GBP/USD has continued its downward trend, falling to a one-month low as recent UK data failed to inspire confidence among sterling bulls. While UK home prices rose for a third consecutive month in September, posting a 0.3% increase and the fastest year-on-year gain since November 2022, the data came in softer than expected. This lukewarm result supports Bank of England (BoE) Chief Economist Huw Pill’s view that future rate cuts should be measured, contrasting with Governor Andrew Bailey’s comments suggesting the pace of rate cuts could increase. The weaker data has compounded pressure on the pound, as the U.S. economic surprise index, according to Citibank, continues to outperform that of the UK, reflecting a more robust U.S. economic outlook since mid-August.

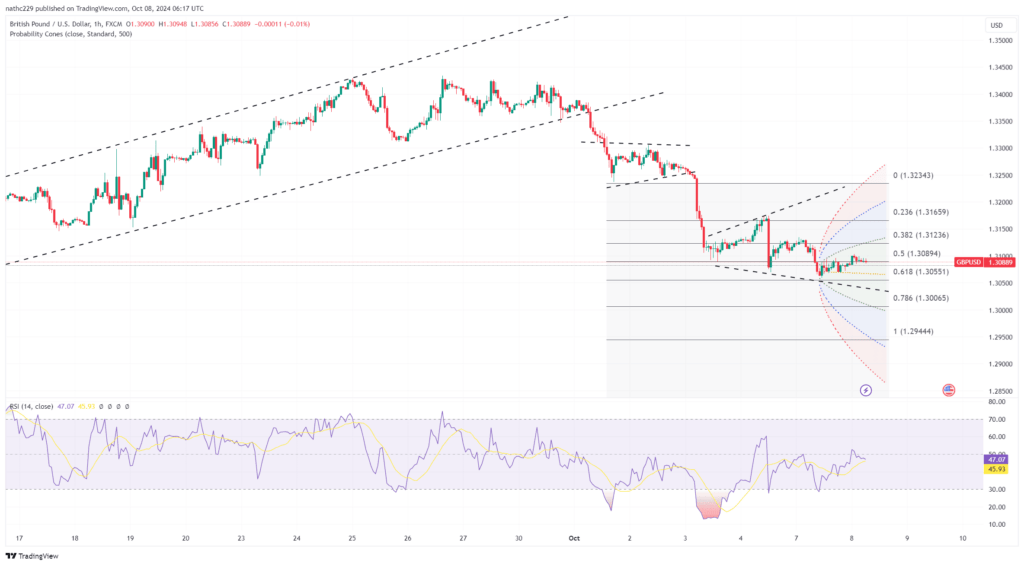

Technically, GBP/USD remains in a bearish trend, with recent price action suggesting a continuation of the decline. The formation of a daily doji on Friday hinted at a potential pause in the downtrend; however, Monday’s drop confirmed that the doji was merely a temporary pause. The daily Relative Strength Index (RSI) is falling but has yet to reach oversold territory, indicating that bearish momentum could persist. Additionally, GBP/USD is facing resistance from the rising daily Ichimoku cloud top, limiting the chances of a near-term rebound. A break below the key psychological support at 1.3000 would likely intensify bearish sentiment, potentially paving the way for a test of September’s monthly low.

Looking ahead, the technical landscape suggests further downside risks for GBP/USD, especially if the pair closes below the crucial 1.3000 level. A close beneath this threshold could trigger a more significant sell-off, with targets around 1.2800 and the 200-day moving average providing potential support. Market sentiment is further clouded by uncertainties surrounding the Middle East conflict, upcoming U.S. elections, and the UK’s October 30 budget release. With speculative long positions in the pound at elevated levels, as reported by the latest CFTC data, the risk of a sharp correction remains if bearish sentiment intensifies and traders unwind their positions.