The key cryptomarket trends as of June 25, 2024:

- Bitcoin price decline: Bitcoin has experienced a significant drop, falling below $62,000 and reaching as low as $60,000 in recent days. This represents a decline of about 12% for the month of June.

- Overall market cap decrease: The global cryptocurrency market cap has dipped to $2.26 trillion, registering a 24-hour decline of 1.08%.

- Cooling demand for Bitcoin ETFs: There’s been a decrease in demand for Bitcoin exchange-traded funds, which had previously helped drive Bitcoin to record highs earlier in the year.

- Outflows from crypto investment products: Digital asset products experienced $584 million in outflows in the week ended June 21, with Bitcoin products accounting for the majority of these outflows.

- Mixed performance among altcoins: While Bitcoin declined, some altcoins showed gains. For example, Fetch.ai (FET) emerged as the biggest gainer with a 24-hour jump of nearly 21%

- Continued market volatility: The crypto market continues to display dynamic movements, with various digital assets exhibiting both gains and losses.

- Regulatory and macroeconomic factors: Uncertainty over U.S. monetary policy and upcoming events like the presidential debate and inflation figures are influencing market sentiment.

- Mt. Gox repayments: The announcement that the Mt. Gox rehabilitation trustee would start repayments of Bitcoin and Bitcoin Cash in July has added to market concerns about increased selling pressure.

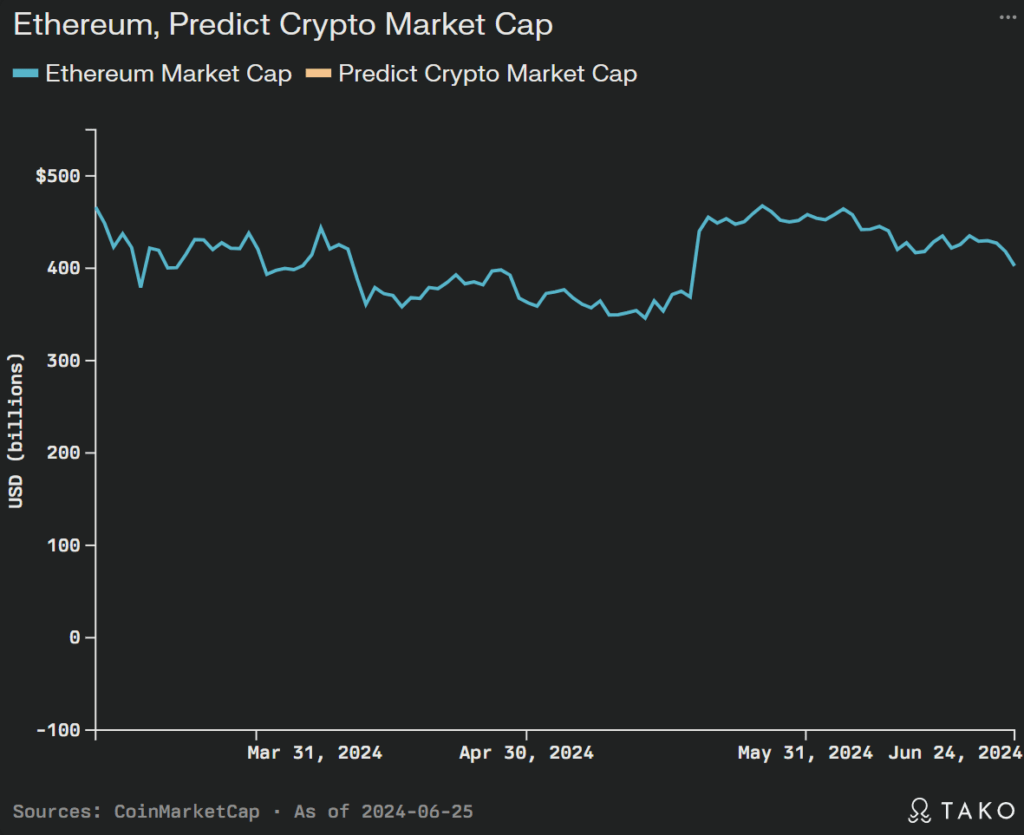

Key predictions and trends for Ethereum in the Coming Weeks:

Price Predictions:

The average price prediction for Ethereum in 2024 ranges from $3,340 to $6,500, representing a significant increase from current levels. Some more optimistic forecasts suggest Ethereum could reach between $6,150 to $7,200 by the end of 2024. However, there’s also a prediction of a potential dip to around $3,000 before a stronger rally in 2025.

Market Cap:

As of June 24, 2024, Ethereum’s market cap is reported to be approximately $402.5 billion.

Key Drivers:

Macroeconomic factors like anticipated interest rate cuts are expected to positively influence Ethereum’s growth. Technological adoption, increased use of smart contracts, and financial inclusion efforts are seen as major catalysts for Ethereum’s momentum.

Regulatory Developments:

The approval of spot Ethereum ETFs by the SEC has boosted investor confidence. Eight Ethereum ETFs have been approved for listing, with a launch date set for July 4, 2024.

Technical Analysis:

As of June 25, 2024, Ethereum is trading at $3,361.7, with immediate support at $3,060.1 and resistance at $3,729.5. The Relative Strength Index (RSI) is around 39.02, indicating bearish momentum in the short term.

Long-term Outlook:

Despite short-term volatility, the long-term outlook for Ethereum remains positive due to its pivotal role in the cryptocurrency space and the continued growth of its ecosystem.

Upcoming Developments:

The Dencun protocol upgrade is anticipated, which could potentially impact Ethereum’s performance and adoption.

Ethereum vs Other Cryptocurrencies:

Ethereum vs Bitcoin:

- While Bitcoin is predicted to reach between $78,000 to $82,000 in 2024, Ethereum’s predictions are more modest but still bullish.

- Ethereum price predictions for 2024 range from $3,340 to $6,500, with some optimistic forecasts suggesting it could reach $6,150 to $7,200 by the end of the year.

- This indicates that while both are expected to grow, Bitcoin is predicted to have higher percentage gains in 2024.

Ethereum vs Altcoins:

- Ethereum is generally seen as more stable and established compared to many altcoins, which often have more volatile price predictions.

- For example, Altlayer (ALT) is predicted to reach a maximum of $1.10 by the end of 2024, showing potentially higher percentage gains but from a much lower base price.

- Ethereum’s established ecosystem and ongoing technological developments (like the Dencun upgrade) contribute to its more stable growth predictions compared to newer altcoins.

Market Cap and Dominance:

- As of June 2024, Ethereum’s market cap is reported to be approximately $402.5 billion, second only to Bitcoin.

- This large market cap means that while Ethereum may not see the explosive growth of smaller altcoins, it’s considered a more stable investment.

Technological Advancements:

- Ethereum’s predictions are bolstered by its technological roadmap, including the anticipated Dencun protocol upgrade.

- This focus on development and improvement sets Ethereum apart from many other cryptocurrencies and contributes to its positive outlook.

Regulatory Environment:

- The approval of spot Ethereum ETFs by the SEC (set to launch on July 4, 2024) is seen as a major positive factor for Ethereum, potentially giving it an advantage over many other cryptocurrencies in terms of institutional adoption.

Overall Trend:

- While Bitcoin is often seen as the primary driver of the crypto market, Ethereum’s performance in 2024 has been noted as “remarkable,” particularly following the Ethereum Dencun Upgrade.

- This suggests that Ethereum might be gaining ground in terms of market influence and could potentially outperform expectations.

In summary, while Ethereum’s price predictions for 2024 are generally positive, they are more conservative compared to Bitcoin’s forecasts. However, Ethereum is viewed as a stronger and more stable investment compared to many altcoins, with its technological advancements and regulatory approvals providing additional support for its growth potential. As always, these predictions are speculative and subject to market volatility and various external factors.

It’s important to note that these predictions are speculative and subject to market volatility and various external factors. Investors should conduct their own research and consider the inherent risks associated with cryptocurrency investments.

These trends indicate a period of uncertainty and volatility in the crypto market, with Bitcoin facing downward pressure while some altcoins show resilience. The market appears to be reacting to a combination of factors including regulatory developments, macroeconomic conditions, and shifts in investor sentiment.

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.