GBP/USD traded near the upper end of its recent range following stronger-than-expected UK employment and wage data. The pair briefly rose above 1.31 but faded back to 1.3065 in the New York afternoon as traders shifted focus to Wednesday’s key inflation data. The sterling had recently declined from its 2024 high of 1.3434 in late September to last week’s low of 1.3011 amid growing expectations for BoE rate cuts. However, the employment data offered the first signal that these dovish expectations could be dialed back. If Wednesday’s CPI data surprises to the upside, it could bolster expectations for a cautious BoE, reducing the probability of further aggressive rate cuts.

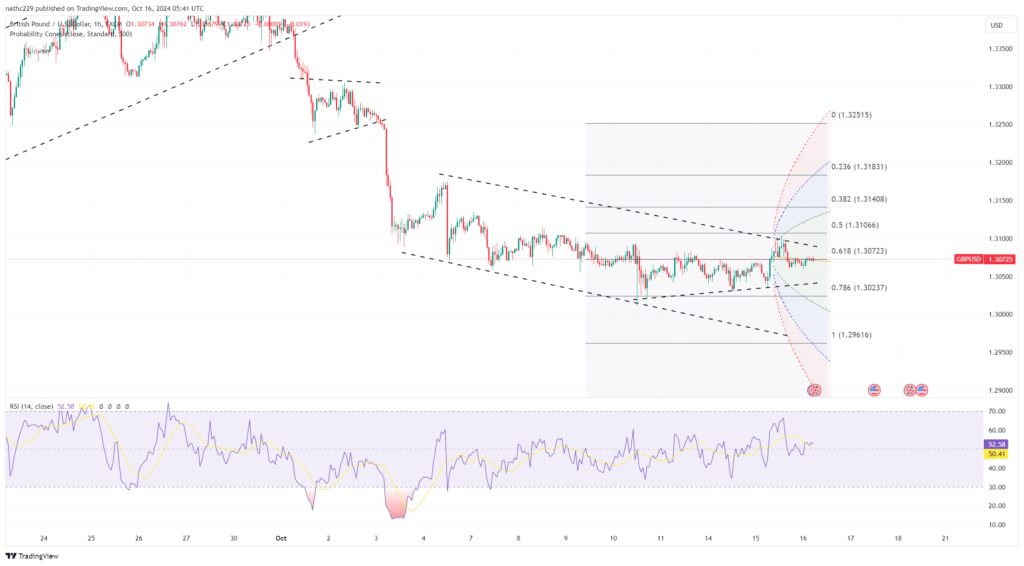

Technically, GBP/USD remains range-bound but has shown signs of stabilization. The pair found resistance near Tuesday’s high of 1.3103, which aligns with the 10-day moving average, followed by the October 8 high at 1.3174. Further resistance lies at the 21-DMA at 1.3218 and the October 3 high of 1.3285, which could become relevant if CPI data boosts sterling sentiment. On the downside, key support levels include Tuesday’s low at 1.3038, followed by the October 10 low of 1.3011 and the September 11 low of 1.3002. With market sentiment hinging on the upcoming CPI release, a break below 1.3011 could trigger a retest of the psychological 1.3000 level, reinforcing the bearish structure.

Looking ahead, the UK CPI report will be crucial for shaping GBP/USD’s trajectory, as inflation readings could significantly alter the market’s view on BoE policy. A higher-than-expected CPI print would reduce the odds of rate cuts and likely push GBP/USD higher, with the October 8 high at 1.3174 becoming the immediate target. In contrast, a downside inflation surprise could revive dovish expectations, increasing the probability of a 25-bps cut at the BoE’s November 7 meeting, with further easing priced in for December. This would likely push GBP/USD lower, testing key support around 1.3002 and potentially extending the pair’s decline.