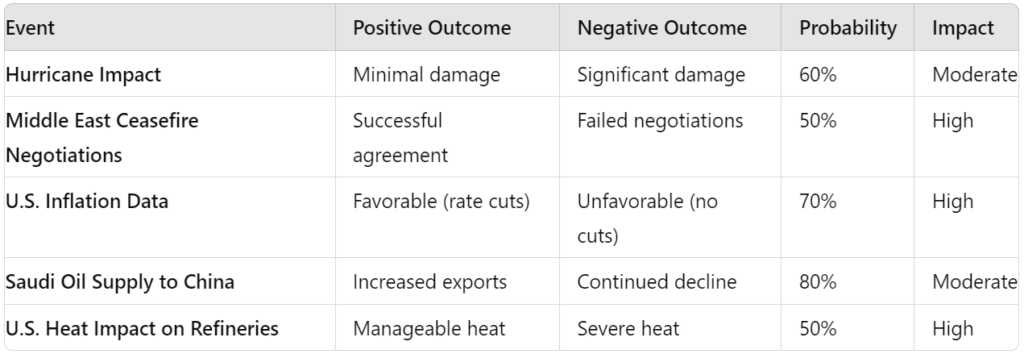

Risk Sentiment and Payoff Matrix:

In the current market environment, investors face a complex interplay of risks and opportunities. The payoff matrix below outlines potential outcomes based on key market events and their impact on oil prices, considering both positive and negative scenarios.

Analysis:

The payoff matrix highlights the mixed sentiment in the market. For instance, the reduced impact of Hurricane Beryl and potential progress in Middle East ceasefire negotiations present opportunities for stability in oil prices. Conversely, significant damage from future hurricanes or failed ceasefire negotiations could lead to volatility. The probability of favorable U.S. inflation data is relatively high, suggesting a strong likelihood of supportive monetary policy, which could positively influence market sentiment.

Investors should remain vigilant of these risk factors while balancing their portfolios to mitigate potential adverse impacts. The combination of geopolitical developments, weather patterns, and economic indicators will continue to shape the market dynamics, necessitating a flexible and responsive investment strategy.

Conclusion

The oil market is currently navigating a complex landscape of reduced hurricane impact, geopolitical negotiations, and economic indicators. The combination of these factors has led to a cautious yet stable market environment. As the situation in the Middle East progresses and U.S. inflation data is released, market participants will continue to adjust their strategies in response to evolving risks and opportunities.

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.