GBP/USD extended its rally to a new 2024 high, marking its fifth consecutive session of gains, as the pair reached 1.3391 amid softer global rate expectations and positive risk sentiment. The People’s Bank of China’s (PBoC) announcement of significant stimulus measures bolstered market enthusiasm, driving risk assets higher and providing additional support for sterling. The pound’s recent strength has been largely attributed to the diverging monetary policies between the Bank of England (BoE) and other major central banks, particularly the Federal Reserve and the European Central Bank. With the BoE expected to take a more measured approach to rate cuts due to persistently high UK inflation, sterling remains well-positioned to benefit from this relative hawkishness, especially as the Fed pivots toward employment concerns and potential rate cuts.

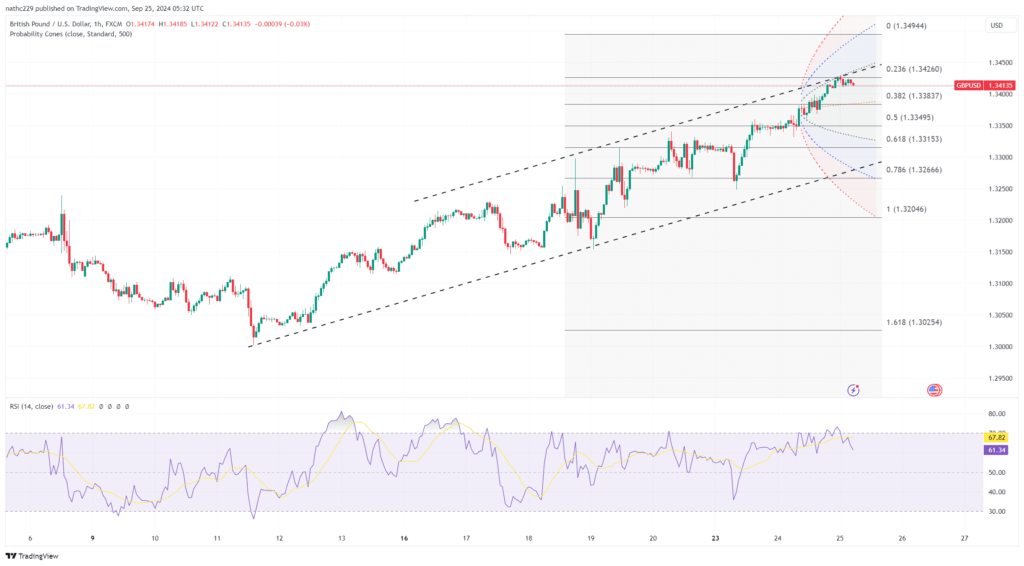

Technically, GBP/USD remains in a strong uptrend, with support emerging at key levels such as the rising 21-day moving average at 1.3364 and Tuesday’s high of 1.3332. Resistance lies at 1.3400, followed by the February 25, 2022 high of 1.3437, which could act as the next target for bulls. Further resistance can be seen at 1.3553, the February 24, 2022 high. The sterling is benefiting not only from the BoE’s relatively hawkish stance but also from weaker U.S. economic data, as shown by the recent drop in consumer confidence. Traders will keep a close eye on U.S. Q2 final GDP data and weekly jobless claims on September 26, which could further influence market expectations regarding the Fed’s rate path.

Looking ahead, the divergence in UK and U.S. rate expectations will likely keep sterling dominant versus the dollar. LSEG’s IRPR indicates a 50% chance of a substantial Fed rate cut in November, with further easing expected by December, whereas short-term interest rate futures are pricing in a more cautious approach from the BoE. With the BoE projected to cut only 39 basis points by their December meeting, compared to the Fed’s expected 76 basis points, this divergence in rate outlooks should continue to favor GBP/USD. As the pair approaches key resistance levels, traders will focus on upcoming U.S. data, particularly the core PCE price index on September 27, which may provide further clues on the Fed’s policy direction.