GBP/USD Faces Resistance Near 1.27 but Uptrend Remains Intact

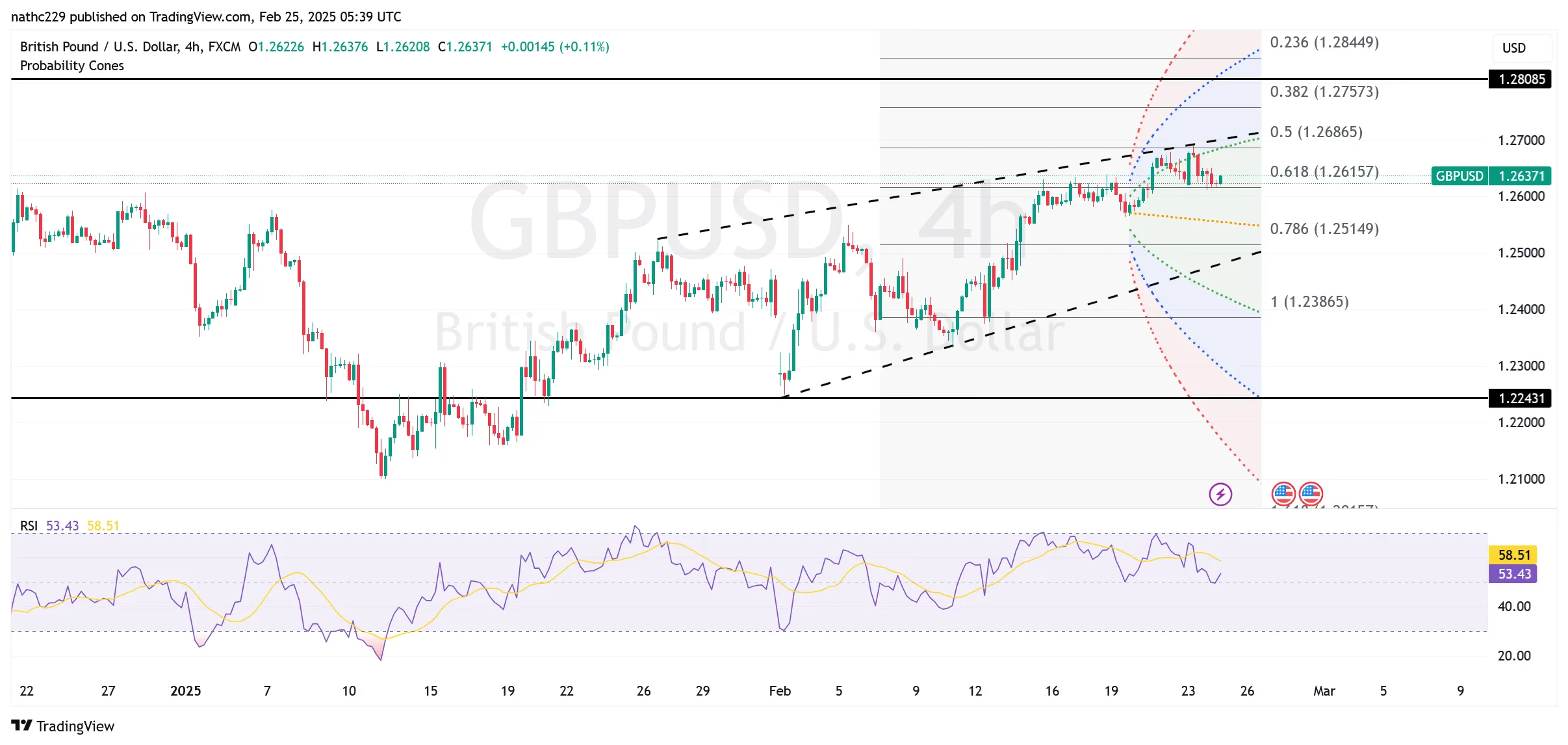

GBP/USD extended its rally to a 9-week high of 1.2690, riding the upper 30-day Bollinger Band before encountering resistance near the psychological 1.2700 level. Persistent UK inflation and resilient economic data continue to underpin sterling, suggesting that the bullish momentum could push the pair toward key technical targets, including 1.2731 (200-WMA) and 1.2788 (200-DMA). A sustained break above 1.2767, the 50% Fibonacci retracement of the September-January decline, would strengthen the case for a move toward early November highs above 1.30. However, risks remain, particularly from the potential impact of U.S. tariff policies and a shift in UK rate expectations if fiscal concerns weigh on gilts.

Technically, GBP/USD remains in a strong uptrend, with the pair supported at 1.2613 (Monday’s low), 1.2582 (rising 10-DMA), and 1.2470 (50% retracement of the 1.2249-1.2690 rally). The upper 30-day Bollinger Band at 1.2708 presents immediate resistance, followed by the key 200-DMA at 1.2788. The RSI remains elevated but has yet to signal overbought conditions, suggesting further upside potential. The shallow pullback from 1.2690 indicates that underlying demand remains strong, particularly with U.S. Treasury yields retreating as Trump-related trades unwind.

Looking ahead, the Bank of England’s policy outlook remains a key driver for GBP/USD. With inflation staying elevated, the BoE’s reluctance to pivot aggressively dovish continues to support sterling. However, any dovish rhetoric from BoE member Dhingra’s speech could cause some bulls to lighten positions. Additionally, further dollar strength, particularly if risk sentiment sours, may cap gains. A close above 1.2708 would confirm continued upside, while a break below 1.2613 could signal a deeper correction toward 1.2582.