Here are the key updates on the crypto markets as of June 20, 2024:

- VanEck Bitcoin ETF Launches on ASX

The Australian Securities Exchange (ASX) has listed the VanEck Bitcoin ETF (VBTC) today, marking the first spot Bitcoin ETF to trade on Australia’s main stock exchange. The ETF launched with a seed investment of around $985,000. - Bitcoin Whales Sold Over $1.2 Billion in Past 2 Weeks

According to data from CryptoQuant, Bitcoin whales (large holders) have sold over $1.2 billion worth of BTC in the past two weeks, indicating a lack of demand from institutional investors. This selling pressure from whales is seen as a key reason for Bitcoin’s recent price drop. - Shiba Inu (SHIB) Eyes Recovery

The meme coin Shiba Inu (SHIB) is eyeing a potential recovery after slipping into the oversold region. One analyst projects an imminent upsurge towards the $0.0001 level for SHIB. - Stablecoin Transfers Surge

Crypto analytics firm Glassnode reported a supersonic jump in stablecoin transfer volumes, potentially signaling increased trading activity in the crypto markets. - LayerZero Airdrop Across 1.28 Million Wallets

The LayerZero protocol airdropped its native token to 1.28 million eligible wallets today as part of its token distribution. - Investor Caution Amid Declining Trading Volumes

A recent report highlighted investor caution in the Bitcoin market, with the cryptocurrency showing modest recovery amidst declining trading volumes.

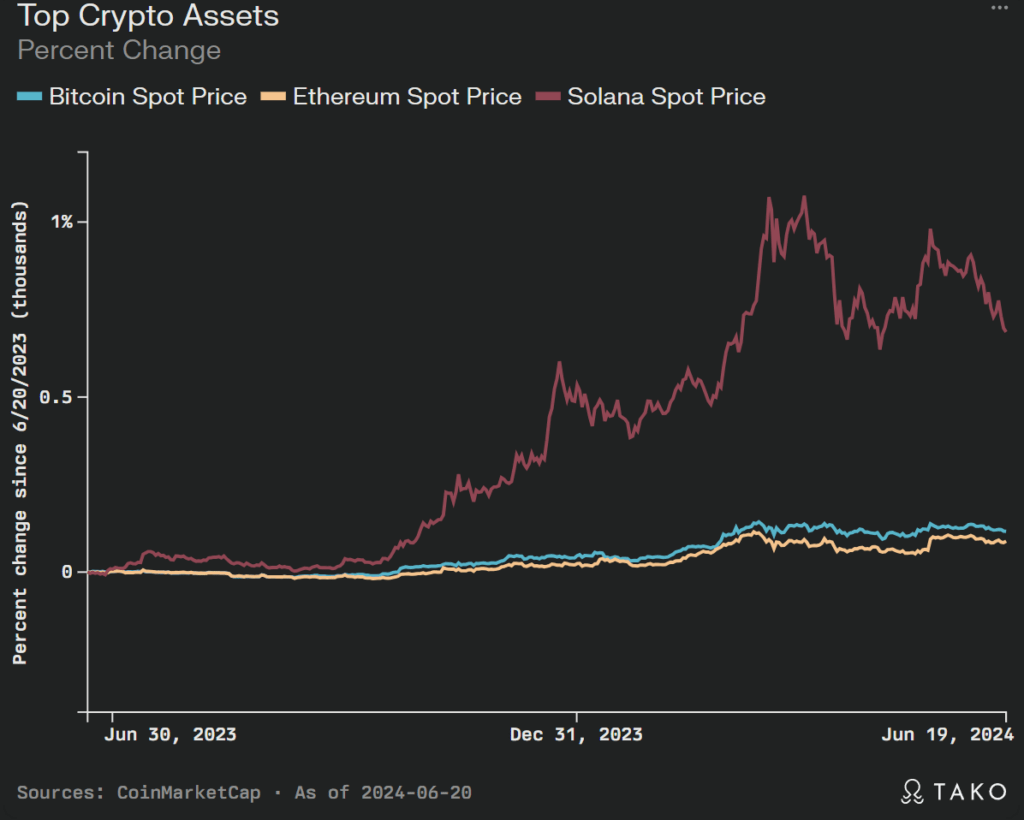

The overall crypto market has seen mixed movements today, with Bitcoin remaining subdued around $65,400 while Ethereum and some meme coins like SHIB and DOGE showed recovery signs.

Market Volatility and Price Movements

- Bitcoin’s price has remained subdued around $65,400 levels, while Ethereum and some major altcoins like Solana and meme coins like Dogecoin showed signs of recovery recently.

- Bitcoin whales (large holders) sold over $1.2 billion worth of BTC in the past two weeks, indicating lack of institutional demand and contributing to the recent price drop.

- Crypto trading volumes have declined overall, suggesting investor caution amidst the broader market downturn.

Regulatory Environment

- The SEC has been actively reviewing applications for spot Ethereum ETFs, providing comments to issuers and signaling a potential approval as soon as July 2024, though the timeline remains uncertain.

- Increased regulatory scrutiny and enforcement actions against major crypto firms like Coinbase and Binance by the SEC for alleged violations.

- Some crypto companies are exploring options to operate from other countries due to the uncertain U.S. regulatory environment.

Adoption and Use Cases

- Mainstream adoption is being driven by partnerships between crypto firms and major companies like Mercedes for Web3 initiatives.

- Increasing use of stablecoins, with a recent surge in stablecoin transfer volumes indicating heightened trading activity.

- Emergence of new sectors like real-world asset tokenization and data availability layers for blockchains.

Funding and M&A Activity

- After the FTX collapse, crypto startup funding rebounded in late 2023 and Q1 2024, with $1.9 billion raised in Q4 2023 alone.

- Increasing M&A activity, with major deals like Maple Finance’s $300 million Series B funding.

So in summary, the key trends include market volatility, intensifying regulatory scrutiny, growing adoption and use cases, reviving funding landscape, and the anticipation around spot crypto ETF approvals, particularly for Ethereum.

Latest developments in the Ethereum ETF approval process

The key updates on the Ethereum ETF approval process as of June 20, 2024:

SEC Provides Comments on ETF Filings

- The SEC has issued comments and feedback on the S-1 registration statements filed by issuers for spot Ethereum ETFs. This indicates the SEC is actively reviewing the filings.

- Issuers have been given a deadline of this Friday, June 23rd to respond to the SEC’s comments and update their filings accordingly.

- This back-and-forth between the SEC and issuers brings spot Ethereum ETFs one step closer to potential approval and launch, possibly as soon as early July 2024.

Renewed Optimism for Approval

- There is growing optimism that the SEC may approve spot Ethereum ETFs after it surprisingly approved spot Bitcoin ETFs in January 2024.

- The SEC’s recent engagement with exchanges regarding Ether ETF applications signals a potential change in stance from earlier expectations of rejection.

- Major players like Fidelity, BlackRock, Grayscale and others have submitted applications for Ether ETFs in anticipation of approval.

Contrasting Views on Approval Timeline

- While some analysts are optimistic about a July 2024 approval based on the SEC’s current review, others believe the process could drag on for several more months.

- The SEC chair Gary Gensler has publicly addressed the considerations and hurdles around approving an Ethereum ETF, citing concerns around Ethereum’s move to proof-of-stake.

- Some experts have labeled the approval process as being influenced by political factors rather than just regulatory merits.

The Ethereum market has seen price gains recently, likely driven by the increasing expectations that spot ETFs will get the regulatory green light and provide easier access for retail investors. However, the SEC’s final decision still remains uncertain amidst the ongoing regulatory review process.

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.