GBP/USD remained stuck near trend lows on Wednesday, finding support for the third consecutive session at 1.3060. The pair has struggled to regain momentum following the Federal Reserve’s aggressive 50 basis point rate cut last month, which shifted the market’s focus toward future central bank policy paths. Traders are eagerly awaiting further clarity from the minutes of the Fed’s September 17-18 meeting, hoping for additional insights into the pace and direction of U.S. monetary policy. Sterling’s vulnerability has been further compounded by comments from BoE Governor Andrew Bailey, who hinted at the possibility of more aggressive rate cuts if UK inflation continues to weaken. Despite this, the BoE remains relatively hawkish for now, with inflation still above target, suggesting a slower pace of easing.

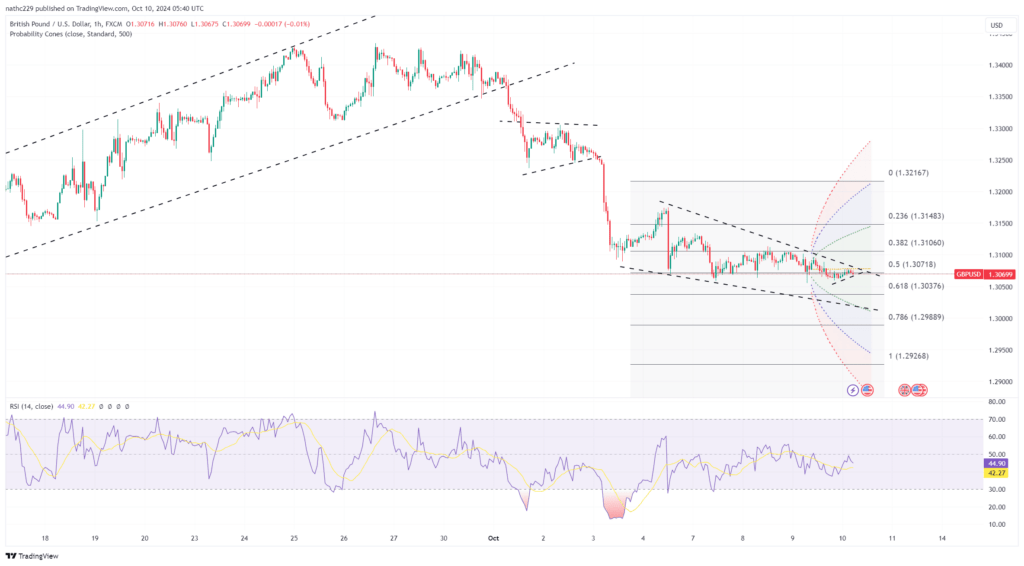

Technically, GBP/USD remains under pressure, trading within a narrow range between 1.3104 and 1.3057. The recent lows near 1.3057 and psychological support at 1.3000 are critical levels to watch. A break below 1.3050, which represents the 50% Fibonacci retracement of the 1.2666-1.3434 rise, could reinforce the bearish trend and potentially open the door to deeper declines toward the September 11 low of 1.3002 and the daily Ichimoku cloud base at 1.2941. On the upside, initial resistance lies at 1.3113, the high from Tuesday, followed by 1.3174, the October 4 high, and the 30-day moving average at 1.3199. Without a clear catalyst, the pair is likely to remain range-bound, awaiting direction from the upcoming Fed minutes and BoE policy updates.

Looking ahead, the broader outlook for GBP/USD will largely depend on how central banks navigate their respective economic conditions. Should the Fed minutes reinforce the narrative of a recalibration rather than a pivot towards sustained easing, it could keep pressure on GBP/USD, especially if U.S. economic data continues to outperform the UK’s. Conversely, a shift in BoE’s stance towards faster rate cuts, as suggested by Bailey, could trigger a wave of selling in the pound, potentially pushing the pair below key support levels. With net speculative long positions in sterling still elevated, any signs of a more dovish BoE could lead to a sharp reduction in long positions, intensifying the downside move.