Key Crypto Trends:

As of July 18, 2024, several key trends and factors are shaping the cryptocurrency market:

Market Performance

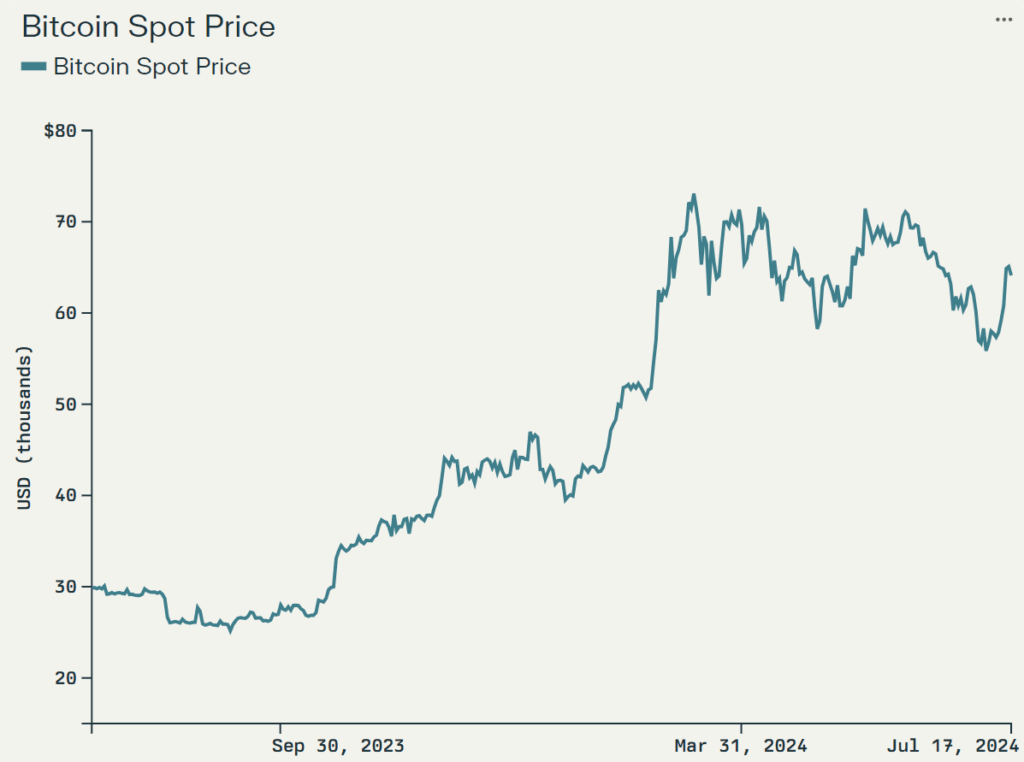

- Bitcoin is currently trading around $64,000, showing a slight decline from recent highs.

- Altcoins are displaying mixed performance, with some gaining and others losing value.

- XRP has retested a key dominance level of 1.03%, with analysts predicting a potential surge to $403.78.

- Litecoin (LTC) is experiencing a surge in July, though specific price levels are not mentioned.

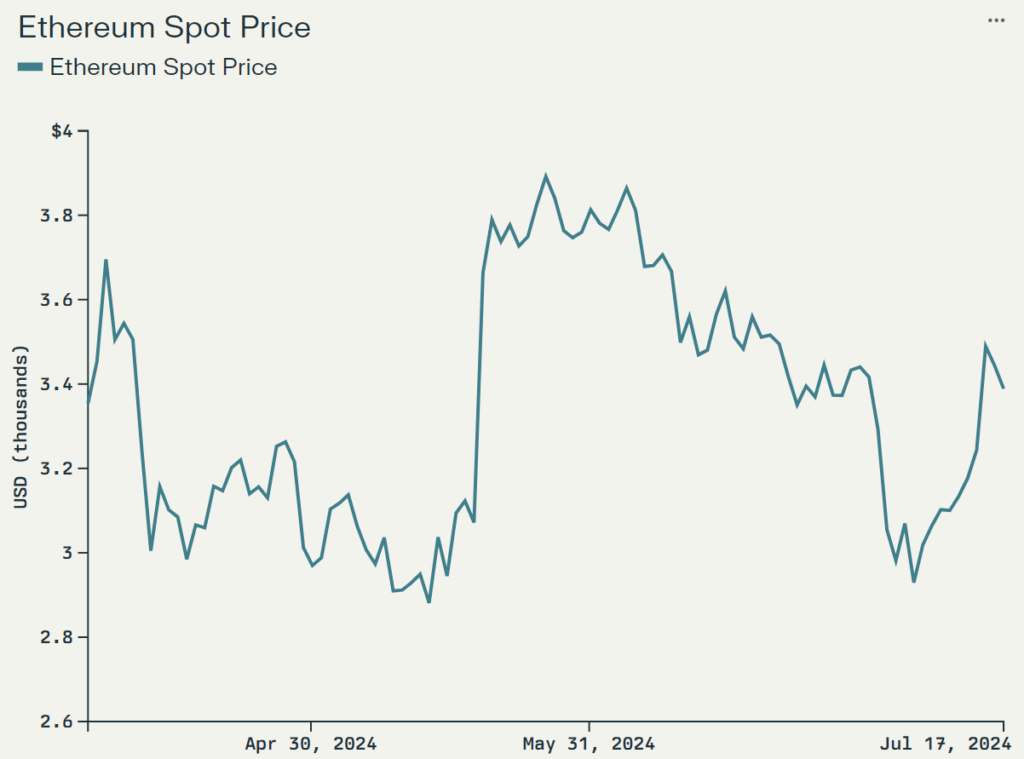

- Ethereum (ETH) is approaching a key resistance level near $3,200.

Market Outlook

- JPMorgan predicts a crypto market rebound starting in August 2024.

- The bank has reduced its year-to-date crypto market net flow estimate from $12 billion to $8 billion.

- Crypto liquidations are expected to abate by the end of July, potentially setting the stage for the August rebound.

Factors Influencing the Market

- Recent liquidations by creditors of Mt. Gox and Gemini, as well as selling by the German government, have contributed to a decline in Bitcoin reserves across exchanges.

- The approval of spot Bitcoin ETFs in January 2024 has not led to the bullish trend some expected.

- Regulatory developments continue to play a significant role in market sentiment and performance.

- The cryptocurrency market remains dynamic, with investors closely tracking price trends and market indicators.

Emerging Trends

- There’s growing interest in cryptocurrency mining apps, with platforms like BlocDAG X1 Miner App offering daily coin rewards.

- The market is showing signs of maturation, with institutional interest and regulatory developments playing increasingly important roles.

These trends and factors highlight the ongoing volatility and evolution of the cryptocurrency market as of July 18, 2024. Investors and market participants should remain vigilant of rapid changes and continue to conduct thorough research before making investment decisions.

JP Morgan’s Key Predictions:

JPMorgan is predicting a crypto market rebound in August 2024 for several key reasons:

- Declining liquidations: JPMorgan expects the current wave of crypto liquidations to finish by the end of July. This reduction in selling pressure could set the stage for a market recovery.

- Decrease in Bitcoin reserves on exchanges: Recent liquidations by creditors of Mt. Gox and Gemini, as well as selling by the German government, have contributed to a decline in Bitcoin reserves across exchanges. This reduction in available supply could potentially lead to price increases.

- Revised market flow estimates: JPMorgan has reduced its year-to-date crypto market net flow estimate from $12 billion to $8 billion. This adjustment suggests a more conservative outlook, which could lead to more stable market conditions.

- Current market stability: Bitcoin’s value has been relatively stable, lingering near the $57,000 level. This stability could provide a foundation for future growth.

- Increased ETF activity: Spot bitcoin Exchange-Traded Funds (ETFs) in the United States have seen heightened purchasing activity, with significant inflows observed recently. This increased institutional interest could drive market growth.

- Potential regulatory changes: The U.S. Securities and Exchange Commission (SEC) is considering revisions to its SAB 121 guidance regarding the safekeeping of crypto assets for clients. These changes could potentially lead to broader acceptance of cryptocurrencies by traditional financial institutions.

It’s important to note that while JPMorgan’s prediction is based on these factors, the cryptocurrency market remains highly volatile and unpredictable. Investors should always conduct their own research and consider their risk tolerance before making investment decisions.

Impact of Liquidations by Mt. Gox and Gemini creditors:

Liquidations by Mt. Gox and Gemini creditors have had a significant impact on Bitcoin reserves:

- Decline in exchange reserves: JPMorgan reports that Bitcoin reserves across exchanges have fallen notably over the past month. This decline is largely attributed to liquidations by creditors of Mt. Gox and Gemini.

- Scale of liquidations: Mt. Gox began repaying creditors in July 2024, with approximately 140,000 bitcoins (valued at nearly $9 billion at current rates) available for distribution. This represents a substantial amount of Bitcoin potentially entering the market.

- Market impact: The liquidations have contributed to downward pressure on Bitcoin’s price. For instance, on July 5, 2024, Bitcoin slumped below $54,000 as Mt. Gox flagged repayments.

- Broader market effects: JPMorgan reduced its year-to-date crypto market net flow estimate from $12 billion to $8 billion, largely due to the decline in Bitcoin reserves across exchanges. This adjustment reflects the significant impact of these liquidations on overall market dynamics.

- Future outlook: Analysts expect these liquidations to abate by the end of July 2024, potentially setting the stage for a market rebound in August.

- Additional selling pressure: Besides Mt. Gox and Gemini creditors, the German government has also been selling seized cryptocurrencies, further contributing to the decline in Bitcoin reserves.

These liquidations have played a crucial role in shaping recent market trends, affecting not only Bitcoin’s price but also overall market sentiment and projections. The crypto market is expected to stabilize as these liquidations conclude, potentially leading to a recovery in the coming months.

Does Ethereum’s 3200 level Hold Significance and Why?

Ethereum’s approaching resistance level near $3,400 is highly significant for several reasons:

- Critical price barrier: The $3,200 level represents a crucial support point that Ethereum has been struggling to break through consistently. This level is seen as a key hurdle for Ethereum’s continued upward momentum.

- Large number of addresses at break-even: On-chain data shows that approximately 2 million addresses that bought Ethereum around this level are currently at a loss. If ETH is above the $3,200, these addresses will break even, potentially leading to increased selling pressure as investors seek to recover their initial investments.

- Market sentiment indicator: The ability or failure to break through this level could significantly impact market sentiment. A successful breach could signal bullish momentum, while continued resistance might lead to bearish sentiment.

- Technical analysis focus: Many traders and analysts are closely watching this level as a key indicator for Ethereum’s short-term price direction.

- Potential trigger for further gains: Some analysts suggest that staying above $3,200 could open the path for Ethereum to target higher levels, potentially up to $3,500.

- Correlation with market dynamics: The struggle at this resistance level is occurring alongside other market factors, such as the anticipated launch of Ethereum ETFs and changes in futures open interest.

- Recent price action: Ethereum has shown the ability to approach this level, having reached as high as $3,450 in recent trading, but has faced difficulty maintaining prices above $3,400.

Given these factors, the $3,400 resistance level is considered a crucial point for Ethereum’s price trajectory in the near term. It represents both a psychological and technical barrier that could significantly influence trading behavior and overall market sentiment for Ethereum.

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.