GBP/USD Hits 5-Week Low as Bearish Momentum Builds Amid Softer U.S. Jobless Claims and Dovish Fed Outlook

Current Price Action: GBP/USD has continued its downward trajectory, sliding to a new 5-week low at 1.2660 in early trading. The pair briefly recovered, climbing to 1.2744 in the afternoon, reflecting a 0.43% gain. The pair’s movement has been influenced by softer-than-expected U.S. jobless claims data, which dialed back expectations for aggressive Federal Reserve rate cuts. This recovery saw the pair holding near its daily high.

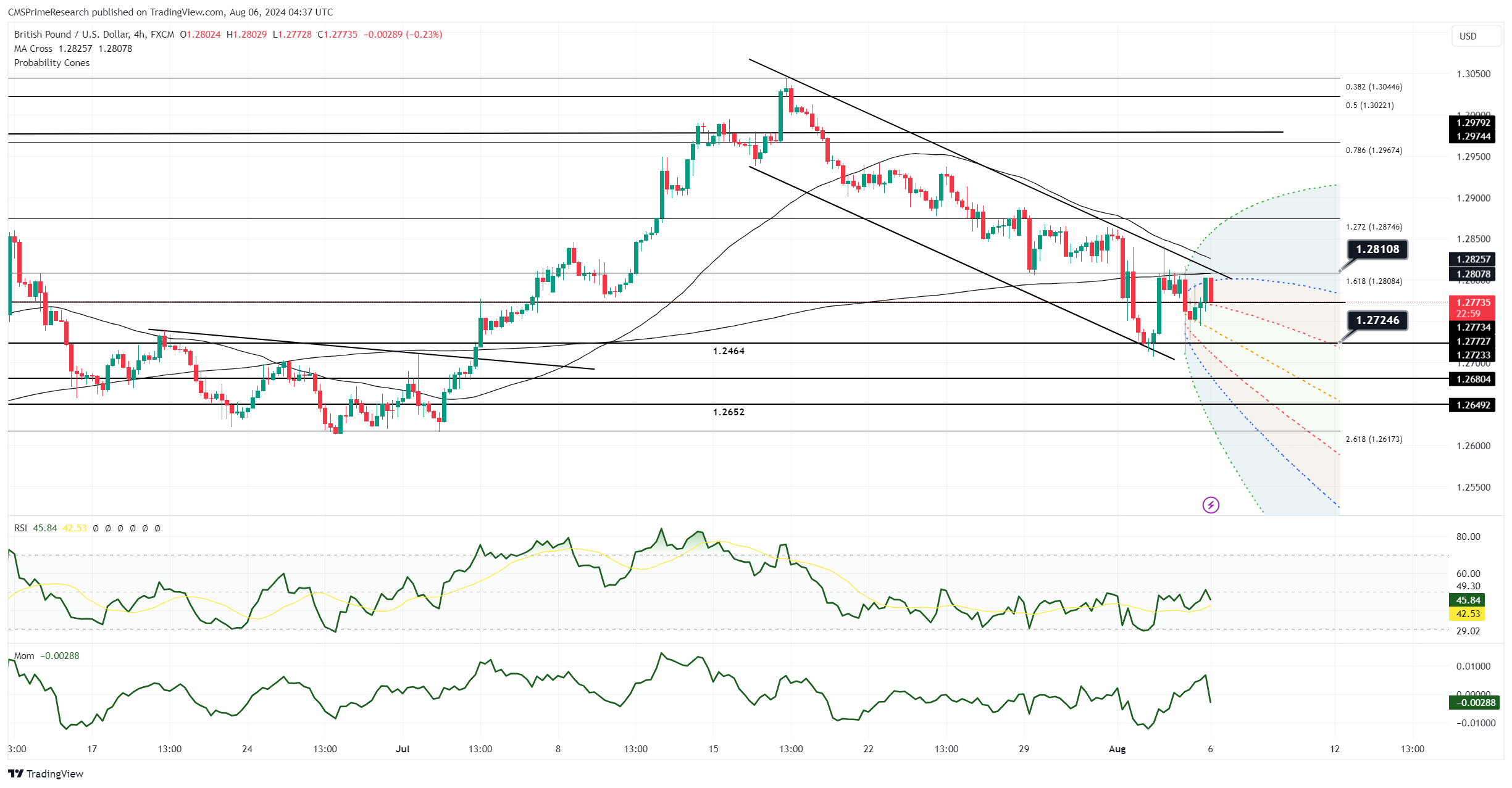

Key Technical Levels:

- Support Levels:

- 200-Day Moving Average (DMA): 1.2650

- Daily Cloud Base: 1.2620

- 30-Day Moving Average (HMA): 1.2685

- Resistance Levels:

- Falling 20-DMA: 1.2775

- 50% Fibonacci Retracement of 1.3040-1.2620: 1.2840

- 20-DMA: 1.2895

Technical Indicators:

- The third consecutive dip below the 100-DMA at 1.2680 strengthens the bearish outlook for GBP/USD.

- The 10-DMA has crossed below longer-term moving averages, indicating increasing bearish momentum.

- The pair’s position above the daily cloud (1.2710-1.2640) offers some support, but a failure to maintain this level could see the pair targeting the early May lows near 1.2500 and 1.2400.

Fundamental Analysis

Market Sentiment and Influences: The softer-than-expected U.S. jobless claims data tempered the market’s expectations for aggressive Fed rate cuts, which had previously been heightened by last Friday’s below-forecast U.S. payroll data. The moderation in recession fears has provided some relief to GBP/USD, helping it to recover from its earlier lows. However, the broader outlook remains bearish as the recent dovish shift in Fed rate expectations, coupled with the Bank of England’s (BoE) recent 25 basis point rate cut, has led to an exit of GBP net speculative longs from the market.

Interest Rate Expectations: Despite the UK’s rate expectations pricing in a higher rate trajectory for 2024 and 2025 compared to the U.S., the softer Fed rate outlook and the recent BoE rate cut have weakened GBP/USD. Traders are now awaiting further inflation and growth data from both the U.S. and the UK to provide clearer direction.

Overall Outlook: The technical structure of GBP/USD suggests that bearish momentum is building, with the pair’s repeated failures to hold above key support levels like the 100-DMA adding to this outlook. If the pair falls below the daily cloud base at 1.2640, further declines toward early May lows near 1.2500 and 1.2420 could be expected. Conversely, if the pair manages to break above the 20-DMA resistance at 1.2775, it could test higher resistance levels, but the bearish cross of the 30-DMA through longer-term moving averages suggests that the upside may be limited.