Range-bound markets are characterized by a financial asset, such as a currency pair, trading within a relatively tight price range. In these markets, the asset’s price remains within the defined support and resistance levels, making it difficult to make money due to low volatility. Traders typically use range-bound trading strategies in conjunction with other indicators, such as volume, to increase their odds of success.

Importance of Currency Pairs in Range-Bound Markets

Currency pairs are the foundation of forex trading, as they represent the relative value of one currency against another. Major currency pairs, which include the most liquid and frequently traded pairs, are crucial for traders to understand and monitor.

Trading in range-bound currency markets can be profitable if traders employ strategies that help them identify key support and resistance levels, use oscillators to identify turning points in the range, and combine range-bound trading with other indicators. By closely monitoring major currency pairs and employing these strategies, traders can potentially profit from range-bound currency markets despite the challenges posed by low volatility. In range-bound markets, technical analysis plays a pivotal role in guiding traders’ decisions. Traders utilize various technical indicators and chart patterns to analyze historical price movements and identify potential breakout or reversal points within the established trading range.

Market Fundamentals; Trends and Conditions of Price Ranges

Market Trends; Upward, Downward and Sideways Movements

Market trends refer to the direction of asset prices based on their movements. There are three types of trends; trends, downward trends and sideways movements. An upward trend is characterized by prices consistently reaching peaks and higher lows. Conversely a downward trend involves prices continually declining with highs and lower lows. Meanwhile a sideways trend, also known as consolidation or range bound movement occurs when prices move horizontally within a range.

Characteristics of Range Bound Markets

Range bound markets are marked by financial assets trading, within a price range while the price remains within defined support and resistance levels. These markets are often described as choppy or exhibiting sideways movement. Traders usually employ range bound trading strategies in conjunction with indicators like volume to increase their chances of success.

Factors Contributing to Range Bound Conditions

factors can contribute to conditions that result in range bound markets, including uncertainty surrounding events the absence of a clear market catalyst technical factors, at play, seasonality effects and even the time of day[3].

For instance in situations where there isn’t any news or economic data being released traders might face difficulties, in finding reasons to either buy or sell a specific asset. This can result in a lack of market direction. Cause prices to move within a limited range. Moreover market volatility and range can also be affected by factors such as seasonality and the time of day. During the summer months or certain times of the day trading volume may decrease, leading to confined conditions, in the market.

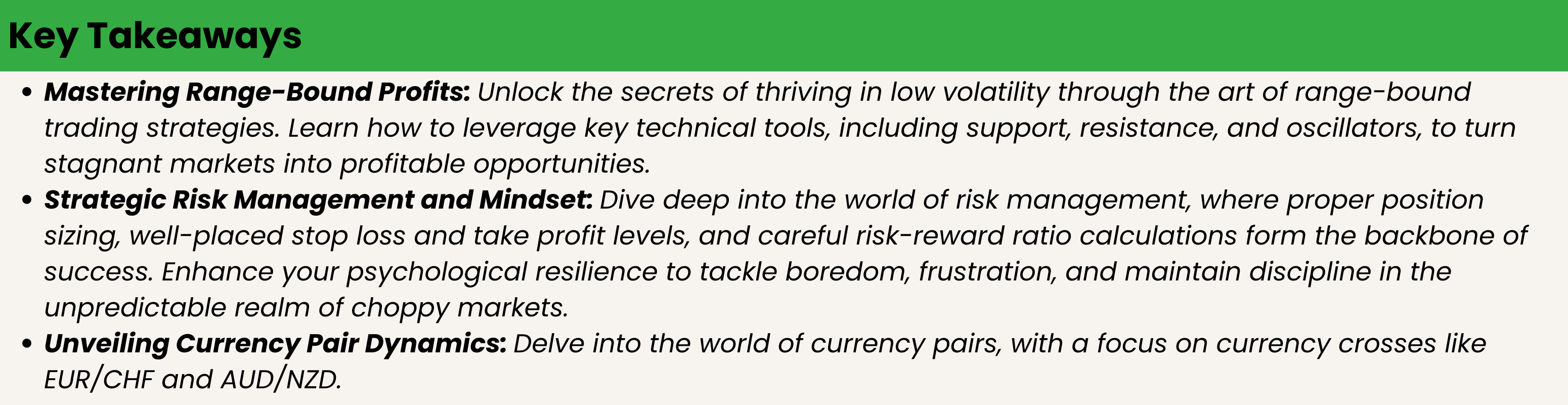

Range-bound markets, characterized by their tight price ranges, challenge traders with low volatility. Navigating these conditions requires employing strategic trading approaches and technical tools like support-resistance levels and oscillators. Through these methods, traders can turn seemingly limited opportunities into profitable ventures

Technical Analysis for Range-Bound Markets

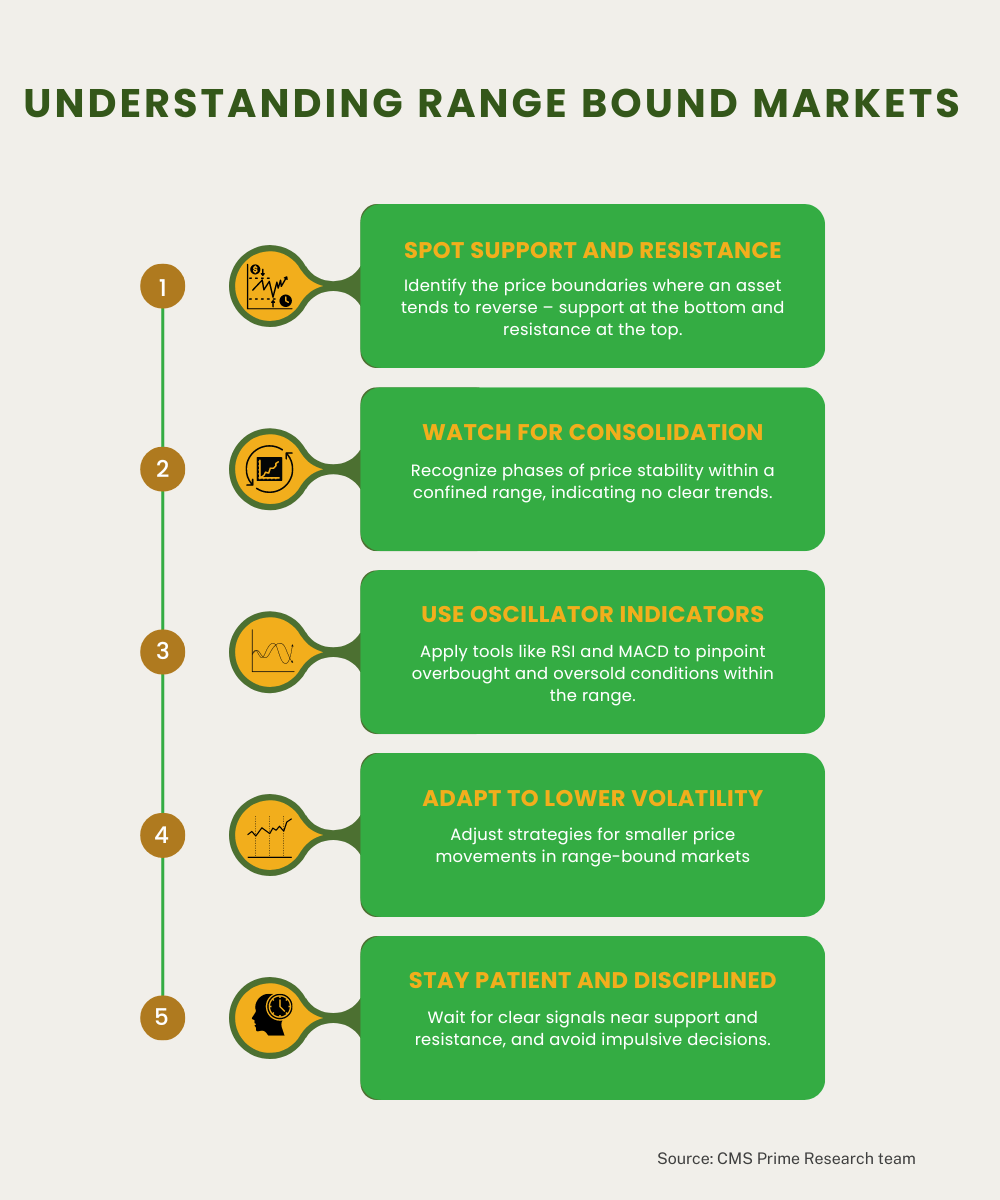

Identifying Support and Resistance Levels

Support and resistance levels are crucial in range-bound markets, as they represent the price points where the asset’s price is likely to pause or reverse. By accurately identifying these levels, traders can make better-informed decisions on when to enter or exit trades.

Bollinger Bands and Keltner Channels

Bollinger Bands and Keltner Channels are technical analysis tools that can help traders identify range-bound market conditions. Bollinger Bands use standard deviation, while Keltner Channels use the average true range (ATR) to measure volatility. Both tools can be used to determine overbought and oversold levels, as well as to monitor for potential breakouts.

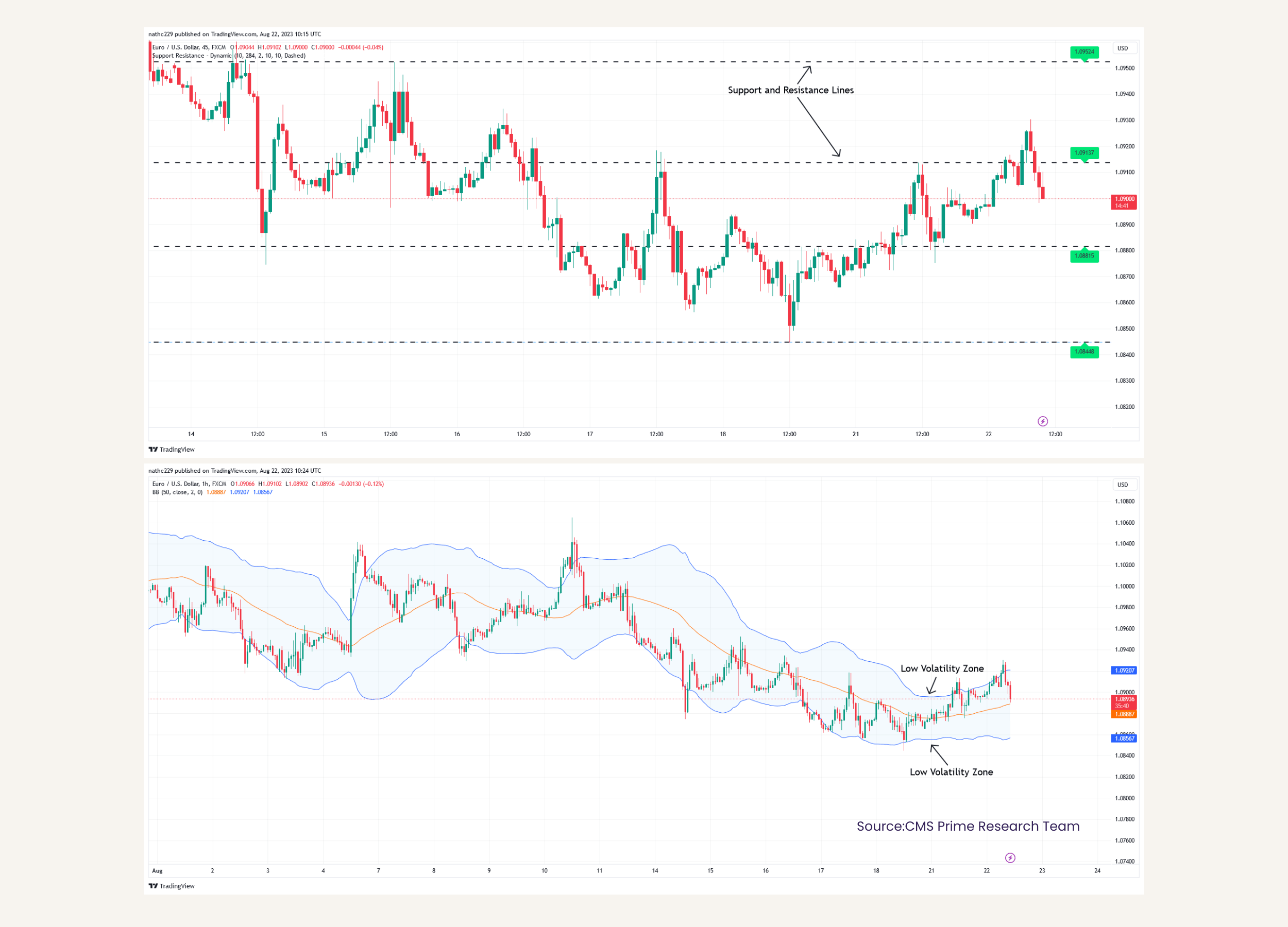

Using Moving Averages in Ranging Conditions

Moving averages can help traders identify trends and gauge overall market sentiment. In range-bound markets, moving averages can be used to determine the direction of price momentum and to establish support and resistance levels.

Oscillators and Momentum Indicators

Oscillators, such as the Relative Strength Index (RSI) and Stochastic Oscillator, are momentum indicators that help traders identify overbought or oversold conditions in range-bound markets. These indicators can provide valuable insights into potential market entry and exit points.

By employing these technical analysis tools and strategies, traders can better navigate and potentially profit from range-bound markets.

Navigating range-bound markets demands strategic finesse. Employing mean reversion and breakout strategies, along with technical tools like support-resistance levels and oscillators, empowers traders to decode and capitalize on these periods of low volatility. These tools serve as the gateway to transforming seemingly stagnant market conditions into profitable opportunities.

Range-Bound Trading Strategies

Mean Reversion Strategy

Mean reversion strategy is a trading approach that exploits the phenomenon of prices reverting to their historical average or trend. In range-bound markets, this strategy can be particularly effective, as prices tend to oscillate between established levels.

Moving Average Crossovers in Ranging Markets

Moving average crossovers can be used as a trading strategy in range-bound markets. When a shorter-term moving average crosses above a longer-term moving average, it can signal a potential buying opportunity. Conversely, when a shorter-term moving average crosses below a longer-term moving average, it can signal a potential selling opportunity. However, in range-bound markets, traders should approach moving average crossovers with caution. Since the price tends to oscillate within a defined range, crossovers might result in false signals, leading to unprofitable trades.

Breakout Strategy within Ranges

A breakout strategy within ranges involves identifying when the price breaks out of its established range and taking a position accordingly. This can be a profitable approach, as it allows traders to capture gains in the direction of the breakout.

Range Trading with Pivot Points

Pivot points are technical analysis indicators used to determine support and resistance levels in range-bound markets. Traders can use pivot points to identify potential entry and exit points for their trades, as well as to gauge overall market sentiment.

By employing these range-bound trading strategies, traders can potentially profit from markets that are moving within a relatively tight price range.

Risk Management in Range-Bound Markets

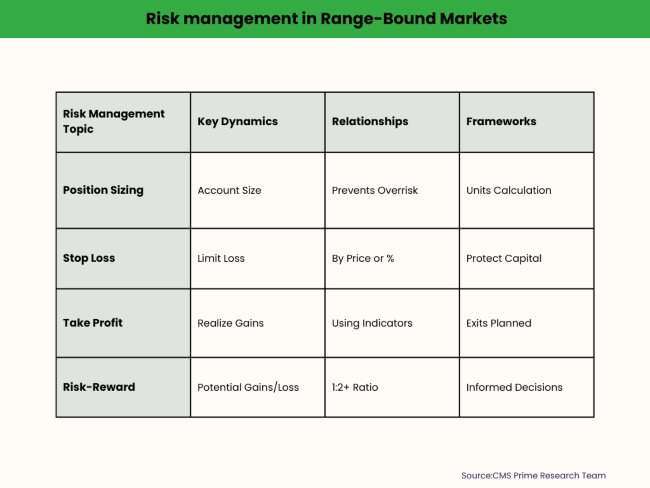

Importance of Proper Position Sizing

Proper position sizing is crucial in risk management, as it determines the number of units to buy or sell in a forex pair or other financial assets. It helps prevent risking too much on a trade and blowing up your account. By adjusting position sizes according to potential losses that can be sustained, traders can better manage their risk and avoid strong emotional responses that could derail their trading.

Setting Stop Loss and Take Profit Levels

Setting stop loss and take profit levels is essential for managing risk in range-bound markets. Stop loss orders can be set at specific price levels or as a percentage of the asset’s current price, which helps limit losses. Take profit levels can be determined using technical indicators, such as support and resistance lines, to identify potential exit points.

Managing Risk-Reward Ratio

The risk-reward ratio is a measure of potential profit versus potential loss in a trade. It is generally recommended to use a risk-reward ratio of at least 1:2 to ensure that the potential profit is greater than the potential loss. By calculating and managing risk-reward ratios, traders can better sustain long-term profitability and make informed decisions about their trades.

Psychology of Trading in Range-Bound Markets

Dealing with Boredom and Frustration

Trading in range-bound markets can be tedious and boring, as traders often spend long hours analyzing data, studying charts, and waiting for the right moment to enter or exit trades. Boredom can lead to overtrading, forcing trades, or increasing risk tolerance, which can result in unnecessary losses. To deal with boredom, traders should remind themselves that it’s okay to take breaks, gather their thoughts, realign their trading goals, and focus on more constructive efforts.

Maintaining Discipline in Choppy Markets

Choppy or range-bound markets can be challenging to navigate, as they lack a clear direction and can lead to missed opportunities or losses. Maintaining discipline in such markets is crucial for long-term success. Traders should stick to their trading plan, avoid impulsive decisions, and employ robust risk management techniques. By staying disciplined and focused on their trading objectives, traders can better manage their emotions and make more informed decisions in range-bound markets.

Example pairs of Range Bound Trading in Currencies

Currency Crosses as Pairs with Limited Range

Pairs that don’t involve the USD as one of the currencies, known as currency crosses are usually more suitable for range bound trading strategies. For instance we have EUR/CHF and AUD/NZD as examples of pairs. These pairs often establish support and resistance zones making them ideal for range trading.

Range Trading with EUR/CHF

EUR/CHF is recognized for its tendency to trade within a defined range since it involves two currencies from culturally similar countries. Traders can implement range bound strategies by identifying support and resistance levels buying when prices are low and selling when prices are high.

Range Trading with AUD/NZD

Another currency pair suitable for range bound trading is AUD/NZD. Similar, to EUR/CHF this pair frequently trades within a price range enabling traders to take advantage of price fluctuations by buying at the end of the range and selling at the upper end. By identifying currency pairs and employing range bound trading strategies traders have the potential to profit from price movements within a predetermined range.

To increase the likelihood of success, in currency markets that tend to stay within a range it is crucial to keep an eye on market conditions and make necessary adjustments, to our strategies.

Conclusion

In summary, range-bound markets are characterized by financial assets trading within a relatively tight price range, making it difficult to make money due to low volatility. Traders can employ various strategies, such as mean reversion, breakout strategies within ranges, range trading with pivot points, and moving average crossovers, to profit from range-bound markets. Technical analysis tools, such as support and resistance levels, moving averages, oscillators, and Bollinger Bands, can help traders navigate these markets.

Risk management is crucial in range-bound markets, with proper position sizing, setting stop loss and take profit levels, and managing risk-reward ratios being essential components. Traders must also deal with the psychological aspects of trading in range-bound markets, such as boredom and maintaining discipline in choppy markets.

Combining range-bound strategies with currency trading involves applying these strategies to suitable currency pairs and adjusting them for volatile forex markets. Real-life examples of range-bound trading in currency pairs include EUR/CHF and AUD/NZD. By employing these strategies and closely monitoring market conditions, traders can potentially profit from range-bound markets despite the challenges posed by low volatility.