Global Macro Trading: An Overview

Introduction

Global Macro Trading is a sophisticated investment strategy that seeks to capitalize on macroeconomic trends and geopolitical events across the globe. This strategy involves making trades based on the economic performance of entire countries, regions, or the world economy, as opposed to focusing on individual companies or sectors. Global Macro Traders analyze a vast array of factors, including interest rates, inflation, currency exchange rates, political developments, and economic indicators, to identify potential opportunities for profit.

History and Evolution

Global Macro Trading emerged as a distinct strategy in the 1980s, largely popularized by legendary investors such as George Soros and Julian Robertson. Soros, in particular, gained fame for his bet against the British pound in 1992, which earned him over a billion dollars in what became known as “Black Wednesday.” Since then, Global Macro Trading has evolved into a highly specialized and influential segment of the financial markets, attracting top talent and significant capital.

Core Principles

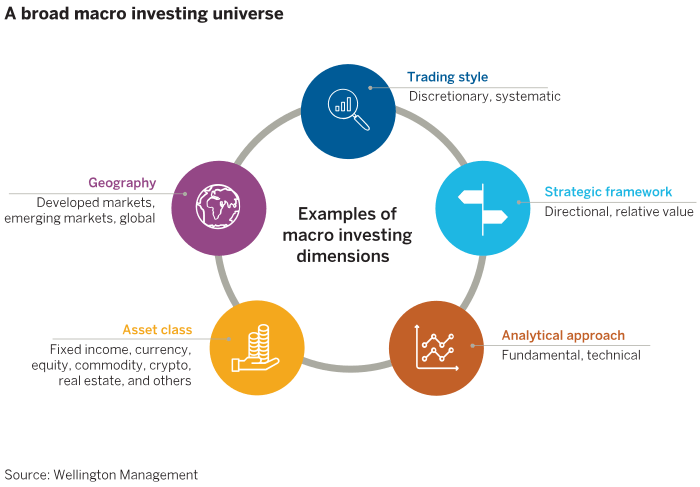

Top-Down Analysis: Unlike bottom-up investors who focus on individual companies, Global Macro Traders employ a top-down approach, starting with the big picture. They analyze macroeconomic trends, such as GDP growth, monetary policy, and fiscal policy, to form a view on how different markets are likely to perform.

Diverse Asset Classes: Global Macro Trading is not limited to a single asset class. Traders may take positions in equities, bonds, currencies, commodities, and derivatives. This flexibility allows them to exploit opportunities wherever they arise, whether it’s a currency devaluation, a shift in interest rates, or a commodity boom.

Leverage and Risk Management: Given the potential for large-scale economic shifts, Global Macro Traders often use leverage to amplify their bets. However, this also requires sophisticated risk management techniques to protect against adverse market movements. Successful Global Macro Traders are adept at managing risk and adjusting their positions in response to new information.

Global Perspective: As the name suggests, Global Macro Trading requires a deep understanding of international markets. Traders must be attuned to developments in different regions, from central bank policies in the United States to political changes in emerging markets. This global perspective is crucial for identifying interconnected trends and making informed decisions.

Key Strategies

Currency Trades: One of the most common strategies in Global Macro Trading is currency speculation. Traders may take long or short positions in currencies based on their expectations of future exchange rate movements. For example, a trader might short a currency if they believe that a country’s economic fundamentals are weakening or that its central bank is likely to cut interest rates.

Interest Rate Plays: Global Macro Traders often bet on the direction of interest rates. They may take positions in government bonds, anticipating that rates will rise or fall based on macroeconomic indicators such as inflation, employment data, or central bank signals.

Equity Indices: Rather than picking individual stocks, Global Macro Traders might trade equity indices, such as the S&P 500 or the Nikkei 225. This allows them to express a view on the overall direction of a country’s stock market, which can be influenced by a wide range of factors, including economic growth, corporate earnings, and investor sentiment.

Commodities: Commodities, such as oil, gold, and agricultural products, are also popular among Global Macro Traders. They may trade these assets based on supply and demand dynamics, geopolitical tensions, or broader economic trends.

Event-Driven Trades: Global Macro Trading also includes event-driven strategies, where traders position themselves to profit from specific geopolitical or economic events. These could include elections, trade negotiations, or natural disasters, which can have significant impacts on markets.

Versatility and Application During Bull and Bear Regimes:

Global Macro Trading strategies are versatile and can be effectively employed in various market regimes, including both bull and bear markets. The strategy’s adaptability allows traders to capitalize on macroeconomic trends regardless of the broader market direction. Here are some of the best times when Global Macro Trading strategies are particularly effective in the context of financial markets:

1. During Economic Transitions

- Bull Market Transition: When the global economy is transitioning from a recession to a period of growth, central banks might start lowering interest rates or implementing expansionary monetary policies. Global Macro Traders can capitalize on this by going long on equities, commodities, or currencies expected to benefit from the economic recovery.

- Bear Market Transition: Conversely, during the transition from economic growth to a slowdown or recession, traders might short equities, sell bonds, or bet on the depreciation of certain currencies. This period often presents opportunities to profit from declining asset prices as central banks might start tightening monetary policy, leading to market corrections.

2. During Interest Rate Cycles

- Rising Interest Rates (Bear Market): When central banks begin to raise interest rates to combat inflation, Global Macro Traders may short government bonds (which lose value as rates rise) or go long on the currency of a country with rising rates, anticipating an appreciation due to higher yields.

- Falling Interest Rates (Bull Market): During periods of declining interest rates, often seen in the early stages of a bull market, traders might go long on bonds, as their prices tend to rise when rates fall. Additionally, equities might benefit from lower borrowing costs, creating opportunities for long positions in stock indices.

3. During Currency Devaluations and Crises

- Bearish Currency Trends: In times of economic or political instability, certain currencies might face significant devaluation. Global Macro Traders can short these currencies or invest in safe-haven assets like gold or the US dollar. For example, during the European sovereign debt crisis, traders shorted the Euro and invested in US Treasuries.

- Currency Appreciations (Bullish Sentiments): Conversely, in a strong economic environment, where a country is outperforming others, its currency may appreciate. Traders can capitalize on this by going long on that currency, benefiting from the strengthening trend.

4. During Commodity Cycles

- Commodity Bull Markets: In periods of strong global growth or supply shocks, commodities such as oil, copper, or agricultural products may experience significant price increases. Global Macro Traders can take long positions in these commodities or the currencies of commodity-exporting countries.

- Commodity Bear Markets: During economic slowdowns or periods of oversupply, commodity prices often decline. Traders can short these commodities or the currencies of commodity-dependent economies to profit from falling prices.

5. During Geopolitical Events

- Bearish Reactions: Geopolitical tensions, wars, or trade conflicts often lead to market volatility. Global Macro Traders can short equities in affected regions, go long on safe-haven assets like gold or the Swiss franc, or take positions in oil if supply disruptions are expected.

- Bullish Reactions: On the other hand, positive geopolitical developments, such as the resolution of a trade dispute or a peaceful political transition, can lead to market rallies. Traders might go long on equities, commodities, or currencies expected to benefit from the improved outlook.

6. During Inflationary or Deflationary Periods

- Inflation (Bear Market for Bonds, Bull for Commodities): In periods of rising inflation, Global Macro Traders might short bonds, as their real returns decline, or go long on commodities, which often perform well as a hedge against inflation.

- Deflation (Bear Market for Commodities, Bull for Bonds): During deflationary periods, when prices are falling, traders might go long on bonds, which increase in value as interest rates fall, or short commodities, which tend to lose value.

7. During Major Policy Shifts

- Bull Market after Policy Easing: When governments or central banks announce significant policy shifts, such as fiscal stimulus or quantitative easing, markets can react positively. Traders might go long on equities or riskier assets expected to benefit from the injection of liquidity into the economy.

- Bear Market after Tightening: Conversely, when policies shift toward tightening, such as rate hikes or reduced government spending, traders might short equities or bonds, anticipating a negative market reaction.

8. During Financial Crises

- Bear Market Opportunities: Financial crises, such as the Global Financial Crisis of 2008, often present significant opportunities for Global Macro Traders. By shorting overvalued assets, taking positions in safe-haven currencies, or betting against financial institutions, traders can profit from market downturns.

- Bull Market Recovery: After a crisis, when markets start to recover, Global Macro Traders might go long on undervalued assets, currencies of recovering economies, or commodities expected to rebound with the global economy.

Challenges and Risks

Global Macro Trading is not without its challenges. The complexity and scale of the markets involved mean that traders must constantly monitor and adapt to a wide range of factors. Political uncertainty, unexpected economic data, and central bank interventions can all lead to sudden market shifts. Additionally, the use of leverage amplifies both potential gains and losses, making risk management a critical component of any Global Macro strategy.

Furthermore, the interconnectedness of global markets means that a trader’s positions can be influenced by events far beyond their control. For example, a trade based on European interest rates might be affected by developments in Asia or the United States, adding another layer of complexity to the decision-making process.

Conclusion

Global Macro Trading remains one of the most dynamic and challenging strategies in the world of finance. It offers the potential for significant returns by capitalizing on macroeconomic trends and global events, but it also requires a deep understanding of the interconnectedness of global markets, rigorous analysis, and disciplined risk management. For those who can master its complexities, Global Macro Trading offers a unique opportunity to profit from the ever-changing global economic landscape. Global Macro Trading strategies are highly effective across various market regimes, whether during bull or bear markets. The key to success lies in the ability to anticipate and react to macroeconomic trends, interest rate cycles, geopolitical events, and major policy shifts. This strategy’s flexibility allows traders to exploit opportunities in both rising and falling markets, making it one of the most robust approaches in the financial trading world.

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.