GBP/USD – Bearish Momentum Deepens Amid Divergent Rate Expectations

GBP/USD – Bearish Momentum Deepens Amid Divergent Rate Expectations

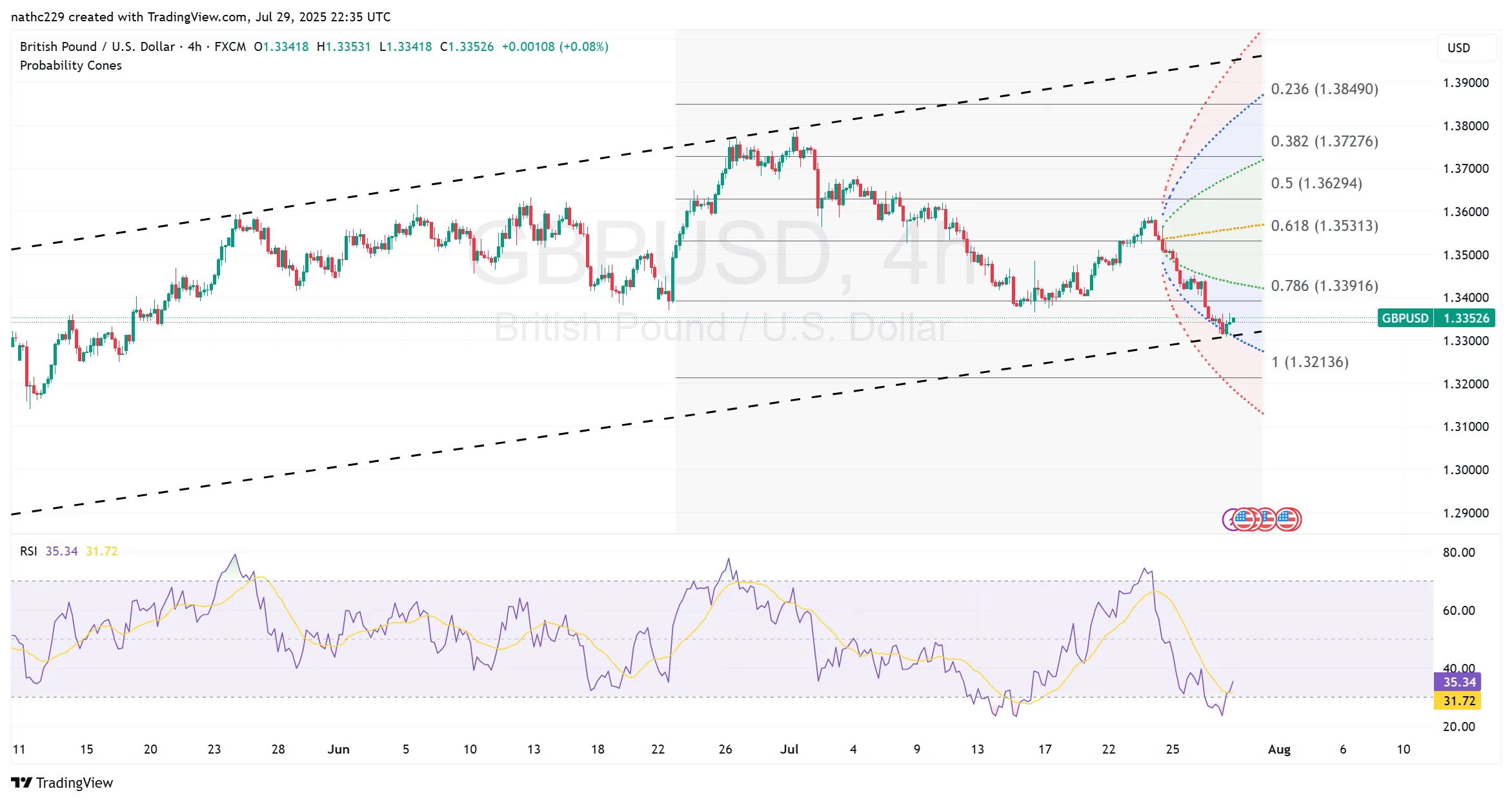

GBP/USD remains tilted to the downside, currently trading modestly lower at 1.3343 during the North American afternoon session. The pair tested intraday lows near the critical psychological and technical level of 1.3308, coinciding precisely with the lower boundary of the 30-day Bollinger Band. This support level has provided temporary respite, but the bearish bias continues to dominate ahead of the Federal Reserve’s key policy announcement scheduled for Wednesday.

Fundamental Context and Market Dynamics:

Market sentiment toward GBP/USD is heavily influenced by increasingly divergent monetary policy trajectories. The Federal Reserve is widely anticipated to maintain its current interest rate policy in Wednesday’s decision, with traders particularly attentive to voting patterns and forward guidance for hints of future policy shifts. Conversely, the Bank of England (BoE) is firmly expected to cut interest rates by 25 basis points on August 7, as indicated by an 88% probability from the LSEG IRPR market data. Moreover, markets anticipate cumulative rate cuts totaling around 47 basis points by the December 18 BoE meeting. This stark divergence between the Fed’s steady stance and the BoE’s dovish bias continues to apply significant bearish pressure on GBP/USD.

Additionally, growing concerns about the UK’s fiscal stability amid rising bond yields and persistent inflationary pressures further amplify negative sentiment towards Sterling. The UK’s challenging fiscal outlook and structural economic uncertainties continue to undermine confidence, exacerbating downward momentum in GBP/USD.

Technical Outlook:

Support Levels: GBP/USD now eyes crucial support at the 100-day moving average (DMA) at 1.3333. A sustained close below this important dynamic support opens the potential for further bearish acceleration towards the lower 30-day Bollinger Band at 1.3306. Further downside pressure beyond 1.3300 could quickly extend declines towards the pivotal Fibonacci support level at 1.3250 (50% retracement of the 1.2712-1.3787 move). If bearish momentum intensifies, the longer-term 200-DMA at 1.2974 emerges as a significant technical target.

Resistance Levels: Immediate resistance is situated at the daily Ichimoku cloud base at 1.3358, followed by the intraday pivot at the 55-hour moving average (HMA) at approximately 1.3395. Beyond these short-term hurdles, a stronger barrier appears at the daily conversion line at 1.3448. Any bullish recovery attempt will need a decisive breakthrough above these resistance points to shift the current bearish sentiment.

Momentum Indicators:

Momentum indicators remain distinctly bearish. The Relative Strength Index (RSI) trades below the neutral 50 line, indicating ongoing negative momentum. Similarly, the MACD histogram and signal lines remain negatively aligned, highlighting continued bearish momentum and potential for further declines.

Conclusion and Strategy:

GBP/USD remains strongly biased toward the downside amid fundamental headwinds and bearish technical conditions. Traders should closely monitor the critical support zone at 1.3300-1.3306. A clear break below this region could confirm further bearish momentum, targeting deeper technical levels around 1.3250 initially, and potentially extending toward the 1.3000 psychological mark in coming sessions. Short-term upside corrections remain possible but may be limited and offer potential selling opportunities unless a significant fundamental shift occurs.