Why Study Market Regimes?

Navigating the complex and dynamic landscape of foreign exchange (Forex) markets requires traders to employ a diverse set of tools and strategies. Market regime detection is a critical approach that aids currency traders in understanding and responding to the ever-shifting market conditions that influence currency pair movements. In this context, we explore the significance of market regime detection for currencies, examining how it enhances trading strategies, facilitates effective risk management, and showcases practical applications through tools like Hidden Markov Models and other techniques. This article delves into the key insights and applications of market regime detection in the Forex arena.

Popular tools for market regime detection in currency trading

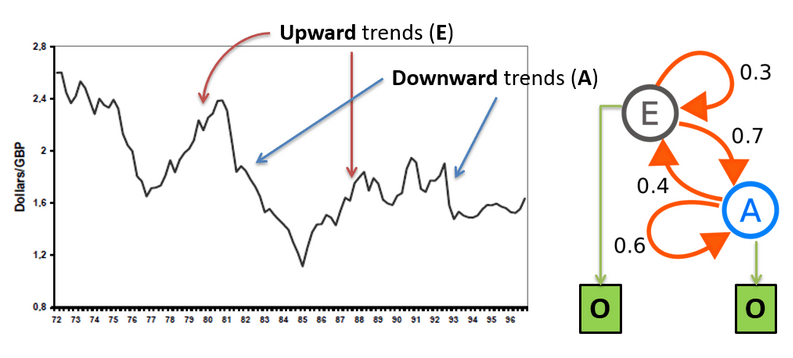

- Hidden Markov Models: These models can help capture correlations between currency pairs and provide insights into the underlying market dynamics.

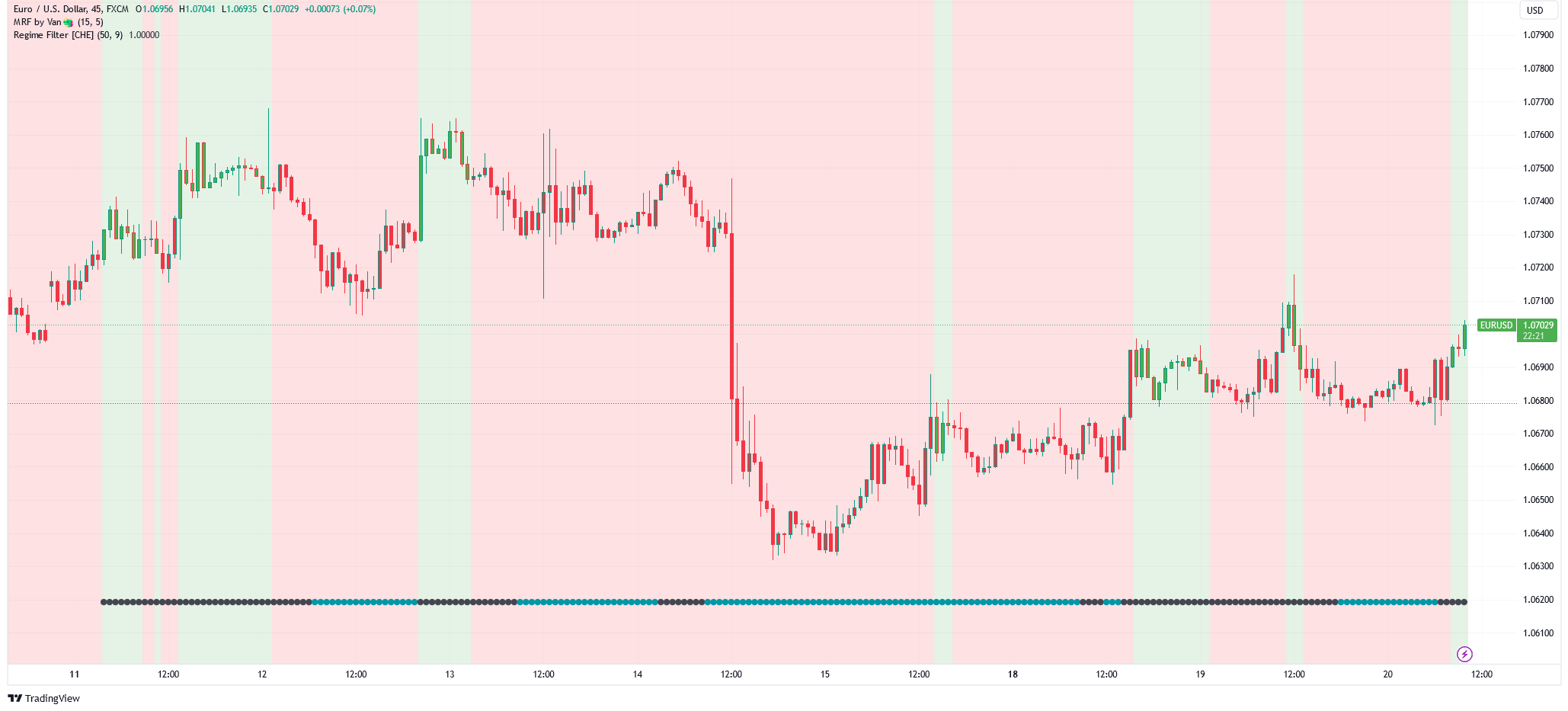

- Technical Analysis Indicators: These indicators, such as moving averages, Bollinger Bands, Average True Range (ATR), and Relative Strength Index (RSI), help traders identify trends, momentum, and volatility in the market.

- Fundamental Analysis Tools: Economic news calendars and financial newswires provide essential information about countries’ economic situations, future prospects, and central banks’ plans for interest rates, which can impact market regimes.

- Sentiment Analysis: This approach gauges the overall market sentiment by analyzing factors such as news events, social media, and trader positioning.

- Market Regime Indicators: Indicators like the Market Regime Indicator (MRI) developed by State Street Global Advisors use forward-looking market information to identify the level of risk aversion/appetite in the market.

- Trading Platforms: Advanced trading platforms like MetaTrader 4 and 5 (MT4/5) provide real-time market analysis features and various tools for analyzing the forex market.

- Charting Software: These tools allow traders to chart currencies in real time and apply various technical oscillators and other indicators to them.

- Currency Correlation Matrix: This tool helps traders understand the relationships between different currency pairs and how they might be influenced by market regimes.

- Forex Volatility Calculator: This calculator helps traders measure the volatility of currency pairs, which can be useful for identifying different market regimes.

By using these tools, traders can gain a better understanding of market regimes and make more informed decisions in their currency trading strategies.

Market regime detection is a valuable tool for currency traders to identify and adapt to different market states that influence currency pairs' behavior. Utilizing techniques such as Hidden Markov Models (HMM), technical analysis indicators, fundamental analysis, sentiment analysis, and market regime indicators empowers traders to make more informed decisions and potentially improve their trading strategies

Market Regime Detection and Risk:

Market regime detection can be used to manage risk in currency trading by identifying different market states that influence the behavior of currency pairs. By understanding these market regimes, traders can make more informed decisions and potentially improve their risk management strategies. One way to manage risk in currency trading is by using Value at Risk (VaR), a well-known risk assessment technique that quantifies the potential loss of an investment or a portfolio over a specified time horizon and at a given confidence level.

VaR can be computed using three methods: historical, variance-covariance, and Monte Carlo simulations. By applying VaR to currency trading, traders can measure and control their risk exposure, helping them to manage their positions and portfolios more effectively. VaR can be used to estimate the potential loss in currency units or as a percentage of portfolio value, given assumed market conditions.

In addition to VaR, market regime detection can help traders identify periods of increased volatility or market stress, which may require adjustments to their trading strategies or risk management practices. For example, during periods of high volatility, traders may need to reduce their position sizes, implement stop-loss orders, or adjust their portfolio allocations to minimize potential losses. By using market regime detection techniques and tools, such as hidden Markov models, technical analysis indicators, and sentiment analysis, traders can better understand the dynamics of currency markets and manage their risk exposure more effectively. This can lead to improved trading performance and more robust risk management strategies in the face of changing market conditions.

Market regime detection plays a vital role in managing risk in currency trading. Traders can employ methods like Value at Risk (VaR) to quantify potential losses and control risk exposure effectively. Additionally, market regime detection helps identify periods of increased volatility or market stress, enabling traders to adjust their strategies and risk management practices accordingly

Examples of Application of Market Regime Indicators

Examples of successful risk management using market regime detection in currency trading are not abundant in the public domain, as many successful strategies are proprietary and kept confidential by trading firms. However, there are some examples of using market regime detection techniques to improve trading strategies and manage risk.

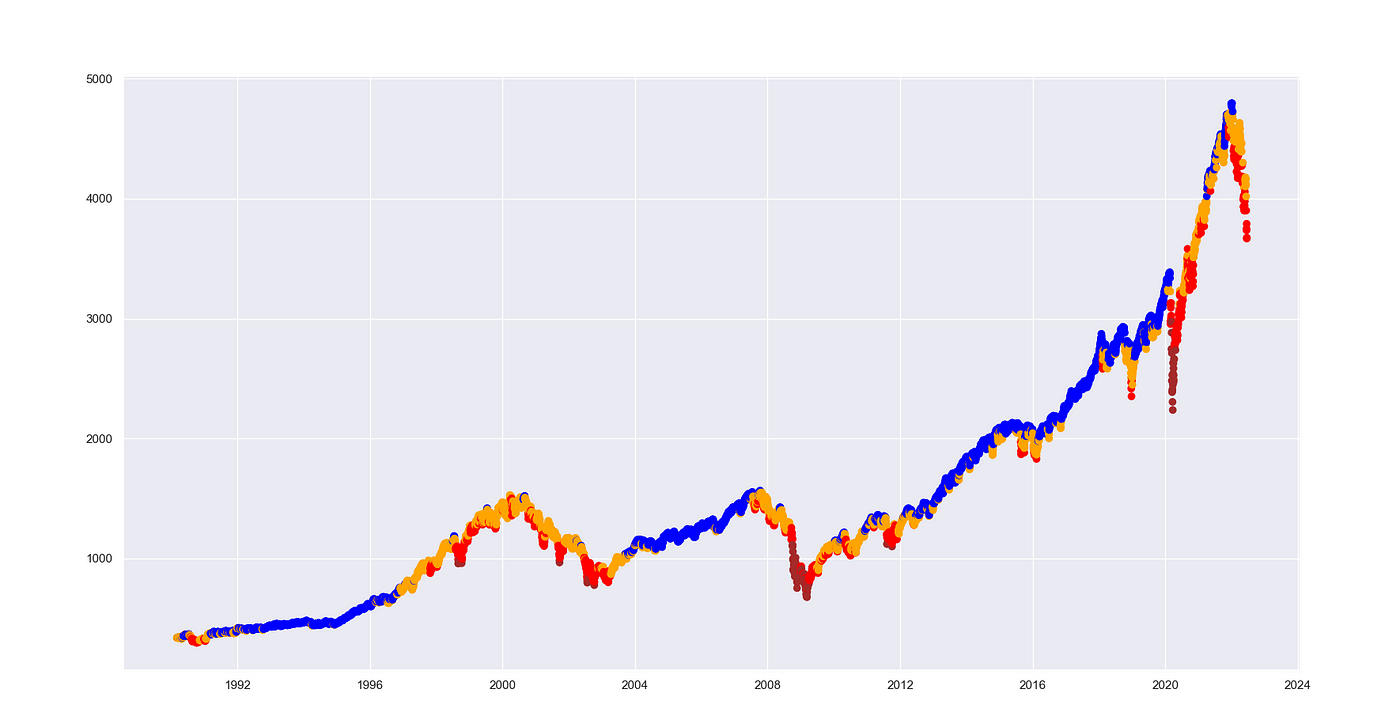

One example is the use of Hidden Markov Models (HMM) within the QSTrader framework as a risk-managing market regime filter. The HMM is used to disallow trades when higher volatility regimes are predicted, with the aim of eliminating unprofitable trades and possibly reducing volatility in the strategy. This approach is paired with a simplistic short-term trend-following strategy based on simple moving average crossover rules. By implementing the risk management logic using HMM, the strategy can better adapt to changing market conditions and manage risk more effectively.

Another example is a study that uses HMM to identify different market regimes in the US stock market and proposes an investment strategy that switches between different factor portfolios based on the identified market regimes. Although this example is focused on the stock market, the same approach can be applied to currency trading to manage risk and improve trading performance.

It is important to note that these examples are not exhaustive, and there may be many other successful risk management strategies using market regime detection in currency trading. However, these examples demonstrate the potential benefits of incorporating market regime detection techniques into trading strategies to manage risk and improve performance.

Conclusion

In the world of currency trading, the ability to discern and adapt to changing market conditions is paramount to success. Market regime detection serves as a valuable compass for currency traders, offering insights into the intricate dynamics of Forex markets. Through tools like Hidden Markov Models, technical indicators, and sentiment analysis, traders can refine their strategies, make informed decisions, and ride the waves of market volatility. Furthermore, effective risk management, exemplified by techniques like Value at Risk (VaR), emerges as a crucial companion to market regime detection. It enables traders to quantify and control potential losses while offering the flexibility to adjust strategies during turbulent market phases. While specific examples of success in market regime detection may be discreet, the potential benefits are clear. These techniques empower traders to adapt to shifting market conditions, manage risk prudently, and ultimately strive for improved trading performance. As currency markets continue to evolve, market regime detection remains an essential tool in the trader’s arsenal, helping them navigate the ever-changing Forex landscape with confidence and competence.

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.